Press release

Rising Credit Card Usage Driving Growth In The Market Due To Increasing Consumer Preference For Cashless And Convenient Transactions: Powering Innovation and Expansion in the Debt Settlement Market by 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Debt Settlement Market Size Growth Forecast: What to Expect by 2025?

The market size for debt settlement has experienced significant growth over the past few years. It is projected to increase from $9.00 billion in 2024 to $9.84 billion in 2025, with a compound annual growth rate (CAGR) of 9.4%. Several factors have contributed to this historical growth, including higher unemployment rates, escalated use of consumer credit cards, an amplified ratio of household debt to income, increased uninsured medical expenses, and elevated interest rates from previous debt cycles.

How Will the Debt Settlement Market Size Evolve and Grow by 2029?

The market size of debt settlement is predicted to experience significant growth in the coming years. It is projected to expand to $13.91 billion by 2029, with a compound annual growth rate (CAGR) of 9.0%. The surge during the forecast period could be due to the escalating cost of living surpassing wage increases, a surge in defaults on buy now, pay later (BNPL) schemes, increased dependency on unsecured digital lending platforms, growth in student loan repayment pressure post-forbearance, and increased financial pressure among the younger population. Key trends to observe during the forecast period include progress in AI-driven debt negotiation tools, improvements in digital payment platforms, shifts in regulatory frameworks, advancements in financial literacy plans, and the incorporation of blockchain technology.

View the full report here:

https://www.thebusinessresearchcompany.com/report/debt-settlement-global-market-report

What Drivers Are Propelling the Growth of Debt Settlement Market Forward?

The market growth is being propelled by the increasing use of credit cards due to consumers' growing preference for cashless and hassle-free transactions.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=27459&type=smp

What Trends Will Shape the Debt Settlement Market Through 2029 and Beyond?

Key players in the debt settlement market are concentrating their efforts on creating sophisticated solutions such as voice AI agents, to turbocharge customer engagement, simplify collections, and maintain compliance. A voice AI agent is an artificial intelligence system that interacts with users verbally, handling tasks like debt reminders, negotiations, and customer support. For example, in April 2025, Kikoff Inc., a credit-building platform located in the United States, introduced an AI-driven Debt Negotiator with the aim of aiding users in automating their debt repayment plans and negotiating proficiently with creditors. This system streamlines negotiations with debt collectors, reducing debt by an average of 30% and thereby making debt alleviation more accessible and affordable. It also decreases user anxiety by managing calls and has proven to be more successful than human negotiators. Its function is to provide a wiser, more inclusive method for millions of Americans to manage and eliminate their debt, hence improving their financial well-being.

What Are the Key Segments in the Debt Settlement Market?

The debt settlement market covered in this report is segmented

1) By Type: Credit Card Debt Settlement, Mortgage Debt Settlement, Student Loan Debt Settlement, Medical Debt Settlement, Personal Loan Debt Settlement, Other Types

2) By Debt Amount: Low-Value Debt (Up To $10,000), Medium-Value Debt ($10,001 To $50,000), High-Value Debt (Over $50,000)

3) By Distribution Channel: Online Or Digital Platforms, Offline Or Traditional Channels

4) By End-User: Individuals, Small And Medium Enterprises, Large Enterprises

Subsegments:

1) By Credit Card Debt Settlement: Secured Credit Card Debt, Unsecured Credit Card Debt, Store Credit Card Debt

2) By Mortgage Debt Settlement: Primary Residence Mortgage, Secondary Residence Mortgage, Commercial Property Mortgage

3) By Student Loan Debt Settlement: Federal Student Loans, Private Student Loans, Parent Plus Loans

4) By Medical Debt Settlement: Hospital Bills, Doctor's Fees, Prescription Medication Debt

5) By Personal Loan Debt Settlement: Secured Personal Loans, Unsecured Personal Loans, Payday Loans

6) By Other Types: Utility Bills Settlement, Tax Debt Settlement, Legal Fee Debt Settlement

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=27459&type=smp

Who Are the Key Players Shaping the Debt Settlement Market's Competitive Landscape?

Major companies operating in the debt settlement market are Freedom Debt Relief LLC, National Debt Relief LLC, The J.G. Wentworth Company LLC, ClearOne Advantage LLC, GreenPath Financial Wellness, Americor Funding LLC, Century Support Services LLC, TurboDebt LLC, Alleviate Financial Solutions LLC, CreditAssociates LLC, Timberline Financial LLC, InCharge Debt Solutions Inc., CuraDebt Systems LLC, DMB Financial LLC, Accredited Debt Relief LLC, Consumers Alliance Processing Corporation, Greenwise Debt Relief, New Era Debt Solutions Inc., Pacific Debt Inc., Clear Coast Debt Relief, and Pioneer Credit Counseling.

What Geographic Markets Are Powering Growth in the Debt Settlement Market?

North America was the largest region in the debt settlement market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in debt settlement report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=27459

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Credit Card Usage Driving Growth In The Market Due To Increasing Consumer Preference For Cashless And Convenient Transactions: Powering Innovation and Expansion in the Debt Settlement Market by 2025 here

News-ID: 4193307 • Views: …

More Releases from The Business Research Company

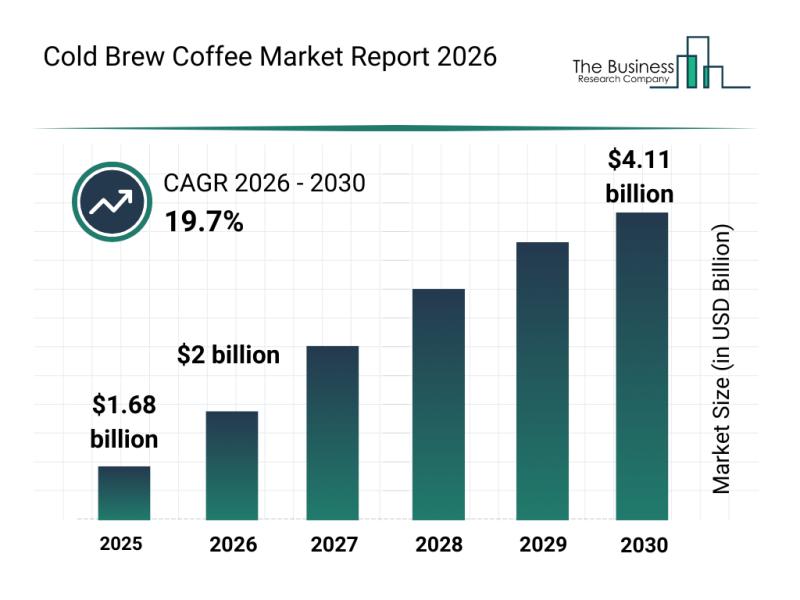

Analysis of Key Market Segments Influencing the Cold Brew Coffee Market

The cold brew coffee sector is rapidly evolving, attracting growing consumer interest due to its unique flavor profiles and convenience. As preferences shift toward healthier and sustainable beverage options, this market is positioned for substantial expansion over the coming years. Let's explore the current market value outlook, key players, emerging trends, and the primary segments contributing to this growth.

Projected Growth and Market Size of the Cold Brew Coffee Industry …

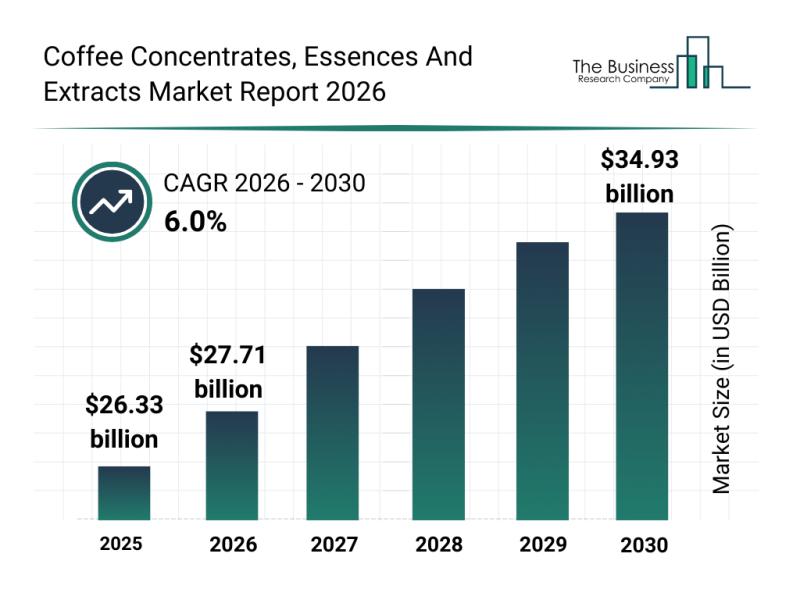

Market Trend Analysis: The Impact of Recent Innovations on the Coffee Concentrat …

The coffee concentrates, essences, and extracts market is positioned for significant expansion over the coming years, driven by evolving consumer preferences and innovative product developments. This sector is experiencing a shift toward more premium and convenient coffee options, which is shaping its growth trajectory through 2030.

Projected Growth and Market Size of the Coffee Concentrates, Essences, and Extracts Market

The market for coffee concentrates, essences, and extracts is anticipated to…

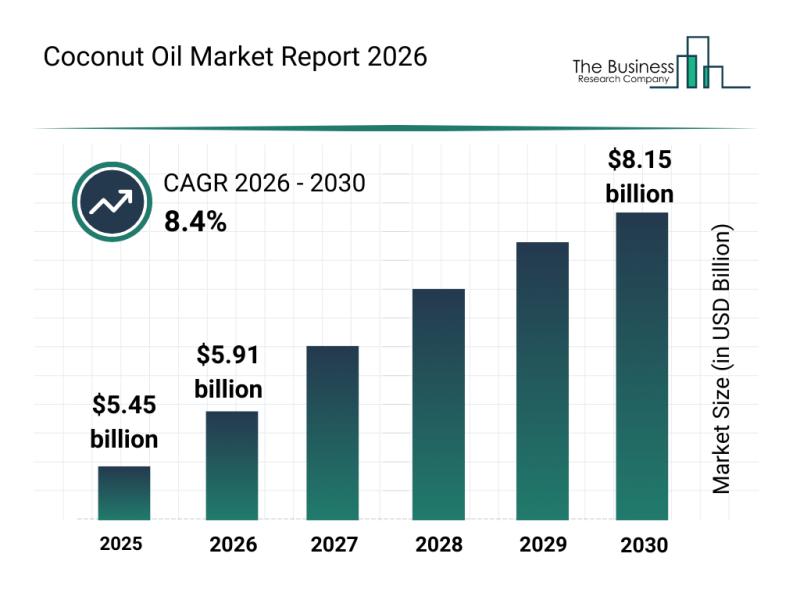

Trends in Growth, Market Segments, and Competitive Strategies Influencing the Co …

The coconut oil industry is poised for remarkable expansion in the coming years, driven by evolving consumer preferences and innovations across various sectors. As demand grows for healthier and sustainable products, the market is expected to witness significant developments that will shape its future trajectory. Let's explore the current market value, key players, trends, and segmentation of the coconut oil industry.

Projected Market Value and Growth Outlook for the Coconut Oil…

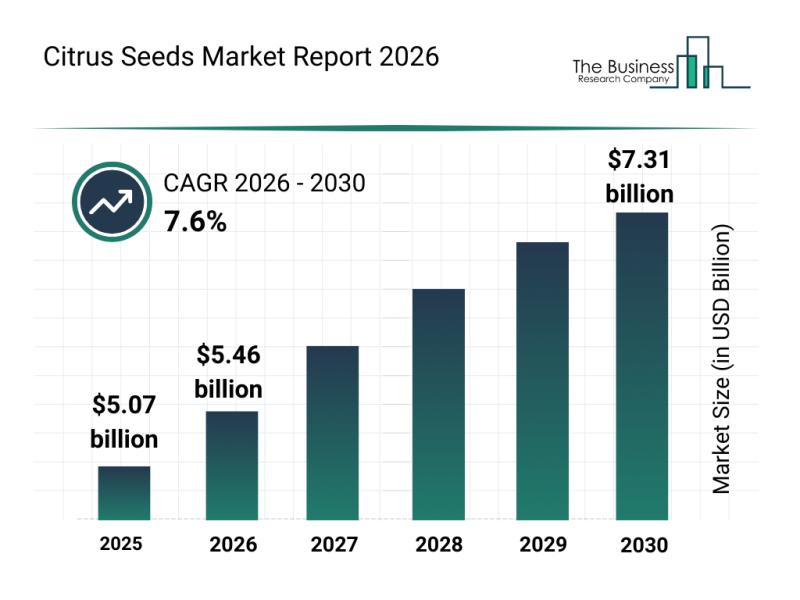

Analysis of Key Market Segments Driving the Citrus Seeds Market

The citrus seeds market is attracting significant attention due to its expanding role in agriculture, cosmetics, and food industries. With increasing emphasis on sustainability and innovative uses, this sector is set to experience notable growth in the coming years. Let's explore the current market size, influential trends, leading companies, and segmentation details shaping the future of the citrus seeds industry.

Citrus Seeds Market Size and Forecast Through 2030

The citrus…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…