Press release

2025-2034 Banking, Financial Services, And Insurance (BFSI) Business Intelligence Market Evolution: Disruptions, Innovations, and Untapped Opportunities

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Banking, Financial Services, And Insurance (BFSI) Business Intelligence Industry Market Size Be by 2025?

The market size of the banking, financial services, and insurance (BFSI) business intelligence sector has seen significant enlargement in the recent past. The perspective suggests that it will appreciate from $21.38 billion in 2024 to a projected $24.03 billion in 2025, demonstrating a compound annual growth rate (CAGR) of 12.4%. This historic progression is ascribed to the surged adoption of digital transformation, increased necessity for fraud detection, growing obligation for risk management, amplified regulatory compliance prerequisites, and an uptrend in the availability of customer data.

What's the Long-Term Growth Forecast for the Banking, Financial Services, And Insurance (BFSI) Business Intelligence Market Size Through 2029?

In the coming years, the market size of the banking, financial services, and insurance (BFSI) business intelligence is anticipated to rapidly expand. The expected growth rate is 12.0% CAGR, reaching a market size of $37.87 billion by the year 2029. The projected growth over the forecast period can be ascribed to the boosted adoption of cloud analytics, the rising use of artificial intelligence, an increased emphasis on customer experience, the growth of fintech firms, and efforts towards optimizing operational cost. The forecast period will also see the prominence of several trends such as enhanced artificial intelligence capabilities, the merging of cloud computing, the advent of technology-enabled fraud detection, the evolution of real-time analytics, and the advancements made in predictive modelling.

View the full report here:

https://www.thebusinessresearchcompany.com/report/banking-financial-services-and-insurance-bfsi-business-intelligence-global-market-report

What Are the Key Growth Drivers Fueling the Banking, Financial Services, And Insurance (BFSI) Business Intelligence Market Expansion?

The growth of the market is being fueled by the growing trend of adopting digital banking solutions, caused by an increase in the usage of smartphones and internet penetration.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27749&type=smp

What Are the Key Trends Driving Banking, Financial Services, And Insurance (BFSI) Business Intelligence Market Growth?

Key players in the banking, financial services, and insurance (BFSI) business intelligence sector are concentrating on creating sophisticated solutions such as artificial intelligence (AI) agents, to augment predictive analytics capabilities, automate decision-making processes, enhance customer insights and fine-tune risk management procedures. These AI agents are essentially software programs capable of independently understanding their environment, processing information, making decisions, and undertaking actions to achieve certain objectives. For example, in November 2024, BUSINESSNEXT Inc., an Indian enterprise specializing in composable cloud services for financial businesses, introduced AGENTNEXT, an AI platform custom-made for the BFSI sector. The platform, designed to automate 60-70% of regular tasks, aims to bring banking operations up to date. It incorporates personalized AI-driven banker advisors and AI-fueled contact centers, increasing efficiency in fields such as sales, marketing, lending, and customer service. The incorporation of AI-based automation and advanced analytics in BFSI business intelligence platforms enhances operational efficiency, ensures regulation compliance, and offers personalized financial services, leading to an enhanced customer experience.

How Is the Banking, Financial Services, And Insurance (BFSI) Business Intelligence Market Segmented?

The banking, financial services, and insurance (BFSI) business intelligence market covered in this report is segmented

1) By Component: Software, Services

2) By Deployment Mode: On-Premises, Cloud

3) By Organization Size: Small And Medium Enterprises, Large Enterprises

4) By Application: Risk Management, Fraud Detection And Prevention, Customer Management, Compliance And Security Management, Other Applications

5) By End-User: Banks, Commercial Banks, Investment Banks

Subsegment:

1) By Software: Data Visualization Tools, Data Management Platforms, Analytics And Reporting Software, Predictive Analytics Software, Risk Management Software

2) By Services: Consulting Services, Integration Services, Managed Services, Support And Maintenance Services, Training And Development Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27749&type=smp

Which Companies Are Leading the Charge in Banking, Financial Services, And Insurance (BFSI) Business Intelligence Market Innovation?

Major companies operating in the banking, financial services, and insurance (BFSI) business intelligence market are Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Zoho Corporation Pvt. Ltd., Informatica LLC, Judge Group, Persistent Systems, Speridian Group, MOURI Tech LLC, Tableau Software LLC, MicroStrategy Incorporated, Comarch SA, Domo Inc., Sisense Inc., Rishabh Software, GoodData Corporation, InetSoft Solutions, and BankBI Ltd.

Which Regions Are Leading the Global Banking, Financial Services, And Insurance (BFSI) Business Intelligence Market in Revenue?

North America was the largest region in the banking, financial services, and insurance (BFSI) business intelligence market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in banking, financial services, and insurance (BFSI) business intelligence report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27749

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025-2034 Banking, Financial Services, And Insurance (BFSI) Business Intelligence Market Evolution: Disruptions, Innovations, and Untapped Opportunities here

News-ID: 4197757 • Views: …

More Releases from The Business Research Company

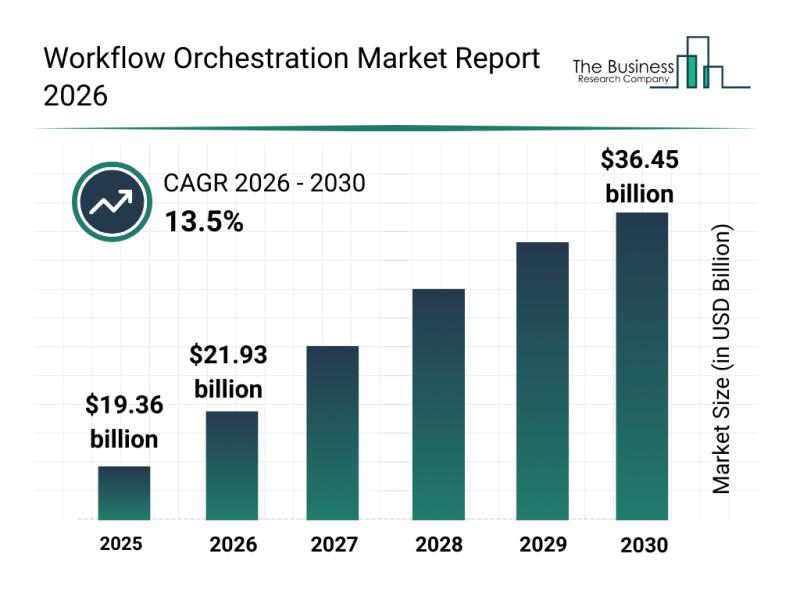

Analysis of Key Market Segments Driving the Workflow Orchestration Market

The workflow orchestration market is positioned for significant expansion over the coming years, driven by technological advancements and evolving business needs. As organizations increasingly seek to automate and streamline processes, this sector is attracting substantial investment and innovation. Let's explore the market's expected growth, key players, emerging trends, and main segments shaping its future.

Projected Market Value and Growth Drivers in the Workflow Orchestration Market

The workflow orchestration market is…

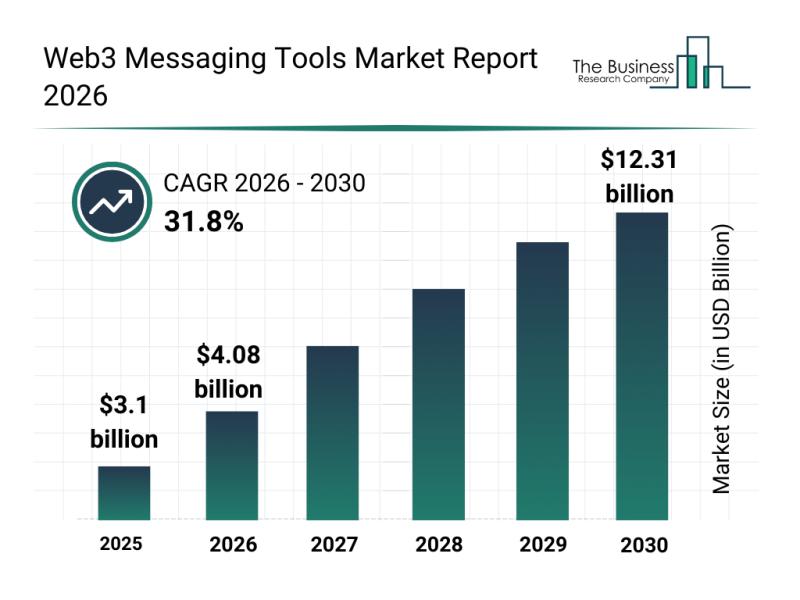

Market Trend Analysis: The Impact of Recent Advances on the Web3 Messaging Tools …

The Web3 messaging tools market is on the brink of remarkable growth, driven by the expanding use of decentralized communication technologies. As businesses and individual users increasingly seek secure, censorship-resistant messaging platforms, this sector is expected to undergo significant transformation. Let's explore the market size projections, leading companies, key trends, and the segmentation that define the future of Web3 messaging tools.

Projected Expansion of the Web3 Messaging Tools Market Size Through…

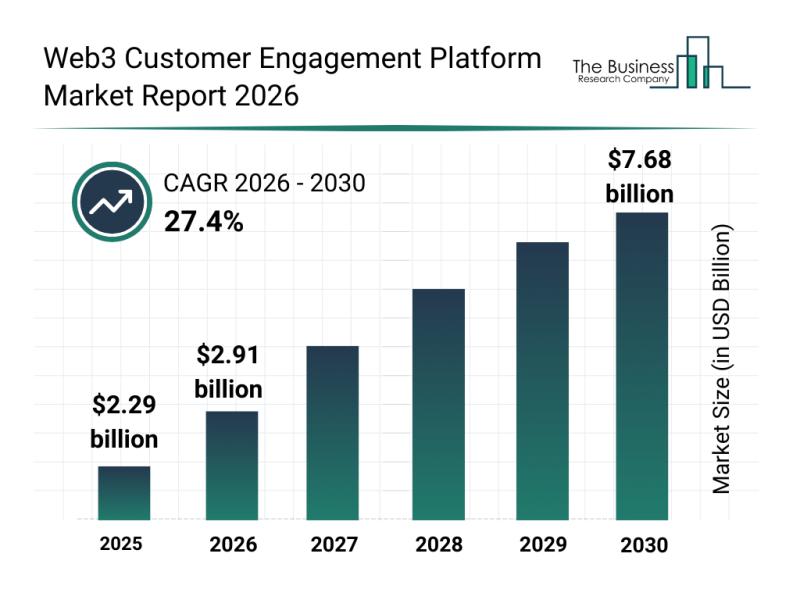

Emerging Growth Patterns, Segment Analysis, and Competitor Approaches Influencin …

The Web3 customer engagement platform sector is on the verge of remarkable growth, driven by increasing interest in decentralized technologies and blockchain applications. This emerging market is rapidly evolving as businesses seek innovative ways to engage customers through new digital experiences. Let's explore the market's projected value, key players, influential trends, and the segment breakdown shaping the future of Web3 engagement platforms.

Projected Market Value and Growth Potential of the Web3…

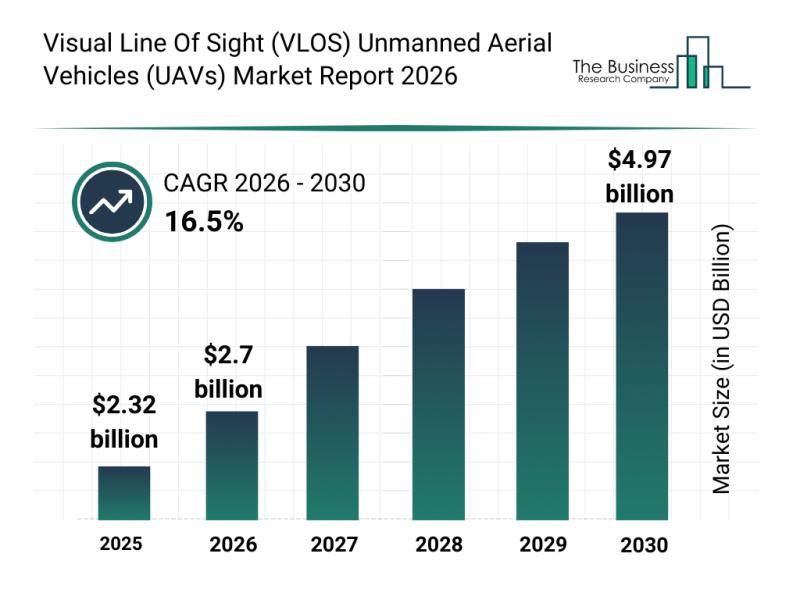

Analysis of Key Market Segments Influencing the Visual Line of Sight (VLOS) Unma …

The Visual Line of Sight (VLOS) Unmanned Aerial Vehicles (UAVs) sector is rapidly evolving, driven by technological advancements and expanding applications across various industries. Demand for these UAVs is intensifying as more sectors seek innovative aerial solutions for monitoring, inspection, and delivery. Let's explore the market's size, key players, impactful trends, and segmentation to understand its current trajectory and future outlook.

Projected Market Growth and Size of the Visual Line of…

More Releases for BFSI

Evolving Market Trends In The Robotic Process Automation In BFSI Industry: Advan …

The Robotic Process Automation In BFSI Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Robotic Process Automation In BFSI Market Size During the Forecast Period?

In recent times, the market size for robotic process automation in bfsi has witnessed a significant surge.…

Evolving Market Trends In The Banking, Financial Services and Insurance (BFSI) S …

The Banking, Financial Services and Insurance (BFSI) Security Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Banking, Financial Services and Insurance (BFSI) Security Market Size During the Forecast Period?

The market size for security within the banking, financial services and insurance (BFSI)…

Key Trend Reshaping the AI in BFSI Market in 2025: Transforming The BFSI Sector …

What combination of drivers is leading to accelerated growth in the ai in bfsi market?

The anticipated surge in the AI in BFSI market may be traced back to the mounting use of AI in improving efficiency. Artificial intelligence (AI) comprises various technologies and algorithms that simulate human intelligence, including problem-solving, drawing insights from data, and making effective decisions. This growing usage of AI for enhancing efficiency could be attributed to…

Mumbai's BFSI Sector Gears Up for Transformation at the 24th Edition of BFSI IT …

Mumbai: The banking, financial services, and insurance (BFSI) sector in Mumbai is currently undergoing a profound transformation, fueled by rapid technological advancements and a significant increase in digital adoption. Emphasizing a strong commitment to digitalization, key stakeholders in Mumbai are championing initiatives akin to advancements in digital payments and the establishment of the Digital Banking Transformation Office. These efforts are propelling the BFSI landscape forward, fostering innovation and paving the…

Empowering BFSI Security: Safeguarding Futures Amid Evolving Threats, BFSI Secu …

Guarding the financial backbone against evolving cyber threats fuels the burgeoning, emergence of tailored solutions, biometrics, and IoT-based cybersecurity solutions significantly enhancing online banking Opportunities for the market.

The BFSI Security Market, valued at USD 61.6 billion in 2022, is poised to witness exponential growth, reaching USD 166.2 billion by 2030, reflecting a robust CAGR of 13.2%. This escalating trajectory is primarily attributed to the stringent regulatory environment governing the banking,…

IoT in BFSI Market : How the Business Will Grow in 2026?�Top Players in IoT in B …

The global internet of things (IoT) in banking, financial services, and insurance (BFSI) market is predicted to reach USD 116.27 billion by 2026, exhibiting a CAGR of 26.5% during the forecast period. The increasing investment of banks and financial institutions in IoT technologies will stimulate the growth of the market in the foreseeable future. According to the studies conducted by Tata consultancy services, financial institutions spend an average IoT budget…