Press release

5G Telematics Box Intelligent Termial (T-BOX) Market to Reach CAGR 11,7% by 2031 Top 20 Company Globally

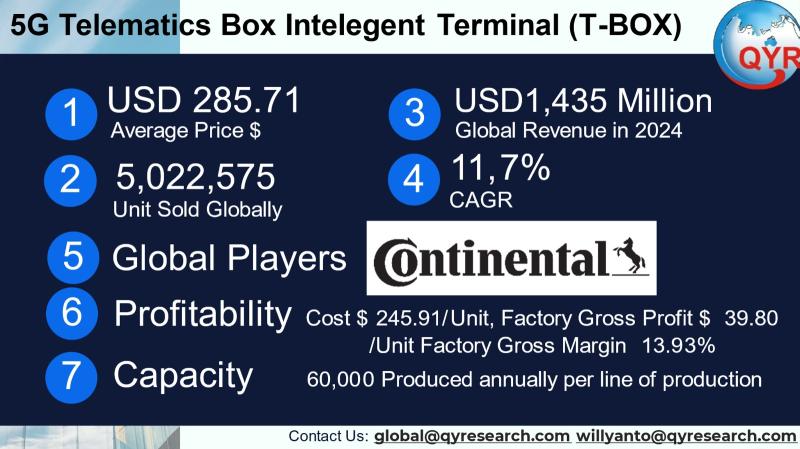

The 5G Telematics Box (T-BOX) is the on-board intelligent terminal that connects vehicles to cellular networks, provides vehicle-level data collection and diagnostics, supports telematics services (remote diagnostics, OTA updates, eCall, insurance telematics, fleet management), and increasingly enables high-bandwidth applications such as multi-camera telematics, over-the-air software/firmware updates, and C-V2X features for advanced driver assistance and vehicle-to-everything services. The transition from 4G to 5G in T-BOXes introduces higher throughput, lower latency and new 5G-specific feature sets (including NR, RedCap/NR-Light options for constrained IoT, and tighter support for C-V2X) that change module selection, thermal and EMC design, and software stacks for vehicle manufacturers and Tier-1 suppliers.The global 5G T-BOX revenue in 2024 is USD 1,435 million and an assumed ASP of USD 285.71, the global installed/marketed volume for 2024 is approximately 5,022,575 units. The average factory. On a per-unit basis the factory gross margin is 13.93%, which produces an average factory gross profit of approximately USD 39.80 per unit and an average cost-of-goods-sold of approximately USD 245.91 per unit. A practical full-machine production capacity per single, well-equipped line is around 60,000 units per month per line for an automotive-grade SMT + assembly + test cell. Downstream demand is concentrated in passenger vehicle OEMs and commercial fleets: a reasonable split of downstream industry demand by application type is passenger vehicles ~55% (consumer OE and premium connectivity), commercial vehicles & trucks ~20%, new-energy vehicles (NEV dedicated variants) ~12%, fleet & aftermarket/fleet telematics retrofit ~10%, and other (specialty/industrial) ~3%. The passenger vehicle dominance is consistent with market reporting that passenger vehicle telematics historically holds the largest revenue share within T-BOX markets.

.

Latest Trends and Technological Developments

The most consequential near-term trend is the adoption of specialized 5G NR device classes for IoT and telematics, notably NR-Light/RedCap (reduced capability) which is being trialed and positioned to bring lower-cost, lower-power 5G connectivity options to automotive and IoT endpoints carriers and chipset vendors have signaled RedCap deployments and early devices, a key development for lower-power telematics use cases (news coverage highlighted early RedCap device timelines in October 2024). This shift can materially reduce modem subsystem cost, power draw and antenna complexity for T-BOX designs that do not need full 5G throughput. (News: RedCap/NR-Light deployments and early device announcements October 2024). Automotive-grade 5G module launches that provide ready-made C-V2X and AEC/Q automotive-grade solutions continue to accelerate; major module vendors have released families of 5G automotive modules (examples highlighted in 2024) that explicitly target T-BOX/TCU integration and support automotive qualification flows such as IATF 16949 and AEC-Q certifications (example product announcements and spec updates through 20242025). In China, adoption ramped quickly in recent years with OEM 5G-equipped vehicle counts reported in market summaries for 2024 (one industry release notes several million 5G-equipped vehicles in China during 2024). These combined signals RedCap maturity, greater availability of automotive-qualified 5G modules, and fast adoption in China are driving both OEM demand and an influx of module + T-BOX system suppliers refining designs for lower price points and higher integration.

Asia is the largest single regional opportunity for 5G T-BOX adoption due to a confluence of early 5G rollout in major markets, a large OEM base, strong local module and component supplier ecosystems, and rapid NEV penetration in China. China in particular is a volume engine: by 2024 the number of vehicles equipped with 5G communications rose strongly, making China the single largest regional market and a hub for lower-cost local module suppliers and contract manufacturers. South Korea and Japan are centers for high-quality, automotive-grade T-BOX adoption by global and domestic OEMs, and India is an expanding market where 5G rollout plus new vehicle electrification programs are creating a growing addressable market for 5G telematics in the mid term. The regional supplier ecosystem in Asia provides a competitive advantage: large 5G module vendors and RF suppliers (with automotive-qualified module families) and a dense contract manufacturing base shorten time-to-volume and reduce per-unit BOM cost for OEMs sourcing locally.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5053218

5G Telematics Box Intelligent Terminal (T-BOX) by Type:

Communication Module Integrated T-BOX

Cockpit/Domain Control Integrated T-BOX

5G Telematics Box Intelligent Terminal (T-BOX) by Application:

Passenger Cars

Commercial Vehicles

Global Top 20 Key Companies in the 5G Telematics Box Intelligent Terminal (T-BOX) Market

LG

Harman International

Valeo

Continental AG

Lear Corporation

Marelli

Denso

Bosch

Shenzhen Thread Tech Co., Ltd.

Huizhou Desay SV Automotive Co., Ltd.

Huawei

Neusoft

Flaircomm Microelectronics, Inc.

Beijing Jingwei Hirain Technologies Co., Inc.

GosuncnWelink Technology Co., Ltd

Shenzhen Lan-You Technology Co.,Ltd.

Yuanfeng Technology Co., Ltd.

JOYNEXT(Ningbo Joyson Electronic Corp.)

DIAS Automotive Electronic Systems Co.,Ltd.

ZTE Corporation

Regional Insights

Within Southeast Asia, market adoption is heterogeneous. Countries with faster 5G network rollouts and stronger OEM assembly footprints (Thailand, Malaysia, Vietnam) are seeing earlier T-BOX adoption at OE level; Indonesia represents a strategic ASEAN market due to its large vehicle parc, increasing NEV policies, and rising telematics interest for fleet management and insurance telematics. However, network readiness, local certification timelines, and price sensitivity in several ASEAN markets favor lower-cost 5G variants (including 5G modules optimized for regional bands and NR-Light options) and OEM decisions to initially deploy hybrid 4G/5G T-BOX SKUs where 5G coverage is limited. For fleet and commercial telematics use cases across ASEAN, aftermarket and retrofit demand remains important because fleet operators prioritize operational telematics and driver-safety solutions that do not always require the highest 5G throughput. Industry observers expect Indonesia to grow strongly as 5G networks and NEV policies progress, but OEM adoption timing will vary by OEM roadmap and by local certification cycles.

Key industry challenges include the cost and thermal/EMC complexity of integrating 5G modems and multiple antennas into automotive environments, the variability of regional 5G band coverage (which creates multi-SKU complexity), long automotive qualification cycles (IATF/APQP/PPAP) that increase time-to-market for new T-BOX designs, and supply-chain pressure on RF front-end components and automotive-grade chipsets. Price sensitivity in many markets means suppliers must reduce BOM cost while preserving automotive reliability; the rise of NR-Light/RedCap helps but also introduces fragmentation risks (multiple device classes and certification paths). Data privacy and regulatory compliance in different jurisdictions (telemetry/driver data rules) also impose product and platform complexity for global offerings.

Suppliers should prioritize a two-track product strategy: a high-reliability, full-feature automotive T-BOX for premium OEM programs (full 5G NR, C-V2X optionality, high throughput) and a low-power, cost-optimized NR-Light/RedCap variant for mass market and retrofit/fleet deployments. Vertical partnerships (with Tier-1s, module vendors, and regional carriers) accelerate certification and reduce integration risk. Contract manufacturers and system integrators in Asia that can provide combined hardware + secure cloud/OTA stacks are at an advantage for OEMs wanting a single-source design and production partner. For ASEAN markets, offering flexible multi-band SKUs and localized certification support is critical to reduce lead times and meet local regulatory requirements.

Product Models

Telematics Box Intelligent Terminals (T-BOX) are advanced vehicle communication and control units that enable connected car functions such as navigation, remote monitoring, vehicle diagnostics, safety services, and infotainment integration.

Communication Module Integrated T-BOX which focuses on connectivity functions like 4G/5G, GPS, and V2X. Notable products include:

Quectel AG520R T-BOX Quectel Wireless Solutions: 5G-enabled telematics module offering GPS and LTE connectivity for vehicles.

Huawei MH5000 T-BOX Huawei Technologies: Supports 5G automotive connectivity with high data transfer speeds.

LG U+ Connected Car T-BOX LG Electronics: Designed for smart vehicle connectivity with LTE and IoT support.

Continental Telematics Control Unit Continental AG: Communication module with eSIM support and over-the-air updates.

Bosch Connectivity Control Unit (CCU) Robert Bosch GmbH: Provides 4G/5G communication and GNSS for global carmakers.

Cockpit/Domain Control Integrated T-BOX which combines telematics with in-vehicle infotainment and centralized control systems. Examples include:

Desay SV Intelligent Cockpit T-BOX Desay SV Automotive: Integrated telematics and cockpit domain controller for smart dashboards.

Harman Ignite Cockpit Controller Harman International: Combines telematics with infotainment and cloud connectivity.

PATEO Qinggan T-BOX PATEO Connected Car: Provides telematics and cockpit integration for Chinese OEMs.

Continental Cockpit Integrated TCU Continental AG: Centralized control system merging telematics and infotainment features.

Aptiv Smart Vehicle Architecture T-BOX Aptiv PLC: Domain controller combining connectivity and cockpit systems.

The 5G T-BOX market is at an inflection point: module and chipset evolution (including NR-Light/RedCap), rapid adoption in high-volume markets especially China and the OEM push for richer connected services are expanding the addressable market. Cost pressures and automotive qualification timelines will force suppliers to optimize BOMs and product families, but those who can offer automotive-qualified 5G modules, integrated software/OTA stacks, and high-volume manufacturing capability should capture the largest share of the coming multi-year growth.

Investor Analysis

This report highlights concrete market sizing and unit economics, which together reveal the underlying volume opportunity and margin structure. For investors, those metrics enable a quick assessment of the revenue scalability, margin leverage and capital intensity required for manufacturing expansion. The regional insights identify Asia (notably China) and ASEAN (notably Indonesia) as the highest-growth geographies information investors need to prioritize market entry, M&A targets, or regional JV strategies. Technology trends (RedCap/NR-Light, automotive-grade 5G modules) highlight which suppliers and chipsets may see demand upside or cost compression; investors can accordingly reweight exposure to module vendors or Tier-1 integrators. The strategic sections point investors to value drivers: scalable manufacturing capacity, strong OEM relationships, and software/OTA ecosystem ownership. Finally, the competitive leaderboard (Quectel, Continental, Bosch, LG/HARMAN, Denso) helps investors shortlist targets for due diligence based on technology/scale fit and potential margin improvement opportunities.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5053218

5 Reasons to Buy This Report

Obtain a concise, numbers-driven snapshot of the 2024 global 5G T-BOX market size, ASP and implied unit volume.

Gain region-level analysis for Asia and ASEAN to prioritize market entry and go-to-market decisions.

Understand per-unit economics to model supplier profitability and margin-improvement levers.

Receive an up-to-date summary of technological trends that materially affect cost and product roadmaps.

Get a short list of leading players and strategic insights for manufacturing, partnership and investment decisions.

5 Key Questions Answered

What was the 2024 global market value for 5G T-BOX and how many units does that imply?

What is the average selling price and the factory economics per unit?

How is COGS typically broken down across module, PCB, assembly and other cost buckets?

Which regions are the primary growth engines and why?

Which companies and supplier types are best positioned to capture 5G T-BOX market share?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 5G Telematics Box Intelligent Termial (T-BOX) Market to Reach CAGR 11,7% by 2031 Top 20 Company Globally here

News-ID: 4196801 • Views: …

More Releases from QY Research

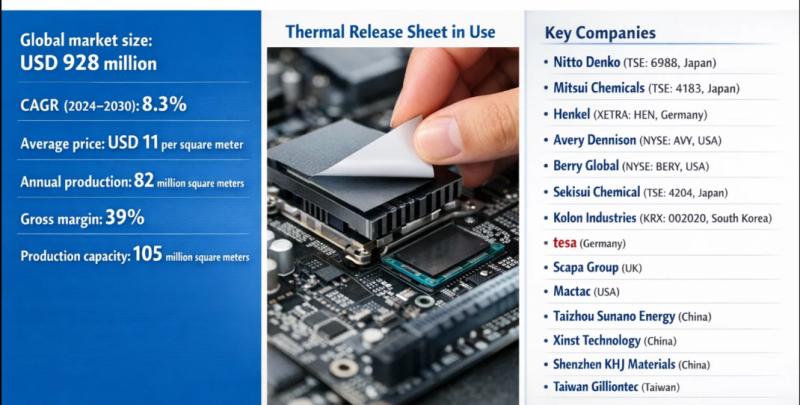

Thermal Release Sheets: An USD 928 Million Market Powering High-Yield Semiconduc …

Problem

Manufacturers using conventional adhesive films or mechanical separation methods faced challenges in precision bonding and debonding processes. These materials often required high peel force, left adhesive residue, or caused substrate damage during removal. In electronics, semiconductor packaging, and display manufacturing, such limitations resulted in lower yield rates, longer cycle times, and increased risk of component breakage-especially for thin wafers, fragile glass, and fine-pitch assemblies.

Solution

Producers adopted Thermal Release Sheet, a functional…

Global and U.S. AI Chips for Self-Driving Market Report, Published by QY Researc …

QY Research has released a comprehensive new market report on AI Chips for Self-Driving, high-performance computing processors designed to handle perception, sensor fusion, decision-making, and vehicle control in autonomous and advanced driver-assistance systems (ADAS). These chips integrate CPU, GPU, NPU/AI accelerators, and safety subsystems to process massive data streams from cameras, LiDAR, radar, and ultrasonic sensors in real time. As global automakers accelerate toward Level 2+ to Level 4 autonomy,…

Global and U.S. Access Control Security Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Access Control Security, refers to systems and technologies used to regulate who can enter or use physical spaces, digital resources, or systems by verifying identity and granting or denying permissions based on predefined rules; it commonly includes methods such as key cards, PIN codes, biometric authentication (fingerprint, facial recognition), and software-based authorization to enhance security, prevent unauthorized access, and ensure…

Top 30 Indonesian Electronics Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

Indonesias electronics sectorspanning electronic manufacturing services (EMS), distribution, components, and systems integration saw mixed performance in Q3 2025. Broadly, established firms with diversified offerings performed steadily, while smaller pure-play electronics names faced variable demand amid global supply chain pressures and moderate domestic demand. Overall revenue and profitability growth was modest with notable outliers outperforming peers thanks to data-center services and enterprise solutions.

PT Metrodata Electronics…

More Releases for OEM

OEM Partnership Guide: Working with a Touch-free Automatic Kitchen Garbage Can O …

With increasing global demand for smart home solutions, Sinoware International Ltd, a top provider in household products industry, is pleased to unveil expanded OEM partnership initiatives.

Sinoware has established itself in Jiangmen--China's premier stainless steel industry zone--as an indispensable touch-free automatic kitchen garbage can OEM manufacturer for global brands seeking to incorporate high-tech sanitation solutions into their portfolios.

By combining their decades-old tradition of metal craftsmanship with cutting-edge infrared and…

Revolutionizing OEM Coatings With Sustainable Solutions Trend: A Crucial Influen …

Which drivers are expected to have the greatest impact on the over the oem coatings market's growth?

The surge in requirements from final consumer industries is forecasted to boost the expansion of the OEM coatings market. These coatings, referred to as OEM, are utilized during the integration of other firms' products into the substrate process or application. They prove to be beneficial for a variety of end-user sectors, including automotive and…

OEM Technology Partnerships Launches Brokerage Specializing in 100+ OEM Technolo …

San Francisco, California, USA - February 13, 2025 - OEM Technology Partnerships is thrilled to announce the launch of its specialized brokerage focused on connecting businesses with a comprehensive portfolio of over 100 Original Equipment Manufacturer (OEM) technologies. This new venture is poised to revolutionize how companies access and implement cutting-edge solutions across diverse industries.

Leveraging deep industry expertise and a vast network of OEM partners, OEM Technology Partnerships offers a…

OEM or ODM Watches? What's the Difference?

When searching for a watch manufacturer for your store or watch brand, you may come across the terms OEM and ODM. But do you truly understand the difference between them? In this article, we will delve into the distinctions between OEM and ODM watches to help you better grasp and choose the manufacturing service that suits your needs.

Image: https://www.naviforce.com/uploads/15a6ba3911.png

What's OEM / ODM Watches [https://www.naviforce.com/products/]

OEM (Original Equipment Manufacturer) watches are produced…

OEM Partnership with Extreme Networks

ComputerVault announces an OEM partnership with Extreme Networks and has certified its switches for use with ComputerVault enterprise software to deliver virtual desktop infrastructure (VDI).

Extreme Networks industry leading switches deliver ComputerVault Virtual Desktops at faster than PC speeds in the LAN and WAN.

“ComputerVault is very excited to work with Extreme Networks. Not only are their switches very reliable, but their exceptional performance guarantees a great user experience”, said Marc…

Humidity Measurement Module for OEM Applications

The EE1900 humidity module from E+E Elektronik is optimised for the measurement of relative humidity (RH) or dew point temperature (Td) in climate and test chambers. With outstanding temperature compensation across the working range from -70 °C to 180 °C (-94 °F to 356 °F) and the choice of stainless steel and plastic probes, the module is suitable for a wide range of applications.

High Accuracy in Harsh Environment

The excellent…