Press release

Australia Forklift Market Projected to Reach USD 8.15 Billion by 2033

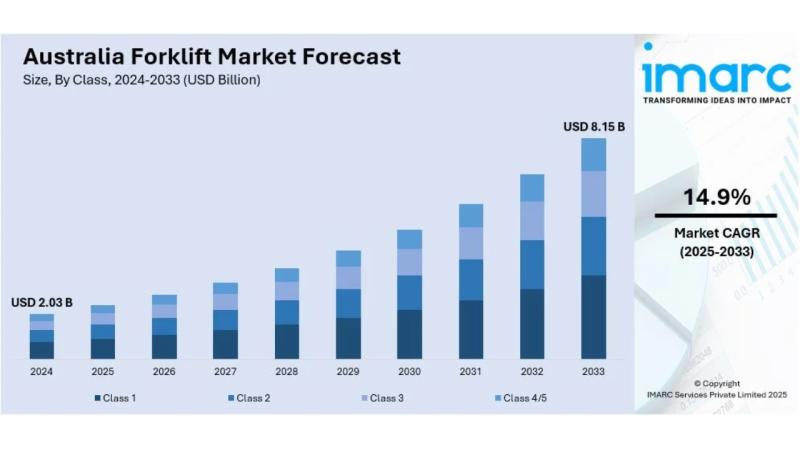

The latest report by IMARC Group, titled "Australia Forklift Market Report by Class (Class 1, Class 2, Class 3, Class 4/5), Power Source (ICE, Electric), Load Capacity (Below 5 Ton, 5-15 Ton, Above 16 Ton), Electric Battery (Li-ion, Lead Acid), End User (Industrial, Logistics, Chemical, Food and Beverage, Retail and E-Commerce, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia forklift market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia forklift market size reached USD 2.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.15 Billion by 2033, exhibiting a CAGR of 14.9% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 2.03 Billion

Market Forecast in 2033: USD 8.15 Billion

Market Growth Rate (2025-2033): 14.9%

Australia Forklift Market Overview

The Australia forklift market is experiencing exceptional growth driven by warehouse automation expansion, e-commerce logistics proliferation, infrastructure development acceleration, and manufacturing sector modernization requirements. The market expansion is supported by electric forklift adoption, advanced safety technology integration, rental and leasing model popularity, and increasing emphasis on operational efficiency and environmental sustainability. Advanced forklift solutions are transforming Australia's material handling landscape through lithium-ion battery technologies, automated guidance systems, telematics integration, and smart fleet management capabilities positioning the country as a leader in modern warehouse operations and industrial automation.

Australia's forklift market foundation demonstrates robust industrial capabilities across diverse sectors including logistics and warehousing, manufacturing operations, construction projects, mining activities, and retail distribution networks. The country's expanding e-commerce sector, growing infrastructure investments, and focus on supply chain optimization create substantial demand for sophisticated forklift solutions capable of enhancing productivity, reducing operational costs, and improving safety standards. The proliferation of automated warehouses, compact urban logistics hubs, service-based deployment models, and sustainability initiatives is creating favorable market conditions, requiring significant investments in electric forklifts, smart technologies, and comprehensive maintenance programs. Australia's industrial modernization focus, combined with stringent safety regulations and environmental consciousness, makes it an increasingly attractive market for innovative forklift technology development and deployment.

Request For Sample Report:

https://www.imarcgroup.com/australia-forklift-market/requestsample

Australia Forklift Market Trends

• Electric forklift acceleration: Rapid adoption of lithium-ion battery-powered forklifts providing zero emissions, reduced operational costs, enhanced performance capabilities, and supporting corporate sustainability goals across warehouse and industrial operations.

• Compact and versatile designs: Growing preference for narrow-aisle and space-efficient forklift models enabling optimal warehouse space utilization, improved maneuverability in tight spaces, and enhanced operational flexibility in urban logistics environments.

• Rental and leasing expansion: Increasing adoption of service-based deployment models including fully maintained rental agreements, flexible leasing options, and comprehensive maintenance contracts reducing capital expenditure and operational risks for businesses.

• Advanced safety integration: Rising implementation of anti-collision sensors, load stability systems, operator assistance technologies, and visibility enhancement features addressing stringent workplace safety regulations and reducing accident risks.

• Automation and connectivity: Growing deployment of automated guidance systems, telematics integration, fleet management software, and IoT connectivity enabling predictive maintenance, performance optimization, and operational analytics.

• Cross-border supply partnerships: Expanding international trade relationships, particularly with India, enhancing forklift attachment sourcing, component availability, and cost-effective supply chain solutions for Australian material handling operations.

Market Drivers

• E-commerce growth explosion: Massive expansion of online retail operations requiring sophisticated warehouse automation, high-throughput material handling systems, and flexible forklift solutions supporting rapid order fulfillment and distribution capabilities.

• Infrastructure development acceleration: Significant government and private sector investment in construction projects, mining operations, port facilities, and industrial developments creating demand for heavy-duty forklifts and specialized material handling equipment.

• Warehouse automation trends: Increasing adoption of automated storage and retrieval systems, robotic warehouse operations, and smart logistics technologies requiring advanced forklifts with connectivity, precision control, and integration capabilities.

• Sustainability mandates: Corporate environmental commitments, government emissions regulations, and sustainability targets driving adoption of electric forklifts, energy-efficient technologies, and environmentally conscious material handling solutions.

• Labor shortage challenges: Growing scarcity of skilled warehouse workers and material handling operators creating demand for automated forklifts, operator-assist technologies, and equipment that reduces training requirements and operational complexity.

• Supply chain optimization pressure: Increasing focus on operational efficiency, cost reduction, and productivity enhancement driving investment in modern forklift technologies, fleet management systems, and performance optimization solutions.

Challenges and Opportunities

Challenges:

• High capital investment costs for advanced electric and automated forklift systems creating financial barriers particularly for small and medium-sized enterprises with limited equipment budgets and extended payback expectations

• Charging infrastructure requirements for electric forklift deployment demanding substantial electrical upgrades, charging station installations, and power management systems particularly in older warehouse facilities

• Skills shortage and training needs for operating sophisticated forklift technologies requiring comprehensive training programs, operator certification, and ongoing technical support creating adoption challenges for traditional operations

• Supply chain disruptions and component availability issues affecting forklift manufacturing, delivery timelines, and spare parts accessibility particularly for specialized equipment and emerging technologies

• Rapid technology evolution and equipment obsolescence concerns requiring frequent upgrades, software updates, and compatibility assessments complicating long-term fleet planning and investment strategies

Opportunities:

• Smart warehouse integration through automated material handling systems, robotic integration, and Industry 4.0 connectivity creating comprehensive logistics solutions and competitive operational advantages

• Export market potential for Australian forklift expertise and service capabilities serving international markets with similar industrial requirements, safety standards, and operational challenges

• Circular economy development through equipment refurbishment, battery recycling programs, and sustainable lifecycle management creating new business models and environmental benefits

• Service sector expansion including maintenance contracts, fleet management services, training programs, and technology support solutions providing recurring revenue streams and enhanced customer relationships

• Mining industry specialization leveraging Australia's mining expertise to develop specialized forklift solutions for extreme conditions, heavy-duty applications, and remote operations requiring exceptional durability

Australia Forklift Market Segmentation

By Class:

• Class 1

o Electric Motor Rider Trucks

o Stand-Up Counterbalanced

o Sit-Down Counterbalanced

• Class 2

o Electric Motor Narrow Aisle Trucks

o Order Pickers

o Reach Trucks

o Side Loaders

• Class 3

o Electric Motor Hand/Rider Trucks

o Walkie/Rider Pallet Trucks

o Pallet Jacks

o Stackers

• Class 4/5

o Internal Combustion Engine Trucks

o Cushion Tire Forklifts

o Pneumatic Tire Forklifts

By Power Source:

• ICE (Internal Combustion Engine)

o Diesel Powered

o LPG Powered

o CNG Powered

o Gasoline Powered

• Electric

o Battery Electric

o Fuel Cell Electric

o Hybrid Electric

By Load Capacity:

• Below 5 Ton

o Light-Duty Applications

o Warehouse Operations

o Retail Environments

• 5-15 Ton

o Medium-Duty Applications

o Manufacturing Operations

o Distribution Centers

• Above 16 Ton

o Heavy-Duty Applications

o Construction Sites

o Port Operations

o Industrial Manufacturing

By Electric Battery:

• Li-ion

o Lithium Iron Phosphate

o Lithium Nickel Manganese Cobalt

o Lithium Titanate

• Lead Acid

o Flooded Lead Acid

o Sealed Lead Acid

o Gel Batteries

By End User:

• Industrial

o Manufacturing Plants

o Heavy Industries

o Assembly Operations

• Logistics

o Warehouses

o Distribution Centers

o Third-Party Logistics

• Chemical

o Chemical Processing

o Petrochemicals

o Pharmaceutical

• Food and Beverage

o Food Processing

o Cold Storage

o Beverage Production

• Retail and E-Commerce

o Retail Distribution

o E-Commerce Fulfillment

o Omnichannel Operations

• Others

o Construction

o Mining

o Ports and Terminals

By Region:

• Australia Capital Territory & New South Wales

• Victoria and Tasmania

• Queensland

• Northern Territory and Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-forklift-market

Australia Forklift Market News (2024-2025)

• October 2024: Kalmar and BlueScope entered fully maintained rental agreement for 13 large forklift trucks at Western Port facility in Victoria, including six electric forklifts with lithium-ion batteries and eight-year service contract supporting emissions reduction goals.

• January 2024: Australia's Consul General in Mumbai announced India-Australia trade expected to double to $100 billion in five years under ECTA, with India already exporting 38% of forklift attachments to Australia, enhancing material handling capabilities.

• 2024: Electric forklift adoption accelerated across Australian warehouses and industrial facilities with lithium-ion battery technology gaining preference for zero emissions, reduced operational costs, and enhanced performance capabilities.

• 2024: Rental and leasing models expanded significantly with businesses preferring service-based deployments including comprehensive maintenance contracts, reducing capital expenditure and operational uncertainty.

• 2024: Compact and versatile forklift designs gained popularity driven by warehouse space optimization requirements and growth of urban logistics hubs requiring narrow-aisle operational capabilities.

• 2024: Advanced safety technology integration increased with anti-collision sensors, load stability systems, and operator assistance features addressing stringent workplace safety regulations and accident prevention requirements.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Class, Power Source, Load Capacity, Electric Battery, and End User Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=34285&flag=F

Q&A Section

Q1: What drives growth in the Australia forklift market?

A1: Market growth is driven by e-commerce growth explosion requiring sophisticated warehouse automation and material handling systems, infrastructure development acceleration through construction and mining projects, warehouse automation trends demanding advanced connectivity and integration capabilities, sustainability mandates promoting electric forklift adoption, labor shortage challenges creating demand for automated solutions, and supply chain optimization pressure focusing on efficiency and productivity enhancement.

Q2: What are the latest trends in this market?

A2: Key trends include electric forklift acceleration with lithium-ion battery technology providing zero emissions and cost benefits, compact and versatile designs enabling space optimization and narrow-aisle operations, rental and leasing expansion offering flexible deployment models, advanced safety integration with collision sensors and operator assistance, automation and connectivity through telematics and fleet management, and cross-border supply partnerships enhancing component availability and cost-effectiveness.

Q3: What challenges do companies face?

A3: Major challenges include high capital investment costs for advanced electric and automated systems, charging infrastructure requirements demanding electrical upgrades and power management systems, skills shortage and training needs for sophisticated technology operation, supply chain disruptions affecting manufacturing and component availability, and rapid technology evolution causing equipment obsolescence concerns and complicating long-term planning.

Q4: What opportunities are emerging?

A4: Emerging opportunities include smart warehouse integration through automated systems and Industry 4.0 connectivity, export market potential leveraging Australian expertise for international industrial markets, circular economy development through equipment refurbishment and battery recycling, service sector expansion with maintenance and fleet management solutions, and mining industry specialization developing solutions for extreme conditions and heavy-duty applications.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Forklift Market Projected to Reach USD 8.15 Billion by 2033 here

News-ID: 4195173 • Views: …

More Releases from IMARC Group

Q4 2025 Chromium Prices Update: USA at USD 13,429/MT, China at USD 8,312/MT - Gl …

North America Chromium Prices Movement Q4 2025:

Chromium Prices in USA:

In Q4 2025, chromium prices in the United States averaged USD 13,429 per metric ton. Demand from stainless steel and specialty alloy industries remained robust. Stable domestic production and consistent import flows supported supply balance. Energy costs and industrial activity levels influenced pricing, while regional trade and logistical considerations contributed to moderate market fluctuations.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/chromium-pricing-report/requestsample

Note: The analysis…

Power Cable Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

Setting up a power cable manufacturing plant positions investors within one of the most infrastructure-critical and steadily expanding segments of the global electrical equipment industry, driven by rising electricity demand, rapid urbanization, and large-scale investments in transmission and distribution networks. Power cables are essential components in residential, commercial, industrial, and renewable energy projects, ensuring reliable and efficient electricity flow across grids and facilities.

As nations modernize aging infrastructure and expand…

Confectionery Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

Setting up a confectionery manufacturing plant positions investors within one of the most dynamic and consistently growing segments of the global food processing industry, supported by rising consumer demand for indulgent snacks, expanding urban populations, and increasing product innovation across chocolates, candies, gums, and baked sweets. Confectionery products benefit from strong brand loyalty, impulse purchasing behavior, and seasonal consumption patterns that sustain year-round sales.

As disposable incomes rise and retail…

PVC Blister Packaging Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with Pro …

Setting up a PVC blister packaging manufacturing plant positions investors within one of the steadily expanding and functionality-driven segments of the global packaging industry, supported by rising demand from pharmaceuticals, consumer goods, electronics, and personal care sectors. PVC blister packs are widely preferred for their transparency, durability, tamper resistance, and ability to protect products from moisture and contamination. As retail markets grow and regulatory standards for product safety and labeling…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…