Press release

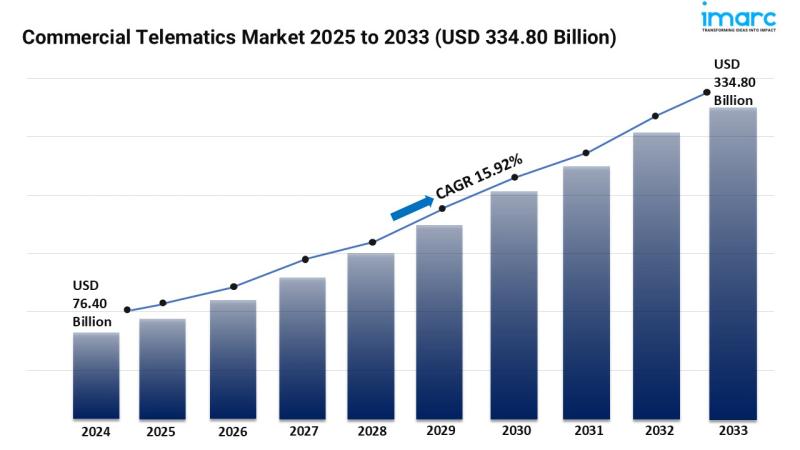

Commercial Telematics Market Size Worth USD 334.80 Billion Globally by 2033 at a CAGR of 15.92%

Market Overview:The commercial telematics market is experiencing rapid growth, driven by Increasing Demand for Fleet Management Solutions, Advancements in Vehicle Connectivity, and Government Regulations Supporting Vehicle Tracking. According to IMARC Group's latest research publication, "Commercial Telematics Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global commercial telematics market size was valued at USD 76.40 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 334.80 Billion by 2033, exhibiting a CAGR of 15.92% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/commercial-telematics-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Commercial Telematics Industry:

● Increasing Demand for Fleet Management Solutions

Fleet operators are facing rising fuel costs, stricter delivery timelines, and mounting challenges in relation to safer driving practices. Commercial telematics platforms address at least these issues through some automation. Real-time fleet monitoring also sees wide adoption of these platforms. These solutions are combining GPS tracking along with data analytics, and this allows for better route optimization that minimizes any idle time. Now, advanced fleet dashboards with driver scorecards and predictive maintenance alerts as well as compliance tools are offered from companies like Verizon Connect and Trimble. Smart telematics demand is accelerating into a mission-critical operational investment. Logistics fleets as well as ride-hailing fleets plus construction fleets exist under pressure for maximizing efficiency.

● Advancements in Vehicle Connectivity

The evolution of vehicle connectivity has turned the customary fleet vehicles into data-driven assets. These assets are smart. With 5G, IoT, and edge computing, telematics systems now support cloud-based fleet ecosystems and ultra-fast data transfer. Ford and also Volvo are both collaborating along with tech providers. These automakers aim to embed telematics within factory-installed systems too. This integration allows for features such as automated crashes being detected, vehicles communicating to infrastructure, and real-time software being updated. When fleet operators link telematics up to ERP and CRM platforms then they can see supply chain performance in a more deep way. These improvements permit total digital conversion and yield clearer client assistance within fleet functions.

● Government Regulations Supporting Vehicle Tracking

Worldwide governments are enforcing stricter regulations accelerating telematics adoption in private and public transport fleets. Electronic logging devices (ELDs) are required by the European Union's Mobility Package to track driver hours as well as ensure road safety compliance. AIS-140 mandates GPS tracking along with panic buttons in commercial vehicles in India. Because of this mandate, passenger security is improved. Also the U.S. Federal Motor Carrier Safety Administration (FMCSA) requires ELDs for trucks with telematics used long-haul. Governments are incentivizing fleet operations that are eco-friendly beyond compliance for them. Subsidies for the green fleet program are a key incentive. This regulatory push ensures that telematics adoption still remains a long-term driver because it aligns fleets with both sustainability and with safety mandates.

Key Trends in the Commercial Telematics Market

● Integration with AI and Predictive Analytics

Artificial intelligence reshapes commercial telematics via enabling smarter decisions through predictive analytics. Because of AI-powered perceptions, fleet operators are now in a position to forecast when parts will fail, predict where traffic bottlenecks will occur, and optimize how they consume fuel. AI models are used by platforms like Samsara and Geotab, plus they analyze driver performance for real-time corrective actions. Fleet availability is increased, with repair expenses lowered, and unplanned downtime reduced. To ensure faster as well as more efficient deliveries, AI-driven analytics are also being applied in last-mile logistics. Telematics systems become proactive tools via AI integration. These tools function to move well beyond descriptive analytics so as to anticipate challenges before operations end up disrupted.

● Expansion of Usage-Based Insurance (UBI)

Insurance providers are in fact increasingly using telematics data. They are using of this data in order to design more personalized usage-based insurance (UBI) products for these commercial fleets. Insurers calculate risk profiles now according to driving behavior, mileage, and accident history. Fixed premiums are not what they rely on, however. This approach also promotes safer practices across fleets in addition to lowering costs for drivers that are responsible. UBI platforms that are allowing insurers to monitor the real-time vehicle performance are offered by companies like Octo Telematics. Small and medium-sized fleet operators increasingly adopt UBI because of cost savings. Over the course of time, insurance companies are likely to power their policies with telematics. Insurance using telematics will then become the standard within the industry.

● Growing Demand for Video Telematics

Video telematics changes fleet management using real-time vehicle tracking plus AI-improved monitoring video. Dashcams coupled to telematics platforms gather driver actions, road conditions, with all incidents, and that gives operators actual visual evidence that then validates insurance claims while it improves safety compliance. Companies such as Lytx and Motive (formerly KeepTruckin) are innovating with features like driver-facing cameras providing immediate feedback on unsafe driving. School transport, logistics, and ride-sharing are quickly embracing such solutions to lower liability risks and strengthen accountability. A market trend like analytics making visual data valuable shows the shift toward video-driven perceptions.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=2496&flag=E

Leading Companies Operating in the Commercial Telematics Industry:

● AirIQ Inc.

● Bridgestone Corporation

● Continental AG

● Geotab Inc.

● GM Envolve

● MICHELIN Connected Fleet

● MiX Telematics (Powerfleet, Inc)

● Octo Telematics S.p.A.

● Platform Science, Inc.

● Solera Holdings, LLC

● Verizon Communications Inc.

Commercial Telematics Market Report Segmentation:

Breakup By Type:

● Solution

● Fleet Tracking and Monitoring

● Driver Management

● Insurance Telematics

● Safety and Compliance

● V2X Solutions

● Others

● Services

● Professional services

● Managed services

Solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) exhibits a clear dominance in the market due to the increasing demand for comprehensive telematics systems that integrate data analytics, real-time tracking, and fleet management services.

Breakup By System Type:

● Embedded

● Tethered

● Smartphone Integrated

Embedded represents the largest segment, as it offers enhanced integration, reliability, and security.

Breakup By Provider Type:

● OEM

● Aftermarket

Aftermarket holds the biggest market share owing to the flexible and cost-effective telematics solutions that can be retrofitted into existing vehicles.

Breakup By End Use Industry:

● Transportation and Logistics

● Media and Entertainment

● Government and Utilities

● Travel and Tourism

● Construction

● Healthcare

● Others

Transportation and logistics account for the majority of the market share attributed to the high reliance on telematics for optimizing route planning, improving fuel efficiency, and ensuring timely deliveries.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America dominates the market, driven by the early adoption of telematics technology, well-developed infrastructure, and stringent regulatory requirements for fleet management and safety.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Telematics Market Size Worth USD 334.80 Billion Globally by 2033 at a CAGR of 15.92% here

News-ID: 4193090 • Views: …

More Releases from IMARC Group

Hydrogen Fluoride Manufacturing Plant DPR 2026: Investment Cost, Market Growth & …

Setting up a hydrogen fluoride manufacturing plant positions investors within a strategically important segment of the global specialty chemicals and fluorochemicals industry, driven by increasing demand for semiconductor manufacturing, refrigerant production, and pharmaceutical intermediates. As modern industrial processes advance, electronics manufacturing expands, and the need for high-purity fluorine compounds grows, hydrogen fluoride continues to gain traction across semiconductor fabrication, aluminum production, and petroleum refining worldwide. Rising demand from high-tech industries,…

Vinyl Acetate Ethylene Production Plant Cost 2026: Industry Overview and Profita …

Setting up a Vinyl Acetate Ethylene Production Plant positions investors in one of the most stable and essential segments of the specialty chemicals and polymer value chain, backed by sustained global growth driven by growing construction activity, rising demand for high-performance dry-mix mortars, increasing use in paints and coatings, and the dual-benefit advantages of delivering flexible, low-VOC polymer binder solutions that meet both industrial performance standards and evolving environmental compliance…

Fluff Pulp Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a fluff pulp manufacturing plant positions investors within a strategically important segment of the global hygiene products and absorbent materials industry, driven by increasing demand for disposable hygiene products, absorbent personal care items, and medical applications. As consumer hygiene standards advance, disposable product adoption expands, and the need for high-quality absorbent materials grows, fluff pulp continues to gain traction across baby diapers, adult incontinence products, feminine hygiene items,…

Fire Alarms Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pro …

Setting up a fire alarms manufacturing plant positions investors within a strategically important segment of the global safety and security equipment industry, driven by increasing demand for fire detection and safety systems, stringent building safety regulations, and growing awareness of fire protection measures. As modern construction practices advance, smart building integration expands, and the need for advanced fire safety infrastructure grows, fire alarms continue to gain traction across commercial buildings,…

More Releases for Tel

Power & Tel Announces Retirement of Dale Stevenson

Image: https://www.getnews.info/wp-content/uploads/2024/04/1713976563.png

Piperton, TN - April 24, 2024 - Power & Tel, a prominent provider of communications infrastructure solutions, announces the planned retirement of Dale Stevenson after 42 years of service, the last 10 in the role of President. Dale has been an essential part of the 60-year story of Power & Tel.

Jennifer Sims, CEO, expressed her gratitude for Dale's remarkable contributions, saying, "Dale's impact on Power & Tel cannot be…

Storage Test Machine Market Factors Benefiting New Entrants | Teradyne, Advantes …

The global Storage Test Machine market is thoroughly researched in this report, noting important aspects like market competition, global and regional growth, market segmentation, and market structure. Our team of analysts has employed the latest research tools and techniques to estimate the size of the Storage Test Machine market in terms of both value and volume. Furthermore, this report includes detailed estimates for market share, revenue, production, consumption, gross profit…

OTS Attending Dealmakers Summit 2012 at Hilton Tel Aviv, Israel

Gurgaon, India - OTS Solutions (“OTS”) today announced that they will be attending Israel Dealmakers Summit 2012 at Hilton Tel Aviv, Israel from 20th February to 21st February, 2012.

Gaurav Sethi, Manager Business Development of OTS Solutions, will be attending the event on behalf of the company and will be meeting the potential clients, prospects to grow the business and help the companies into their IT needs. We are hoping that…

The Association for Tourism Tel Aviv – Jaffa Has Escalated the Connotation of …

Tel Aviv Israel, 17th December 2010 – Tel Aviv Travel and Tourism is gaining worldwide popularity thanks to the The Association for Tourism Tel Aviv – Jaffa which is essentially a foremost Municipal Company. It is owned by the Tel Aviv Jaffa Municipality. The principal aim of this body is to sustain and escalate this white city’s beautiful depiction with all round development and enhance domestic as well as foreign…

Tel-Domains: Great Opportunities for "gold digger"

With less than some days until the start of the .tel Landrush, Telnic Limited, the registry operator for the new tel-domains, announced today that it will not be holding any auctions for high value or premium domain names nor is it withholding any tel-domains from the Landrush, with the exception of a few names on a "reserved list" as required by ICANN and as needed for registry operations.

“People…

TEL electronics, inc. Launches New Website

TEL electronics, inc. is proud to announce the launch of its new website, tel-electronics.com.

Interested customers can now watch presentations, browse support manuals, view product brochures, screenshots, and specifications, and learn more about how call accounting can help their specific industry.

Online presentations, such as “Cutting Telecom Costs”, explain how the WIN-SENSE 32 can help businesses lower expenses by decreasing phone abuse, eliminating toll fraud, optimizing phone system performance, and…