Press release

Emerging Trends to Drive Next-Gen ATM Market Growth at 8.9% CAGR Through 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Next-Gen ATM Market Size Growth Forecast: What to Expect by 2025?

The market size of next-generation ATMs has seen robust growth in the past few years. Projected growth sees it increase from a value of $3.26 billion in 2024, to a value of $3.49 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 7.1%. Factors contributing to this historic growth can be linked to the upsurge in demand for digital banking solutions, a rise in cardless transactions, a heightened adoption of mobile wallets, amplified spending capacity, and an increase in disposable income.

How Will the Next-Gen ATM Market Size Evolve and Grow by 2029?

In the coming years, the next-gen ATM market is predicted to enjoy robust growth, expanding to a market size of $4.9 billion by 2029. This represents a Compound Annual Growth Rate (CAGR) of 8.9%. The growth during this forecast period is linked to the escalating demand for bespoke services and experiences for banking customers, enhanced efficiency and decreased costs for financial institutions, and the steadily increasing use of smartphones and internet services. Key trends expected to shape the market during the forecast period are the integration with mobile banking applications, the offering of personalized and user-specific experiences, API-based architectural innovations, product advancements, and market proliferation.

View the full report here:

https://www.thebusinessresearchcompany.com/report/next-gen-atm-global-market-report

What Drivers Are Propelling the Growth of Next-Gen ATM Market Forward?

The anticipated increase in the value of consumers' purchasing power parity (PPP) is projected to stimulate the growth of the next-gen ATM market. The PPP, a key macroeconomic indicator, offers a comparison of different countries' currencies using a basket of goods approach. Unlike fluctuating market rates, PPP exchange rates remain fairly consistent over time and give a more precise assessment of relative economic productivity and living standards between nations. This can aid next-gen ATMs in deciding where to extend their operations. For instance, data from the Energy Information Administration, an American federal statistical system organization, revealed that in 2021, the purchasing power annual average index value was 270.97. This figure is predicted to rise to 292.66 in 2022. Thus, the escalating value of consumers' purchasing power parity (PPP) is fueling the growth of the next-gen ATM market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12646&type=smp

What Are the Key Trends Driving Next-Gen ATM Market Growth?

Leading firms in the diamond wall saw market are concentrating on technologies such as Blaze to improve the accuracy of cutting, boost operational competency, and minimize material wastage in construction and demolition endeavors. Blaze is a flexible technology platform tailored for the efficient processing of data and conducting analytics. For example, Financial Software & Systems Pvt. Ltd., a private banking organization in India, introduced a novel payments technology platform, Blaze, in August 2023. With a capacity to process over 5,000 transactions per second (TPS), Blaze aligns perfectly with the escalating acceptance of digital commerce and is ideal for high-demand settings.

What Are the Key Segments in the Next-Gen ATM Market?

The next-gen atmmarket covered in this report is segmented -

1) By Type: Cash Dispensers, Deposit ATMs, Cash Recycling ATMs, Self-Service ATMs, Self-Service Kiosks, Mobile ATMs, Other Types

2) By Solutions: Deployment, Managed Services

3) By Technology: Contactless, Voice Recognition, Biometrics, Video Banking, AI (Artificial intelligence) And IoT (Internet of Things) Integration

4) By Application: Bank Service Agent, Bank, Retail, Enterprises

Subsegments:

1) By Cash Dispensers: Basic Cash Dispensers, High-Volume Cash Dispensers

2) By Deposit ATMs: Envelope Deposit ATMs, Bulk Note Deposit ATMs

3) By Cash Recycling ATMs: Single-Cassette Recycling ATMs, Multi-Cassette Recycling ATMs

4) By Self-Service ATMs: Cardless Self-Service ATMs, Interactive Self-Service ATMs

5) By Self-Service Kiosks: Bill Payment Kiosks, Ticketing Kiosks

6) By Mobile ATMs: Temporary Event ATMs, Mobile Banking ATMs

7) By Other Types: Biometric ATMs, Cryptocurrency ATMs

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=12646&type=smp

Who Are the Key Players Shaping the Next-Gen ATM Market's Competitive Landscape?

Major companies operating in the next-gen ATM market include Fujitsu Limited, NCR Corporation, Diebold Nixdorf Inc., Euronet Worldwide Inc., OKI Electric Industry Co. Ltd., Hyosung Corporation, ACI Worldwide Inc., GRG Banking Equipment Co. Ltd., Bancsource, Hitachi Payment Services Pvt. Ltd., Nautilus Hyosung America Inc., Invenco Group Ltd., Aevi International GmbH, HESS Cash Systems GmbH, Puloon Technology Inc., Triton Systems of Delaware LLC, Spinnaker International Ltd., Ark Technologies Group, Citywide ATM Inc., Unified Payments Services Ltd., Genmega Inc., Sharenet Inc., Cypress Advantage, TEKchand Pty Ltd.

What Geographic Markets Are Powering Growth in the Next-Gen ATM Market?

North America was the largest region in the next-gen ATM market in 2024. The regions covered in the next-gen ATM market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12646

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Trends to Drive Next-Gen ATM Market Growth at 8.9% CAGR Through 2029 here

News-ID: 4191529 • Views: …

More Releases from The Business Research Company

An Overview of Segmentation, Market Dynamics, and Competitive Landscape in the B …

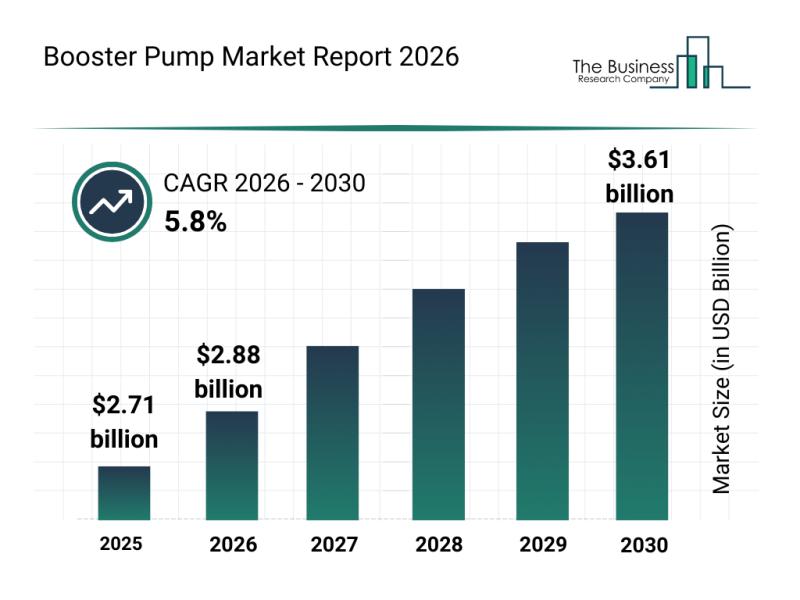

The booster pump market is positioned for significant expansion as global infrastructure and water management systems evolve. With increasing urbanization and a growing emphasis on sustainable, energy-efficient technology, this sector is witnessing notable advancements and rising demand. Let's explore the latest market size projections, key players, emerging trends, and detailed segmentation shaping this industry's future.

Steady Expansion in Booster Pump Market Size by 2030

The booster pump market is projected to…

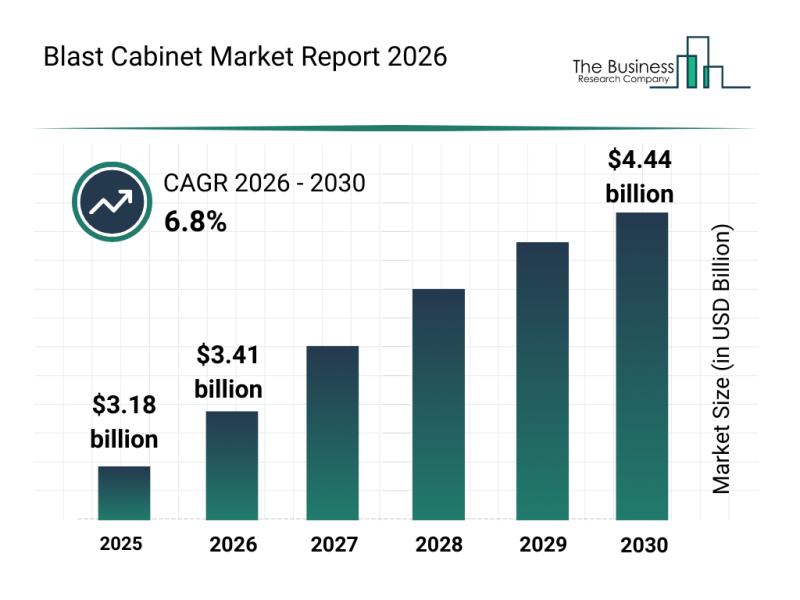

Analysis of Key Market Segments Driving the Blast Cabinet Market

The blast cabinet market is poised for significant expansion over the coming years, driven by advances in technology and growing industrial requirements. As industries increasingly focus on precision and safety, the demand for efficient surface preparation equipment like blast cabinets continues to rise. Let's explore the expected market size, leading players, segmentation, and key trends shaping this industry.

Forecasted Market Size and Growth Prospects of the Blast Cabinet Market

The blast…

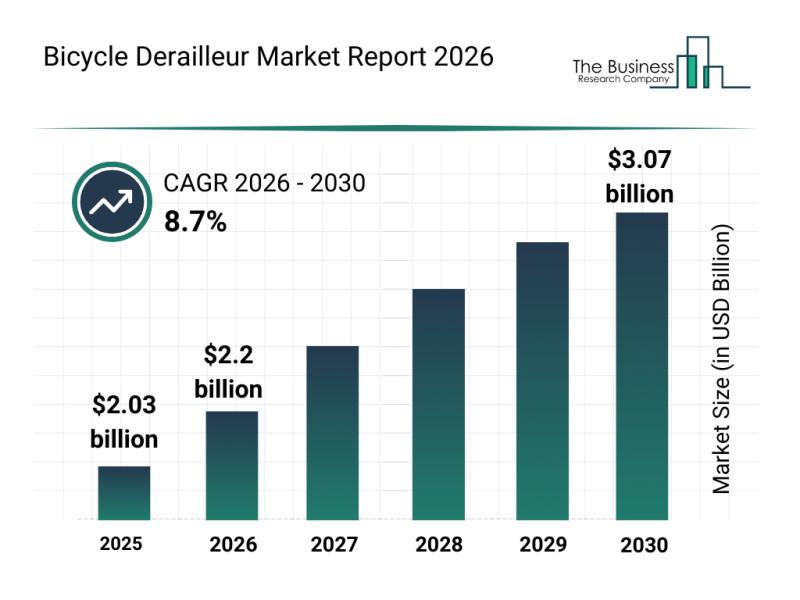

Top Players and Competitive Dynamics in the Bicycle Derailleur Market

The bicycle derailleur market is on track for significant expansion in the coming years, driven by evolving cycling technologies and growing global interest in premium cycling gear. As more riders seek enhanced performance and innovative features, this market is poised to experience noteworthy growth.

Projected Growth and Size of the Bicycle Derailleur Market

The bicycle derailleur market is anticipated to reach a value of $3.07 billion by 2030, expanding at a…

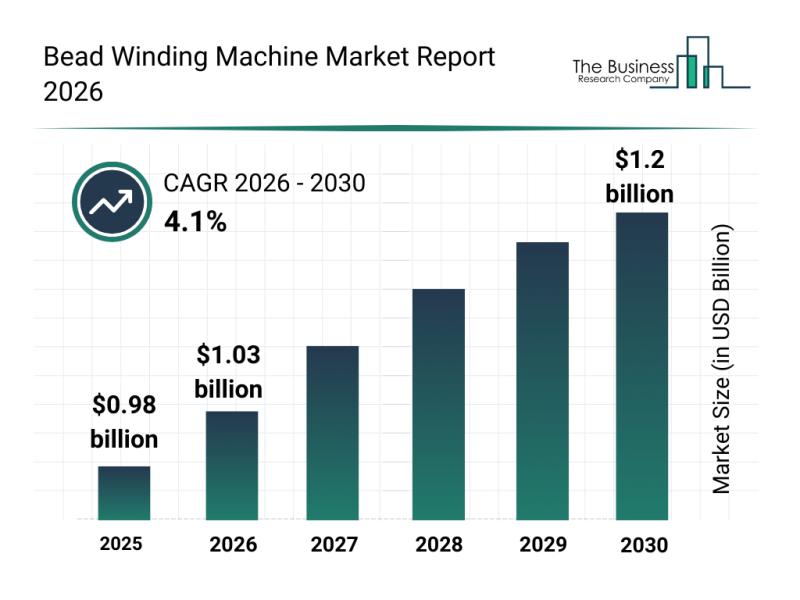

Future Perspective: Key Trends Shaping the Bead Winding Machine Market Until 203 …

The bead winding machine market is positioned for consistent growth as global industries increasingly demand advanced manufacturing solutions. Fueled by rising vehicle production and technological advancements, this sector is set to expand steadily through the coming years. Let's explore the market size outlook, key drivers, leading companies, prevailing trends, and segmentation details shaping this industry's development.

Steady Expansion Forecast for the Bead Winding Machine Market Size Through 2030

The bead winding…

More Releases for ATM

ATM Managed Services Market Expands: AI, Cloud & ATM-as-a-Service Drive Transfor …

ATM Managed Services Market size was valued at USD 10.5 Billion in 2024 and is projected to reach USD 16.2 Billion by 2033, exhibiting a CAGR of 5.2% from 2026 to 2033.

What are the potential factors contributing to the growth of the ATM Managed Services Market?

The ATM Managed Services Market is experiencing growth due to several key factors. The increasing demand for cost-effective banking operations is a major driver, as…

Prominent Automatic Teller Machine (ATM) Security Market Trend for 2025: Innovat …

"Which drivers are expected to have the greatest impact on the over the automatic teller machine (atm) security market's growth?

The surge in automated teller machine (ATM) fraud incidents is projected to fuel the expansion of the automated teller machine (ATM) security market in the future. An ATM is a specific type of computerized device that allows individuals to conduct a range of banking activities without requiring human assistance or a…

Global ATM Market by Types(On-site ATM,Off-site ATM,Work Site ATM,Mobile Site AT …

The global ATM market has the potential to grow with xx million USD with growing CAGR in the forecast period from 2021f to 2026f.

Global ATM Market Overview

This market research report consists of a number of sections that provide data on the current state of the market, industry trends, and future prospects. It also includes analysis of key players and their positions in the market. The increasing adoption…

Contactless ATM (Cardless ATM) Market: Industry Future Developments, Competitive …

The Contactless ATM (Cardless ATM) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Global Contactless ATM (Cardless ATM) Industry Professional Market Size Survey b …

This report also researches and evaluates the impact of Covid-19 outbreak on the Contactless ATM (Cardless ATM)�industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Contactless ATM (Cardless ATM)�and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

�

Scope of the Report:

The report presents the market outlook for the Indian Phospho Gypsum product from the year 2019…

Global Contactless ATM (Cardless ATM) Market Expected to Witness a Sustainable G …

LP INFORMATION offers a latest published report on Contactless ATM (Cardless ATM) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Contactless ATM (Cardless ATM) Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have been scrutinized…