Press release

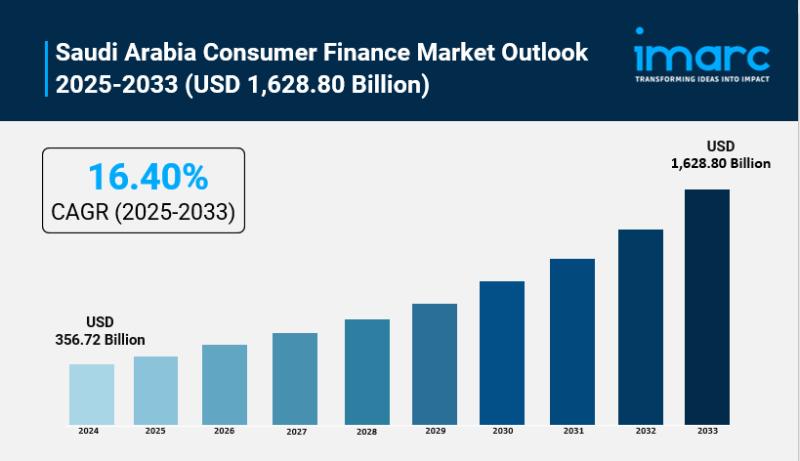

Saudi Arabia Consumer Finance Market Size Worth USD 1,628.80 Billion by 2033, Growing at 16.40% CAGR

Saudi Arabia Consumer Finance Market OverviewMarket Size in 2024: USD 356.72 Billion

Market Size in 2033: USD 1,628.80 Billion

Market Growth Rate 2025-2033: 16.40%

According to IMARC Group's latest research publication, "Saudi Arabia Consumer Finance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia consumer finance market size was valued at USD 356.72 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,628.80 Billion by 2033, exhibiting a CAGR of 16.40% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Consumer Finance Market

● Enhancing Digital Lending Platforms: AI-powered algorithms streamline loan approval processes, with fintech solutions offering personalized financial services and faster processing through advanced credit scoring systems.

● Revolutionizing Credit Assessment: Machine learning models analyze vast datasets to provide more accurate credit evaluations, reducing default risks while expanding access to financial services for underserved populations.

● Powering Automated Customer Service: AI chatbots and virtual assistants handle routine inquiries and loan applications 24/7, improving customer experience while reducing operational costs for financial institutions.

● Enabling Predictive Analytics: AI tools help lenders forecast market trends and consumer behavior, allowing for proactive risk management and customized financial product offerings tailored to individual needs.

● Strengthening Fraud Detection: Advanced AI algorithms continuously monitor transactions and identify suspicious patterns, protecting both consumers and lenders from fraudulent activities in real-time.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-consumer-finance-market/requestsample

Saudi Arabia Consumer Finance Market Trends & Drivers:

Saudi Arabia's consumer finance market is experiencing unprecedented growth, driven by Vision 2030's digital transformation initiatives and favorable regulatory reforms. The Saudi Central Bank's (SAMA) regulatory sandbox has received over 500 fintech applications, with 89 fintech companies licensed through November 2023, fostering innovation in open banking and peer-to-peer lending. The market benefits from increased consumer spending, better economic stability, and a growing youth population with evolving financial needs. Personal loans reached SR1.25 trillion as of January 2024, showing 7% annual growth, while digital banking adoption continues to accelerate across the Kingdom.

The rise of digital lending platforms is significantly transforming Saudi Arabia's consumer finance landscape. With 70% growth in non-cash payments in 2023, the shift toward cashless transactions highlights increasing consumer preference for digital financial services. Traditional banks are collaborating with fintech startups to enhance their digital offerings, creating more inclusive and user-friendly financial solutions. Mobile banking and digital wallets are becoming mainstream, with tech-savvy consumers demanding seamless, convenient financial interactions. This digital-first approach is making financial services more accessible while driving innovation in loan processing and personalized financial products.

The demand for consumer and personal loans is surging due to factors including rising disposable incomes, improved credit accessibility, and diversified loan products. Banks are introducing flexible financing options for specific purposes such as education, home renovations, and car purchases, with attractive interest rates and repayment schedules. Enhanced credit scoring systems and more lenient lending policies are expanding credit availability to a broader customer base. The integration of sophisticated risk assessment tools and regulatory support for market expansion continues to fuel growth in personal credit and financing options across various consumer segments.

Saudi Arabia Consumer Finance Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● Personal Loans

● Credit Cards

● Mortgages

● Auto Loans

● Home Equity Loans

Credit Score Insights:

● Excellent (700-850)

● Good (620-699)

● Fair (580-619)

● Poor (300-579)

Application Channel Insights:

● Online

● In-Store

● Mobile App

● Broker

Loan Purpose Insights:

● Debt Consolidation

● Home Renovations

● Education

● Car Purchase

● Medical Expenses

Term Length Insights:

● Short-Term (less than 1 year)

● Medium-Term (1-5 years)

● Long-Term (5+ years)

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=29525&flag=E

Recent News and Developments in Saudi Arabia Consumer Finance Market

● February 2025: Saudi Arabia's fintech sector witnessed a 25% increase in digital loan applications, with new AI-powered credit assessment platforms reducing approval times from days to hours, enhancing customer satisfaction and operational efficiency.

March 2025: The Saudi Central Bank announced new regulations supporting open banking initiatives, enabling third-party financial service providers to access consumer banking data with consent, fostering innovation in personalized financial products.

● April 2025: Major Saudi banks launched integrated mobile banking platforms with embedded finance solutions, allowing customers to access loans, insurance, and investment products seamlessly within a single digital ecosystem.

● May 2025: The Kingdom's consumer lending market expanded significantly with the introduction of Sharia-compliant fintech solutions, attracting 40% more customers seeking ethical financing options aligned with Islamic principles.

June 2025: Saudi Arabia's digital payment infrastructure upgrades resulted in 85% adoption rate of contactless payments, driving demand for associated credit and financing products among tech-savvy consumers.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Consumer Finance Market Size Worth USD 1,628.80 Billion by 2033, Growing at 16.40% CAGR here

News-ID: 4197576 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…