Press release

Global Smart Pipe Auto-Alignment Welding Machines Market to Reach US 3.485 Billion by 2031 with 12.3% CAGR Driven by Lincoln Electric and ESAB

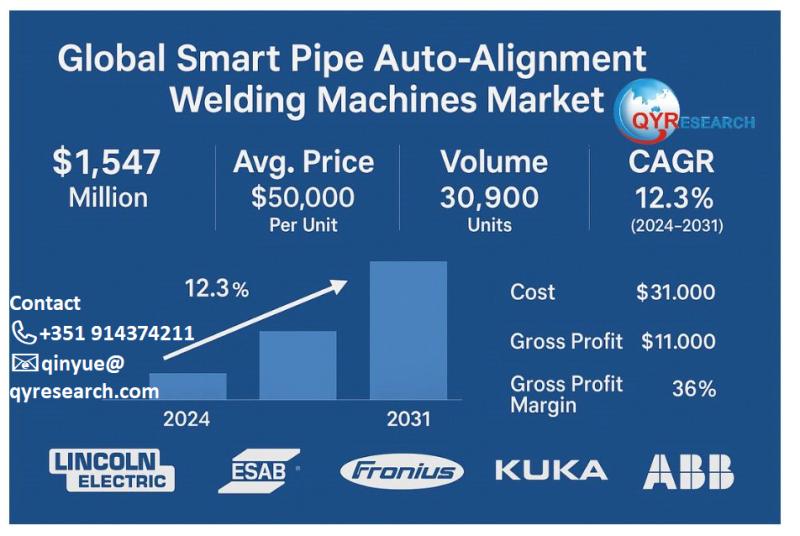

The new Global Smart Pipe Auto-Alignment Welding Machines Market Research Report 2025 from QYResearch projects the market will grow from US$1,547 million in 2024 to US$3,485 million by 2031 (CAGR 12.3%, 2025-2031). In 2024, global production reached ~30,900 units at an average selling price of ~US$50,000 per unit. Smart pipe auto-alignment welding machines-automated systems that align and weld pipes with precision-continue to penetrate large pipeline and critical-process construction in oil & gas, power, chemicals, municipal water/sewage, and other infrastructure applications.Latest Data

• 2024 market size: US$1,547 million

• 2031 forecast: US$3,485 million

• CAGR (2025-2031): 12.3%

• 2024 global output: ~30,900 units

• Average price per unit (2024): ~US$50,000

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample/4936832

Costs & Margins Snapshot:

List prices for orbital/pipe welding equipment vary by configuration. For example, an open-head orbital welding machine plus power supply is listed at US$18,900 retail; individual weld heads range ~US$7,700-US$21,000, illustrating entry and mid-tier pricing bands.

At the company level, welding-equipment leaders reported recent gross margins in the ~36-38% range (e.g., Lincoln Electric FY2024 GM ~36.7%; ESAB FY2024 GM ~37.8%), while a major robotics integrator relevant to automated welding, KUKA, reported a ~22.5% gross margin for FY2024.

Implied unit economics: applying those margins to the category's ~US$50,000 ASP yields an estimated per-unit gross profit of ~US$11,000-US$19,000 and an estimated cost of ~US$31,000-US$39,000, depending on configuration and supplier cost structure.

Company List

Lincoln Electric

Fronius International

ESAB

KUKA

ABB

Miller Electric

ITW Welding

Orbitalum Tools

Polysoude

Magnatech

Aotai Electric

KOIKE

IGM Robotersysteme

Daihen Corporation

Panasonic Welding Systems

Kobelco Welding

Hyundai Welding

Arcos Industries

Bug-O Systems

JASIC Technology

Changzhou Huarui Welding & Cutting

Tianjin Golden Bridge Welding

Shanghai Hugong Electric

Zhengzhou Riland Industry

Beijing Time Technologies

KEMPPI

Voestalpine Böhler Welding

Kemppi Oy

OTC Daihen Europe

EWM AG

REHM Schweißtechnik

Product profiles for five leading companies:

1. Novarc Technologies - Spool Welding Robot (SWRTM)

• Pipe diameter range: 2′′ to 60′′ (≈ 50 mm to 1,520 mm)

• Height / working radius: approx. 15 ft (≈ 4.5 m) reach; manipulator height 15 ft; working height between ~1-9 ft

• Accuracy: horizontal seam tracking and vertical distance control to ± 0.1 mm

• Weave / Oscillation: Weave stroke about 0.59 in (~15 mm), weave frequency up to ~5 Hz, weave dwell up to 0.4 sec

• Wire types and diameters: Solid, metal-cored, flux-cored; wire diameters from 0.035 to 0.062 in (~0.9 to 1.6 mm)

• Productivity / Repair-rate data: 3-5× improvement in productivity for carbon steel, up to 12× for stainless steel; < 1 % repair rates reported

• Other features: Integrated laser / vision system for seam tracking; multiple positioners can be used with one SWR to maximize arc-on time; remote pendant / operator control for adjustments during welding

2. Orbitalum Tools - ORBIWELD 25 GC

• Pipe diameter range: 6.0 mm to 34.0 mm (≈ 0.236′′ to 1.339′′)

• Electrode diameter supported: 1.6 mm or 2.4 mm (~0.063′′ / 0.094′′)

• Machine weight (with hose package): ~6.0 kg ≈ 13.2 lbs

• Hose package length: 7.5 m (~24.6 ft)

• Dimension profile: Slim, compact micro weld head; includes detachable clamping cassette; in-handle control panel; LED display for status; pipe center gauge for alignment; electrode setting gauge for consistency

• Duty cycle / robustness: High load capacity for long duty cycle with minimal electrode wear for the given pipe size range

3. Polysoude - MU IV 25/115

• Outer Diameter (O.D.) range: 25 mm up to 115 mm (~1′′ to ~4.5′′)

• Modular head sizes: Part of a range of MU IV heads covering many O.D. sizes from ~8 mm up to ~275 mm depending on version

• Duty cycle / power: Available with AVC (Arc Voltage Control) and OSC (Oscillation) options; open-head, capable of high-precision work; torch cooling (liquid cooling for some versions); capability for on-board or external wire feeder depending on model

• HD video / monitoring upgrade: MU IV 25/115 now available with integrated HD on-board video allowing real-time monitoring and remote supervision up to ~10 meters; enhancing joint tracking and parameter consistency

4. ESAB - A6 Mastertrac A6TF Single/Twin SAW Tractor

• Type: Automatic tractor device, SAW (Submerged Arc Welding) configuration, capable of single or twin arc operation

• Wire capacity / wire size: For single configuration, wire diameters up to ~6.0 mm; for twin-arc conversion, use of two wires of ~2.0-3.0 mm each

• Power / current / amperage: Designed to work with heavy production conditions; current up to ~1,500 A under some models

• Weight: ~110 kg for single-arc version; ~145 kg for twin-arc version

• Use-case strengths: Fast changeover between wire types, suitable for fillet and b-utt welds; designed for heavy production scenarios

5. Lincoln Electric - Mechanized Pipeliner AutoShield

• Product goal: Improve pipeline welding in mechanized form, reducing number of starts/stops, improving productivity, lowering heat input

• Productivity gain: Up to ~30% increase compared to downhill-low hydrogen SMAW; reduction of start/stop cycles by up to ~80% compared to conventional SMAW process

• Operating context: Designed for pipeline vertical down welding under field conditions; suited for large diameter pipe where mechanization adds consistency

Application List

Oil & Gas Pipeline Construction

Power and Nuclear Grid Installation

Chemical Piping Installation

Municipal and Water/Sewage Systems

Others

Classification List

Automatic Orbital Welding Machine

Portable Auto-Alignment Welding Machine

Robotic Integrated B-utt Welding System

High-Pressure Pipe Welding Machine

Others

Downstream companies:

CRC Evans

Harder Mechanical Contractors, Inc.

Ganotec-Muga Fab Inc.

Metropolitan Mechanical Contractors, Inc.

Emcor Group, Inc.

Michels Corporation

Comfort Systems USA, Inc.

Bechtel Corporation

Fluor Corporation

Kiewit Corporation

2025 Trendlines & Company Milestones

The smart pipe auto-alignment welding machine category is accelerating in 2025 on the back of AI-enabled autonomy, higher-fidelity vision and sensing, tighter integration between robotic motion and welding process control, and more comprehensive data logging for code compliance and QA traceability. These advances are converging just as trade and tariff shifts reshape equipment bills-of-materials and sourcing strategies, making software and data advantages even more decisive.

AI-Vision Autonomy moves from pilot to production. In 2024, Novarc introduced NovEyeTM Autonomy Gen 2, a computer-vision and AI system designed to "fully automate the pipe welding process" on the company's Spool Welding Robot (SWR) by integrating real-time imaging with robotic controls. Through 2025, industry coverage and contractor case stories have continued to spotlight the technology as emblematic of the shift to zero- or low-intervention, "set-and-start" workflows that free the operator to prep the next joint while the robot executes repeatable, X-ray-quality welds. The core promise: better throughput on stainless and carbon steels with extremely low repair rates, while reducing dependence on scarce, top-tier manual skills.

Orbital innovation targets high-purity, semicon, and tight-tolerance jobs. Demand from ultra-clean process industries (semiconductor, pharma, bioprocess) is pushing suppliers to add compact heads, better cooling, and faster changeover. In April 2025, Orbitalum Tools announced a new OW 25 GC welding head family covering pipes up to 34 mm, emphasizing compatibility with existing orbital systems to lower investment costs and simplify fleet upgrades-an important lever in a tariff-volatile environment. The emphasis on economy, flexible hose packages, and serviceability aligns with users' push for higher uptime and predictable cost of ownership.

Visual monitoring and traceability step up. On the monitoring front, Polysoude introduced HD on-board cameras for its MU IV 25/115 (February 2025), enhancing weld pool visibility and enabling richer data capture for quality records. The company also highlighted its UHP 1025 solution for high-purity applications in February 2025, signaling sustained investment in the most demanding orbital niches. Together, these updates reflect a broader theme: welding heads, power sources, and software are increasingly delivered as integrated systems that capture process parameters, video, and event data to streamline audit trails for ASME and related codes.

Pipe-spool stations continue to scale impact. Tecnar's Rotoweld 3.0 remains a reference point for automated spool welding cells. A March 2025 industry feature traced Rotoweld's evolution and described how earlier integration of Lincoln Electric's STT for root pass control gave way to today's ruggedized, semi-automated platforms that democratize high-quality spool fabrication. In the field, MEP contractors have also reported productivity and quality gains; recent material from the mechanical contracting community underscores growing confidence in automated stations as a way to standardize outcomes across shifts and crews. Expect more cells to be digitally connected for production analytics, consumable tracking, and operator performance management in 2025-2026.

Mechanized pipeline welding extends automation's range. On cross-country and long-line projects where orbital systems must withstand wind, dust, and fit-up variability, suppliers are optimizing for robustness. Lincoln Electric's Mechanized Pipeliner AutoShield® solution-launched earlier-was positioned to reduce heat input versus conventional FCAW-G and cut weld time on mechanized orbital passes by double-digit percentages. Through 2025, operators have been evaluating such systems not only on deposition rates but also on repeatable alignment and cap-pass quality under tough conditions. With workforce shortages lingering, these mechanized solutions bridge the gap between full robotics and manual processes.

Robotics platforms simplify deployment. ESAB has pushed a theme of "smarter, easier automation," bundling hardware with intelligent software and faster setup to lower the skills barrier for robotic integration. Throughout 2025, the company has been promoting modular cells and scalable controls so fabricators can start small and expand. This modularity dovetails with the report's segmentation: from portable auto-alignment tools to fully integrated robotic b-utt-welding systems, buyers are choosing architectures that match project scope, code requirements, and plant layouts.

Data is becoming the differentiator. Beyond cycle times and bead geometry, buyers now scrutinize how systems capture, store, and share weld data: amperage/voltage/current waveforms, heat input, travel speed, wire feed, shielding gas events, and even synchronized video. The goal is twofold-first-time-right quality and instant traceability. In 2025, vendors that deliver open data export, APIs to MES/QMS, and analytics dashboards are commanding attention, especially among EPCs and OEMs mustering documentation across thousands of welds. This "QA-by-design" approach is particularly valuable in nuclear, pharma, and semiconductor segments where traceability is non-negotiable.

Tariffs reshape sourcing, favor software-heavy value. The report flags 2025 U.S. tariff policies as a structural uncertainty. Recent actions-including new tariffs on semi-finished copper products and copper-intensive goods-increase input-cost volatility for power electronics, cables, and cooling components in welding systems. In response, manufacturers are diversifying suppliers, reshoring select assemblies, and leaning into software-defined advantages (AI, vision, monitoring) where value is less exposed to commodity swings. For buyers, total cost of ownership (TCO) analysis increasingly weighs spare-parts localization and service SLAs, not just CapEx list prices.

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4936832

Where adoption is fastest. In 2025, the Oil & Gas Pipeline Construction segment continues to deploy mechanized and semi-robotic solutions for root/fill/cap standardization and to mitigate weather/skill variability. Power and Nuclear Grid Installation leans on orbital TIG and high-pressure capability for critical joints. Chemical Piping emphasizes corrosion-resistant alloys and process-control fidelity, while Municipal Water/Sewage projects value portable auto-alignment machines that travel well and set up quickly. Across segments, the headline is the same: consistent alignment + automated parameter control + digital QA yield fewer repairs and predictably code-compliant welds-all while compressing schedules.

What's next. Expect continued convergence of adaptive vision, process metallurgy models, and robotic motion planning, so machines compensate for fit-up variation without operator edits. Suppliers will also expand remote support (secure connectivity, over-the-air updates), add HD/thermal imaging at the torch, and roll out template libraries for common materials and joint preps. With labor scarcity persisting, collaborative layouts-where one operator orchestrates multiple heads/cells-will spread, especially in spool shops. Finally, given the tariff and supply-chain climate, 2025-2026 will reward platforms that are component-agnostic and service-friendly, minimizing downtime and dependence on any single import category.

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 ; +351 914374211(Tel & Whatsapp); +86-1082945717

Email: qinyue@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

Related Report:

Global Smart Pipe Auto-Alignment Welding Machines Market Research Report 2025

https://www.qyresearch.com/reports/4936832/smart-pipe-auto-alignment-welding-machines

Global Smart Pipe Auto-Alignment Welding Machines Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/4936827/smart-pipe-auto-alignment-welding-machines

2025-2031全球与中国智能管道自动对接焊接机市场现状及未来发展趋势

https://www.qyresearch.com.cn/reports/5747142/smart-pipe-auto-alignment-welding-machines

2025年全球智能管道自动对接焊接机行业总体规模、主要企业国内外市场占有率及排名

https://www.qyresearch.com.cn/reports/5747141/smart-pipe-auto-alignment-welding-machines

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Smart Pipe Auto-Alignment Welding Machines Market to Reach US 3.485 Billion by 2031 with 12.3% CAGR Driven by Lincoln Electric and ESAB here

News-ID: 4200265 • Views: …

More Releases from QYResearch Europe

Global Aerospace Grade Smart Assembly Lines Market 2024 USD 4251 Million to 2031 …

According to recent report from QYResearch, the global market for aerospace-grade smart assembly lines stood at US$4,251 million in 2024 and is projected to reach US$8,712 million by 2031 at a 10.2% CAGR (2025-2031). In 2024, approximately 670 lines were produced globally at an average selling price (ASP) of about US$6.343 million per line. These highly automated systems integrate AI, industrial robotics, advanced sensing, and digital control to deliver repeatable,…

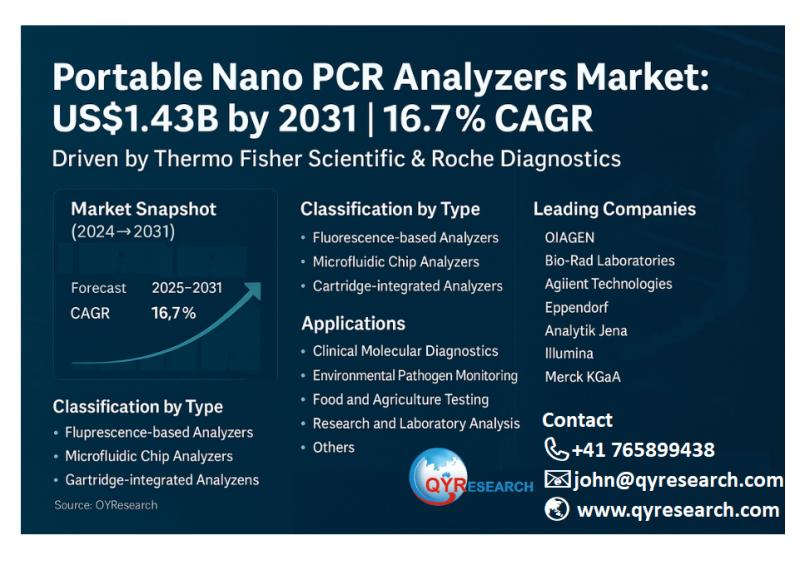

Portable Nano PCR Analyzers Market Growth to US$1.43 Billion by 2031 with 16.7% …

According to the latest QYResearch Report, the global market for Portable Nano PCR Analyzers was valued at US$484 million in 2024 and is expected to reach US$1,427 million by 2031, growing at a CAGR of 16.7% during the forecast period of 2025-2031. Global production in 2024 reached around 96,800 units, with an average price of about US$5,000 per unit. These portable devices utilize nanotechnology-enhanced PCR processes for rapid on-site genetic…

Global Multiphase Flow Conveying Equipment Market to Reach USD 10.88 Billion by …

The global market for Multiphase Flow Conveying Equipment is transitioning from a specialized engineering niche to a core enabler of industrial efficiency across upstream energy, chemicals, mining, and wastewater sectors. According to QYResearch 2025 edition of Multiphase Flow Conveying Equipment - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031, the market was valued at US$7,380 million in 2024 and is projected to reach US$10,879 million by 2031,…

Global Smart Eye-Tracking Medical Devices Market Size Reaches US$3.0 Billion by …

The global Smart Eye-Tracking Medical Devices market has entered a stage of accelerated clinical adoption and product diversification. According to QYResearch 2025 Global Smart Eye-Tracking Medical Devices Market Research Report, the market was valued at US$973 million in 2024 and is projected to reach US$3,009 million by 2031, growing at a CAGR of 17.5% from 2025 to 2031. Global output in 2024 reached approximately 64,900 units, with an average price…

More Releases for Welding

Welding Consumables Market to Witness Unbelievable Growth from 2024 to 2030: Ged …

The latest survey on Welding Consumables Market is conducted to provide hidden gems performance analysis of Welding Consumables to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

EMEA Welding Consumables Market | welding supplies, welding machine, welding equ …

Market Research Reports Search Engine (MRRSE) has been serving as an active source to cater intelligent research report to enlighten both readers and investors. This research study titled “Welding Equipment and Welding Services Market “

The welding industry comprises welding equipment, welding consumables and welding services. Welding consumables account for a significant share of the welding industry compared to welding equipment and welding services. The welding consumables industry has been experiencing…

EMEA Welding Consumables Market | welding supplies, welding machine, welding equ …

Market Research Reports Search Engine (MRRSE) has been serving as an active source to cater intelligent research report to enlighten both readers and investors. This research study titled “Welding Equipment and Welding Services Market “

The welding industry comprises welding equipment, welding consumables and welding services. Welding consumables account for a significant share of the welding industry compared to welding equipment and welding services. The welding consumables industry has been experiencing…

Electric Welding Clamp Market 2018 Shandong Solid Solider, Shandong Juli Welding …

Global Electric Welding Clamp market 2018 by ReportsQuest presents a professional and complete analysis of on the current Industry situation. The Global report includes Electric Welding Clamp Revenue, market Share, industry volume, Trends, Growth aspects. It analyses the important factors of the based on present industry situations, demands, business strategies utilized by Electric Welding Clamp market players and the future prospects from various angles in detail. Industry analysis is a…

Global Welding Equipment Market: Arc welding, Resistant welding, Oxy fuel weldin …

MarketResearchReports.Biz adds “Global Welding Equipment Market 2016 Share, Size, Trends and Forecast to 2021 Market Research Report” reports to its database. This report provides a strategic analysis of the Welding Equipment market and the growth estimates for the forecasted period.

A comprehensive research report created through extensive primary research (inputs from industry experts, companies, stakeholders) and secondary research, the report aims to present the analysis of global welding equipment market on…

Global Welding Consumables Market 2017 - Lincoln Electric, Hyundai Welding, Colf …

Global Welding Consumables Market 2017, presents a professional and in-depth study on the current state of the Welding Consumables market globally, providing basic overview of Welding Consumables market including definitions, classifications, applications and industry chain structure, Welding Consumables Market report provides development policies and plans are discussed as well as manufacturing processes and cost structures. Welding Consumables market size, share and end users are analyzed as well as segment markets…