Press release

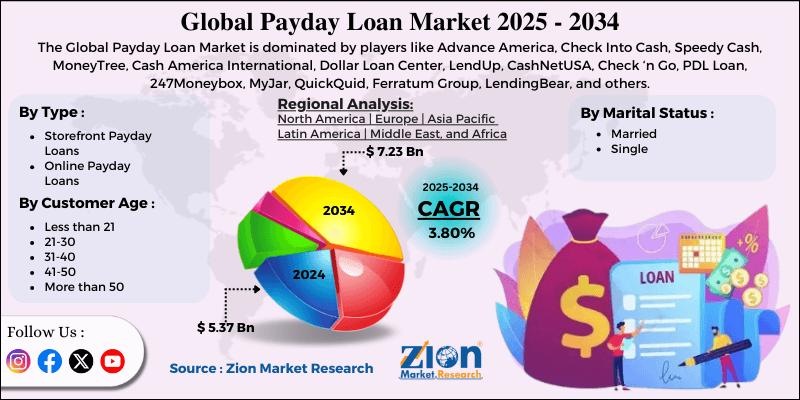

Payday Loan Market Size to Grow from USD 5.37 Billion in 2024 to USD 7.23 Billion by 2034, at a 3.8% CAGR

The global payday loan market was valued at approximately USD 5.37 billion in 2024 and is projected to reach around USD 7.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.8% between 2025 and 2034.Access key findings and insights from our Report in this Free sample -https://www.zionmarketresearch.com/sample/payday-loan-market

Payday loans, also known as short-term or cash advance loans, provide consumers with quick access to funds before their next paycheck. The market is primarily driven by increasing demand for short-term liquidity solutions, growing financial inclusion, and digital lending platforms.

The rise of online payday loan platforms, mobile banking, and fintech innovations is significantly enhancing market penetration. Regulatory frameworks, technological advancements, and evolving consumer behavior will shape the growth trajectory of the global payday loan market over the next decade.

1. Introduction

Payday loans are short-term, high-interest financial instruments designed to provide immediate cash to consumers. Typically, the loan is repaid on the borrower's next payday, often with high annual percentage rates (APR).

The market has witnessed growth due to the increasing need for quick financial solutions among salaried employees, freelancers, and individuals with limited access to traditional banking services. The expansion of digital lending platforms and mobile apps is facilitating easier and faster access to payday loans, boosting market adoption globally.

2. Market Dynamics

2.1 Growth Drivers

a) Rising Demand for Short-Term Financial Solutions:

Consumers facing unexpected expenses, medical emergencies, or urgent payments are increasingly turning to payday loans.

Quick disbursal and minimal documentation make payday loans attractive.

b) Digital Transformation and Fintech Adoption:

Online payday loan platforms, mobile apps, and digital payment systems are improving accessibility and convenience.

Fintech innovations, including AI-based credit scoring, allow lenders to offer instant approval.

c) Growing Financial Inclusion:

Payday loans provide credit access to underbanked and unbanked populations, especially in emerging economies.

Expansion of micro-lending and digital banking services supports market growth.

d) Economic Uncertainty and Personal Expenses:

Rising cost of living, inflation, and economic uncertainty lead individuals to seek short-term credit options.

e) Regulatory Reforms Encouraging Digital Lending:

Governments in various regions are enabling regulated digital lending frameworks, which facilitate secure payday lending operations.

2.2 Market Challenges

High Interest Rates and Fees: Payday loans are often associated with high APR, which may lead to regulatory scrutiny and borrower default risks.

Debt Cycle Risk: Frequent borrowing may trap consumers in a cycle of debt, limiting long-term adoption.

Regulatory Constraints: Different countries impose restrictions on loan amount, interest rates, and lending practices, which can hinder market growth.

Fraud and Security Risks: Online payday lending platforms face challenges related to fraud prevention, data security, and identity verification.

2.3 Market Opportunities

Expansion of Online Lending Platforms: Digital lending platforms can capture underserved markets globally.

Integration with Mobile Banking and Fintech Solutions: Leveraging AI, big data, and analytics improves credit assessment and risk management.

Emerging Economies: Growth potential in Asia-Pacific, Africa, and Latin America, where access to short-term credit is limited.

Collaborations with Financial Institutions: Partnerships with banks and fintech companies can enhance market reach and regulatory compliance.

3. Market Segmentation

3.1 By Loan Type

Single-Payment Loans: Repaid on the borrower's next payday.

Installment Loans: Repaid over multiple intervals.

3.2 By Mode of Lending

Online Lending: Mobile apps, web-based platforms, and digital banking solutions.

Offline Lending: Traditional payday loan providers, pawn shops, and retail lenders.

3.3 By End User

Individual Consumers: Salaried employees, freelancers, and underbanked individuals.

Small Businesses: Microloans for operational and emergency expenses.

3.4 By Region

North America: Dominated by the U.S. due to widespread payday lending regulations and fintech adoption.

Europe: Stringent regulations and growing digital lending platforms drive the market.

Asia-Pacific: Rapid fintech adoption and urban population growth.

Latin America: Rising financial inclusion and digital payment penetration.

Middle East & Africa: Emerging demand among underbanked populations.

4. Regional Analysis

4.1 North America

The United States leads due to a well-established payday lending framework and growing digital lending adoption.

Canada's market is emerging with regulated online lending platforms.

4.2 Europe

The market is driven by countries such as the UK, Germany, and France, which are seeing growing digital payday lending platforms under regulatory oversight.

4.3 Asia-Pacific

High growth expected in China, India, and Southeast Asian countries due to increasing smartphone penetration and digital banking adoption.

Expansion of fintech solutions provides easy access to credit for urban and rural populations.

4.4 Latin America

Brazil, Mexico, and Argentina are witnessing growth due to fintech innovations and digital micro-lending solutions.

4.5 Middle East & Africa

Gradual adoption with potential in underbanked populations and emerging digital financial ecosystems.

Access our report for a comprehensive look at key insights -https://www.zionmarketresearch.com/report/payday-loan-market

5. Competitive Landscape

Key players in the global payday loan market include:

Wonga PLC

CashNetUSA

ACE Cash Express, Inc.

Advance America

Check Into Cash

MobiKwik (India)

Payday Financial (UK)

Elevate Credit, Inc.

LendUp

OppLoans

Strategies Adopted by Key Players:

Expansion of digital lending platforms to reach underserved consumers.

Partnerships with banks, fintech companies, and mobile payment platforms.

Investment in AI, machine learning, and big data analytics for credit scoring and risk assessment.

Compliance with regional regulations to enhance consumer trust and market credibility.

6. Key Market Trends

Digital Transformation: Shift from traditional payday loans to online and mobile lending platforms.

AI and Analytics in Credit Assessment: Enhanced risk evaluation and faster loan approvals.

Financial Inclusion Focus: Expanding access to payday loans for underbanked and unbanked populations.

Integration with Mobile Payments and Fintech Solutions: Seamless user experience and instant loan disbursement.

Regulatory Adaptation: Players adjusting to changing regulations to ensure compliance and market stability.

7. Market Outlook (2025-2034)

The global payday loan market is projected to grow from USD 5.37 billion in 2024 to USD 7.23 billion by 2034, reflecting a CAGR of 3.8%.

Key Drivers for the Forecast Period:

Continued adoption of digital and mobile lending platforms.

Growth in financial inclusion and access to credit for underbanked consumers.

Technological advancements in AI, machine learning, and big data analytics for credit evaluation.

Regulatory reforms enabling safe and transparent digital lending practices.

8. Conclusion

The global payday loan market is set for steady growth over the next decade, reaching USD 7.23 billion by 2034. Growth is primarily driven by digital transformation, increasing financial inclusion, rising demand for short-term liquidity, and technological innovation in fintech lending solutions.

Market players that invest in digital platforms, adopt advanced risk assessment technologies, and comply with regional regulations will be well-positioned to capitalize on growth opportunities.

Payday loans will continue to serve as a critical financial tool for short-term liquidity needs, supporting both individual consumers and small businesses, especially in regions with limited access to traditional banking services.

More Trending Reports by Zion Market Research -

Voice-over-5G (Vo5G) Market-https://www.zionmarketresearch.com/report/voice-over-5g-vo5g-market

Education ERP Market-https://www.zionmarketresearch.com/report/education-erp-market

Point-of-Use Water Treatment Systems Market-https://www.zionmarketresearch.com/report/point-of-use-water-treatment-systems-market

Advanced Packaging Market-https://www.zionmarketresearch.com/report/advanced-packaging-technologies-market

Pharmacovigilance Outsourcing Market-https://www.zionmarketresearch.com/report/pharmacovigilance-outsourcing-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1-855-465-4651

Email: sales@zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us-after all-if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payday Loan Market Size to Grow from USD 5.37 Billion in 2024 to USD 7.23 Billion by 2034, at a 3.8% CAGR here

News-ID: 4199455 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

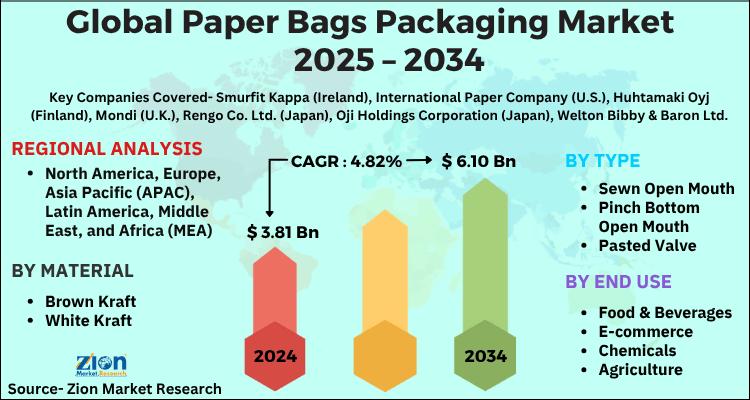

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

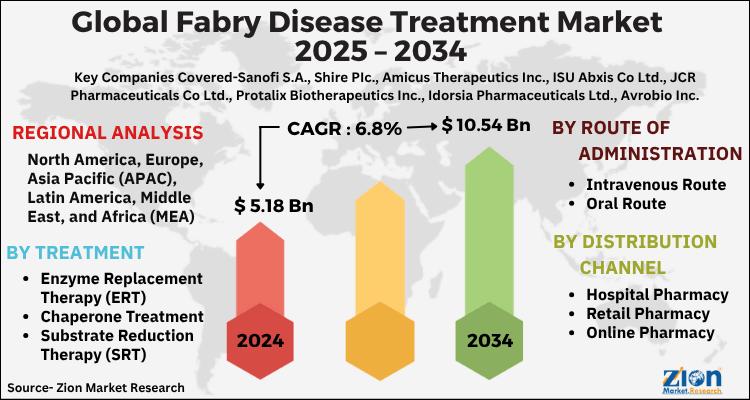

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Payday

$500 Google Payday Review - Legit or Another Hype?

$500 Google Payday Review - Legit or Another Hype?

With so many online money-making systems launching every day, it's hard to separate real opportunities from overhyped products. One of the latest entries is "$500 Google Payday" by Glynn Kosky, a WarriorPlus product promising a plug-and-play system that leverages Google's algorithm to generate commissions without selling, ads, or tech skills. But does it really work, or is it just another rehashed system?…

Payday Loans Market Outlook 2023-2030

A payday credit is a transient unstable advance, frequently described by exorbitant loan costs. The expression "payday" in payday credit alludes to when a borrower composes a postdated check to the moneylender for the payday pay, yet gets some portion of that payday total in prompt money from the loan specialist. Likewise, payday loans have little credit limits, ordinarily up to $500, and don't need a credit check. Moreover, the…

Payday Loans Service Market Astonishing Growth with Top Influencing Key Players …

Report Description

The Payday Loans Service Market is expected to register a CAGR of around 4.1%, during the forecast period 2022 to 2027.

The Global Payday Loans Service Market Report provides Insightful information to the clients enhancing their basic leadership capacity identified with the global Payday Loans Service Market business, including market dynamics, segmentation, competition, and regional growth. The strategy of expansion has been adopted by key players who are increasing their…

Payday Loans Rise in Public interest

PaydayLoanSolutions believes that the personal payday loan is becoming a necessary element of the modern consumers way of life. The company offers insight with regard to the near cultural necessity of the payday loan for significant parts of the general population.

Location—PaydayLoanSolutions allows consumers to organise a quick and small sized loan based upon the stability and reliability of their employment history and that is paid back to the company automatically…

Enjoy Financial Freedom with Payday Loan Solutions

Payday Loan Solutions is an online lender of the loans for American citizens at any hour of the day. It is the most trustworthy site to get payday loan of any amount within few hours.

“Fast cash delivery and other exciting features that our website offers to loan seekers make us the best choice,” says a company spokesperson.

The website operates 365 days a year and 24 hours a day,…

Payday Loan Consolidation Company "Payday Freedom" Announces Lender Scam Still T …

There has been a massive increase of fraudulent payday loan debt collectors trying to collect fake payday loan debts. Most of the callers have very strong Indian accents from the client reports coming in. It's been ongoing for many months now with no end in sight.

Unfortunately, so many people are falling for this trap and the main problem is the operators of this scam are working out of the country.…