Press release

Australia Payment Gateways Market Projected to Reach USD 1.41 Billion by 2033

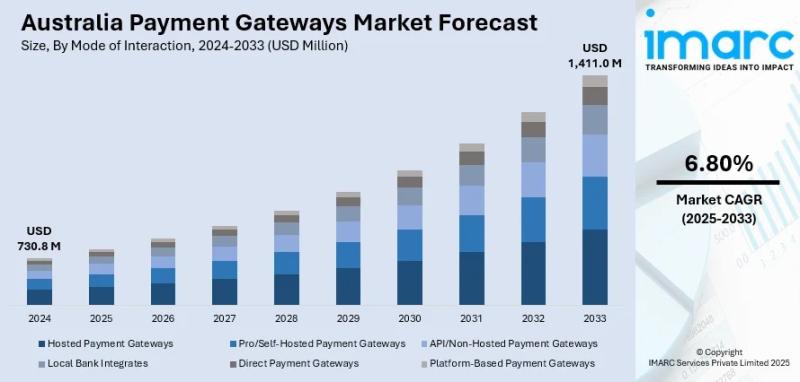

The latest report by IMARC Group, titled "Australia Payment Gateways Market Report by Application (Large Enterprises, Micro and Small Enterprises, Mid-Size Enterprises), Mode of Interaction (Hosted Payment Gateways, Pro/Self-Hosted Payment Gateways, API/Non-Hosted Payment Gateways, Local Bank Integrates, Direct Payment Gateways, Platform-Based Payment Gateways), and Region 2025-2033," offers a comprehensive analysis of the Australia payment gateways market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia payment gateways market size reached USD 730.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,411.0 Million by 2033, exhibiting a CAGR of 6.80% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 730.8 Million

Market Forecast in 2033: USD 1,411.0 Million

Market Growth Rate (2025-2033): 6.80%

Australia Payment Gateways Market Overview

The Australia payment gateways market is experiencing robust growth driven by regulatory modernization by RBA and APRA, NPP integration, ISO 20022 support, PCI DSS compliance, real-time settlement capabilities, CDR alignment, cross-border e-commerce expansion, alternative payment adoption, BNPL integration, fraud screening tools, and increasing demand for omnichannel merchant services. The market expansion is supported by digital payment transformation with 90% of Australians now using digital payment methods, New Payments Platform enabling real-time bank transfers with data-rich messaging, and growing consumer expectations for compatibility with diverse payment platforms including Afterpay, Zip, PayPal, and Apple Pay. Enhanced regulatory compliance requirements and fintech innovation are positioning Australia's payment gateways market for sustained modernization and technological advancement.

Australia's payment gateways foundation demonstrates strong regulatory and technological fundamentals through RBA and APRA modernization initiatives, comprehensive NPP infrastructure supporting real-time transactions, and advanced data security standards compliance. The country maintains sophisticated payment ecosystem with seamless integration capabilities across legacy bank systems and modern fintech platforms. The proliferation of cross-border e-commerce, alternative payment methods, and digital wallet adoption is creating favorable market conditions, requiring substantial investments in secure, scalable payment architecture and multi-currency processing capabilities. Australia's strategic focus on payment innovation, combined with Consumer Data Right implementation and modernized Payments Systems Regulation Act, makes it an increasingly attractive market for advanced payment gateway technology development and deployment.

Request For Sample Report:

https://www.imarcgroup.com/australia-payment-gateways-market/requestsample

Australia Payment Gateways Market Trends

• Digital payment transformation: Rapid shift with 90% of Australians now using digital payment methods driven by regulatory reforms under modernized Payments Systems Regulation Act and increased non-bank provider participation.

• NPP integration advancement: New Payments Platform compatibility enabling real-time bank transfers with data-rich messaging, ISO 20022 support, and real-time settlement features transforming transaction processing capabilities.

• Alternative payment method expansion: Growing consumer demand for compatibility with Afterpay, Zip, PayPal, Apple Pay, and BNPL options requiring gateways to incorporate broader payment types and customizable checkout experiences.

• Cross-border e-commerce growth: Expansion of international online retail creating demand for fraud screening tools, currency conversion options, and compliance management across multiple jurisdictions.

• Regulatory compliance enhancement: Strengthened Consumer Data Right alignment, PCI DSS compliance, and encryption standards driving higher service quality among gateway providers and merchant platform selection criteria.

• PayTo adoption acceleration: Strategic collaboration between Australian Payments Plus and Thoughtworks focusing on scaling PayTo real-time digital payment solution through enhanced user experiences and customer-centric design.

Market Drivers

• Regulatory modernization: RBA and APRA championing innovation, transparency, and security in digital transactions creating standardized framework for payment gateway services and fintech ecosystem development.

• NPP infrastructure deployment: New Payments Platform enabling real-time bank transfers with advanced messaging capabilities requiring gateway integration for competitive advantage and merchant service differentiation.

• E-commerce expansion: Growing online retail sector and cross-border commerce creating demand for secure, scalable payment processing solutions supporting international transactions and multi-currency operations.

• Digital wallet adoption: Consumer preference for mobile payment solutions, digital wallets, and contactless transactions driving gateway providers to offer omnichannel capabilities and seamless user experiences.

• BNPL integration requirements: Rising popularity of Buy Now, Pay Later services requiring payment gateways to support alternative credit options and flexible payment structures for merchant competitiveness.

• Compliance standardization: Consumer Data Right implementation, PCI DSS requirements, and data security regulations creating market opportunities for compliant gateway providers offering advanced encryption and fraud prevention.

Challenges and Opportunities

Challenges:

• Regulatory complexity navigation across multiple compliance frameworks including CDR, PCI DSS, and modernized Payments Systems Regulation Act requiring specialized expertise and ongoing adaptation to evolving requirements

• Security and fraud prevention demands for advanced encryption, real-time fraud screening, and chargeback management creating technical complexity and operational cost pressures

• Integration complexity coordinating legacy bank systems, modern fintech platforms, and diverse payment methods requiring custom API development and extensive testing processes

• Competitive market pressure from established providers and emerging fintech companies requiring differentiation through innovation, pricing strategies, and value-added services

• Cross-border transaction challenges including currency conversion, international compliance, tax handling, and varying regulatory requirements across different jurisdictions

Opportunities:

• PayTo platform expansion leveraging real-time digital payment solution development and enhanced user experience design creating new market segments and revenue streams

• SME market development providing tailored payment gateway solutions for micro, small, and medium enterprises requiring cost-effective, scalable payment processing capabilities

• API-first architecture advancement enabling customizable integration solutions for developers, merchants, and platform providers seeking flexible payment infrastructure

• Alternative payment integration focusing on emerging methods including cryptocurrencies, digital wallets, and innovative BNPL options appealing to tech-savvy consumers and forward-thinking merchants

• Cross-border e-commerce specialization developing expertise in international payment processing, multi-currency support, and global compliance management serving Australian businesses expanding internationally

Australia Payment Gateways Market Segmentation

By Application:

• Large Enterprises

• Micro and Small Enterprises

• Mid-Size Enterprises

By Mode of Interaction:

• Hosted Payment Gateways

• Pro/Self-Hosted Payment Gateways

• API/Non-Hosted Payment Gateways

• Local Bank Integrates

• Direct Payment Gateways

• Platform-Based Payment Gateways

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-payment-gateways-market

Australia Payment Gateways Market News (2024-2025)

• February 19, 2025: Industry report revealed 90% of Australians now use digital payment methods, highlighting rapid shift from cash driven by regulatory reforms under modernized Payments Systems Regulation Act and expanded NPP capabilities.

• September 23, 2024: Australian Payments Plus and Thoughtworks announced strategic collaboration to accelerate PayTo adoption through enhanced user experiences and customer-centric design earning recognition at 2024 Good Design Awards.

• 2024: New Payments Platform integration expanded with payment gateways adapting NPP compatibility, ISO 20022 data support, and real-time settlement features aligning with modern fintech ecosystems and legacy bank systems.

• 2024: Consumer Data Right implementation accelerated with payment gateway providers enhancing compliance capabilities, encryption standards, and data security measures meeting regulatory requirements and merchant expectations.

• 2024: Cross-border e-commerce growth drove demand for international payment processing capabilities including fraud screening tools, currency conversion options, and multi-jurisdiction compliance management.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Application and Mode of Interaction Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32888&flag=F

Q&A Section

Q1: What drives growth in the Australia payment gateways market?

A1: Market growth is driven by regulatory modernization through RBA and APRA initiatives promoting digital innovation, NPP infrastructure deployment enabling real-time bank transfers, e-commerce expansion creating demand for secure payment processing, digital wallet adoption requiring omnichannel capabilities, BNPL integration supporting alternative payment methods, and compliance standardization through CDR and PCI DSS requirements.

Q2: What are the latest trends in this market?

A2: Key trends include digital payment transformation with 90% of Australians using digital methods, NPP integration advancement supporting real-time transactions, alternative payment method expansion including Afterpay and Apple Pay, cross-border e-commerce growth requiring international processing capabilities, regulatory compliance enhancement through data security standards, and PayTo adoption acceleration through strategic industry collaborations.

Q3: What challenges do companies face?

A3: Major challenges include regulatory complexity navigation across multiple compliance frameworks, security and fraud prevention demands requiring advanced encryption systems, integration complexity coordinating diverse payment platforms and legacy systems, competitive market pressure from established and emerging providers, and cross-border transaction challenges including currency conversion and international compliance requirements.

Q4: What opportunities are emerging?

A4: Emerging opportunities include PayTo platform expansion creating new digital payment revenue streams, SME market development providing tailored solutions for smaller enterprises, API-first architecture advancement enabling customizable integration solutions, alternative payment integration including cryptocurrencies and innovative BNPL options, and cross-border e-commerce specialization serving Australian businesses expanding internationally.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Payment Gateways Market Projected to Reach USD 1.41 Billion by 2033 here

News-ID: 4196914 • Views: …

More Releases from IMARC Group

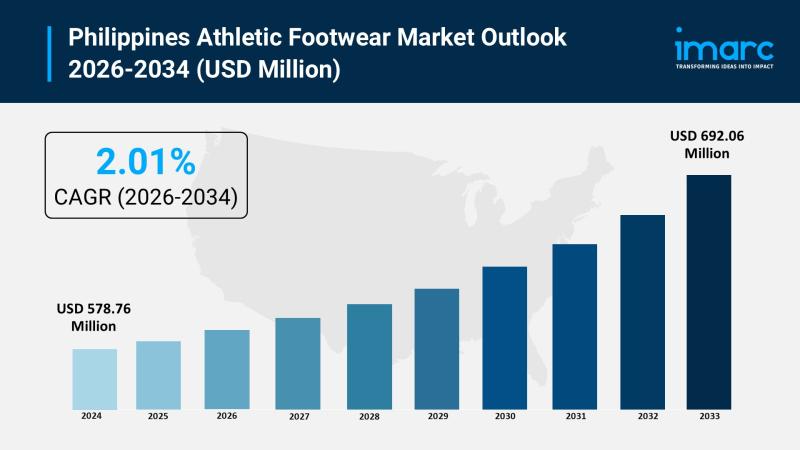

Philippines Athletic Footwear Market 2026 to Reach USD 692.06 Million by 2034 Am …

Market Overview

The Philippines athletic footwear market size was valued at USD 578.76 Million in 2025 and is projected to reach USD 692.06 Million by 2034, growing at a compound annual growth rate of 2.01% from 2026-2034. The market is expanding rapidly, driven by increasing health consciousness, fitness trends, and demand for stylish yet functional shoes. With a growing middle class and a focus on performance and comfort, the Philippines athletic…

IMARC Group: Philippines Lingerie Market 2026 | Poised for Rapid Growth at 6.70% …

Market Overview

The Philippines lingerie market size was valued at USD 433.27 Million in 2025 and is projected to reach USD 776.72 Million by 2034, growing at a compound annual growth rate (CAGR) of 6.70% during 2026-2034. The market is experiencing robust expansion driven by evolving consumer preferences, rising disposable incomes, and increasing emphasis on comfort and personal expression in intimate apparel. Urbanization and expanding retail infrastructure are reshaping purchasing patterns…

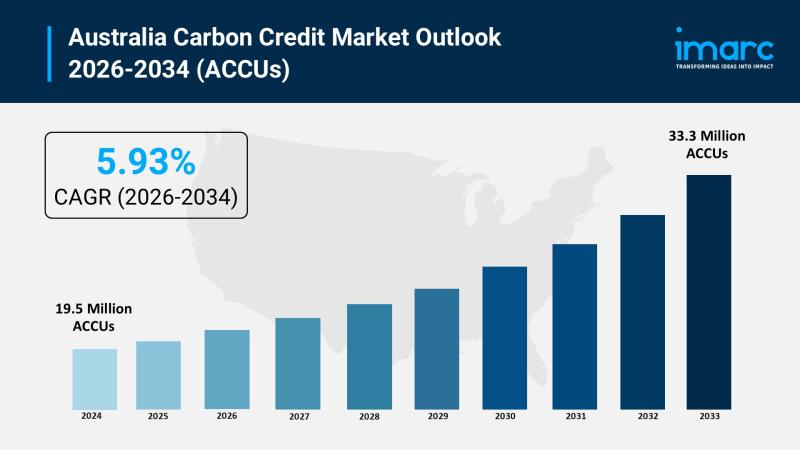

Australia Carbon Credit Market 2026 | Worth 33.3 Million ACCUs by 2034

Market Overview

The Australia carbon credit market size reached 19.5 Million ACCUs in 2025 and is projected to reach 33.3 Million ACCUs by 2034, exhibiting a CAGR of 5.93% during the forecast period 2026-2034. The industry is expanding significantly due to favorable government policies and regulations, increased dedication to corporate social responsibility, expanded international trade prospects, and significant expansion in renewable energy projects.

Request a Sample Report: https://www.imarcgroup.com/australia-carbon-credit-market/requestsample

How AI is Reshaping the…

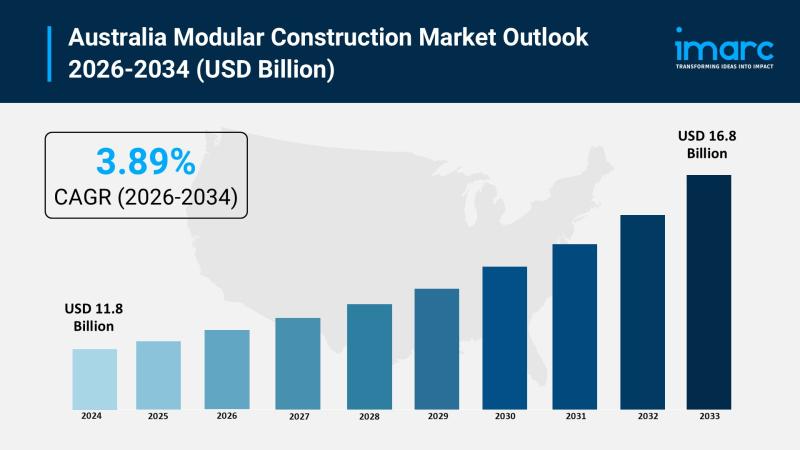

Australia Modular Construction Market 2026 | USD 16.8 Billion by 2034

Market Overview

The Australia modular construction market size reached USD 11.8 Billion in 2025 and is projected to reach USD 16.8 Billion by 2034, exhibiting a CAGR of 3.89% during the forecast period 2026-2034. The market is primarily driven by government infrastructure support, increasing housing demand, environmental considerations, and technological advances addressing the rising demand for efficient, adaptable housing solutions in urban and remote areas across the country.

Request a Sample Report:…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…