Press release

Comprehensive Energy And Power Insurance Market Forecast 2025-2034: Growth Trends and Strategic Shifts

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Energy And Power Insurance Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

In recent times, there has been a significant increase in the size of the energy and power insurance market. The market, which was valued at $7.29 billion in 2024, is projected to grow to $7.82 billion in 2025, at a Compound Annual Growth Rate (CAGR) of 7.2%. The growth witnessed during the historic period can be ascribed to several factors. These include a growing demand for insurance coverage for traditional power plants, increased investment in fossil fuel infrastructure, evolving regulatory requirements for the energy sector, the broadening of insurance coverage for risks associated with natural disasters, and a rise in the financing of energy projects.

Energy And Power Insurance Market Size Forecast: What's the Projected Valuation by 2029?

In the upcoming years, the energy and power insurance market is predicted to experience significant growth, expanding to a size of $10.20 billion by 2029 with a compound annual growth rate (CAGR) of 6.9%. This progress during the forecasted period is seen as a result of increasing adoption of renewable energy insurance solutions, growing cyber security risks to energy facilities, escalating government incentives for sustainable energy projects, the proliferation of insurance for advanced grid technologies, and a surging requirement for insurance in the realm of electric vehicle infrastructure. The forecast period is also expected to feature prominent trends such as impressive strides in risk modeling technology, advancements in digital claim processing methods, enhanced investments in R&D, innovation pursuing parametric insurance products, and meaningful progress in applying blockchain for policy management transparency.

View the full report here:

https://www.thebusinessresearchcompany.com/report/energy-and-power-insurance-global-market-report

What Are the Drivers Transforming the Energy And Power Insurance Market?

The growth of the market is being propelled by the escalating demand for renewable energy, a consequence of the surge in investments towards renewable projects.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27617&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Energy And Power Insurance Market?

Key players in the energy and power insurance sector are working towards the creation of novel solutions such as insurance for renewable energy initiatives in an effort to manage potential risks and lure investments into eco-friendly energy structures. The renewable energy project insurance shields the development, construction, and operation of facilities like wind turbines, solar energy systems, and hydroelectric power installations. This coverage aids stakeholders in mitigating losses caused by damages, delays, or operational defects and assures the necessary financing for their projects. For example, in July 2024, Zurich Insurance Group AG, a multinational insurance corporation based in Switzerland, in partnership with Aon Plc, a UK-based professional services company, debuted a clean hydrogen insurance facility. This facility offers comprehensive insurance for blue and green hydrogen projects and covers aspects such as construction, operations, business disruption, and carbon capture risks. The unique design of the facility ensures coverage throughout the entire lifespan of a project, allowing for the management of intricate risks tied to hydrogen production, infrastructure, transportation, not forgetting carbon capture, utilization, and storage (CCUS) technologies. The goal of this facility is to aid project developers and investors reduce the risks associated with their projects, secure sufficient insurance coverage, and draw capital for their large-scale clean hydrogen enterprises.

Which Segments in the Energy And Power Insurance Market Offer the Most Profit Potential?

The energy and power insurance market covered in this report is segmented

1) By Insurance Product Type: Property Insurance, Liability Insurance, Business Interruption Insurance, Environmental Liability Insurance

2) By Type Of Energy Source: Renewable Energy, Non-Renewable Energy, Fossil Fuels, Nuclear Energy

3) By Coverage Period: Short-Term Policies, Long-Term Policies, Event-Specific Insurance

4) By Application: Oil And Gas, Renewable Energy, Power Generation, Other Applications

5) By End-User: Commercial, Industrial, Other End-Users

Subsegments:

1) By Property Insurance: Fire Insurance, Flood Insurance, Theft Insurance, Equipment Insurance, Natural Disaster Insurance

2) By Liability Insurance: Public Liability Insurance, Product Liability Insurance, Employer Liability Insurance, Contractual Liability Insurance, Professional Liability Insurance

3) By Business Interruption Insurance: Contingent Business Interruption Insurance, Non Contingent Business Interruption Insurance, Extended Period Of Indemnity Insurance, Ingress Egress Insurance

4) By Environmental Liability Insurance: Pollution Liability Insurance, Waste Management Liability Insurance, Site Remediation Liability Insurance, Environmental Impairment Liability Insurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27617&type=smp

Which Firms Dominate the Energy And Power Insurance Market by Market Share and Revenue in 2025?

Major companies operating in the energy and power insurance market are Berkshire Hathaway Specialty Insurance Company, Allianz SE, Munich Reinsurance Company, Liberty Mutual Insurance Company, Tokio Marine Holdings Inc., Swiss Reinsurance Company Ltd., Zurich Insurance Group Ltd., Sompo Holdings Inc., Marsh & McLennan Companies Inc., Everest Reinsurance Company, Markel Corporation, Willis Towers Watson Public Limited Company, Amwins Group Inc., Axis Capital Holdings Limited, Starr International Company Inc., Anand Rathi Insurance Brokers Limited, kWh Analytics Inc., Total Risk Solutions Inc., WealthGuard Insurance Group Inc., and Inigo Insurance Services Inc.

Which Regions Offer the Highest Growth Potential in the Energy And Power Insurance Market?

North America was the largest region in the energy and power insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in energy and power insurance report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27617

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Comprehensive Energy And Power Insurance Market Forecast 2025-2034: Growth Trends and Strategic Shifts here

News-ID: 4193896 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Approaches Influencing the R …

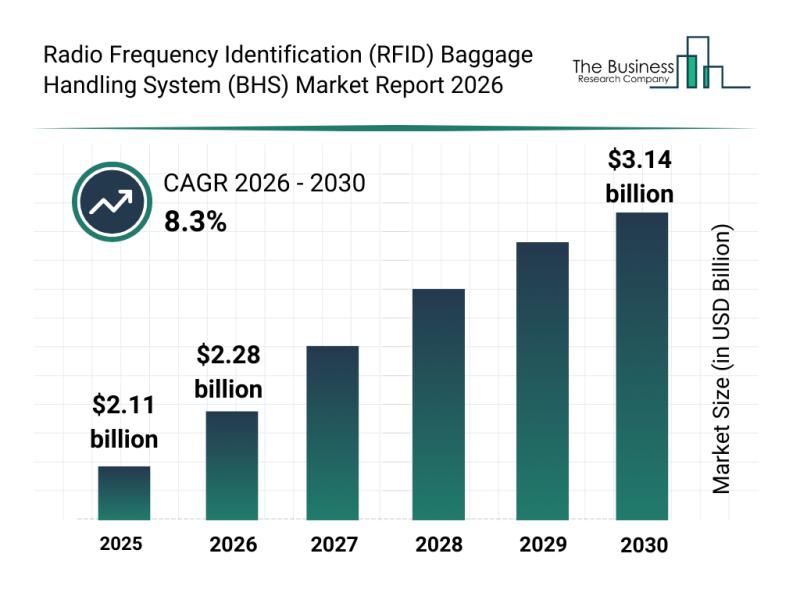

The radio frequency identification (RFID) baggage handling system (BHS) market is set to experience significant growth over the coming years, driven by advancements in airport technology and evolving passenger needs. As airports continue to modernize and automate their operations, the demand for efficient baggage handling solutions is increasing rapidly. This overview explores the market's size, influential players, emerging trends, and key segments shaping its future.

Projecting the Radio Frequency Identification Baggage…

Leading Industry Participants Reinforce Their Presence in the Process Informatio …

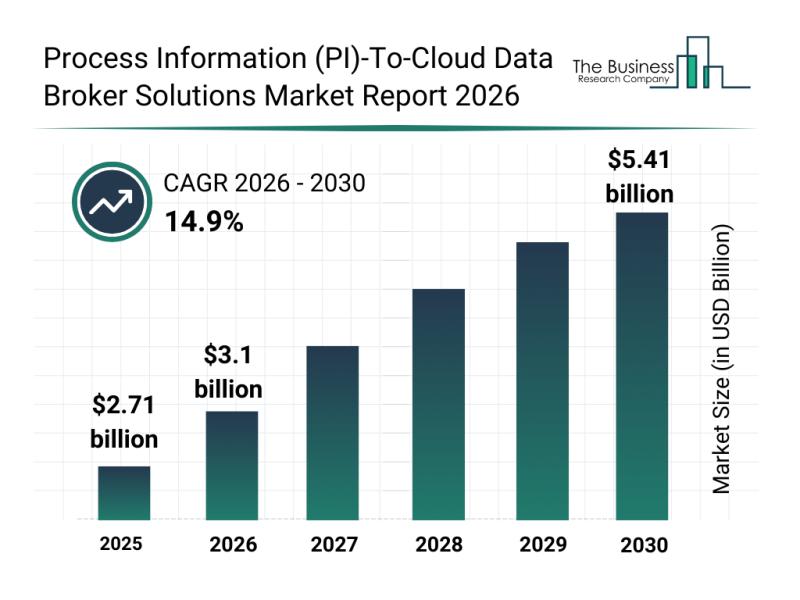

The process information (PI)-to-cloud data broker solutions industry is positioned for significant expansion as digital transformation accelerates across industrial sectors. Increasing demand for real-time data access and seamless integration between operational technology (OT) and information technology (IT) systems is driving rapid innovations and investments. Let's explore the market size projections, key players, emerging trends, and segment insights shaping this evolving landscape.

Projected Market Size Growth in the Process Information (PI)-To-Cloud Data…

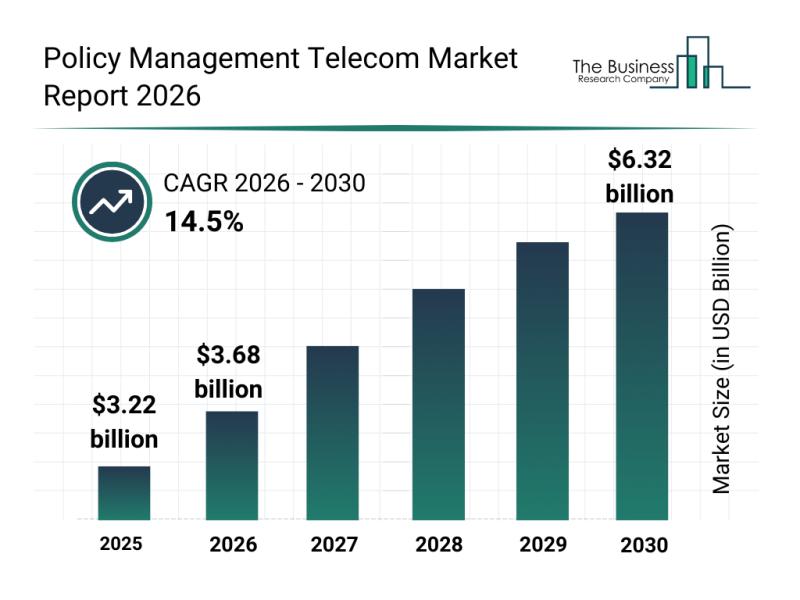

Future Perspective: Key Trends Shaping the Policy Management Telecom Market Up t …

The policy management telecom sector is set to experience significant expansion over the coming years, driven by technological advances and growing network demands. This evolving market is playing a crucial role in supporting the complex needs of modern telecom operators, enabling more efficient management and automation of network policies. Below, we explore the current market size projections, leading companies, key trends, and segmentation details that define this dynamic industry.

Strong Growth…

Competitive Analysis: Key Market Leaders and New Entrants in the Pantyhose and T …

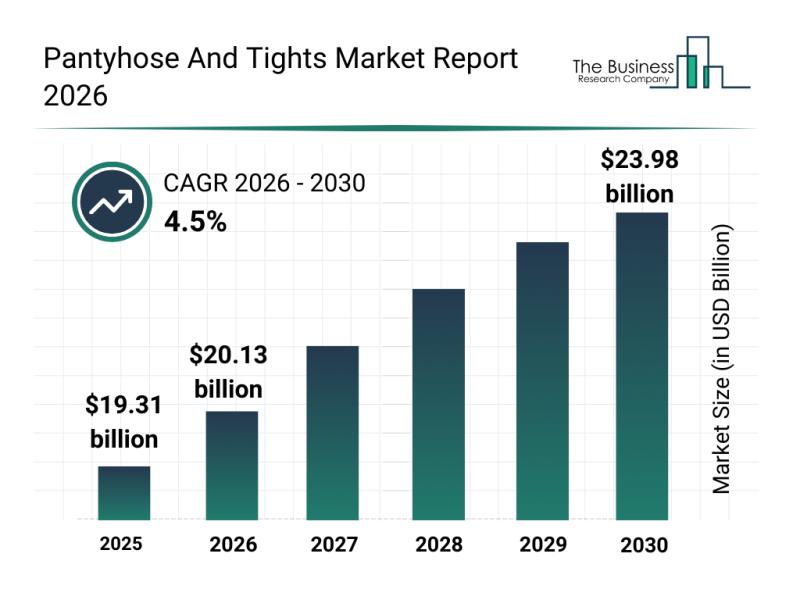

The pantyhose and tights market is set to witness consistent growth as consumer preferences evolve and new trends gain traction. With increasing emphasis on sustainability, comfort, and style, this sector is poised for meaningful expansion through 2030. Let's dive into the market's valuation, key players, emerging trends, and segmentation to understand the trajectory of this dynamic industry.

Forecasted Market Value and Growth Rate of the Pantyhose and Tights Market

The…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…