Press release

Mathew Moxness: Tried-and-True Methods to Reduce Real Estate Risk

Discover Mathew Moxness's proven strategies to reduce real estate risk through diversification, multifamily focus, due diligence, and conservative financing.Image: https://www.abnewswire.com/upload/2025/09/966595eca640f1a101ccaf46d3182f15.jpg

Investors tend to look at real estate as a source of long-term wealth, but the business always carries some level of risk. Markets fluctuate, lenders contract terms, and development deals falter unexpectedly. Mathew Moxness built his career by handling these realities directly. With a background in multifamily acquisitions, financing, and development projects, he uses proven strategies that minimize risk while creating avenues for growth. His experience demonstrates discipline and purposeful action to ward off unnecessary risk.

The Nature of Real Estate Risk

Each property has a unique set of challenges. Real estate [https://www.f6s.com/member/mathewmoxness] offers enticing opportunities, yet it tests investors in various ways:

*

Market Volatility: Cycles in property mirror interest rates, inflation, and overall economic activity.

*

Financing Risks: Lenders change terms, limit credit, or increase borrowing costs.

*

Operational Challenges: Increased repair expenses, tenant turnover, and vacancies reduce revenue.

*

Development Issues: Delays, zoning limitations, and construction costs hinder progress.

Investors cannot eliminate such risks. The most optimal result stems from dealing with them through preparation and anticipation. Professionals thrive when they confront issues head-on, expect changes, and depend on systematic plans that enable constant advancements in all environments.

Tried-and-True Risk Reduction Strategies.

The property sector provides mechanisms that hold up every year. Seasoned professionals hone them through practice and continuous decision-making.

1. Diversify Across Assets and Markets

Diversification is one of the best defenses. A portfolio with multifamily housing, commercial buildings, and development ventures insulates investors from declines in one sector. Geographic diversification provides another level of security.

To illustrate, a city that experiences a recession might cause rental demand to decline, but another city might have growth and higher occupancy rates. A diversified portfolio protects investors from heavy dependence on a single market.

2. Conduct Rigorous Due Diligence

No pro shuns due diligence. Thorough inspection of property records, tenant information, and compliance issues avoids surprises. A thorough examination of income statements and expenses also verifies whether a property actually sustains the expected returns.

Inspections are also important. They expose maintenance issues that owners can fix prior to their development into large financial issues. By exposing problems upfront, investors save money from misdirection later on.

3. Use Conservative Financing

Leverage is provided by borrowing, but excessive borrowing undermines stability. Skilled investors constrain leverage to amounts that are still safe even when the situation turns down. They choose financing conditions that maintain debt service affordable under increasing interest charges or short-term declines in income.

A solid cash buffer underscores this strategy. Additional capital enables investors to absorb surprise expenses and maintain properties during business cycles without the need for frantic selling. This interplay between leverage and liquidity differentiates prudent investors from irresponsible ones.

4. Emphasis on Multifamily Properties

Multifamily properties bring stability that few other sectors can provide. Shelter is a fundamental human necessity irrespective of financial health. Even in times of recession, middle-market and lower-cost apartments continue to draw renters.

Sustained demand equates to consistent cash flow, which decreases exposure and provides a solid foundation for expansion. Mathew Moxness [https://kfor.com/business/press-releases/ein-presswire/711590709/building-dreams-mathew-moxness-leads-real-estate-investment-with-social-impact] emphasizes multifamily properties as a core part of his strategy. His historical success in the segment demonstrates the power of targeting stable, income-generating assets.

5. Pursue Strategic Value-Add Projects

New development projects tend to carry more risk. Value-add solutions represent a more secure option with high upside. Refurbishing units, upgrading amenities, or enhancing energy efficiency all enhance property value without disrupting current revenue streams.

These improvements appeal to tenants, increase lease duration, and enhance overall property performance. Investors gain increased income and appreciation without the risk that major development tends to engender.

Risk Management in Practice

Real strategies are relevant only when executed in real projects. Mathew Moxness illustrates the effectiveness of these principles by following a disciplined method. When he acquires multifamily properties, he acquires them in markets with robust rental demand and sound fundamentals. It guarantees long-term occupancy and stable returns.

He also does not overdepend on high leverage. Through proper structuring of finance and contingency planning, he ensures that surprise setbacks do not stop projects in their tracks. This disciplined approach keeps the projects on course and protects investors from the shocks that derail many less prepared projects.

The message is clear. Real estate success is not based on speculation or chance. It results from measured, steady decisions based on proven methods. Short-run pursuits of profit less frequently yield returns comparable to the disciplined consistency that professionals uphold.

Adaptability Creates an Edge

Even tried-and-true methods need adjustment. The real estate market is constantly evolving. Laws are modified, economic times vary, and tenant expectations are elevated. The best investors blend conventional practices with innovation.

Technology is one aspect of adjustment. Automated leasing software, e-payments, and intelligent building technology lower costs and enhance tenant satisfaction. Energy-efficient retrofits lower utility bills while drawing eco-friendly tenants. All these actions bolster income streams and minimize risk.

Adapting investors stay competitive. Ones that don't, however, face increasing challenges that are eating into profitability. The balance between tradition and innovation guarantees strength during both good and bad times.

Conclusion

Real estate provides riches and expansion, but only when handled through discipline of risk. Moxness [https://councils.forbes.com/profile/Mathew-Moxness-Founder-Crescendo-Equity-Corporation/8e025b2d-b3ec-4136-a909-b66e55267ab5] demonstrates how to be a success through the use of effective tactics like diversification, prudent financing, aggressive due diligence, and an emphasis on multifamily properties. His career demonstrates that adherence to tried principles guarantees stability and expansion over time.

Investors cannot avoid risk in property, but they can control it smartly. By emulating time-tested procedures and being sensitive to emerging realities, they shield their portfolios and create wealth that lasts. Success is not a matter of luck but of steady effort informed by tested strategies.

Media Contact

Company Name: CB Herald

Contact Person: Ray

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=mathew-moxness-triedandtrue-methods-to-reduce-real-estate-risk]

City:

State:

Country: United States

Website: http://Cbherald.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mathew Moxness: Tried-and-True Methods to Reduce Real Estate Risk here

News-ID: 4198704 • Views: …

More Releases from ABNewswire

Living Forever - AI Selected for Startup Grind Global Conference 2026 - Named Am …

AI-powered platform preserving living people's personalities, voices, and stories earns exhibition and pitch slot at premier Silicon Valley startup event

ATLANTA, GA - February 26, 2026 - Living Forever - AI [https://livingforeverai.com], an Atlanta-based startup building fully interactive video AI digital twins that preserve the personalities, voices, and life stories of living people for future generations, today announced its acceptance into the Startup Grind Global Conference 2026. The company was selected…

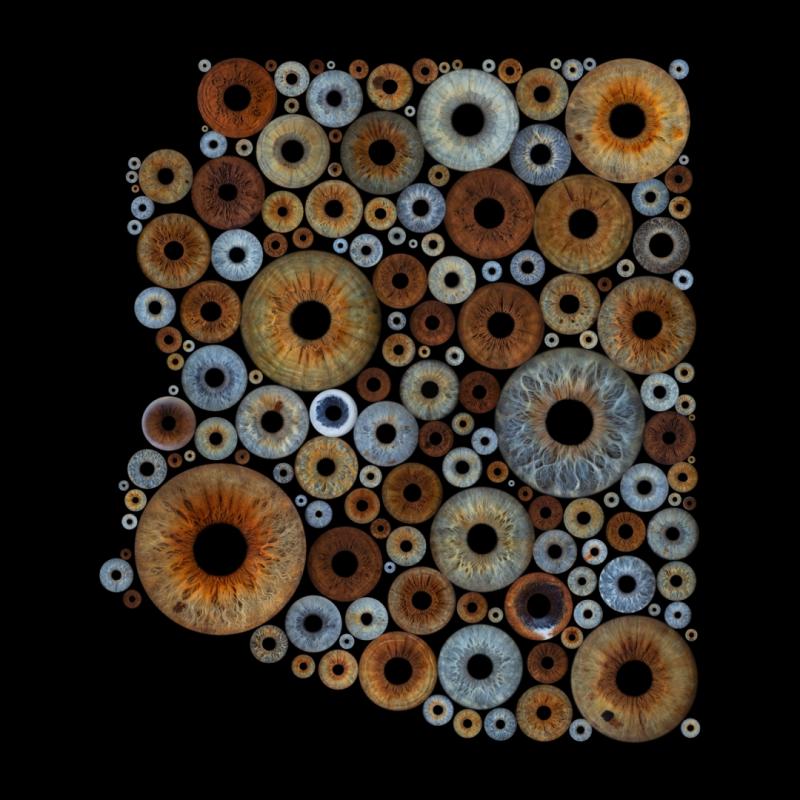

Mesa Studio Blends Iris Photography with the Art of Becoming Through the Iris Wi …

Sol Iris Photography founder Saskia Soliz draws on a background in autism support and personal growth to create a creative experience rooted in self-discovery.

MESA, AZ - February 26, 2026 - Sol Iris Photography, a Mesa-based studio specializing in high-resolution iris photography, is quietly building something beyond photography. Through the Iris Wisdom Project, clients are invited to share a brief piece of wisdom alongside their iris portrait - a thought, truth,…

Power Couple Combines Army Structure and Insurance Expertise to Launch Family-Ow …

Red Rover Roofing, a family-owned roofing company in Williamson County, Tennessee, brings Xactimate-certified insurance claim expertise and CertainTeed Master Shingle Applicator credentials to Middle Tennessee homeowners navigating storm damage roof replacement and insurance disputes across Franklin, Brentwood, Spring Hill, Nashville, and Murfreesboro.

SPRING HILL, TN - February 26, 2026 - When retired U.S. Army Captain Courtney Hostetler came home from deployment in Kuwait, she and her husband Alex knew they wanted…

Primary Biliary Cholangitis Market: Rapid Increment Driven by Innovation by 2034 …

The Key Primary Biliary Cholangitis Companies in the market include - CymaBay Therapeutics, Inc., Zydus Therapeutics Inc., Gannex Pharma Co., Ltd., Nanjing Chia-tai Tianqing Pharma, Intercept Pharmaceuticals, Enanta Pharmaceuticals, COUR Pharmaceutical, Novartis, Merck, Mirum Pharmaceuticals, Inc., Genfit, CymaBay Therapeutics, Inc., Calliditas Therapeutics, HighTide Biopharma Pty Ltd, Albireo, Curome Biosciences, Biotie Therapies Corp., and others.

DelveInsight's "Primary Biliary Cholangitis Market Insights, Epidemiology, and Market Forecast-2034 report offers an in-depth understanding of the…

More Releases for Moxness

Growing Demand and Trends of High-precision Medical Plastic Molding Market To Re …

Worldwide Market Reports has added a new research study on the Global "High-precision Medical Plastic Molding Market" 2024 by Size, Growth, Trends, and Dynamics, Forecast to 2031 which is a result of an extensive examination of the market patterns. This report covers a comprehensive investigation of the information that influences the market regarding fabricates, business providers, market players, and clients. The report provides data about the aspects which drive the…

Emerging Trends in Custom Medical Plastic Molding Services Market 2024 and Globa …

Worldwide Market Reports has added a new research study on the Global "Custom Medical Plastic Molding Services Market" 2024 by Size, Growth, Trends, and Dynamics, Forecast to 2031 which is a result of an extensive examination of the market patterns. This report covers a comprehensive investigation of the information that influences the market regarding fabricates, business providers, market players, and clients. The report provides data about the aspects which drive…

New Horizons in Medical Plastic Injection Molding Services Market Exploring Futu …

The latest competent intelligence report published by WMR with the title "An Increase in Demand and Opportunities for Global Medical Plastic Injection Molding Services Market 2024" provides a sorted image of the Medical Plastic Injection Molding Services industry by analysis of research and information collected from various sources that have the ability to help the decision-makers in the worldwide market to play a significant role in making a gradual impact…

Latest Research Report on Precision Medical Molding Solutions Market With Includ …

A newly released report on the "Precision Medical Molding Solutions Market 2023" provides a comprehensive view of the industry with market insights on the competitive scenarios and market segments with complete representation through graphs, tables, and charts to study the market easy to use and compare the numbers and user-friendly. The Precision Medical Molding Solutions Market research report is the hub of market information, which precisely expounds on critical challenges…