Press release

Global Economic Growth Boosting Investment Banking Market Growth: A Key Catalyst Accelerating Investment Banking Market Growth in 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Investment Banking Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size for investment banking has significantly expanded in the past few years. There is an anticipated rise from $140.16 billion in the year 2024 leading up to $150.49 billion in 2025, representing a compound annual growth rate (CAGR) of 7.4%. Such growth during previous periods is linked to the stability and instability pertaining to geopolitical scenarios, amalgamation in the industry, the deregulation of financials, advancements in derivatives markets, and the rise of private equity.

Investment Banking Market Size Forecast: What's the Projected Valuation by 2029?

The market size of investment banking is forecasted to experience significant expansion in the coming years. A compound annual growth rate (CAGR) of 7.6% is predicted to take the market to $202.06 billion by the year 2029. This growth can be linked to a number of factors, including the integration of sustainable finance and ESG, the implementation of resilience plans, enhancements in risk management, the rise of digital assets and cryptocurrency services, and the focus on infrastructure investments as well as sustained private equity activity. Key trends for this forecast period would involve the incorporation of technology, the emergence of digital currencies, collaboration within fintech, flexible working models, new capital raising strategies, and the advancement of data analytics and artificial intelligence.

View the full report here:

https://www.thebusinessresearchcompany.com/report/investment-banking-global-market-report

What Are the Drivers Transforming the Investment Banking Market?

The upward trajectory of the global economy is set to boost the investment banking market's further progression. Economical growth can be defined as a stage in the business cycle characterized by a continuous growth in the economical activities, which may include aspects like an increase in gross domestic product (GDP), an improvement in employment rates, increase in consumer spending, and enhanced business confidence. This growth in the economy fosters the demand for financial services, including Mergers and Acquisitions (M&A), fundraising, and advisory services, which primarily benefits the investment banks. For instance, future forecasts from The World Bank, a US-based international financial entity, anticipate a 1.7% growth in the global economy in 2023, followed by an increment of 2.7% in 2024. Consequently, this economic upswing is expected to steer the forward progress of the global investment banking market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2896&type=smp

What Trends Will Shape the Investment Banking Market Through 2029 and Beyond?

Global investment banks are progressively transitioning towards businesses that necessitate fewer regulatory capitals. In line with this, renowned investment banks such as Barclays, Deutsche Bank, and Credit Suisse, intend to shift from customary underwriting businesses to alternative operations like mergers and acquisitions advisory and fundraising. This changeover is mainly rooted in regulatory amendments that have made certain investment banking activities costlier than the rest. Despite these new regulations limiting the scope of some banks and pushing them to specialize, there are still some investment banks, like Citibank and JPMorgan, that continue to provide a comprehensive array of investment banking services.

Which Segments in the Investment Banking Market Offer the Most Profit Potential?

The investment bankingmarket covered in this report is segmented -

1) By Type: Mergers And Acquisitions Advisory, Financial Sponsor Or Syndicated Loans, Equity Capital Markets Underwriting, Debt Capital Markets Underwriting

2) By Enterprise Size: Large Enterprises, Medium And Small Enterprises

3) By End-Use Industry: Financial Services, Retail And Wholesale, Information Technology, Manufacturing, Healare, Construction, Other End-Use Industries

Subsegments:

1) By Mergers And Acquisitions Advisory: Buy-Side Advisory, Sell-Side Advisory, Merger Integration Services

2) By Financial Sponsor Or Syndicated Loans: Leveraged Buyout Financing, Acquisition Financing, Refinancing Solutions

3) By Equity Capital Markets Underwriting: Initial Public Offerings (IPOs), Follow-On Offerings, Private Placements

4) By Debt Capital Markets Underwriting: Corporate Bonds, High-Yield Debt, Structured Finance Products

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=2896&type=smp

Which Firms Dominate the Investment Banking Market by Market Share and Revenue in 2025?

Major companies operating in the investment banking market include JPMorgan Chase & Co., Bank of America Corporation, HSBC Holdings plc, Citigroup Inc., Wells Fargo & Company, Morgan Stanley, BNP Paribas SA, Goldman Sachs Group Inc., UBS Group AG, Barclays plc, Deutsche Bank AG, Credit Suisse Group AG, Mizuho Financial Group Inc., Raymond James Financial Inc., Nomura Holdings Inc., Jefferies Financial Group Inc., Stifel Financial Corp., Lazard Ltd., Evercore Inc., RBC Capital Markets, Houlihan Lokey Inc., Cowen Inc., Piper Sandler Companies, William Blair & Company LLC, PJT Partners Inc., Moelis & Company, Perella Weinberg Partners LP, Greenhill & Co. Inc., Centerview Partners LLC, Rothschild & Co.

Which Regions Offer the Highest Growth Potential in the Investment Banking Market?

North America was the largest region in the investment banking market in 2024. Asia-Pacific was the second-largest region in the investment banking market. The regions covered in the investment banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2896

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Economic Growth Boosting Investment Banking Market Growth: A Key Catalyst Accelerating Investment Banking Market Growth in 2025 here

News-ID: 4193253 • Views: …

More Releases from The Business Research Company

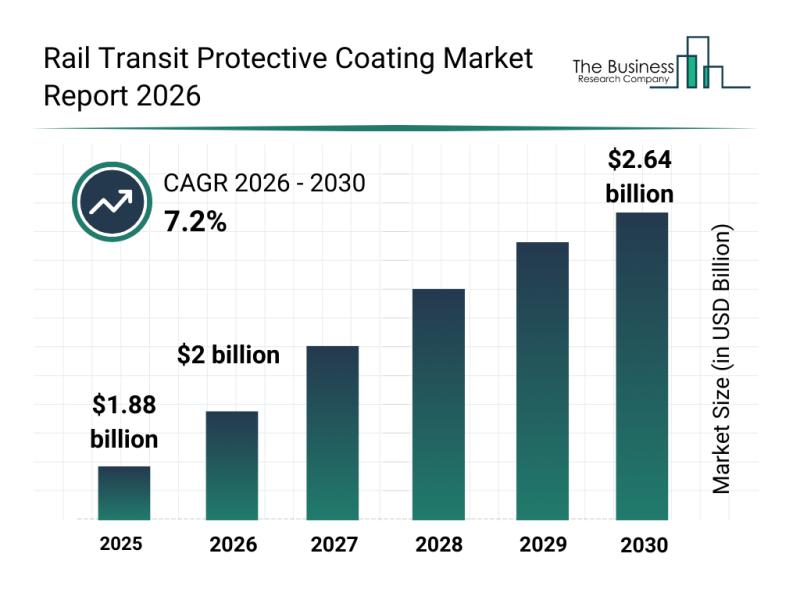

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

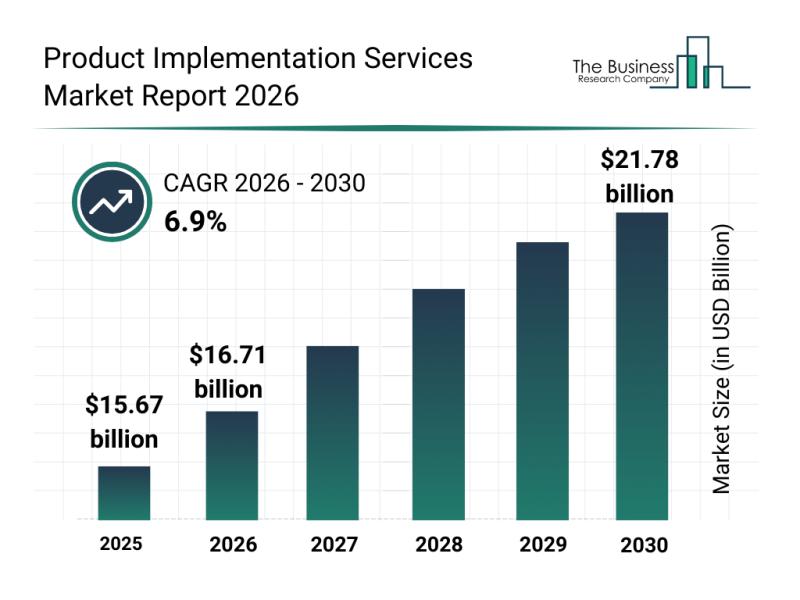

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

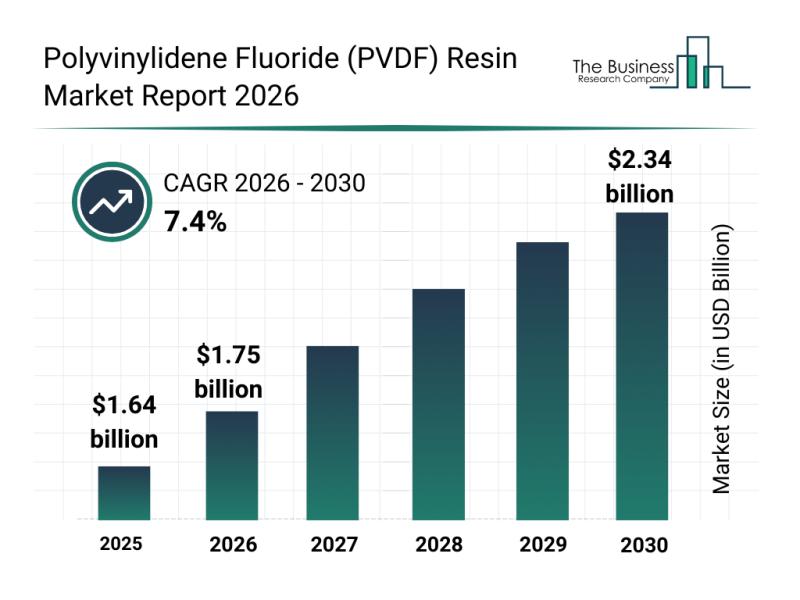

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

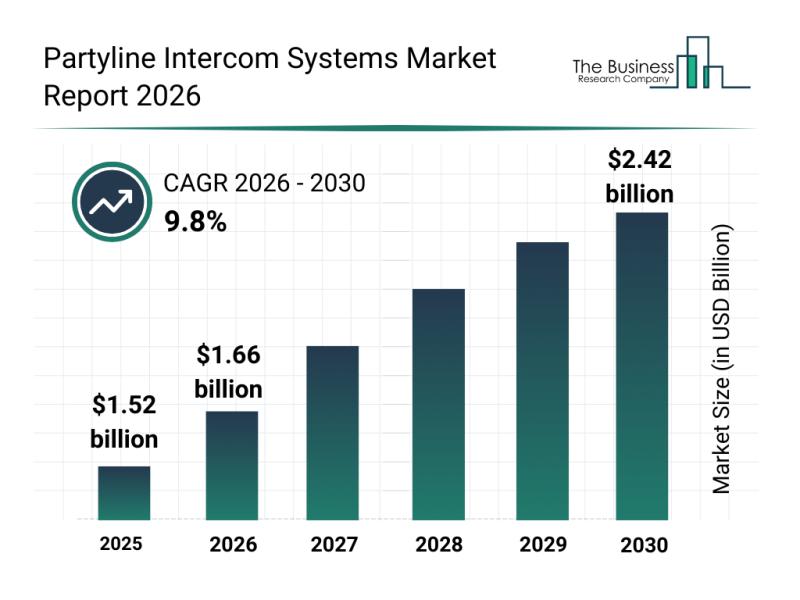

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…