Press release

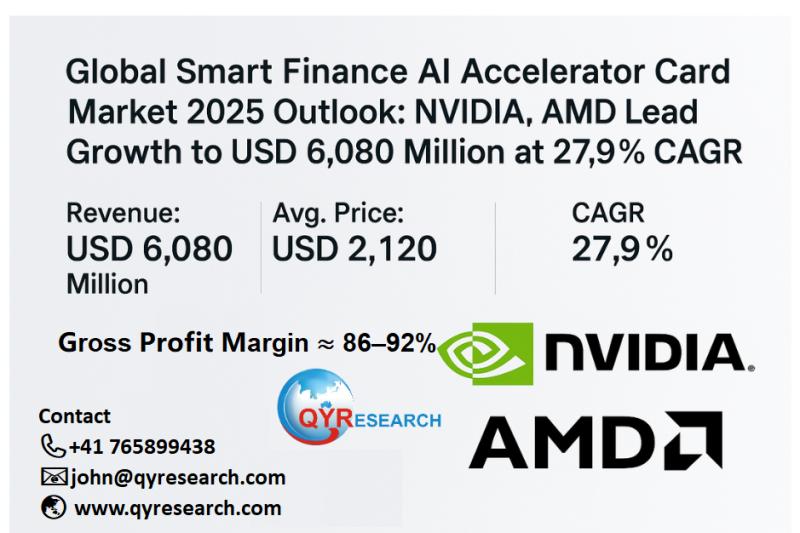

Global Smart Finance AI Accelerator Card Market 2025 Outlook NVIDIA, AMD Lead Growth to USD 6,080 Million at 27.9% CAGR

According to the recent report from QYResearch, the global Smart Finance AI Accelerator Card market is undergoing rapid transformation, with demand from the financial services industry intensifying. The market was valued at US$1,180 million in 2024 and is projected to reach US$6,080 million by 2031, growing at a strong 27.9% CAGR (2025-2031). This acceleration reflects financial institutions' need for real-time data processing, compliance-ready AI, and secure deployment in both cloud and on-premises systems.Smart Finance AI Accelerator Card: using a mainstream high-end GPU card as proxy, unit cost ≈ US$3.3k; typical price US$25-40k/card, implying gross profit ≈ US$21.7-36.7k and gross margin ≈ 86-92%.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample/4937035

Latest Data

• Global Market Size: US$1,180 million (2024) → US$6,080 million (2031)

• CAGR (2025-2031): 27.9%

• Regions Covered: North America, Europe, Asia Pacific, South America, Middle East & Africa

• Segments by Type: Cloud Deployment; Terminal Deployment

• Segments by Application: Banking; Securities; Insurance; Other

• Coverage: Revenue forecasts, company share, competitive landscape, growth drivers, risks, regulatory policies, and new product developments

Leading Companies

NVIDIA

AMD

Intel

Huawei

Qualcomm

IBM

Hailo

Denglin Technology

Haiguang Information Technology

Achronix Semiconductor

Graphcore

Suyuan

Kunlun Core

Cambricon

DeepX

Advantech

Applications

Banking

Securities

Insurance

Other

Classification

Cloud Deployment

Terminal Deployment

Breaking Developments 2024-2025

• Deutsche Bank has advanced its collaboration with NVIDIA, moving pilot projects into production for AI-driven risk and pricing models, signaling wider European adoption of secure AI stacks in finance.

• London Stock Exchange Group (LSEG) deepened its partnership with Microsoft Azure, modernizing its financial data platforms to integrate AI workloads across trading and analytics.

• Commonwealth Bank of Australia (CBA) launched its AI Factory on AWS infrastructure powered by NVIDIA H100 GPUs, highlighting the use of large-scale GPU fleets for banking AI deployment.

• Intel rolled out its Gaudi 3 accelerator, featuring 128 GB HBM and 24× 200 GbE ports, offering banks Ethernet-based scale-out options and lowering interconnect costs.

• Huawei continued domestic expansion in China's financial sector with Ascend-based AI cards, strengthening its ecosystem amid export restrictions.

• NVIDIA introduced its GPU cloud marketplace, enabling financial firms to access burst capacity across multiple providers with reduced procurement friction.

Five Key Products

NVIDIA - H200 NVL (PCIe) Tensor Core GPU

• 141 GB HBM3e, 4.8 TB/s bandwidth

• FP8/FP16/BF16 tensor support, up to 7 GPU partitions via MIG

• Designed for real-time LLM inference, KYC document processing, and fraud detection

AMD - Instinct MI300X

• 192 GB HBM3, 5.3 TB/s bandwidth

• Large memory capacity reduces latency in long-context AI models

• Enables advanced financial chatbots and insurance claims automation

Intel - Gaudi 3 PCIe Accelerator

• 128 GB HBM, ~3.7 TB/s bandwidth

• 24× 200 GbE networking ports for Ethernet-first scale-out

• Ideal for inference clusters in banking data centers

Huawei - Atlas 300I (Ascend 310 series)

• 32 GB LPDDR4X, ≤72 W power, ~88 TOPS INT8

• Low-power PCIe card for branch automation, ATM monitoring, and OCR

• Supports edge financial services with minimal latency

Achronix - VectorPath S7t-VG6 FPGA Card

• 16× GDDR6 channels, ~448 GB/s bandwidth

• 400 GbE networking with ultra-low latency

• Built for high-frequency trading and pre-trade risk calculations

Downstream Customers

Deutsche Bank

London Stock Exchange Group

Bloomberg

Commonwealth Bank of Australia

Capital One

Two Sigma

BNY Mellon

PayPal

Stripe

Swedbank

Ant Group

Market Trend

1. Memory-Centric Accelerators

Large Language Models in finance are increasingly memory-bound. Accelerators like NVIDIA H200 (141 GB HBM3e) and AMD MI300X (192 GB HBM3) are becoming central, enabling long-context inference for fraud analytics, compliance scanning, and complex documentation processing.

2. Inference at Scale

Banks now spend more on inference workloads than training. AI copilots, risk scoring, and fraud checks are inference-heavy. NVIDIA's GPU marketplace addresses capacity fluctuations, allowing financial institutions to scale rapidly without long procurement delays.

3. Private AI for Financial Institutions

Regulatory constraints drive private AI deployments where sensitive data stays within controlled environments. Deutsche Bank's adoption of NVIDIA AI infrastructure and LSEG's Azure modernization show that secure-by-design deployments are the new industry standard.

4. Terminal Deployment at the Edge

Low-power cards like Huawei Atlas 300I and Hailo modules are used for branch and ATM intelligence, covering OCR, biometric security, and queue monitoring. This trend reduces dependence on central servers while improving latency and operational efficiency.

5. Diversification of Accelerators

To mitigate supply and cost challenges, banks are exploring Intel Gaudi 3 as an alternative. Its Ethernet-first design fits existing banking data centers and lowers the cost of scaling inference clusters.

6. China's Parallel Ecosystem

Chinese banks are building domestic AI stacks based on Huawei's Ascend cards, ensuring supply chain resilience. This reflects a dual-track global ecosystem where Western institutions standardize on NVIDIA, AMD, and Intel, while Chinese banks develop a localized accelerator base.

7. Rack-Scale AI Factories

Financial AI is scaling to rack-level GPU systems with shared memory and low-latency fabrics. These dense systems enable real-time surveillance and risk modeling, but also require new strategies for cooling and power optimization in bank data centers.

8. GPU-Native Fraud Detection

Payment networks and retail banks are leveraging GPU-accelerated fraud detection with graph models. Results show 10-20% higher accuracy in catching fraudulent transactions, a critical factor for instant payment systems where milliseconds matter.

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4937035

9. Vendors Expanding Beyond Hardware

Chip vendors are moving upstream, offering orchestration platforms, cloud marketplaces, and verticalized financial AI solutions. While this shortens time-to-value for financial institutions, it raises new challenges of vendor lock-in and multi-cloud strategy.

Conclusion

The Smart Finance AI Accelerator Card market is no longer a niche technology but a core enabler of digital finance. With memory-centric designs, inference-first cost structures, private AI deployments, and edge acceleration, financial institutions are building the foundations of AI-native infrastructure. By 2025, adoption is accelerating across banking, securities, and insurance, redefining both customer experience and operational resilience in global finance.

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Details

Tel: +1 626 2952 442 ; +41 765899438(Tel & Whatsapp); +86-1082945717

Email: john@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

Related Report

Global Smart Finance AI Accelerator Card Market Research Report 2025

https://www.qyresearch.com/reports/4937035/smart-finance-ai-accelerator-card

Smart Finance AI Accelerator Card - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/4937034/smart-finance-ai-accelerator-card

Global Smart Finance AI Accelerator Card Market Outlook, In‐Depth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/4936969/smart-finance-ai-accelerator-card

Global Smart Finance AI Accelerator Card Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/4936968/smart-finance-ai-accelerator-card

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Smart Finance AI Accelerator Card Market 2025 Outlook NVIDIA, AMD Lead Growth to USD 6,080 Million at 27.9% CAGR here

News-ID: 4192902 • Views: …

More Releases from QYResearch Europe

Global Aerospace Grade Smart Assembly Lines Market 2024 USD 4251 Million to 2031 …

According to recent report from QYResearch, the global market for aerospace-grade smart assembly lines stood at US$4,251 million in 2024 and is projected to reach US$8,712 million by 2031 at a 10.2% CAGR (2025-2031). In 2024, approximately 670 lines were produced globally at an average selling price (ASP) of about US$6.343 million per line. These highly automated systems integrate AI, industrial robotics, advanced sensing, and digital control to deliver repeatable,…

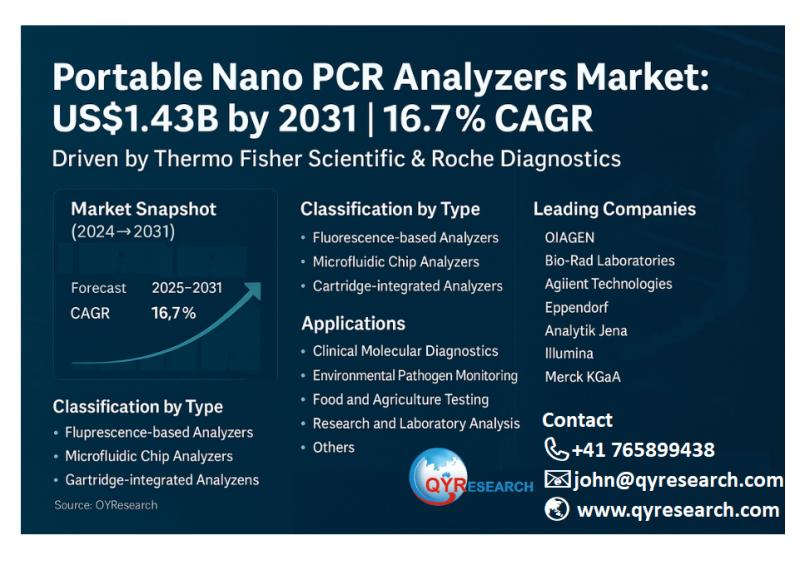

Portable Nano PCR Analyzers Market Growth to US$1.43 Billion by 2031 with 16.7% …

According to the latest QYResearch Report, the global market for Portable Nano PCR Analyzers was valued at US$484 million in 2024 and is expected to reach US$1,427 million by 2031, growing at a CAGR of 16.7% during the forecast period of 2025-2031. Global production in 2024 reached around 96,800 units, with an average price of about US$5,000 per unit. These portable devices utilize nanotechnology-enhanced PCR processes for rapid on-site genetic…

Global Multiphase Flow Conveying Equipment Market to Reach USD 10.88 Billion by …

The global market for Multiphase Flow Conveying Equipment is transitioning from a specialized engineering niche to a core enabler of industrial efficiency across upstream energy, chemicals, mining, and wastewater sectors. According to QYResearch 2025 edition of Multiphase Flow Conveying Equipment - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031, the market was valued at US$7,380 million in 2024 and is projected to reach US$10,879 million by 2031,…

Global Smart Eye-Tracking Medical Devices Market Size Reaches US$3.0 Billion by …

The global Smart Eye-Tracking Medical Devices market has entered a stage of accelerated clinical adoption and product diversification. According to QYResearch 2025 Global Smart Eye-Tracking Medical Devices Market Research Report, the market was valued at US$973 million in 2024 and is projected to reach US$3,009 million by 2031, growing at a CAGR of 17.5% from 2025 to 2031. Global output in 2024 reached approximately 64,900 units, with an average price…

More Releases for Accelerator

Growing Digitization On The Accelerator Card Market : The Driving Engine Behind …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Accelerator Card Market Size Growth Forecast: What to Expect by 2025?

The market for accelerator cards has seen a tremendous increase in size in the past few years. The growth is projected to continue, from $20.24 billion in 2024 and reaching $27.99 billion in 2025, representing a compound annual…

Growing Digitization On The Accelerator Card Market : A Key Driver Powering Acce …

The Accelerator Card Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Accelerator Card Market Size and Its Estimated Growth Rate?

The accelerator card market has expanded rapidly and is expected to jump from $20.24 billion in 2024 to $27.99 billion in 2025…

Shotcrete Accelerator Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Shotcrete Accelerator Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

The impact of manufacturers on the market is significant across various industries, influencing supply chains, consumer choices, and economic growth. Manufacturers are key players in…

Irradiation Accelerator Market | IBA, IOTRON, Jiangsu Dasheng Electron Accelerat …

The global irradiation accelerator market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the irradiation accelerator market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth of the…

MBRIF Picks InsureAtOasis for Accelerator Programme

Dubai based Insurance partner InsureAtOasis has been chosen as the Best Innovative ideas for the Accelerator Programme by MBRIF. InsureAtOasis has been chosen from a total of 159 applicants coming from 38 countries.

InsureAtOasis.com is the Digital Product of Oasis Insurance.

Oasis Insurance is the leading Insurance Brokerage Firm in the UAE. To empower the customers by simplifying the way policies were issued earlier be it for motor, travel or…

Global Data Center Accelerator Market

Global Data Center Accelerator Market Research Report, by analyzing historical data and future prospects, represents the total size of the market from a global perspective. Data Center Accelerator Market report analyzes their production sites, capacity, production, ex-factory price and revenue and market share on the global market for each manufacturer covered. All business profiles of leading players and brands have been published in the Global Automation Testing market report. The…