Press release

Cards & Payments Market: Major Trends Reshaping the Future of the Industry

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Cards & Payments Industry Market Size Be by 2025?

In the past few years, there has been a notable surge in the scale of the cards & payments market. This market is projected to expand from $1053.21 billion in 2024 to $1140.12 billion in 2025, representing an 8.3% compound annual growth rate (CAGR). The growth observed in the historic period is linked to the rise in electronic payment systems, the initiation of credit and debit cards, globalization and international transactions, the consumer shift towards e-commerce and improved security protocols.

What's the Long-Term Growth Forecast for the Cards & Payments Market Size Through 2029?

In the forthcoming years, a robust growth is anticipated in the cards & payments market, with predictions to reach $1604.85 billion in 2029, thanks to a compound annual growth rate (CAGR) of 8.9%. This growth trend in the upcoming years can be traced back to the rise of mobile payments, the expansion of open banking campaigns, sustained e-commerce growth, advancements in regulations, and sustainability in payment methods. The major trend movements for the forecast period are expected to revolve around the surge of contactless payments, the acceptance of digital wallets, the integration of cryptocurrency, the advent of biometric verification, and the emergence of subscription and recurring payments.

View the full report here:

https://www.thebusinessresearchcompany.com/report/cards-and-payments-global-market-report

What Are the Key Growth Drivers Fueling the Cards & Payments Market Expansion?

The expansion of the e-commerce sector is anticipated to drive growth in the cards and payments market. Essentially, e-commerce is the online purchase and sale of products and services, with cards and payments forming the crucial framework that enables online business transactions. For example, in August 2023, as per data from the United States Census Bureau, a governmental department in the US, the projected increase for e-commerce in the second quarter of 2023 was 7.5% (or 1.4%) as opposed to the second quarter of 2022, while general retail sales escalated by 0.6% (or 0.4%). Online sales accounted for 15.4% of total sales in the second quarter of 2023. Hence, the growth of the e-commerce sector is functioned as the catalyst for the cards and payments market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3576&type=smp

Which Emerging Trends Are Transforming the Cards & Payments Market in 2025?

Leading corporations in the cards and payments sector are leveraging innovative offerings like digital checking accounts and debit cards to enhance their market standing. These new products distinctively offer online accessibility, superior security features, compatibility with digital tools, and increased user personalization. For example, Experian PLC, a data analytics and consumer credit reporting enterprise based in Ireland, unrolled a new smart money digital checking account and debit card in October 2023. The account bears the Experian Boost feature, a FICO score-increasing mechanism that tracks Experian Boost-eligible payments and appends them to the consumer's credit file. The Experian Smart Money Digital Checking Account is crafted for clients seeking a streamlined financial platform to boost their credit status and general financial well-being with added specialized benefits.

How Is the Cards & Payments Market Segmented?

The cards & paymentsmarket covered in this report is segmented -

1) By Type: Cards, Payments

2) By Institution Type: Banking Institutions, Non-Banking Institutions

3) By Application: Food And Groceries, Health And Pharmacy, Restaurants And Bars, Consumer Electronics, Media And Entertainment, Travel And Tourism, Other Applications

Subsegments:

1) By Cards: Credit Cards, Debit Cards, Prepaid Cards, Charge Cards, Virtual Cards

2) By Payments: Digital Payments, Mobile Payments, Contactless Payments, E-commerce Payments, Cross-Border Payments

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=3576&type=smp

Which Companies Are Leading the Charge in Cards & Payments Market Innovation?

Major companies operating in the cards & payments market include Apple Inc., China Construction Bank Corporation (CCB), Industrial and Commercial Bank of China Limited (ICBC), Banco Santander S.A., American Express Company, Visa Inc., PayPal Holdings Inc., Mastercard Incorporated, Intesa Sanpaolo S.p.A., Fiserv Inc, Franchise Payments Network Inc., Global Payments Inc, Concardis AG, Total Pay Solutions Inc., AffiniPay Corp., BlueSnap Inc, BillGO Inc., nCourt Inc., Versapay Corp., PayProTec Inc., Spreedly Inc., New West Technologies Inc., International Payout Systems Inc, Pivot Payables Corporation

Which Regions Are Leading the Global Cards & Payments Market in Revenue?

Asia-Pacific was the largest region in the cards and payments market in 2024. Western Europe was the second largest region in the card and payments market. The regions covered in the cards & payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=3576

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cards & Payments Market: Major Trends Reshaping the Future of the Industry here

News-ID: 4193741 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Approaches Influencing the R …

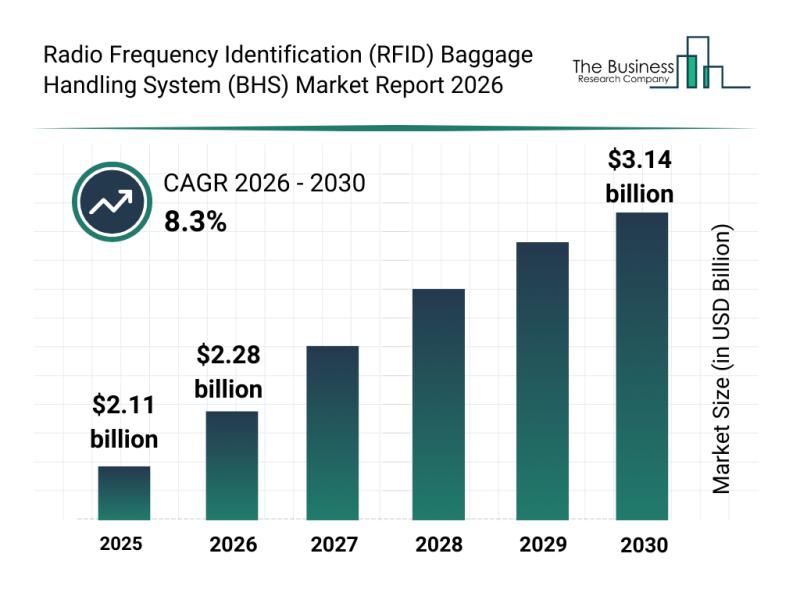

The radio frequency identification (RFID) baggage handling system (BHS) market is set to experience significant growth over the coming years, driven by advancements in airport technology and evolving passenger needs. As airports continue to modernize and automate their operations, the demand for efficient baggage handling solutions is increasing rapidly. This overview explores the market's size, influential players, emerging trends, and key segments shaping its future.

Projecting the Radio Frequency Identification Baggage…

Leading Industry Participants Reinforce Their Presence in the Process Informatio …

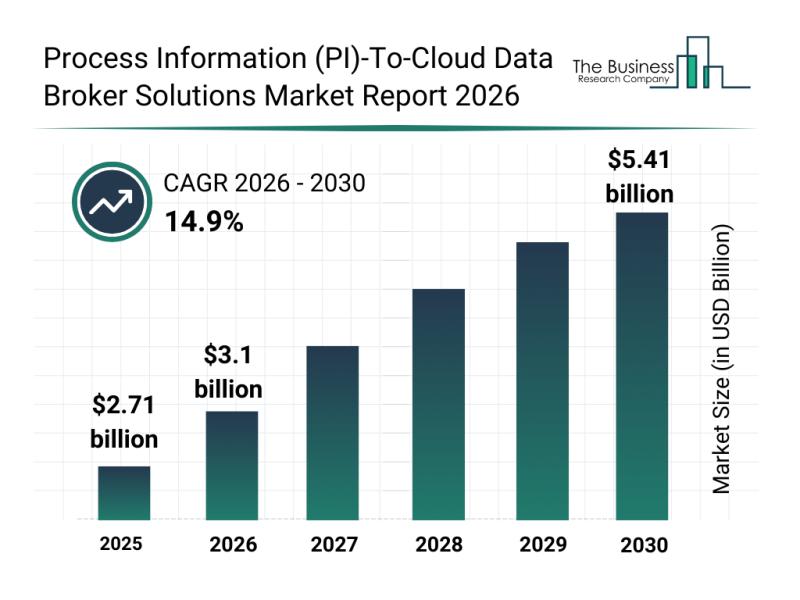

The process information (PI)-to-cloud data broker solutions industry is positioned for significant expansion as digital transformation accelerates across industrial sectors. Increasing demand for real-time data access and seamless integration between operational technology (OT) and information technology (IT) systems is driving rapid innovations and investments. Let's explore the market size projections, key players, emerging trends, and segment insights shaping this evolving landscape.

Projected Market Size Growth in the Process Information (PI)-To-Cloud Data…

Future Perspective: Key Trends Shaping the Policy Management Telecom Market Up t …

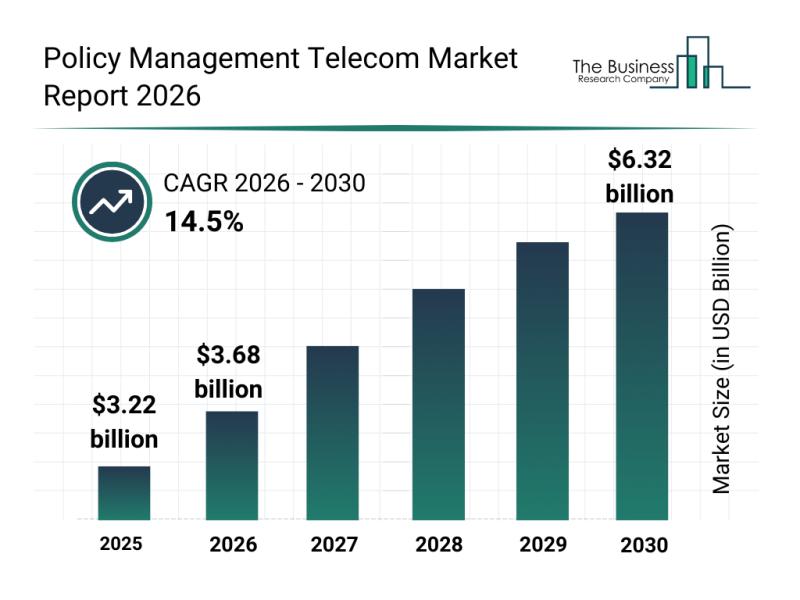

The policy management telecom sector is set to experience significant expansion over the coming years, driven by technological advances and growing network demands. This evolving market is playing a crucial role in supporting the complex needs of modern telecom operators, enabling more efficient management and automation of network policies. Below, we explore the current market size projections, leading companies, key trends, and segmentation details that define this dynamic industry.

Strong Growth…

Competitive Analysis: Key Market Leaders and New Entrants in the Pantyhose and T …

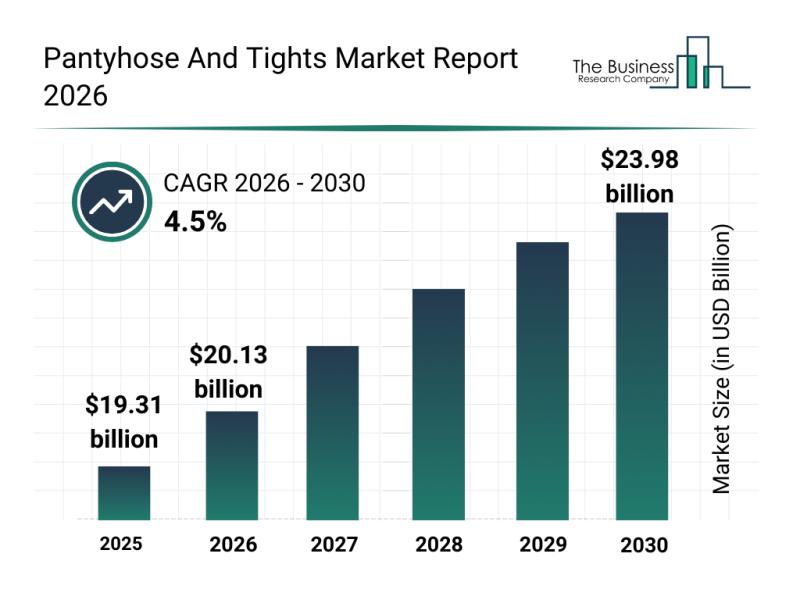

The pantyhose and tights market is set to witness consistent growth as consumer preferences evolve and new trends gain traction. With increasing emphasis on sustainability, comfort, and style, this sector is poised for meaningful expansion through 2030. Let's dive into the market's valuation, key players, emerging trends, and segmentation to understand the trajectory of this dynamic industry.

Forecasted Market Value and Growth Rate of the Pantyhose and Tights Market

The…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…