Press release

2025-2034 Credit Card Issuance Services Market Outlook: Key Drivers, Emerging Challenges, and Strategic Insights

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Credit Card Issuance Services Industry Market Size Be by 2025?

The market for issuing credit cards has seen robust growth in past years. It is expected to expand from $520.01 billion in 2024 to $565.47 billion in 2025, with a compound annual growth rate (CAGR) of 8.7%. Factors such as changes in consumer spending behavior, initiatives for financial inclusion, economic expansion, loyalty schemes, and regulatory modifications have contributed to the growth in the past.

What's the Long-Term Growth Forecast for the Credit Card Issuance Services Market Size Through 2029?

The market size of credit card issuance services is predicted to experience significant expansion in the coming years, reaching $785.37 billion in 2029 with a compound annual growth rate (CAGR) of 8.6%. Drivers for this projected growth during the forecast period include the rise of contactless payments, issues related to data security, the introduction of cryptocurrencies, the growth of embedded finance, as well as customization and personalization. Key trends anticipated during this forecast period consist of biometric authentication, integration with financial wellness services, instantaneous payment processing, the use of blockchain for enhanced security, and the application of AI and predictive analytics.

View the full report here:

https://www.thebusinessresearchcompany.com/report/credit-card-issuance-services-global-market-report

What Are the Key Growth Drivers Fueling the Credit Card Issuance Services Market Expansion?

The projected increase in credit card usage is likely to stimulate the expansion of credit card issuance service industry in the future. A credit card is basically a lending product provided by banks, allowing customers to borrow up to a previously established credit limit. Credit card issuing institutions are critical in carrying out card transactions, reimbursing previously authorized purchases, and managing chargeback inquiries. For example, data from the Federal Reserve Bank of New York, a US federal bank overseeing the second district of the Federal Reserve System, revealed that in the fourth quarter of 2022, there was a rise of $61 billion in credit card balances, bringing the total to $986 billion in the USA. This surpassed the prior record before the pandemic, which stood at $927 billion. Thus, the growing demand for credit cards is fueling the expansion of the credit card issuance service sector.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12484&type=smp

What Are the Key Trends Driving Credit Card Issuance Services Market Growth?

The continual enhancement of technology is a prominent trend seen in the credit card issuance service market. Leading firms in this market are innovating with new technology to maintain their market standing. For example, in April 2024, AU Small Finance Bank, a banking establishment from India, introduced two insurance credit cards, namely Secured Credit Card - NOMO (No Missing Out) and AU SPONT Rupay Credit Card. The NOMO credit card is specifically tailored for those who may not be eligible for regular unsecured credit cards as a result of reasons like inadequate credit score, limited credit history, or lack of sufficient income evidence. It comes with exclusive perks such as reward points, exemption in fuel surcharge, and access to airport lounges. On the other hand, the Rupay credit card distinguishes itself by enabling users to connect the card to their chosen UPI-enabled application, thereby simplifying payments via the UPI Scan and Pay function. It also offers 1% cashback on a majority of transactions and COINS rewards for UPI transactions conducted on the AU 0101 app, thereby ensuring its accessibility to customers of diverse income groups.

How Is the Credit Card Issuance Services Market Segmented?

The credit card issuance servicesmarket covered in this report is segmented -

1) By Type: Consumer Credit Cards, Business Credit Cards

2) By Issuers: Banks, Credit Unions, Non-Banking Financial Companies

3) By End-User: Personal, Business

Subsegments:

1) By Consumer Credit Cards: Standard Credit Cards, Rewards Credit Cards, Secured Credit Cards, Student Credit Cards, Premium Credit Cards

2) By Business Credit Cards: Small Business Credit Cards, Corporate Credit Cards, Commercial Credit Cards, Business Rewards Credit Cards, Charge Cards

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=12484&type=smp

Which Companies Are Leading the Charge in Credit Card Issuance Services Market Innovation?

Major companies operating in the credit card issuance services market include JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., American Express Company, HSBC Holdings plc., Toronto-Dominion Bank Group, Goldman Sachs Group Inc., Capital One Financial Corporation, Barclays Bank PLC, U.S. Bancorp, Standard Chartered PLC, PNC Financial Corp., Fiserv Inc., Synchrony Financial, Fidelity National Information Services Inc., Stripe Inc., Wells Fargo & Co., Fifth Third Bank NA, Navy Federal Credit Union, Huntington Bancshares Incorporated, Santander Bank N.A., Giesecke+Devrient GmbH, Synovus Financial Corp., Penfed Federal Credit Union, Marqeta Inc., Entrust Corporation, Comenity Bank, Nium Pte. Ltd.

Which Regions Are Leading the Global Credit Card Issuance Services Market in Revenue?

North America was the largest region in the credit card issuance services market in 2024. The regions covered in the credit card issuance services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12484

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Speak With Our Expert:

Saumya Sahay

Europe - +44 7882 955267,

Asia: +91 88972 63534,

Americas - +1 310-496-7795 or

Email:saumyas@tbrc.info

Follow Us On:

• LinkedIn: https://in.linkedin.com/company/the-business-research-company

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025-2034 Credit Card Issuance Services Market Outlook: Key Drivers, Emerging Challenges, and Strategic Insights here

News-ID: 4193222 • Views: …

More Releases from The Business Research Company

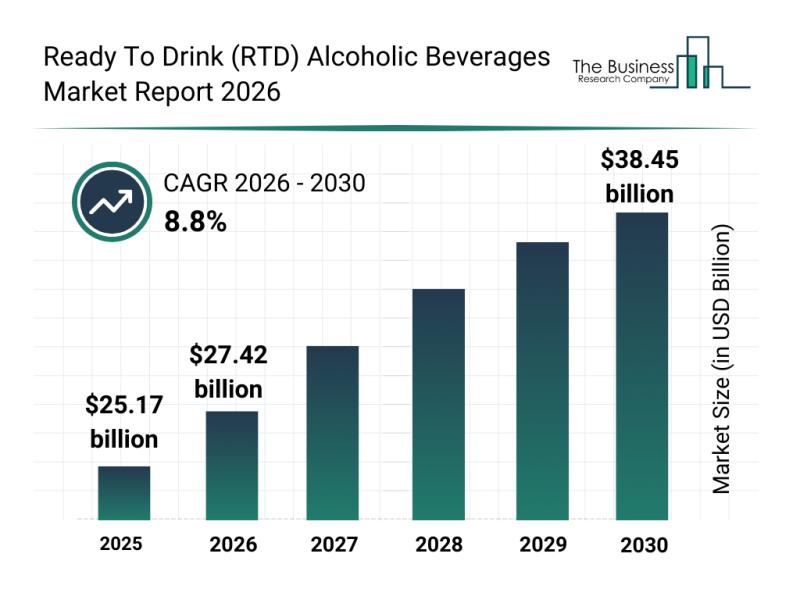

Outlook for the Ready To Drink (RTD) Alcoholic Beverages Market: Major Segments, …

The ready-to-drink (RTD) alcoholic beverages market is on track to experience significant growth over the coming years, driven by evolving consumer preferences and industry innovations. This sector is rapidly expanding as more consumers seek premium, convenient, and sustainable options in their alcoholic beverage choices. Let's explore the market's projected size, key drivers, major players, emerging trends, and segmentation details shaping its future.

Projected Expansion and Market Size of the Ready To…

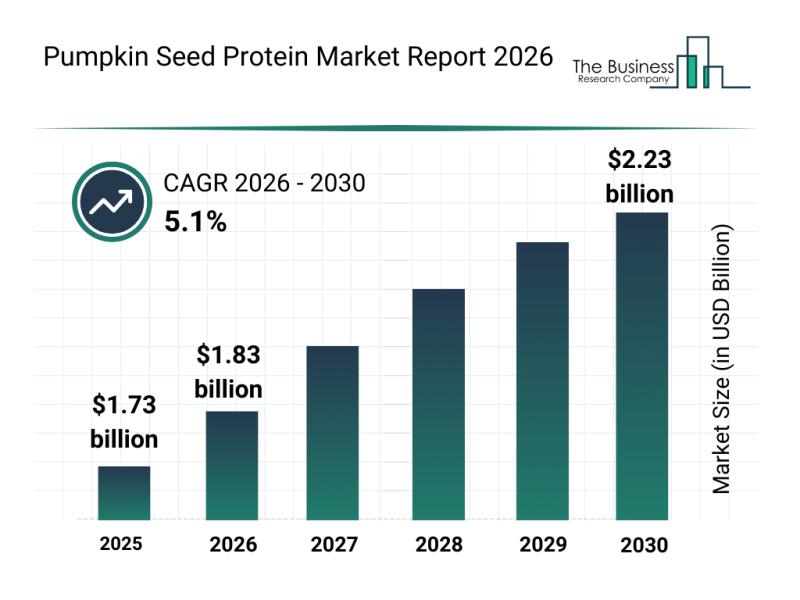

Emerging Sub-Segments Transforming the Pumpkin Seed Protein Market Landscape

The pumpkin seed protein market is emerging as a promising sector within the broader landscape of plant-based proteins. With increasing consumer interest in alternative, allergen-free protein sources and sustainable nutrition, this market is set to witness substantial growth and innovation. Let's explore the market size projections, key players, current trends, and major product segments shaping the future of pumpkin seed protein.

Projected Market Valuation and Growth Expectations for Pumpkin Seed Protein…

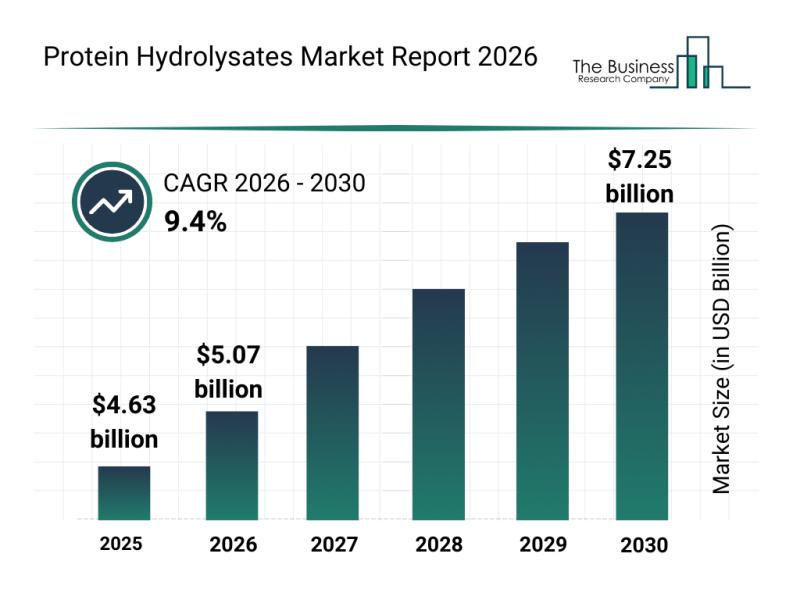

Top Players and Market Competition in the Protein Hydrolysates Industry

The protein hydrolysates market is positioned for significant expansion in the coming years as consumer preferences and nutritional science continue to evolve. With increasing attention on tailored nutrition solutions and the rise of plant-based options, this market is gearing up for robust growth and innovation.

Protein Hydrolysates Market Size Projections Through 2030

The protein hydrolysates market is forecasted to grow substantially, reaching a value of $7.25 billion by 2030. This…

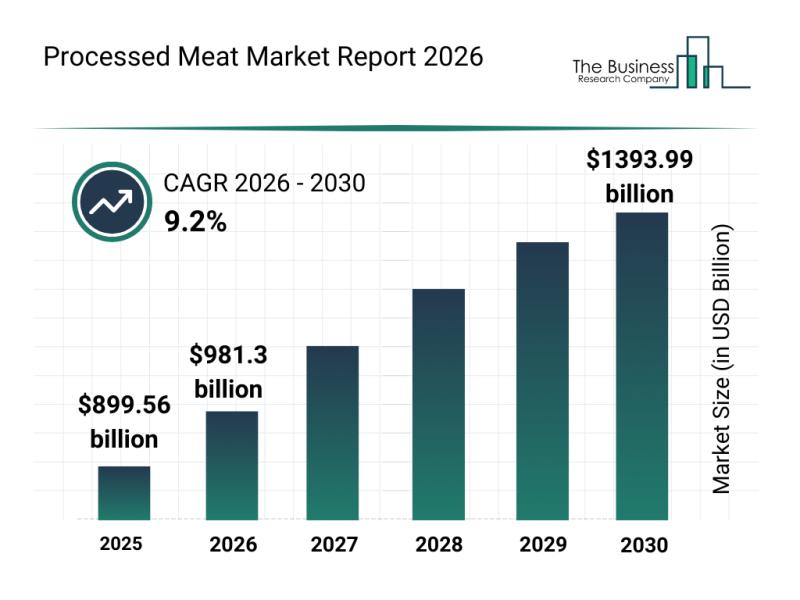

Processed Meat Market Overview: Major Segments, Strategic Developments, and Lead …

The processed meat industry is positioned for substantial expansion over the coming years, driven by evolving consumer preferences and technological advancements. As the market adapts to changing demands and regulatory landscapes, it is expected to reach impressive valuation milestones. Let's explore the current market size, key players, emerging trends, and detailed segment analyses shaping this sector's future.

Forecasted Market Size and Growth Trajectory of the Processed Meat Market

The processed…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…