Press release

Australia Used Truck Market 2025 | Projected to Reach USD 2.0 Billion by 2033

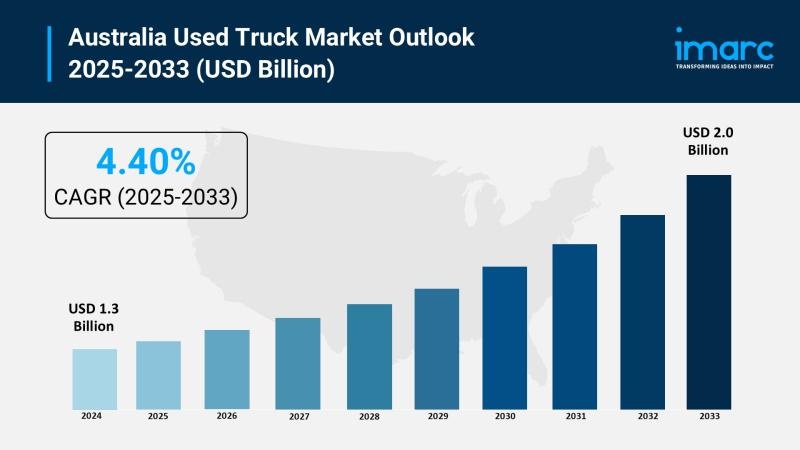

The latest report by IMARC Group, "Australia Used Truck Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, End User, and Region, 2025-2033," provides an in-depth analysis of the Australia used truck market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia used truck market size reached USD 1.3 billion in 2024 and is projected to grow to USD 2.0 billion by 2033, exhibiting a steady growth rate of 4.40% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1.3 Billion

Market Forecast in 2033: USD 2.0 Billion

Growth Rate (2025-2033): 4.40%

Australia Used Truck Market Overview:

The Australia used truck market is experiencing steady growth driven by growing pressure on freight and logistics firms to keep costs under control, increasing online shopping activities among the masses, and rising shift towards more environment friendly and sustainable transport. The market demonstrates consistent momentum with small and medium-sized businesses (SMEs) representing a large majority of Australia's construction and freight sectors operating on limited budgets that make used trucks a realistic option over new models. Strategic developments include The Australian Renewable Energy Agency (ARENA) providing $100 million in finance under the Driving the Nation program in 2024 to facilitate shifting heavy vehicles to electric, creating fleet turnover that generates a constant stream of well-preserved used trucks. The sector benefits from lower initial investment, reduced depreciation expense, instant availability, and widespread aftermarket assistance enabling companies to sustain or build fleets without extended procurement lead times while maximizing total cost of ownership (TCO).

Request For Sample Report: https://www.imarcgroup.com/australia-used-truck-market/requestsample

Australia Used Truck Market Trends:

• Cost-Effective Fleet Solutions expanding through growing pressure on freight and logistics firms to control costs with used trucks providing lower initial investment, reduced depreciation, and instant availability

• E-commerce Growth Integration advancing with 38% of individuals shopping online monthly and 21% weekly in Australia, driving demand for agile urban freight and last-mile delivery vehicles

• Fleet Turnover from Environmental Regulations accelerating through companies upgrading to newer models with improved environmental performance, releasing well-preserved used trucks aged five to seven years

• SME Market Penetration increasing adoption by small and medium-sized businesses operating on limited budgets requiring cost-effective transportation solutions without compromising service levels

• Urban Freight Specialization growing demand for light-duty and medium-duty used trucks ideal for city operations, last-mile deliveries, and compliance with urban emission regulations

• Seasonal Demand Fluctuations creating consistent market turnover through holiday peaks, promotional periods, and short-term rental requirements supporting year-round demand stability

• Government Policy Support encouraging vehicle reuse and recycling through second-use car schemes promoting sustainable transport practices and extended vehicle lifecycles

Australia Used Truck Market Drivers:

• Rising Demand for Cost-Effective Logistics Solutions motivating freight and logistics firms to choose used trucks over new models due to budget constraints and immediate availability requirements

• Growth of E-commerce and Urban Freight Sector creating demand for agile transportation solutions with online shopping growth requiring flexible, cost-efficient delivery vehicle options

• Regulatory Incentives and Environmental Considerations supporting fleet modernization through government programs like ARENA's $100 million Driving the Nation initiative promoting electric heavy vehicle adoption

• SME Budget Constraints driving demand from small and medium-sized businesses requiring affordable fleet expansion options without significant capital investment or extended procurement timelines

• Australia's Geographic Distribution necessitating efficient road freight networks across vast distances where used trucks provide cost-effective solutions for maintaining service coverage

• Fleet Replacement Cycles generating steady supply of quality used trucks as large operators upgrade to newer models with enhanced safety and fuel efficiency features

• Aftermarket Support Infrastructure strengthening market appeal through widespread availability of spare parts, financing options, and maintenance services supporting used truck operations

Market Challenges:

• Vehicle Quality and Reliability Concerns creating buyer hesitation regarding maintenance history, remaining operational life, and potential repair costs affecting purchase decisions

• Limited Warranty Coverage reducing buyer confidence compared to new vehicles with comprehensive manufacturer warranties and service guarantees

• Financing Accessibility constraining market growth through limited lending options and higher interest rates for used vehicle purchases compared to new truck financing

• Technology Gap Issues affecting competitiveness as older used trucks may lack advanced safety features, fuel efficiency technologies, and emission compliance systems

• Market Price Volatility impacting buyer planning through fluctuating used truck values influenced by new vehicle prices, economic conditions, and supply-demand dynamics

• Regulatory Compliance Complexity requiring buyers to ensure used trucks meet current emission standards, safety regulations, and operational requirements across different states

• Supply Chain Dependencies affecting spare parts availability and maintenance services for older truck models potentially increasing operational costs and downtime

Market Opportunities:

• Electric Vehicle Fleet Turnover creating premium used truck supply as companies transition to electric vehicles under government incentive programs generating well-maintained conventional trucks

• Digital Platform Integration developing online marketplaces, virtual inspections, and digital documentation systems improving transparency and accessibility in used truck transactions

• Specialized Segment Growth targeting niche applications including food delivery, construction, oil and gas sectors requiring specific vehicle configurations and capabilities

• Warranty and Service Packages creating competitive advantages through extended warranties, certified pre-owned programs, and comprehensive maintenance packages reducing buyer risk

• Regional Market Expansion developing distribution networks in underserved rural and remote areas where used trucks provide affordable transportation solutions

• Fleet Management Services offering comprehensive solutions including financing, insurance, maintenance, and remarketing services creating integrated customer value propositions

• Technology Retrofit Opportunities upgrading older used trucks with modern safety systems, telematics, and efficiency improvements extending vehicle lifespan and market appeal

Browse the Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-used-truck-market

Australia Used Truck Market Segmentation:

By Vehicle Type:

• Light Trucks

• Medium-Duty Trucks

• Heavy-Duty Trucks

By Sales Channel:

• Franchised Dealer

• Independent Dealer

• Peer-to-Peer

By End User:

• Construction

• Oil and Gas

• Others

By Regional Distribution:

• Australian Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Used Truck Market News:

September 2025: IMARC Group reports continued growth in Australia's used truck market driven by e-commerce expansion and cost-conscious fleet management strategies across freight and logistics sectors.

August 2025: Industry analysis shows increasing adoption of used trucks by SMEs in construction and freight sectors seeking cost-effective alternatives to expensive new vehicle acquisitions.

July 2025: Market research indicates seasonal demand peaks during holiday periods driving short-term purchasing and rental activities supporting consistent market turnover throughout the year.

June 2025: Government environmental initiatives continue creating fleet turnover opportunities as companies upgrade to cleaner technologies, releasing quality used trucks into secondary markets.

May 2025: E-commerce growth statistics reveal 38% of Australians shopping online monthly, with 21% weekly, driving sustained demand for urban freight and delivery vehicle solutions.

Key Highlights of the Report:

• Comprehensive market analysis projecting steady growth from $1.3 billion in 2024 to $2.0 billion by 2033

• Detailed examination of e-commerce impact with 38% of Australians shopping online monthly and 21% weekly driving delivery vehicle demand

• Strategic assessment of government initiatives including ARENA's $100 million Driving the Nation program supporting fleet modernization and used truck supply

• In-depth analysis of cost-effectiveness advantages including lower initial investment, reduced depreciation, and immediate availability for SMEs and budget-conscious operators

• Regional market evaluation covering all major Australian territories with diverse industrial and logistics requirements

• Sales channel insights highlighting franchised dealers, independent dealers, and peer-to-peer transactions serving different market segments

• End-user segment analysis revealing opportunities across construction, oil and gas, and other industrial sectors

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia's used truck market growth to $2.0 billion by 2033?

A1: The market is driven by growing pressure on freight and logistics firms to control costs, increasing online shopping activities with 38% of Australians shopping online monthly, and the shift towards more environmentally friendly transport. SMEs operating on limited budgets find used trucks a realistic alternative to expensive new models, while government initiatives like ARENA's $100 million program create fleet turnover generating quality used truck supply.

Q2: How is e-commerce growth impacting the used truck market?

A2: E-commerce expansion is significantly driving demand for used trucks, particularly light-duty and medium-duty vehicles ideal for urban freight and last-mile delivery. With 38% of Australians shopping online monthly and 21% weekly, businesses need agile, cost-effective transportation solutions. Used trucks provide faster deployment and lower capital costs, making them attractive to smaller transport operators and gig economy players entering the logistics industry.

Q3: What role do environmental regulations play in market development?

A3: Environmental regulations are facilitating fleet restructuring as companies upgrade to newer models with improved environmental performance to comply with emission standards. This creates a steady stream of relatively recent, well-preserved used trucks (typically 5-7 years old) entering the secondary market. Government programs like ARENA's electric vehicle initiative and policies favoring vehicle recycling support this trend by encouraging fleet modernization and vehicle reuse.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=33025&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Used Truck Market 2025 | Projected to Reach USD 2.0 Billion by 2033 here

News-ID: 4195105 • Views: …

More Releases from IMARC Group

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…