Press release

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

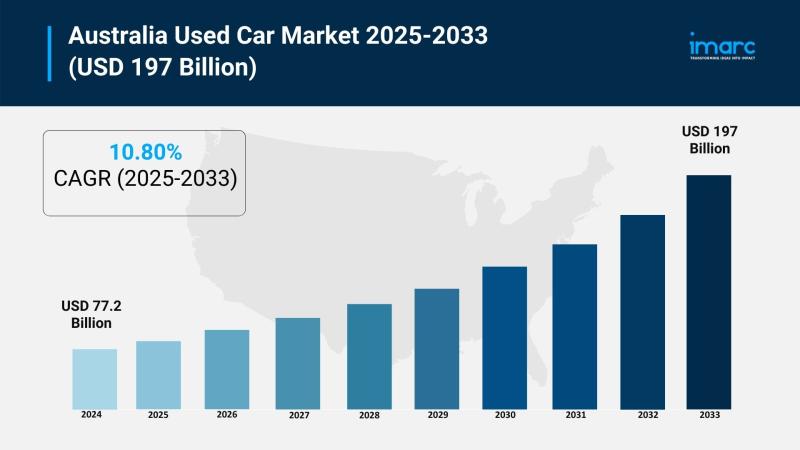

The latest report by IMARC Group, titled "Australia Used Car Market Report by Vehicle Type (Hatchbacks, Sedan, Sports Utility Vehicle, Others), Vendor Type (Organized, Unorganized), Fuel Type (Gasoline, Diesel, Others), Sales Channel (Online, Offline), and Region 2025-2033," offers a comprehensive analysis of the Australia used car market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia used car market size reached USD 77.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 197 Billion by 2033, exhibiting a CAGR of 10.80% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 77.2 Billion

Market Forecast in 2033: USD 197 Billion

Market Growth Rate (2025-2033): 10.80%

Australia Used Car Market Overview

The Australia used car market grows strongly because of how affordability concerns drive the growth, people have an increasing demand for reliable pre-owned vehicles, and digital platforms increasingly simplify all transactions. Because economic realities motivate people to seek affordable solutions, market growth persists. Buyer confidence also improves due to certified pre-owned programs with financing alternatives flexible for buyers. Digital transformation has improved the market as awareness of sustainable practices has grown too. These trends are putting Australia's used car market in a position so that it will greatly contribute to the overall expansion of the automotive industry.

Wide-ranging vehicle ownership coupled with changing consumer preferences indicates Australia's automotive landscape has strong fundamentals. The country maintains one of the world's highest per-capita car usage rates, and this creates substantial demand for personal vehicles throughout urban and regional areas. Online marketplaces proliferate as well as certified pre-owned programs exist plus flexible financing options happen so market conditions favor substantial investments that digital infrastructure and inventory management systems require. Australia's geographic advantage is because wide-ranging regional areas require personal transportation, and supply chain disruptions affect new car availability, which makes it an increasingly attractive market for used vehicle sales and distribution.

Request For Sample Report:

https://www.imarcgroup.com/australia-used-car-market/requestsample

Australia Used Car Market Trends

• Digital platform expansion: Online marketplaces transforming transactions with comprehensive tools including price comparisons, vehicle history reports, virtual tours, and integrated financing options enhancing buyer convenience and transparency.

• SUV and crossover preference: Growing consumer demand for sports utility vehicles reaching 82,494 units in November 2024, reflecting changing lifestyles and preferences for versatile, practical transportation suitable for both urban and rural settings.

• Fuel-efficient vehicle focus: Increasing adoption of hybrid and electric pre-owned vehicles with plug-in hybrid market share rising 1.49% by June 2024, driven by high fuel costs and environmental consciousness among buyers.

• Certified pre-owned program growth: Expanding dealer offerings of warranty-backed vehicles with comprehensive inspections, brief return periods, and verified vehicle histories building consumer confidence and market credibility.

• Regional market penetration: Enhanced logistics and online platform capabilities reaching underserved rural and remote areas where personal vehicles remain essential for work commutes and social mobility.

• Omnichannel retail evolution: Integration of physical and digital experiences through click-and-collect models, mobile test drives, and seamless online-to-offline purchasing processes meeting evolving consumer expectations.

Market Drivers

• Affordability and cost-of-living pressures: Rising new vehicle costs and high living expenses driving consumers toward pre-owned alternatives offering reduced initial purchase costs and lower insurance and registration expenses.

• Supply chain disruptions: Global semiconductor shortages and production delays pushing buyers to used vehicle market as new car deliveries extend, creating increased demand for available inventory.

• Digital transformation acceleration: Online platform adoption enabling convenient, transparent purchasing with tools for price benchmarking, condition verification, and financing integration appealing to tech-savvy consumers.

• Sustainable transportation shift: Growing environmental awareness encouraging pre-owned vehicle purchases as eco-conscious alternatives reducing waste and extending vehicle lifespans while maintaining affordability.

• Regional transportation needs: Australia's extensive geography and limited public transport infrastructure in rural areas creating essential demand for personal vehicles with used cars offering accessible mobility solutions.

• Vehicle retention economics: Strong resale value performance with models like Land Rover Defender retaining 102% of value after 2-4 years, demonstrating market stability and investment attractiveness.

Challenges and Opportunities

Challenges:

• High operational costs for dealerships including inventory management, reconditioning expenses, and digital platform maintenance affecting profit margins particularly in competitive metropolitan markets

• Consumer confidence issues regarding vehicle condition, odometer manipulation, and undisclosed damage in private sales requiring enhanced verification and inspection processes

• Regulatory compliance complexity with varying state requirements for vehicle safety, emissions, and consumer protection standards creating operational challenges for multi-regional operators

• Market saturation risks in urban areas with increasing competition from online platforms and traditional dealerships requiring differentiation strategies and value-added services

• Electric vehicle depreciation concerns as Tesla price reductions impact used EV market values creating uncertainty for dealers and consumers regarding long-term investment viability

Opportunities:

• Regional expansion opportunities addressing underserved rural and remote markets through targeted logistics, online platforms, and flexible financing reaching previously inaccessible customer segments

• Electric and hybrid vehicle resale growth as charging infrastructure expands making eco-friendly pre-owned vehicles more viable for middle-class consumers seeking sustainable transportation

• Digital retailing advancement through virtual showrooms, automated recommendations, and comprehensive online purchasing capabilities expanding market reach and customer convenience

• Partnership development with ride-sharing companies, fleet operators, and subscription services creating new distribution channels and customer acquisition opportunities

• Certified pre-owned market development providing differentiated offerings with warranties, inspections, and verified histories appealing to quality-conscious consumers seeking reliability assurance

Australia Used Car Market Segmentation

By Vehicle Type:

• Hatchbacks

• Sedan

• Sports Utility Vehicle (23.1% market share)

• Others

By Vendor Type:

• Organized

• Unorganized (58.8% market share)

By Fuel Type:

• Gasoline (63.3% market share)

• Diesel

• Others

By Sales Channel:

• Online

• Offline (72.2% market share)

By Region:

• Australia Capital Territory & New South Wales (34.5% market share)

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-used-car-market

Australia Used Car Market News (2024-2025)

• November 2024: SUV sales reached 82,494 units reflecting notable shift in used car market preferences toward versatile and practical vehicles suitable for Australian urban and rural lifestyles.

• August 2024: Uber and Car Empire launched Australian-first pilot program in Brisbane and Gold Coast providing Uber drivers access to affordable pre-owned EVs through vehicle marketplace supporting zero emissions goal by 2040.

• June 2024: Plug-in hybrid market share increased by 1.49% highlighting growing demand for eco-friendly vehicle options with externally rechargeable batteries reducing petrol consumption and environmental impact.

• March 2024: FinTech startup AutoSettle launched platform transforming vehicle-buying process with instant settlements, enhanced security, and digital identity verification reducing fraud risks and streamlining transactions.

• 2024: Australia's second-hand market showed 52% average increase in used car loans across three vehicle age categories reflecting growing demand for pre-owned sustainable vehicles and changing consumer preferences.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Vehicle Type, Vendor Type, Fuel Type, and Sales Channel Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=21959&flag=F

Q&A Section

Q1: What drives growth in the Australia used car market?

A1: Market growth is driven by affordability and cost-of-living pressures, supply chain disruptions affecting new car availability, digital transformation acceleration through online platforms, sustainable transportation shift toward eco-friendly options, regional transportation needs in areas with limited public transport, and strong vehicle retention economics maintaining resale values.

Q2: What are the latest trends in this market?

A2: Key trends include digital platform expansion with comprehensive online tools, SUV and crossover preference surge reaching over 82,000 units monthly, fuel-efficient vehicle focus on hybrids and electrics, certified pre-owned program growth with warranty offerings, regional market penetration through enhanced logistics, and omnichannel retail evolution integrating physical and digital experiences.

Q3: What challenges do companies face?

A3: Major challenges include high operational costs for inventory and digital platform maintenance, consumer confidence issues regarding vehicle condition and odometer manipulation, regulatory compliance complexity across state jurisdictions, market saturation risks in competitive urban areas, and electric vehicle depreciation concerns affecting long-term investment viability.

Q4: What opportunities are emerging?

A4: Emerging opportunities include regional expansion addressing underserved markets, electric and hybrid vehicle resale growth with expanding charging infrastructure, digital retailing advancement through virtual showrooms and automated systems, partnership development with ride-sharing and fleet operators, and certified pre-owned market development with quality assurance programs.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Used Car Market Projected to Reach USD 197 Billion by 2033 here

News-ID: 4193028 • Views: …

More Releases from IMARC Group

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

Vegetable Oil Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a vegetable oil processing plant positions investors in one of the most stable and essential segments of the food and agro-processing value chain, backed by sustained global growth driven by rising population, increasing consumption of edible oils, growth in packaged food demand, and expanding applications across food, personal care, and industrial sectors. As urbanization accelerates, consumer lifestyles shift toward convenience and packaged foods, and regulatory frameworks increasingly support…

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

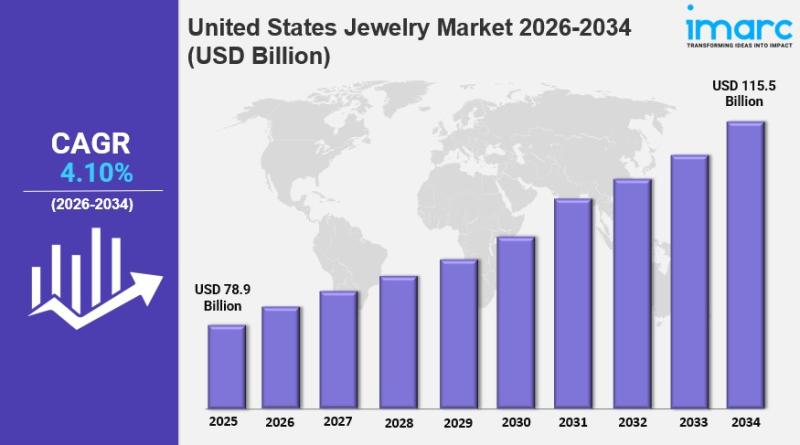

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…