Press release

Australia Tops List of British Expat Mortgage Clients

New data from UK Expat Mortgage reveals that Australia continues to lead as the most common location for British expats seeking UK property finance. The findings highlight strong demand from the Middle East, North America, and Europe, with expats earning an average income of ?101,141 and borrowing an average of ?302,397. Residential mortgages narrowly outpaced investment buy-to-let loans, marking a shift in expat mortgage trends for 2025.Bristol, UK - 25 September 2025 - UK Expat Mortgage, a specialist expat mortgage brokerage, has released its latest year-to-date statistics for 2025, providing unique insights into the financial and geographic profiles of British expatriates investing in UK property.

Global Client Distribution

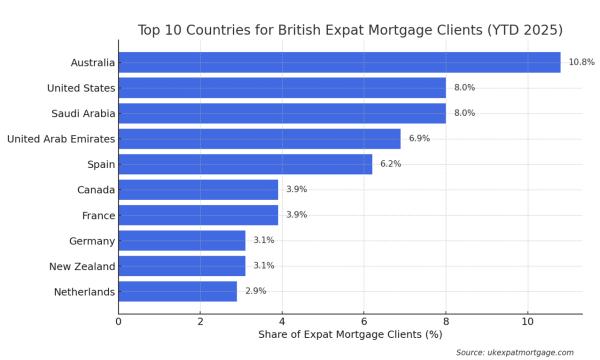

Australia leads the way, accounting for 10.8% of all clients seeking UK mortgages. The United States (8.0%), Saudi Arabia (8.0%), and the United Arab Emirates (6.9%) also ranked highly. Spain (6.2%), Canada (3.9%), France (3.9%), Germany (3.1%), New Zealand (3.1%), and the Netherlands (2.9%) completed the top 10.

Regionally, Europe (28.9%) and Asia-Pacific (27.1%) dominate, followed by the Middle East (20.1%) and North America (13.9%). Africa and Latin America make up smaller but notable shares of the market at 2.6% and 1.5% respectively.

Income & Borrowing Power

The report found that British expats earn significantly more than their domestic counterparts, with an average income of ?101,141. This translates into strong borrowing capacity, reflected in an average loan size of ?302,397 across applications processed in 2025.

Mortgage Application Trends

Residential mortgages narrowly outpaced buy-to-let activity, accounting for 51.1% of applications compared to 48.9% for investment properties. Within these categories:

Residential Purchases made up 46.0% of total applications.

Residential Remortgages accounted for 5.1%.

Buy-to-Let Remortgages represented 27.7%.

Buy-to-Let Purchases made up 21.2%.

This shift highlights growing interest among expats in securing UK homes for personal use alongside continued investment demand.

Market Implications

The data underscores several key trends shaping the expat mortgage market in 2025:

Australia remains the top hub for British expats financing UK property.

Middle East demand reflects ongoing professional opportunities and strong expatriate communities in Saudi Arabia and the UAE.

Residential purchases rising suggests a trend towards expats planning for long-term relocation or family security in the UK.

Investment confidence strong, with nearly half of expats still prioritising buy-to-let as a stable asset class.

About UK Expat Mortgage

UK Expat Mortgage is a specialist brokerage helping British expatriates and foreign nationals secure property finance in the UK. With one of the most comprehensive datasets on expatriate mortgage activity, the firm's insights are cited by financial publications, property analysts, and industry researchers.

For further information, interviews, or access to the full dataset, please contact:Email: josh@ukexpatmortgage.com

Website: www.ukexpatmortgage.com

Contact Details

Organization: UK Expat Mortgage

Contact Person: Josh Thompson

Website: https://www.ukexpatmortgage.com/

Email: josh@ukexpatmortgage.com

Country: United Kingdom

Release Id: 27092534495

The post Australia Tops List of British Expat Mortgage Clients appeared first on King Newswire. This content is provided by a third-party source. King Newswire is a press release distribution agency. We do not accept any responsibility or liability for the accuracy, content, images, videos, licences, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright concerns related to this article, please contact the company listed in the 'Media Contact' section above.

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. king Newswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact support@kingnewswire.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Tops List of British Expat Mortgage Clients here

News-ID: 4200423 • Views: …

More Releases from King Newswire

FinanceAndMarkets.com Expands Digital Publishing Infrastructure to Support Scala …

Cody Burgat, a Lead Contributor, outlines platform focus on long-term media stability and operational refinement

United States, 16th Feb 2026 - FinanceAndMarkets.com has announced an expansion of its digital publishing infrastructure as part of an ongoing effort to strengthen the operational foundation of its independent financial media platform.

The company stated that recent backend enhancements were implemented to support structured content deployment across its business, markets, and economic coverage categories. These infrastructure…

CH Group Crypto Hive LLC -- A Pioneer in Web3 Innovation and Inclusive Finance

United States, 16th Feb 2026 - Crypto Hive LLC, headquartered in the United States and serving as a core member of CH Group, is dedicated to building an innovative, efficient, and sustainable digital asset ecosystem. Since its establishment, the company has been deeply engaged in the Web3 sector for many years. Leveraging extensive industry experience and continuous technological innovation, Crypto Hive LLC has successfully delivered diversified digital asset services to…

IPO Genie Secures 1M Dollars to Expand Tokenized Venture Capital Solutions

IPO Genie has secured $1 million in funding to expand its tokenized venture capital infrastructure and enhance its AI-based opportunity assessment tools. The investment will support development of its Fund-as-a-Service model, on-chain portfolio tracking, and structured deal evaluation systems.With its ERC-20 token ($IPO), defined allocation model, and active presale portal, the platform continues to position itself among emerging Top presale crypto projects focused on standardized, blockchain-based private market access.

United States,…

Octopus Bridge Launches Counterpoint-Shopify Gift Card Integration for Omnichann …

Octopus Bridge launches a Counterpoint-Shopify Gift Card Integration, enabling seamless online and in-store gift card management and redemption.

San Jose, CA, United States, 16th Feb 2026 - Octopus Bridge, a leading retail POS-eCommerce integration solution, today announced the availability of its Counterpoint-Shopify Gift Card Integration, designed to help retailers deliver a seamless gift card experience across online and in-store channels.

Gift cards are a key driver of customer loyalty, yet many retailers…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…