Press release

Insurtech Market Landscape to 2034: Key Forces Shaping the Next Decade of Growth

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Insurtech Market Size By 2025?

The insurtech industry has seen an explosive growth recently. Its market value is expected to surge from $17.08 billion in 2024 to an astounding $21.96 billion in 2025, signifying a compound annual growth rate (CAGR) of 28.5%. The substantial growth in the previous years is a result of robust economic advancement in developing markets, heightened digital transformation in insurance services, wider application of robotic process automation in insurance firms, and a surge in the number of insurtech startups.

How Big Is the Insurtech Market Size Expected to Grow by 2029?

The insurtech market is poised for dramatic expansion in the approaching years, with projections suggesting it will reach a size of $77.63 billion by 2029. This represents a compound annual growth rate (CAGR) of 37.1%. This anticipated upsurge during the forecast period can be linked to a rise in insurance claims, the embracing of cutting-edge technologies within the insurance sector, and supportive governmental policies. The forecast period also signals some key trends; these include the application of artificial intelligence (AI), concentration on smart automation responses, emphasis on product innovation, pursuit of blockchain technology, a drive towards partnerships and collaborations, as well as investment in IoT (Internet of Things) technology.

View the full report here:

https://www.thebusinessresearchcompany.com/report/insurtech-global-market-report

Which Key Market Drivers Powering Insurtech Market Expansion and Growth?

The anticipated surge in insurance claims is foreseen to fuel the insurtech market's expansion. Insurtech plays an integral role in enhancing the efficiency of claims processing, risk evaluation, contract processing, and policy underwriting. A spike in hospitalization incidents during the COVID-19 pandemic has resulted in an upswing of insurance claims. For example, in April 2024, LV=, one of the UK's largest personal line insurers, reported that in 2023, it had disbursed $175.16 million (£135 million) in individual protection claims, demonstrating a 6% rise compared to 2022. Thus, the expected escalation in insurance claims is predicted to spearhead the growth of the insurtech market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=5581&type=smp

Which Emerging Trends Are Transforming the Insurtech Market in 2025?

Leading corporations in the insurtech market are prioritizing the creation of groundbreaking solutions such as AI-fueled insurance platforms to enrich the client experience. These platforms denote digital systems that bank on artificial intelligence technologies to automate and refine various insurance procedures, including underwriting, managing claims, and customer service, leading to elevated efficiency and superior decision-making. For instance, Sapiens International Corporation, a computer software firm based in Israel, unveiled its Next-Gen Intelligent Insurance Platform in June 2024. Utilizing AI, machine learning, and cloud-native technologies, this next-gen platform streamlines insurance procedures and boosts data-driven deliberation. It provides insurers with the capability to innovate swiftly, enhance operational efficiency, and offer superior customer service by means of a robust ecosystem.

What Are the Emerging Segments in the Insurtech Market?

The insurtechmarket covered in this report is segmented -

1) By Product: Health Insurance, Life Insurance, Travel Insurance, Car Insurance, Business Insurance, Home Insurance, Other Products

2) By Technology: Blockchain, Cloud Computing, IoT (Internet Of Things), Artificial Intelligence, Big Data And Business Analytics, Other Technologies

3) By Offering: Solutions, Services

4) By Deployment: On-Premises, Cloud

5) By Application: Automotive Industry, Banking And Financial Services, Government Sector, Healthcare Industry, Manufacturing Industry, Retail Industry, Transportation, Other Applications

Subsegments:

1) By Health Insurance: Individual Health Insurance, Group Health Insurance, Critical Illness Insurance

2) By Life Insurance: Term Life Insurance, Whole Life Insurance, Universal Life Insurance

3) By Travel Insurance: Single Trip Insurance, Annual Multi-Trip Insurance, Medical Travel Insurance

4) By Car Insurance: Third-Party Liability Insurance, Comprehensive Car Insurance, Collision Coverage

5) By Business Insurance: General Liability Insurance, Property Insurance, Workers' Compensation Insurance

6) By Home Insurance: Homeowners Insurance, Renters Insurance, Landlord Insurance

7) By Other Products: Pet Insurance, Cyber Insurance, Event Insurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=5581&type=smp

Who Are the Global Leaders in the Insurtech Market?

Major companies operating in the insurtech market include DXC Technology, Damco Group, Majesco, Shift Technology, Earnix, Simplesurance, Outsystems, Cytora Ltd, Planck Resolution LTD, Bdeo, Allianz (China) Insurance Holding Co., Ltd, Insurance Technology Services, Oscar Insurance, Quantemplate, Tokio Marine & Nichido Fire Insurance Co. Ltd, Aioi Nissay Dowa Insurance Co. Ltd, Sompo Japan Nipponkoa Insurance Inc, Grupo Nacional Provincial, MetLife Mexico, Seguros BBVA Bancomer, AXA Seguros, Banorte Seguros, State Farm Insurance, Nationwide Mutual Insurance Company, Liberty Mutual Group, The Progressive Corporation, American International Group Inc, Bradesco Saude, South America Health Insurance Company, Amil International Medical Assistance, Mapfre Seguros Gerais, Porto Seguro General Insurance Company, Dubai Insurance Company, Alliance Insurance PSC, Union Insurance Company, Zurich Life Insurance Middle East, Al Nabooda Insurance Brokers, National General Insurance Co, Al Buhaira Insurance, Howden Guardian Insurance Brokers LLC, Tawasul Insurance Services LLC, Al Wathba National Insurance Company

Which are the Top Profitable Regional Markets for the Insurtech Industry?

North America was the largest region in the insurtech service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the insurtech market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=5581

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurtech Market Landscape to 2034: Key Forces Shaping the Next Decade of Growth here

News-ID: 4193755 • Views: …

More Releases from The Business Research Company

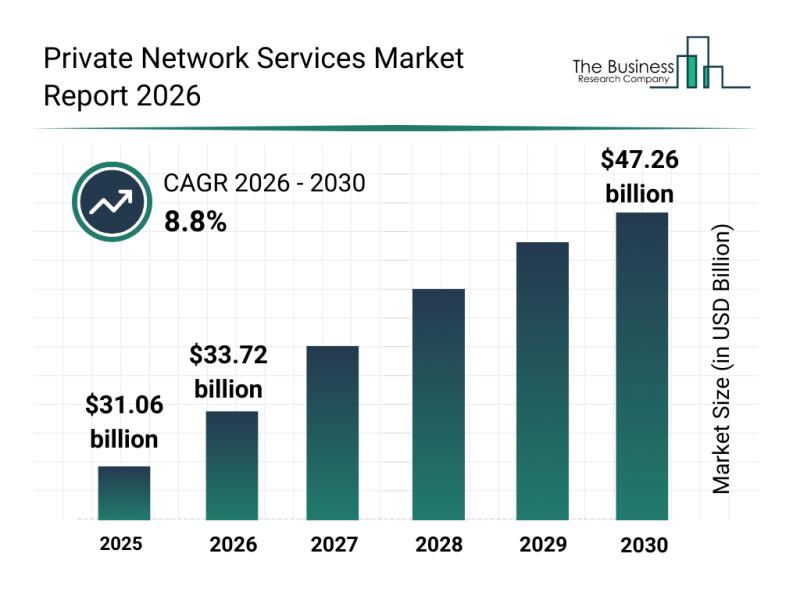

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

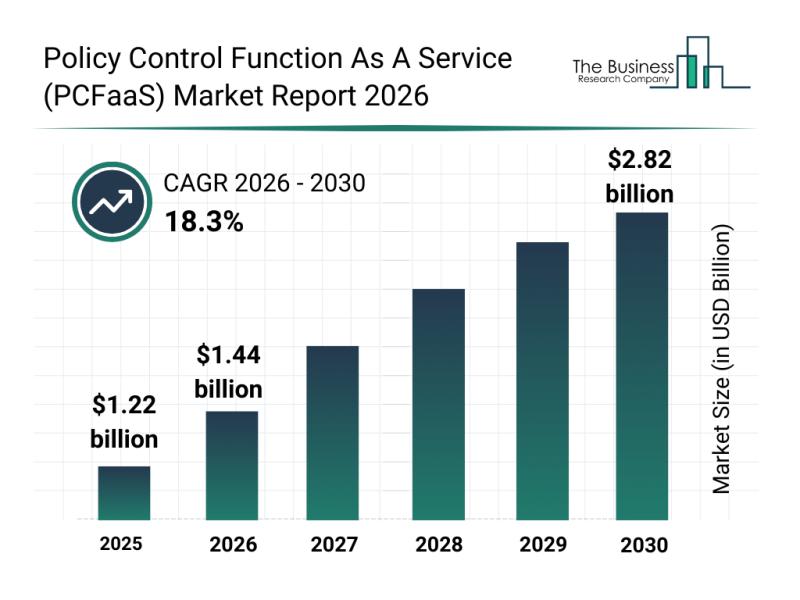

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

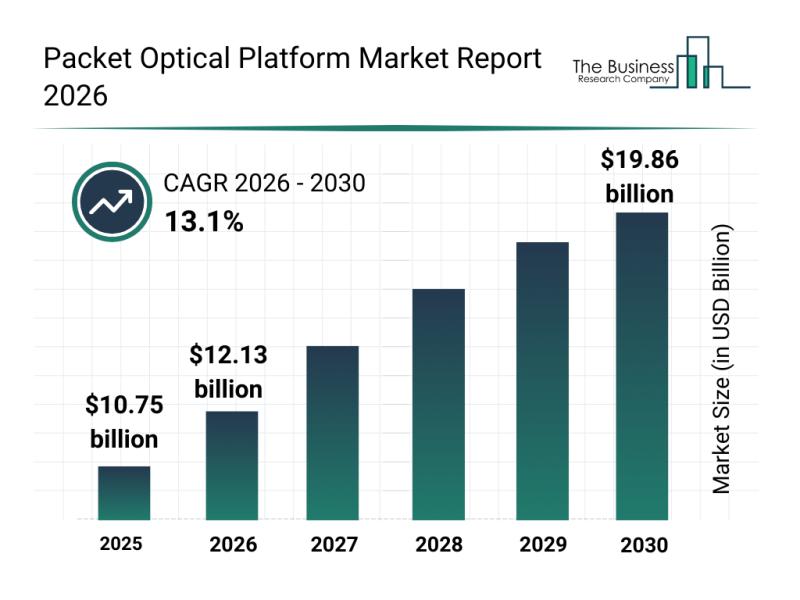

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

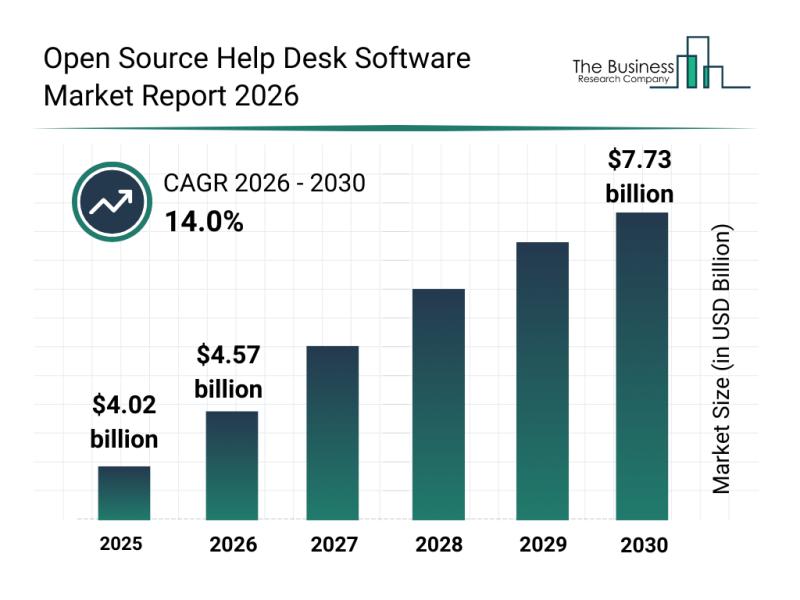

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…