Press release

2025-2034 Insurance, Reinsurance And Insurance Brokerage Market Evolution: Disruptions, Innovations, and Untapped Opportunities

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Insurance, Reinsurance And Insurance Brokerage Market Through 2025?

Recent years have seen robust growth in the size of the insurance, reinsurance, and insurance brokerage market. The market is predicted to expand from its size of $8902.5 billion in 2024 to $9516.36 billion in 2025, at a compound annual growth rate (CAGR) of 6.9%. Factors that have influenced growth during the historical period include the effect of the COVID-19 pandemic, the adoption of reinsurance for healthcare, escalating healthcare expenses, and an increase in home ownership and mortgage uptake.

What's the Projected Size of the Global Insurance, Reinsurance And Insurance Brokerage Market by 2029?

Expectations are high for robust expansion in the insurance, reinsurance and insurance brokerage market in the upcoming years. The market is projected to escalate to a valuation of $12503.69 billion by 2029, propelled by a compound annual growth rate (CAGR) of 7.1%. The ascension expected in the forecast interval is due to factors such as the surge in chronic diseases and disabilities, the burgeoning middle-class in developing markets, increased governmental backing, swift urbanization, and a rising consumer demand for insurance policies. The major trends for the forecast span also encompass an increase in chronic illnesses and disabilities, expanded middle-class in up-and-coming markets, more governmental support, accelerated urbanization, and an uptick in demand for insurance products.

View the full report here:

https://www.thebusinessresearchcompany.com/report/insurance-reinsurance-and-insurance-brokerage-global-market-report

Top Growth Drivers in the Insurance, Reinsurance And Insurance Brokerage Industry: What's Accelerating the Market?

The burgeoning development in online accessibility and the escalation of risks involved with utilizing the internet for critical deals are boosting the demand for cyber insurance. This type of insurance caters to threats based on the internet and those linked with information technology infrastructure. It also provides coverage for property theft, business disruption, loss of software and data, cyber extortion, liabilities stemming from network failure, cyber-crime, and damage to physical assets. For instance, from a report by the National Telecommunications and Information Administration, a US government agency, we learn that there was an upsurge of 13 million more internet users in 2023 in comparison to 2021. Thus, the swift increase in internet accessibility and heightened risks tied to its use stimulate the growth of insurance, reinsurance, and insurance brokerage markets.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3544&type=smp

What Are the Key Trends Driving Insurance, Reinsurance And Insurance Brokerage Market Growth?

There is a gradual rise in the prominence of peer-to-peer insurance in both developing and developed markets. This is due to the lower premium costs in developing nations, a consequence of increased internet accessibility within these areas. The concept of peer-to-peer insurance involves collecting insurance premiums from participants. These collected amounts can then be utilized to cover future undetermined losses, and any remaining funds would be shared among the participants. The objective of this approach is to lower both premium and overhead expenses relative to traditional insurance providers, minimize waste, and enhance business transparency.

What Are the Main Segments in the Insurance, Reinsurance And Insurance Brokerage Market?

The insurance, reinsurance and insurance brokeragemarket covered in this report is segmented -

1) By Type: Insurance, Insurance Brokers And Agents, Reinsurance

2) By Mode: Online, Offline

3) By End-User: Corporate, Individual

Subsegments:

1) By Insurance: Life Insurance, General Insurance, Health Insurance, Specialty Insurance

2) By Insurance Brokers And Agents: Independent Insurance Brokers, Captive Agents, Online Insurance Brokers, Insurance Agencies

3) By Reinsurance: Treaty Reinsurance, Facultative Reinsurance, Excess-of-Loss Reinsurance, Proportional Reinsurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=3544&type=smp

Which Top Companies are Driving Growth in the Insurance, Reinsurance And Insurance Brokerage Market?

Major companies operating in the insurance, reinsurance and insurance brokerage market include Allianz Group, Ping An Insurance, China Life Insurance Company Limited, Axa Group, Centene Corporation, Assicurazioni Generali S.p.A., Humana Inc, The People's Insurance Company (Group) of China Limited, Berkshire Hathaway, Munich Re, General Insurance Corporation of India (GIC Re), New India Assurance - General Insurance Brokers, Oriental Insurance Company, ICICI Lombard General Insurance Company, United India Insurance, HDFC ERGO Non-Life Insurance Company, Fanhua Inc, Chang'an Insurance Brokers Co., Ltd, Mintaian Insurance Surveyors & Loss Adjusters Group Co., Ltd, Shenzhen Huakang Insurance Agency Co. (China), Ltd., CPIC, China Property and Casualty Reinsurance Company Ltd, PICC Reinsurance Co. Ltd., Taiping Reinsurance Co. Ltd., Peak Reinsurance Co. Ltd, SCOR Reinsurance Co. (Asia) Ltd., Korean Reinsurance Company, Tokio Marine & Nichido Fire Insurance Co. Ltd., Aioi Nissay Dowa Insurance Co. Ltd, Sompo Japan Nipponkoa Insurance Inc., Toa Reinsurance Co., Mitsui Sumitomo Insurance Co. Ltd., PVI Reinsurance Company, Singapore Reinsurance Corporation Ltd, Marsh & McLennan Companies UK Limited, Arthur J Gallagher & Co, Willis Towers Watson plc., Lloyd's of London Limited, Aon Holding Deutschland GmbH, Funk Gruppe GmbH, Ecclesia Holding GmbH, Hannover Re, Swiss Re, Crédit Agricole Assurances, CNP Assurance, Société Générale, BNP Paribas Cardiff, Sogaz Insurance Group, Ingosstrakh Insurance Co., Russian Re Co. Ltd, Polskie Towarzyst Reasekuracji S.A., Nationale-Nederlanden (NN) Life Insurance Co. Ltd, Uniqa Insurance Group AG, Ceská Pojištovna, MAI Insurance Brokers Poland Sp. z o.o, European Investment Bank (EIB), VIG RE zajist'ovna a.s., Brighthouse Financial (MetLife), Northwestern Mutual, New York Life, Prudential, Lincoln National, MassMutual, John Hancock, Transamerica, Manulife Financial, Chubb Life, Great-West Lifeco, Inc, Sun Life Financial, IA Financial Group, RBC Insurance, Empire Life, National Indemnity Company, Everest Reinsurance Company, XL Reinsurance America, Reinsurance Group of America, Inc, Fairfax Financial Holdings Ltd., Transatlantic Holdings Inc, Markel Corporation, Companhia de seguros alliance do Brazil, Bradesco Vida E Previdencia S.A, AR LIFE, MAPFRE Argentina, Crecer Seguros, Ohio National Seguros de Vida, Instituto de Resseguros do Brasil(IRB), Alliance Insurance, Mashreq bank, Buruj Cooperative Insurance, Al Alamiya, Menora Mivtachim Insurance, Oman Insurance Company, Kuwait Reinsurance company, Arab Re (Lebanon), RGA Re, African Reinsurance Corporation, Compagnie Centrale de Réassurance, J.B.Boda Insurance & Reinsurance Brokers Pvt. Ltd., Société Centrale de Réassurance, Insurance Brokers Of Nigeria (IBN), Northlink Insurance Brokers, Carrier Insurance Brokers, Hogg Robinson Nigeria, Union Commercial Insurance Brokers, Misr Life Insurance Company, Metlife Egypt, GIG Egypt.

Which Regions Will Dominate the Insurance, Reinsurance And Insurance Brokerage Market Through 2029?

North America was the largest region in the insurance, reinsurance, and insurance brokerage market in 2024. Asia/Pacific was the second largest region in insurance, reinsurance, and insurance brokerage. The regions covered in the insurance, reinsurance and insurance brokerage market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=3544

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 310-496-7795

Asia +44 7882 955267 & +91 8897263534

Europe +44 7882 955267

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025-2034 Insurance, Reinsurance And Insurance Brokerage Market Evolution: Disruptions, Innovations, and Untapped Opportunities here

News-ID: 4191568 • Views: …

More Releases from The Business Research Company

In-Depth Examination of Segments, Industry Developments, and Key Players in the …

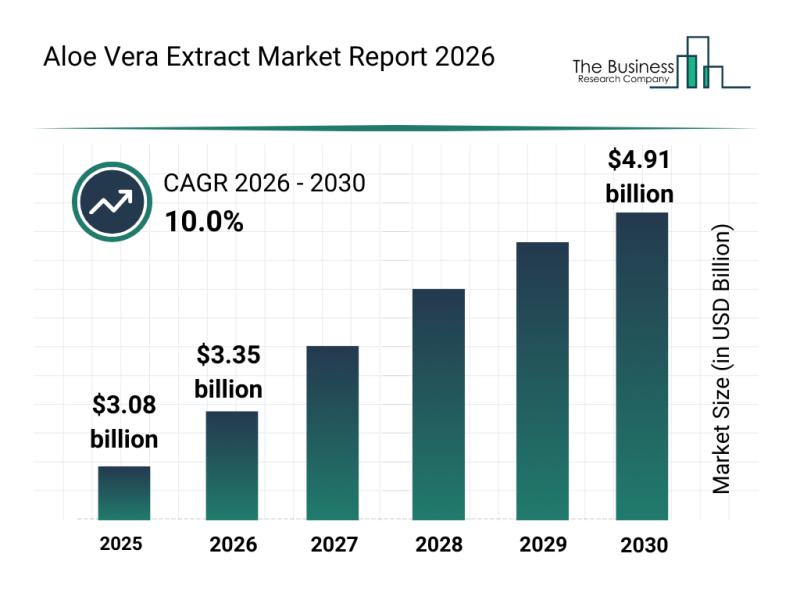

The aloe vera extract market is on track for significant expansion in the coming years, driven by a surge in consumer interest and innovation across various sectors. Growing awareness of natural skincare benefits, alongside rising demand in food and beverage industries, is setting the stage for robust market growth through 2030. Let's explore the market size projections, key players, emerging trends, and segmentation details shaping this dynamic industry.

Projected Growth and…

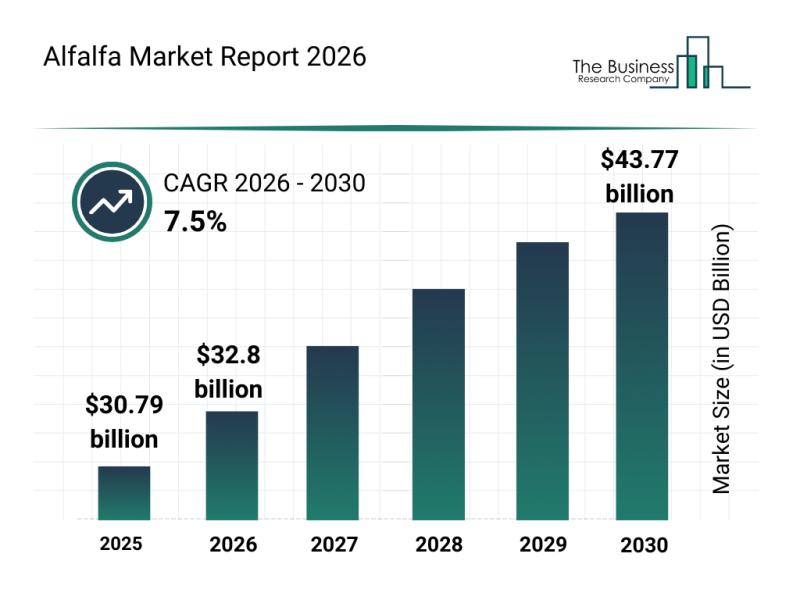

Leading Companies Fueling Growth and Innovation in the Alfalfa Market

The alfalfa market is poised for significant expansion over the coming years, driven by evolving demands in livestock nutrition and global trade. As sustainability becomes a priority, and premium feed ingredients gain traction, the market landscape is set to undergo notable changes. Here's an in-depth look at the market size, key players, emerging trends, and segment breakdowns shaping the future of the alfalfa industry.

Projected Growth Trajectory of the Alfalfa Market…

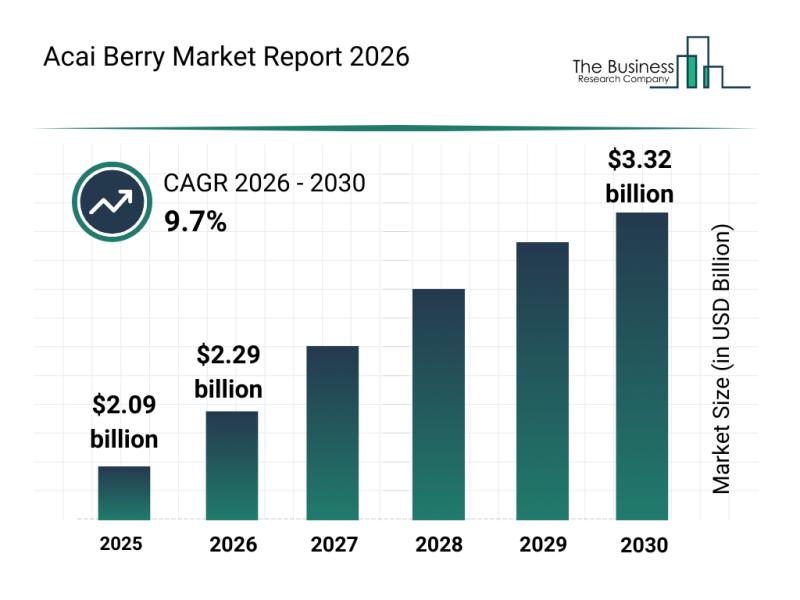

Key Factors and Emerging Trends Shaping the Acai Berry Market Landscape

The acai berry market is gaining significant traction as consumer interest in health and wellness products continues to grow. With increasing awareness of its nutritional benefits and expanding applications, the market is poised for substantial growth through the end of the decade. Here is an insightful overview of the market size projections, influential players, emerging trends, and key segments shaping the future of the acai berry industry.

Projected Expansion and Size…

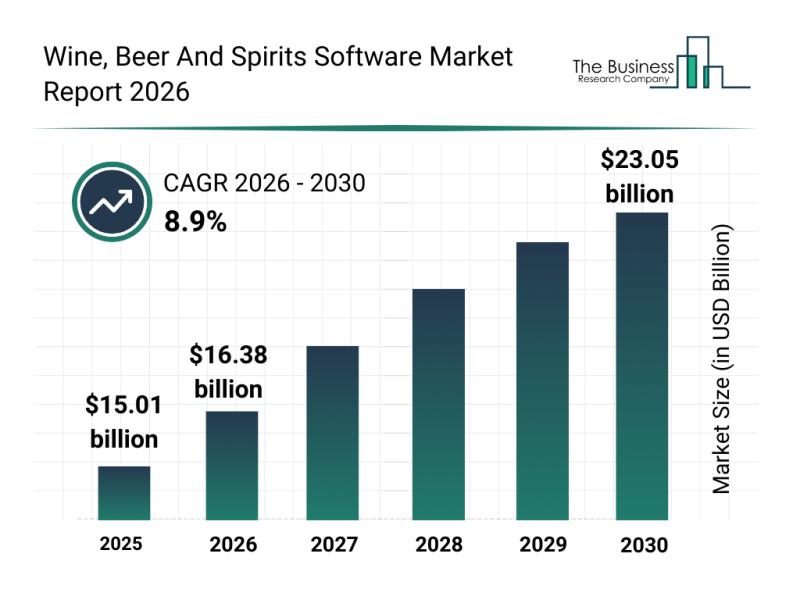

Global Drivers Overview: The Rapid Development of the Wine, Beer, and Spirits So …

The wine, beer, and spirits software sector is positioned for significant expansion over the coming years, driven by technological advancements and evolving industry demands. This market is witnessing a transformation as beverage businesses increasingly adopt digital solutions to streamline operations, ensure compliance, and enhance customer engagement. Let's explore the market size, key players, emerging trends, and growth segments shaping this dynamic industry.

Projected Growth Trajectory of the Wine, Beer, and Spirits…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…