Press release

Australia Automotive Lubricants Market Projected to Reach USD 3.3 Billion by 2033

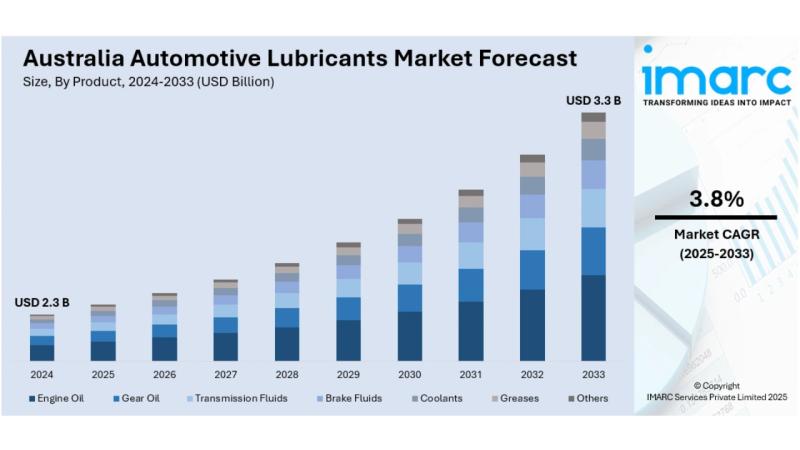

The latest report by IMARC Group, titled "Australia Automotive Lubricants Market Report by Product (Engine Oil, Gear Oil, Transmission Fluids, Brake Fluids, Coolants, Greases, Others), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia automotive lubricants market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia automotive lubricants market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.3 Billion by 2033, exhibiting a CAGR of 3.8% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 2.3 Billion

Market Forecast in 2033: USD 3.3 Billion

Market Growth Rate (2025-2033): 3.8%

Australia Automotive Lubricants Market Overview

The Australia automotive lubricants market is still experiencing steady growth due to the fact car ownership throughout Australia is increasing, since synthetic and semi-synthetic lubricants are even more in demand because they provide better thermal stability plus longer drain intervals, also policies that are aimed at reducing greenhouse gas emissions are implemented more often. The market expands because technology advances in engine design since engines require high-performance lubricants and the vehicle fleet ages which increases aftermarket service demand as government environmental regulations promote eco-friendly lubricant products. Australia's automotive lubricants market is growing, due to its focus more on sustainability. Programs such as the Product Stewardship for Oil scheme rightly recycle waste oil supporting that growth.

Australia's automotive lubricants foundation shows strong market fundamentals because 1,237,287 new vehicles were sold in 2024, also that represents a 1.7% increase from the previous year. That country keeps an old vehicle fleet so servicing plus lubricant changes happen often. Cycles for replacement are more longer, particularly for remote and for regional areas. Advanced engine technologies are proliferating such as turbocharged engines, start-stop systems, also hybrid powertrains; this creates favorable market conditions plus requires investors to invest substantially within high-performance lubricant formulations. Australia regulates under the National Clean Air Agreement and has climate change policies, combines with growing sustainability awareness, so the market increasingly attracts eco-friendly lubricant developers and distributors.

Request For Sample Report:

https://www.imarcgroup.com/australia-automotive-lubricants-market/requestsample

Australia Automotive Lubricants Market Trends

• Synthetic lubricant advancement: Growing demand for synthetic and semi-synthetic lubricants offering superior thermal stability, reduced friction, and extended drain intervals compared to conventional mineral oils meeting modern engine requirements.

• Aftermarket expansion: Steady growth in automotive aftermarket services driven by aging vehicle fleet requiring more frequent maintenance and lubricant replacements, particularly in remote and regional areas with longer replacement cycles.

• Advanced engine compatibility: Lubricant formulations specifically designed for contemporary engine technologies including turbocharged engines, start-stop systems, and hybrid powertrains requiring precise viscosity control and enhanced wear protection.

• Environmental compliance focus: Increasing adoption of eco-friendly lubricants supporting cleaner engine operation and meeting regulatory mandates around carbon emissions and fuel economy standards.

• Waste oil recycling programs: Enhanced focus on proper disposal and recycling of waste lubricants through government-sponsored initiatives like Product Stewardship for Oil scheme creating secondary market for re-refined lubricants.

• Regional market penetration: Expansion of lubricant distributors and manufacturers into remote areas providing value-added services including oil analysis and custom maintenance kits addressing underserved markets.

Market Drivers

• Vehicle ownership growth: Sustained increase in car ownership with 1,237,287 new vehicles sold in 2024 representing 1.7% growth driving routine maintenance services and regular lubricant changes across Australian market.

• Aging vehicle fleet: Increasing average age of Australian vehicles creating long-term aftermarket demand for frequent servicing and lubricant replacements, particularly in regional areas with extended vehicle replacement cycles.

• Technological engine advancements: Modern engine designs emphasizing fuel economy, emissions control, and performance enhancement requiring advanced lubricants capable of withstanding harsh conditions and extended use periods.

• Environmental regulations: Government policies including National Clean Air Agreement and climate change initiatives promoting low-emission vehicles and green lubricant products supporting cleaner technology adoption.

• Performance requirements: Contemporary automotive systems including turbocharged engines and hybrid powertrains demanding high-performance lubricants with precise viscosity control and superior wear protection capabilities.

• Sustainability consciousness: Growing consumer awareness of environmental impact driving demand for biodegradable and low-toxicity lubricant products meeting sustainability values and regulatory compliance requirements.

Challenges and Opportunities

Challenges:

• Price volatility of raw materials including base oils and additives affecting lubricant manufacturing costs and profit margins, particularly impacting smaller manufacturers and distributors in competitive market conditions

• Regulatory compliance complexity with varying environmental standards, emissions requirements, and waste disposal regulations creating operational challenges and increased compliance costs across different market segments

• Market saturation risks in urban areas with intense competition between established brands and new entrants requiring differentiation strategies and value-added services to maintain market share

• Supply chain disruptions affecting raw material availability, manufacturing processes, and distribution networks particularly impacting remote and regional market access and service delivery

• Technology transition challenges as automotive industry shifts toward electric vehicles potentially reducing long-term demand for traditional engine lubricants requiring strategic adaptation and product diversification

Opportunities:

• Electric vehicle lubricant development for specialized applications including transmission fluids, coolants, and thermal management systems as EV adoption accelerates creating new market segments and revenue streams

• Premium product positioning through high-performance synthetic lubricants offering extended drain intervals, superior protection, and fuel economy benefits appealing to quality-conscious consumers and fleet operators

• Regional expansion opportunities in underserved remote areas through targeted distribution networks, mobile service units, and custom maintenance solutions addressing unique regional requirements and longer service intervals

• Circular economy integration through waste oil recycling, re-refined lubricant production, and sustainable packaging solutions aligning with environmental regulations and consumer sustainability preferences

• Fleet services development targeting commercial vehicle operators, mining companies, and logistics providers requiring bulk lubricant supply, maintenance contracts, and technical support services

Australia Automotive Lubricants Market Segmentation

By Product:

• Engine Oil

• Gear Oil

• Transmission Fluids

• Brake Fluids

• Coolants

• Greases

• Others

By Vehicle Type:

• Passenger Cars

• Light Commercial Vehicles

• Heavy Commercial Vehicles

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-automotive-lubricants-market

Australia Automotive Lubricants Market News (2024-2025)

• 2024: LIQUI MOLY launched new generalist motor oils specifically designed for Australian market, engineered to provide enhanced wear protection and maintain engine cleanliness meeting local performance requirements.

• 2024: Australia recorded 1,237,287 new vehicle sales representing 1.7% increase from previous year, driving sustained demand for automotive lubricants and maintenance services across the country.

• 2024: Product Stewardship for Oil (PSO) scheme expanded collection and treatment of waste oil, creating enhanced secondary market for re-refined lubricants supporting circular economy initiatives.

• 2024: Government environmental regulations including National Clean Air Agreement promoted adoption of eco-friendly lubricants supporting cleaner engine operation and reduced emissions standards.

• 2024: Automotive aftermarket experienced steady growth driven by aging vehicle fleet requiring more frequent servicing and lubricant replacements particularly in remote and regional areas.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Product Type and Vehicle Type Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=33013&flag=F

Q&A Section

Q1: What drives growth in the Australia automotive lubricants market?

A1: Market growth is driven by sustained vehicle ownership growth with 1,237,287 new vehicles sold in 2024, aging vehicle fleet requiring more frequent maintenance, technological engine advancements demanding high-performance lubricants, environmental regulations promoting eco-friendly products, contemporary automotive system performance requirements, and growing sustainability consciousness among consumers.

Q2: What are the latest trends in this market?

A2: Key trends include synthetic lubricant advancement offering superior performance characteristics, aftermarket expansion driven by aging fleet requirements, advanced engine compatibility for turbocharged and hybrid systems, environmental compliance focus meeting emissions standards, waste oil recycling programs through PSO initiatives, and regional market penetration providing specialized services in underserved areas.

Q3: What challenges do companies face?

A3: Major challenges include price volatility of raw materials affecting manufacturing costs and margins, regulatory compliance complexity with varying environmental and emissions standards, market saturation risks in competitive urban areas, supply chain disruptions impacting availability and distribution, and technology transition challenges as the automotive industry shifts toward electric vehicles.

Q4: What opportunities are emerging?

A4: Emerging opportunities include electric vehicle lubricant development for specialized EV applications, premium product positioning through high-performance synthetic formulations, regional expansion in underserved remote areas, circular economy integration through waste oil recycling and sustainable packaging, and fleet services development targeting commercial operators requiring bulk supply and maintenance contracts.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Automotive Lubricants Market Projected to Reach USD 3.3 Billion by 2033 here

News-ID: 4193115 • Views: …

More Releases from IMARC Group

Industrial Enzymes Manufacturing Plant DPR 2026: Cost Structure, Production Proc …

Setting up an industrial enzymes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of fermentation-based production technologies. These biological catalysts serve critical roles in detergents, food and beverages, animal feed, biofuels, pulp and paper, textiles, and wastewater treatment. Success requires careful site selection, efficient microbial fermentation processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial and environmental regulations to ensure profitable and…

Fly Ash Bricks Manufacturing Plant DPR & Unit Setup Report 2026

Setting up a fly ash bricks manufacturing plant positions investors in one of the fastest-growing and most environmentally progressive segments of the construction materials value chain, backed by sustained global growth driven by the increased demand for environmentally friendly construction materials, the growing trend of sustainable construction, and increasing government support towards waste utilisation and green construction methods. As urbanization accelerates, infrastructure development intensifies, and regulatory frameworks increasingly mandate the…

ERW Steel Pipes Manufacturing Plant DPR 2026: Investment Cost, Demand Analysis & …

Setting up an ERW steel pipes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. These high-strength, cost-effective pipes serve the oil and gas, construction, automotive, water transportation, and energy infrastructure sectors. Success requires careful site selection, advanced welding and precision manufacturing processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial safety and environmental regulations to ensure profitable and sustainable…

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…