Press release

Flue Duct Expansion Joints Market to Reach USD 816 Million by 2031 Top 10 Company Globally

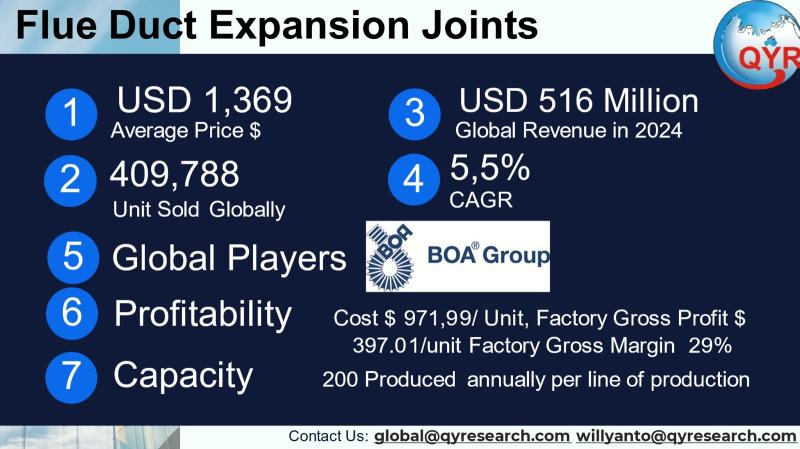

Flue duct expansion joints are engineered flexible connectors installed in industrial and utility ducting systems to absorb thermal movement, vibration, and misalignment while preserving system integrity and sealing against particulate or gas leakage. Used across power generation, cement and steel plants, petrochemical refineries, waste-to-energy facilities and large HVAC systems, they exist in metal (bellows), elastomeric and fabric constructions and are specified by pressure, temperature, chemical compatibility and expected movement cycles. The product set spans small replacement bellows for HVAC to large custom fabric joints used on high-temperature flue gas ducts in thermal power and heavy industry.The global market for flue duct joints in the scope of this report is stated at USD 561 million in 2024 with a projected compound annual growth rate of 5.5% through 2031, reaching market size of USD 816 million in 2031. Key technology and materials trends include increasing adoption of engineered fabric (non-metallic) solutions for large low-pressure flue ducts, modular standardized metal bellows for piping/duct retrofit, and more stringent testing/certification requirements for high-temperature, corrosive flue gas applications. The average selling price used for this report is USD 1,369 per unit. Based on the 2024 market value of USD 561 million at that price, total units sold globally in 2024 are approximately 409,788 units. A representative factory cost of goods sold per unit is USD 971.99. The internal COGS breakdown by component is: materials 50%, direct labor 20%, manufacturing overhead 15%, freight/logistics 10%, and testing/packaging 5%. This yields a factory gross profit of about USD 397.01 per unit. A full-machine production roughly at 200-500 units per line per year; downstream end-market demand split supporting those volumes is dominated by power & utilities, cement & steel, petrochemical/refining and HVAC/commercial. These economics are grounded in market pricing, manufacturer product pages and industry capacity descriptions for expansion-joint production.

Latest Trends and Technological Developments

The market is seeing two intersecting trends: material & design optimization for higher temperature and corrosion resistance, and modularization/standardization to reduce lead times for retrofit work. In May 2025, a major market analysis update reiterated faster growth in APAC driven by power and industrial retrofit demand, noting uptake of engineered fabric joints for large flue ducts as a cost- and installation-time saving compared with large welded metal bellows. That report highlighted supplier consolidation and stronger certification/regulatory requirements for flue gas handling systems on major projects (reported May 2025). Separately, industry sourcing sites and manufacturers continue to publish technical guidance promoting fabric (non-metallic) joints where temperature and pressure allow, citing easier replacement cycles and lower installed cost. These items represent the most recent market-level commentary about demand drivers and materials/production advances.

Asia is the largest and fastest-growing regional market for flue duct expansion joints due to massive thermal power capacity, rapid industrialization in China and India, and continual expansion of cement, steel and petrochemical sectors across the region. Large retrofit waves in coal-fired power plants, continued construction of combined-cycle plants and growing waste-to-energy projects are sustaining demand for both bespoke large fabric flue joints and smaller metal/elastomeric units. Manufacturers in China, Japan and India both supply domestic projects and export to neighboring markets; many Asian suppliers compete on price for commodity-style metal bellows while specialty fabric and high-temperature bellows remain the domain of more specialized manufacturers. Regional technical support, local fabrication and shorter delivery times are material advantages for Asia-based suppliers. Market-level reporting and company lists corroborate the prominence of Asia in unit volumes and manufacturing capacity.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5053719

Flue Duct Expansion Joints by Type:

Belt Type

Flanged Type

Flue Duct Expansion Joints by Application:

Power Plants

Industrial

Others

Global Top 10 Key Companies in the Flue Duct Expansion Joints Market

Teadit Group

Flexicraft

Baker Bohnert

Lamons

Alimex

UIP International

Global Flex Manufacturing

Badger

Kadant

Boa Group

Regional Insights

Within Southeast Asia, Indonesia is a high-impact country due to large cement production, growing power generation projects (including both grid expansion and independent power plants), and industrial process plants that require flue gas handling. ASEAN-level demand is heavily project-driven: Indonesia, Vietnam, Thailand and the Philippines account for the majority of regional consumption, with Indonesia commonly representing the single largest share inside ASEAN because of its scale of heavy industry and ongoing replacement/upgrade cycles. Demand composition in ASEAN skews toward fabric/non-metallic joints for larger low-pressure flue ducts in cement and pulp & paper, and elastomeric/metal solutions in petrochemical and power applications. Local content requirements and logistics costs mean that regional suppliers and regional fabrication often win projects versus long-distance imports for larger, heavier items. Company product pages and regional market commentary show this pattern of project-driven demand in ASEAN.

The industry faces several structural challenges. First, specification complexity: many projects require custom designs (size, multi-layer composites, specific connectors or flanges), which reduces repeatability and economies of scale. Second, quality and certification: high-temperature or corrosive flue gas environments demand strict materials testing, which raises manufacturers capital and quality-control costs and lengthens lead times. Third, fragmentation: the supplier base is broad, with many small-to-medium manufacturers supplying commodity bellows while only a few specialize in engineered large fabric joints this fragmentation complicates procurement and can compress margins. Fourth, logistical and installation constraints for very large joints (onsite welding, heavy lifts, alignment) add hidden project costs. Finally, raw-material price volatility (rubber, high-grade textiles, stainless alloys) can squeeze factory margins when contracts are fixed-price. Industry guides and supplier technical notes document these recurring industry headwinds.

Manufacturers should prioritize modularization and standardized trim sizes to shorten lead times and reduce custom engineering costs while developing documented testing and certification packages for high-temperature service to win utility and refinery contracts. Buyers should balance total installed cost (including downtime and replacement cycles) against lowest purchase price; fabric joints frequently deliver better installed economics on large low-pressure flue ducts. Investors evaluating the sector should seek companies with strong engineering IP, documented certification records, and regional fabrication footprint in Asia/ASEAN to capture shorter lead-time premium pricing. Vertical integration into pre-fabricated connector assemblies and partnerships with local installation contractors are differentiators that reduce project risk and strengthen bid competitiveness. Market reports and manufacturer news corroborate that certified, engineering-led suppliers capture higher-margin projects.

Product Models

Flue duct expansion joints are critical components used in power plants, refineries, and industrial exhaust systems to absorb thermal expansion, vibrations, and misalignments in ductwork. They ensure system reliability, extend service life, and reduce maintenance costs.

Belt Type Expansion Joints which use flexible fabric or elastomer belts for lightweight applications. Notable products include:

EagleBurgmann BELT EJ EagleBurgmann: Flexible belt joint designed for power plant and flue gas applications.

Flexican Belt Expansion Joint Flexican Bellows & Hoses: Lightweight expansion joint with fabric-reinforced belts for ductwork.

Senior Flexonics Belt Joint Senior Flexonics: Fabric belt-based duct joint offering thermal and vibration resistance.

Holz Rubber Fabric Belt EJ Holz Rubber Company: Belt-type expansion joint for gas handling and pollution control systems.

Kadant Johnson Belt Expansion Joint Kadant Inc.: Fabric belt-based expansion joint for low-pressure flue ducts.

Flanged Type Expansion Joints which are bolted and designed for higher mechanical strength and sealing efficiency. Examples include:

EagleBurgmann FLX EJ EagleBurgmann: Flanged duct expansion joint with bolted steel frame for secure sealing.

Flexican Flanged EJ Flexican Bellows & Hoses: Flanged steel expansion joint for high-temperature gas ducts.

Senior Flexonics Flanged Joint Senior Flexonics: Heavy-duty flanged joint designed for thermal cycling in ducts.

Holz Rubber Flanged EJ Holz Rubber Company: Flanged duct joint providing durability in harsh flue gas conditions.

Kadant Flanged EJ Kadant Inc.: Steel-flanged expansion joint for tight sealing and long service life.

The flue duct expansion joint market is a technically specialized, project-driven segment with a 2024 value of USD 561 million and 5,5% growth forecast to 2031. Asia and ASEAN (notably Indonesia) constitute the core of volume growth due to heavy industrial activity and power/utility projects. Competitive advantage accrues to suppliers who combine engineering capability, certifications for severe service, and regional fabrication to minimize lead times. Buyers and investors should value engineering IP, quality assurance, and on-the-ground service networks as primary drivers of sustainable margin and growth.

Investor Analysis

This report highlights three investor-relevant elements: stable end-market demand, margin dynamics at the factory level, and regional concentration of growth. What investors should care about is the unit economics (price per unit vs. COGS) and the replacement-driven nature of demand in power, cement and petrochemical sectors; how investors can act is by prioritizing equity or private investment in engineers/players that demonstrate higher gross profits per unit and have regional fabrication footprints in Asia/ASEAN; why this matters is that regional presence shortens lead times, raises win rates on retrofit projects, and preserves margin even where contract pricing is competitive. Additionally, production-line scalability (e.g., 6,000 units/year per line in a mid-size facility) allows investors to model capital expenditures versus incremental revenue, and the downstream demand mix informs portfolio exposure to sectors that are cyclically more stable (power & utilities) versus those more cyclical (cement, petrochem). Overall, the combination of modest CAGR, concentrated regional growth and clear cost structure makes the sector attractive to strategic buyers, consolidation plays and growth-oriented manufacturing investors

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5053719

5 Reasons to Buy This Report

Comprehensive Asia & ASEAN-focused breakdown tying unit economics to regional demand and supplier strategy.

Factory-level unit economics and operational capacity benchmarks to assess manufacturer profitability and CAPEX payback.

Technology and materials trend analysis that highlights areas for product differentiation and premium pricing.

Competitive landscape and top-player profiling for M&A or supplier-selection decisions.

Investor-oriented analysis translating technical market detail into actionable investment signals and risk factors.

5 Key Questions Answered

What was the 2024 market value and how many units did that represent at representative pricing?

What are realistic factory-level COGS, their breakdown, and resulting per-unit gross profit?

Which downstream industries drive demand regionally and what is the likely demand mix?

Who are the established suppliers and what capabilities differentiate higher-margin players?

What operational scale (units per production line per year) and production constraints should investors and buyer model?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Flue Duct Expansion Joints Market to Reach USD 816 Million by 2031 Top 10 Company Globally here

News-ID: 4198809 • Views: …

More Releases from QY Research

Why Faux Leather Vinyl Fabric Is Replacing Genuine Leather Across Automotive, Fu …

Problem

Manufacturers using genuine leather faced rising raw material costs, inconsistent quality, limited color consistency, and supply chain volatility. Natural leather also posed challenges related to moisture sensitivity, maintenance requirements, and regulatory scrutiny over animal welfare and environmental impact. These issues increased production costs and limited scalability across automotive interiors, furniture, fashion, and commercial upholstery.

Solution

Producers increasingly adopted Faux Leather Vinyl Fabric, a synthetic material typically based on PVC or PU coatings…

Global and U.S. Metal Bellows Expansion Joints Market Report, Published by QY Re …

QY Research has released a comprehensive new market report on Metal Bellows Expansion Joints, refers to flexible mechanical components made from thin-walled, corrugated metal (bellows) designed to absorb thermal expansion, vibration, and mechanical movement in piping and duct systems. They help protect pipes, equipment, and structures by compensating for axial, lateral, angular, or combined movements caused by temperature changes, pressure fluctuations, or seismic activity, and are widely used in power…

Global and U.S. Universal Wall Connectors Market Report, Published by QY Researc …

QY Research has released a comprehensive new market report on Universal Wall Connectors, wall-mounted AC electric vehicle (EV) charging devices designed to deliver safe, efficient, and interoperable charging across multiple vehicle brands and connector standards. Supporting protocols such as Type 1 (SAE J1772), Type 2 (IEC 62196), and region-specific configurations, universal wall connectors are foundational infrastructure for residential garages, workplaces, commercial parking, fleet depots, and multi-unit dwellings. As EV adoption…

Top 30 Indonesian Paper Manufacturing Public Companies Q3 2025 Revenue & Perform …

1) Overall companies performance (Q3 2025 snapshot)

PT Indah Kiat Pulp & Paper Tbk (INKP) Integrated pulp & paper

PT Pabrik Kertas Tjiwi Kimia Tbk (TKIM) Paper and cultural products

PT Toba Pulp Lestari Tbk (INRU) Pulp producer

PT Suparma Tbk (SPMA) Industrial & consumer paper products

PT Indonesia Fibreboard Industry Tbk (IFII) Fibreboard & related materials

PT SLJ Global Tbk (SULI) Forestry & wood-linked products

PT Inter Delta Tbk (INTD)…

More Releases for Joint

"Joint Genesis Launches Revolutionary Natural Supplement for Joint Pain Relief & …

Joint Genesis has officially launched its breakthrough natural supplement designed to provide effective joint pain relief, improve mobility, and support long-term joint regeneration. This scientifically inspired formula combines powerful natural ingredients to help adults maintain an active lifestyle, reduce stiffness, and support overall joint health. Joint GenesisTM is ideal for anyone looking for a safe, natural alternative to traditional painkillers. Customers can purchase the supplement online at https://us-jointgenesisis.com

and experience…

Arthro MD+ Joint Support - Enhance Mobility And Joint Stability!

As we age or engage in physically demanding activities, our joints often take the brunt of the damage. Stiffness, pain, and reduced flexibility can limit mobility and affect our quality of life. This is where Arthro MD+ Joint Support comes into play. In this comprehensive guide, we will explore everything you need to know about this joint supplement, from its benefits to how it works, customer reviews, and more. By…

Pharma Flex RX Joint Support™ Healthy Joint Mobility Flexibility!

Are you tired of living with joint pain, inflammation, and arthritis? Pharma Flex RX Joint Support is here to help. This is made to ease your joint pain and support your health. It uses natural ingredients that work together to fix the real causes of your joint pain. This means you can move freely and enjoy your life again.

● Product Name - Pharma Flex RX Joint Support

● Results - In…

BioDynamix Joint Genesis - Time To Say Bye To Joint Pain (Joint Genesis Reviews)

What is BioDynamix Joint Genesis?

BioDynamix Joint Genesis is a doctor-formulated supplement designed to treat joint pain and discomfort. The formula rejuvenates and restores your joints, offering a pain-free life.

BioDynamix Joint Genesis ensures you enjoy flexibility, movement, and independence for a long time. It soothes all kinds of joint inflammation and combats stiffness. The formula works by addressing the underlying cause of joint issues.

BioDynamix Joint Genesis works for adults between ages…

Revolutionizing Sacroiliac Joint Treatment: Minimally Invasive Sacroiliac Joint …

Minimally Invasive Sacroiliac Joint Fusion (MIS-SIJ Fusion) is a surgical procedure for treating sacroiliac joint disorders, where the sacroiliac joint is stabilized through minimally invasive techniques. MIS sacroiliac joint fusion is a less invasive alternative to traditional open sacroiliac joint fusion and is gaining popularity among patients and healthcare providers. The MIS sacroiliac joint fusion market is expected to grow significantly in the coming years, driven by the increasing demand…

Flexotone Joint Pain Relief Reviews: Get Relief from Joint Pain & Arthritis

Joint pain & inflammation has come to be an instead usual problem among older consumers, as well as they are frequently entrusted to identify exactly how to deal with these problems with a topical cream or resting. Nevertheless, the makers behind Flexotone think that the reason behind this concern has every little thing to do with something that takes place within the joints. This trouble triggers unbelievable pain; however Big…