Press release

Mitigation Banking Market To Reach USD 23.3 Billion by 2030 | CAGR 12.5%

🌍 Mitigation Banking Market OverviewThe global mitigation banking market was valued at USD 9.1 billion in 2022 and is projected to reach USD 23.3 billion by 2030, growing at a robust CAGR of 12.5% between 2023 and 2030.

Mitigation banking refers to the restoration, creation, enhancement, or preservation of wetlands, streams, or other aquatic resources to compensate for unavoidable adverse impacts permitted under Section 404 or equivalent regulations. It has become a critical instrument in balancing economic development with ecosystem conservation, backed by regulatory bodies, private developers, and NGOs.

Access a Sample Report with Full TOC and Figures @ https://www.zionmarketresearch.com/sample/mitigation-banking-market

📈 Key Insights

Market Size (2022): USD 9.1 Billion

Market Forecast (2030): USD 23.3 Billion

Growth Rate: CAGR of 12.5% (2023-2030)

Dominant Type: Wetland or Stream Banks

Leading Vertical: Construction & Mining

Regional Leader: North America

🚀 Market Growth Drivers

Biodiversity Protection

Rising government focus on ecosystem preservation and biodiversity protection is a key driver. Mitigation banks help reduce the negative effects of industrialization, mining, and infrastructure projects on wetlands and streams.

Increasing Industrial & Construction Activities

The expansion of construction and mining industries worldwide is directly fueling demand for mitigation banks, which offer developers compliance-friendly and sustainable options.

Attractive Investment Opportunities

Mitigation banks not only support ecosystem sustainability but also create new investment channels by monetizing ecosystem services, drawing foreign direct investments and private funding.

⚠️ Market Restraints

Regulatory Complexity: Mitigation banking faces multiple layers of federal, state, and municipal rules, often leading to delays and uncertainties in approvals.

High Approval Time: Establishing new banks requires extensive documentation, stakeholder engagement, and permit clearances, slowing project execution.

🌟 Opportunities in the Market

Government Initiatives: Programs like the "America the Beautiful" initiative (2021) and Global Environment Facility (GEF-8) highlight rising public funding and political commitment.

Climate Change Response: Mitigation banks are seen as vital tools for protecting carbon sinks and aquatic ecosystems, creating opportunities for both public and private players.

Growing Public Awareness: Rising consciousness around sustainable infrastructure and ecosystem services is likely to drive demand for mitigation credits.

🛑 Challenges

Economic Valuation Issues: Assigning accurate monetary value to ecological losses remains complex.

Geographic Limitations: Banks must be located in the same watershed as impacted areas, which restricts flexibility and can complicate credit transactions.

🔍 Segmentation Analysis

By Type:

Wetland or Stream Banks (Dominant)

Forest Conservation

Conservation Banks

By Verticals:

Construction & Mining (Largest Share)

Transportation

Energy & Utilities

Healthcare

Manufacturing

By Region:

North America (Leader)

Europe

Asia Pacific (Fastest Growing)

Latin America

Middle East & Africa

Want to know more? Read the full report here: https://www.zionmarketresearch.com/report/mitigation-banking-market

🌐 Regional Outlook

North America is expected to dominate due to strict EPA & USACE regulations, rapid urban development, and proactive environmental policies.

Asia-Pacific is emerging as a high-growth market, fueled by urbanization in China, India, and Southeast Asia, along with government-backed conservation projects.

Europe benefits from strong environmental laws, though market expansion is slower compared to North America.

🏢 Competitive Landscape

Prominent players include:

Mitigation Credit Services LLC

Wetland Studies and Solutions Inc.

Burns & McDonnell

THabitat Bank LLC

Ecosystem Investment Partners (EIP)

The Loudermilk Companies

The Wetlandsbank Company (TWC)

EarthBalance

Weyerhaeuser

WRA Inc. LLC

Alafia River Wetland Mitigation Bank Inc.

Wildwood Environmental Credit Company

The Mitigation Banking Group Inc.

Great Ecology

LJA Environmental Services Inc.

Ecosystem Services LLC

These companies are actively expanding through strategic acquisitions, partnerships, and new bank development projects to meet growing demand.

✅ Conclusion

The mitigation banking market is poised for remarkable growth, with its valuation expected to more than double by 2030. Driven by rising biodiversity concerns, stricter regulations, and large-scale construction activities, mitigation banking will remain a crucial mechanism to balance development with ecological preservation.

While regulatory complexity and valuation challenges remain obstacles, North America continues to lead globally, and Asia-Pacific offers promising untapped opportunities. Companies that prioritize compliance, innovation, and long-term partnerships with regulators will be best positioned to capitalize on this rapidly expanding market.

Click On This Below Link to See Similar Reports :

Blood Banking Devices Market Size, Share, Growth, Global Trends, & Forecast 2034 : https://www.zionmarketresearch.com/report/blood-banking-devices-market

IoT in Banking And Financial Services Market Size, Share, Trends, Growth and Forecast 2034 : https://www.zionmarketresearch.com/report/iot-in-banking-and-financial-services-market

Banking Cyber Security Market Size, Share, Analysis, Trends, Growth, 2032 : https://www.zionmarketresearch.com/report/banking-cyber-security-market

U.S. Commercial Banking Market Size, Share, Analysis, Industry Growth, Forecasts 2032 : https://www.zionmarketresearch.com/report/us-commercial-banking-market

B2B Payments Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032 : https://www.zionmarketresearch.com/report/b2b-payments-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

📞 US OFFICE NO +1 (302) 444-0166

📞 US/CAN TOLL FREE +1-855-465-4651

📧 Email: sales@zionmarketresearch.com

🌐 Website: www.zionmarketresearch.com

In addition to providing our clients with market statistics released by reputable private publishers and public organizations, we also provide them with the most current and trending industry reports as well as prominent and specialized company profiles. Our database of market research reports contains a vast selection of reports from the most prominent industries. To provide our customers with prompt and direct online access to our database, our database is continuously updated.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mitigation Banking Market To Reach USD 23.3 Billion by 2030 | CAGR 12.5% here

News-ID: 4201312 • Views: …

More Releases from zion market research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

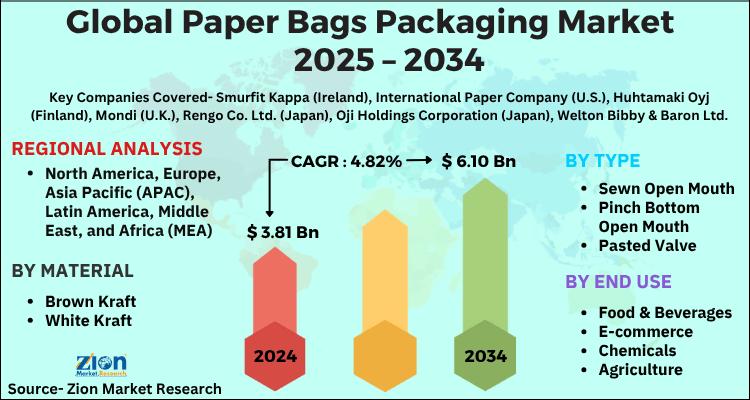

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

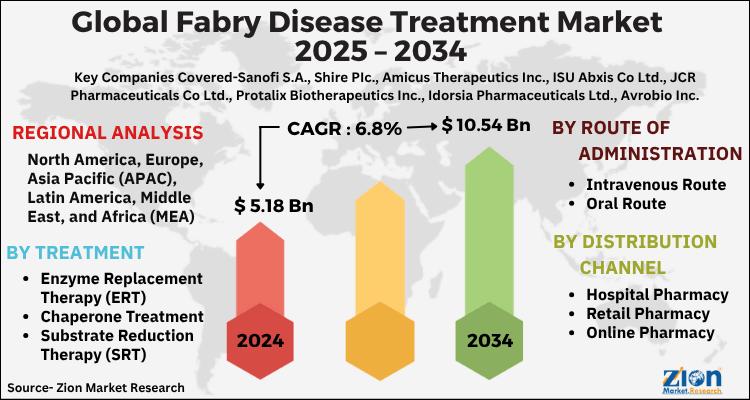

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…