Press release

Crypto Asset Management Industry Forecasted to Grow at 22.4% CAGR, Surpassing USD 2.28 Billion by 2031

The crypto asset management market is experiencing rapid growth, driven by the rising adoption of digital assets and the increasing need for secure, efficient, and optimized investment strategies. The market is projected to grow from US$1.1 billion in 2024 to US$2.28 billion by 2031, recording a CAGR of 22.4% during the forecast period. The increasing use of advanced technologies like artificial intelligence (AI) and machine learning (ML) has revolutionized portfolio management, automated trading, and transaction processing, contributing to the sector's growth.With cryptocurrencies gaining mainstream acceptance, investors, hedge funds, and institutional players are actively seeking sophisticated crypto asset management solutions that provide better risk mitigation, portfolio diversification, and real-time analytics. The market is dominated by portfolio management solutions, accounting for the largest segment, while North America continues to lead geographically due to robust financial infrastructure, regulatory support, and the presence of leading crypto-focused technology firms.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/34765

Key Highlights from the Report

The crypto asset management market is expected to double in size by 2031, reflecting growing investor confidence.

AI and ML technologies are key enablers for smarter portfolio and risk management.

Portfolio management solutions represent the leading product segment in the market.

Institutional investors are the primary end-users, driving adoption.

North America dominates the market due to technological maturity and strong regulatory frameworks.

Rising demand for digital asset security and transparency is accelerating market growth.

Market Segmentation

The crypto asset management market is segmented based on product type and end-user categories. Product-wise, the market is categorized into portfolio management platforms, trading and execution platforms, and analytics and risk management tools. Portfolio management solutions dominate due to their ability to offer real-time insights, automated strategies, and optimized asset allocation. Trading and execution platforms are increasingly adopted by institutional traders seeking fast and reliable execution in volatile crypto markets.

Based on end-users, the market includes institutional investors, retail investors, hedge funds, and family offices. Institutional investors are leading the market adoption, leveraging advanced AI-driven solutions for large-scale portfolio optimization. Retail investors are gradually adopting crypto asset management platforms due to the growing availability of user-friendly applications and educational resources. Hedge funds and family offices are also adopting tailored solutions to manage diversified crypto portfolios effectively.

Read More: https://www.persistencemarketresearch.com/market-research/crypto-asset-management-market.asp

Regional Insights

North America is the leading market, driven by the presence of major blockchain technology providers, crypto exchanges, and a favorable regulatory environment that encourages digital asset adoption. Investors in the region are highly receptive to AI-enabled portfolio management, contributing to a substantial market share.

Europe is witnessing steady growth due to increasing institutional participation and regulatory clarity in crypto asset management. Countries like Switzerland, Germany, and the UK are emerging as hubs for crypto investment solutions, attracting international investors seeking secure and compliant platforms.

Market Drivers, Restraints, and Opportunities

The market growth is primarily driven by the growing adoption of AI and ML technologies, which enhance portfolio performance, risk assessment, and automated trading strategies. Increasing institutional investments and the expanding ecosystem of digital assets are also key growth factors fueling market expansion.

However, regulatory uncertainty and the inherent volatility of cryptocurrencies pose significant challenges. Market participants face difficulties navigating complex compliance frameworks, which may hinder adoption, particularly in regions with restrictive regulations.

Opportunities lie in developing advanced risk management solutions, expanding services for retail investors, and integrating emerging technologies such as blockchain analytics and decentralized finance (DeFi) platforms. These innovations can create new revenue streams and drive market penetration in untapped regions.

Reasons to Buy the Report

✔ Comprehensive analysis of global market trends and growth drivers.

✔ In-depth segmentation based on product type and end-user.

✔ Detailed regional insights covering North America, Europe, Asia-Pacific, and the rest of the world.

✔ Evaluation of key players and their strategic developments.

✔ Identification of opportunities, challenges, and investment potential in the crypto asset management market.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/34765

Frequently Asked Questions (FAQs)

#1 How Big is the Crypto Asset Management Market currently and by 2031?

#2 Who are the Key Players in the Global Crypto Asset Management Market?

#3 What is the Projected Growth Rate of the Market during 2024-2031?

#4 What is the Market Forecast for Crypto Asset Management by 2032?

#5 Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

Key players operating in the market include:

CoinShares

Galaxy Digital

Bitwise Asset Management

Grayscale Investments

Fidelity Digital Assets

Genesis Global Capital

Anchorage Digital

Recent Developments:

Grayscale Investments launched a new DeFi-focused fund to cater to the growing interest in decentralized assets.

Fidelity Digital Assets introduced AI-powered analytics tools for institutional crypto investors to optimize portfolio management.

The crypto asset management market is poised for robust growth, supported by technological innovation, increasing institutional adoption, and expanding regional penetration. Investors and enterprises seeking exposure to digital assets are actively leveraging sophisticated platforms to enhance returns and manage risk efficiently. With continuous technological advancements, regulatory clarity, and a growing global investor base, the market is expected to see sustained growth throughout the forecast period.

Related Reports:

Digital Audio Workstations Market https://www.persistencemarketresearch.com/market-research/digital-audio-workstations-market.asp

Real-time analysis Market https://www.persistencemarketresearch.com/market-research/real-time-analysis-market.asp

Sentiment Analysis Software Market https://www.persistencemarketresearch.com/market-research/sentiment-analysis-software-market.asp

Public Cloud Service Market https://www.persistencemarketresearch.com/market-research/public-cloud-service-market.asp

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Asset Management Industry Forecasted to Grow at 22.4% CAGR, Surpassing USD 2.28 Billion by 2031 here

News-ID: 4199985 • Views: …

More Releases from Persistence Market Research

Current Transducer Market to Reach US$1,090 Million by 2033, Driven by Rising En …

Current Transducer Market Overview and Growth Outlook

The current transducer market is witnessing steady growth as industries increasingly prioritize accurate current measurement, system safety, and energy efficiency. According to the latest study by Persistence Market Research, the global current transducer market size is likely to be valued at US$ 770.7 million in 2026 and is projected to reach US$ 1,090 million by 2033, growing at a CAGR of 5.1% between 2026…

Tungsten Carbide Powder Market Poised to Hit US$27.5 Billion by 2033, Driven by …

Tungsten Carbide Powder Market Overview and Growth Outlook

The tungsten carbide powder market is experiencing consistent growth as industries increasingly rely on high-performance materials for durability, precision, and efficiency. According to the latest study by Persistence Market Research, the global tungsten carbide powder market size is likely to be valued at US$ 18.2 billion in 2026 and is projected to reach US$ 27.5 billion by 2033, expanding at a CAGR of…

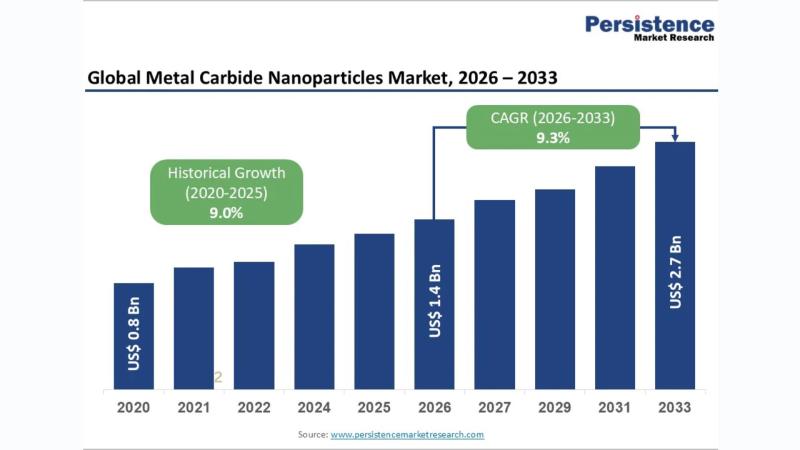

Metal Carbide Nanoparticles Market Set to Reach US$2.7 Billion by 2033, Driven b …

Metal Carbide Nanoparticles Market Overview and Growth Outlook

The metal carbide nanoparticles market is gaining strong momentum as industries increasingly demand materials with superior hardness, thermal stability, and wear resistance. According to the latest study by Persistence Market Research, the global metal carbide nanoparticles market size is likely to be valued at US$ 1.4 billion in 2026 and is expected to reach US$ 2.7 billion by 2033, growing at a CAGR…

Agricultural Lime Market Projected to See Steady Rise to US$3 Billion by 2033, D …

Agricultural Lime Market Overview and Growth Potential

The agricultural lime market plays a crucial role in improving soil fertility and crop productivity across global agricultural systems. According to the latest study by Persistence Market Research, the global Agricultural Lime Market was valued at US$ 1.7 billion in 2020 and reached US$ 2.1 billion in 2026. It is further projected to reach US$ 3 billion by 2033, growing at a CAGR of…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…