Press release

Future of the Algorithmic Trading Market: Trends, Innovations, and Key Forecasts Through 2034

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Algorithmic Trading Market Size Growth Forecast: What to Expect by 2025?

The size of the algorithmic trading market has seen substantial growth in recent years. The market, which is projected to expand from $19.95 billion in 2024 to $21.89 billion in 2025, will experience a compound annual growth rate (CAGR) of 9.7%. The historical growth can be credited to multiple factors, including the robust growth of emerging markets, the escalating demand for quick, reliable, and efficient order execution, enhancing government regulations, the expansion of digitalization, and a rise in the demand for computing devices like PCs and laptops.

How Will the Algorithmic Trading Market Size Evolve and Grow by 2029?

The size of the algorithmic trading market is projected to undergo swift expansion in the coming years. The market is set to reach $38.13 billion by 2029, with a compound annual growth rate (CAGR) of 14.9%. This anticipated growth can be linked to multiple factors including government backing, global population increase and urbanization, heightened internet reach, and the growing acceptance of algorithmic trading by financial entities. Notable tendencies for this forecast period involve the implementation of artificial intelligence (AI) to exploit data derived from digital channels, a focus on partnerships and acquisitions to enhance financial robustness, product range, and geographic visibility, and emphasis on emerging technologies and pioneering solutions to solidify market standing.

View the full report here:

https://www.thebusinessresearchcompany.com/report/algorithmic-trading-global-market-report

What Drivers Are Propelling the Growth of Algorithmic Trading Market Forward?

The projected growth of the algorithmic trading market is heavily linked to the increased accessibility of the Internet. Greater Internet connectivity facilitates consumers' access to online platforms where they can learn about and engage in online trading. Since online trading relies significantly on Internet connectivity, a surge in Internet use may boost the market growth. For instance, according to DataReportal, a digital library based in Singapore, there were 5.16 billion global Internet users at the beginning of 2023, representing 64.4% of the entire global population. In another report by Livemint, a financial publication from India, as of July 2022, India had 692 million active Internet users, of which 351 million were from rural areas and 341 million from urban areas. The number of Internet users in India is forecasted to rise to 900 million by the year 2025. Hence, the continual increase in Internet connectivity is poised to spur the expansion of the algorithmic trading market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7783&type=smp

What Are the Key Trends Driving Algorithmic Trading Market Growth?

Leading players in the algorithmic trading market are prioritizing product innovations such as AI-based instruments to augment trade analysis and refine trading strategies for better decision making and results. An AI-based instrument is a software solution that employs artificial intelligence technologies like machine learning and natural language processing to analyse data and automate decisions. For example, in October 2024, Octa, a Malaysia-based global broker proffering online trading services, unveiled OctaVision, an AI-based instrument incorporated into their trading platform. It was conceived to enhance trade analysis and provide bespoke recommendations for traders. This ingenious solution harnesses next-gen AI algorithms to study trading sessions, aiding users in honing their decision-making abilities and eventually amplifying their trading performance.

What Are the Key Segments in the Algorithmic Trading Market?

The algorithmic tradingmarket covered in this report is segmented -

1) By Type: Foreign Exchange (FOREX), Stock Markets, Exchange-Traded Fund (ETF), Bonds, Other Types

2) By Component: Solution, Services

3) By Function: Programming, Debugging, Data Extraction, Back-Testing And Optimization, Risk Management

4) By Type Of Traders: Institutional Investors, Retail Investor, Long-Term Trading, Short-Term Traders

Subsegments:

1) By Foreign Exchange (FOREX): Spot Trading, Futures Trading, Options Trading

2) By Stock Markets: Equity Trading, Derivative Trading, Short Selling

3) By Exchange-Traded Fund (ETF): Equity ETFs, Commodity ETFs, Bond ETFs

4) By Bonds: Government Bonds, Corporate Bonds, Municipal Bonds

5) By Other Types: Cryptocurrencies, Commodity Markets, Real Estate Investment Trusts (REITs)

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=7783&type=smp

Who Are the Key Players Shaping the Algorithmic Trading Market's Competitive Landscape?

Major companies operating in the algorithmic trading market include Virtu Financial Inc, IG Group Holdings Plc, FXCM Group, London Stock Exchange Group Plc, Trade Station, Software AG, Wyden (Algo Trader AG), Symphony Fintech Solutions Pvt Ltd, MetaQuotes Software Corp, 63 Moons Technologies Limited, iRage Capital, AlphaGrep, Kivi Capital, Mansukh Securities, Algoji, Tickeron, Inc, 1000pip Climber Robot, Build Alpha, Coinrule, Trality, Barclays, DTI Algorithmic, BitOasis, MidChains, HAYVN, XTX Markets, ActiveViam, Redline Trading Solutions, Inc, J.P. Morgan, Capital Group, Goldman Sachs, Zen Trading Strategies, SmarttBot, Banco Bradesco S.A, Itau Unibanco, Interactive Brokers, AVAtrade, eTORO, Arabeya Online, Plus500, XTB, Saxo Bank, City Index

What Geographic Markets Are Powering Growth in the Algorithmic Trading Market?

North America was the largest region in the algorithmic trading market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the algorithmic trading market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7783

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future of the Algorithmic Trading Market: Trends, Innovations, and Key Forecasts Through 2034 here

News-ID: 4191390 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Approaches Influencing the R …

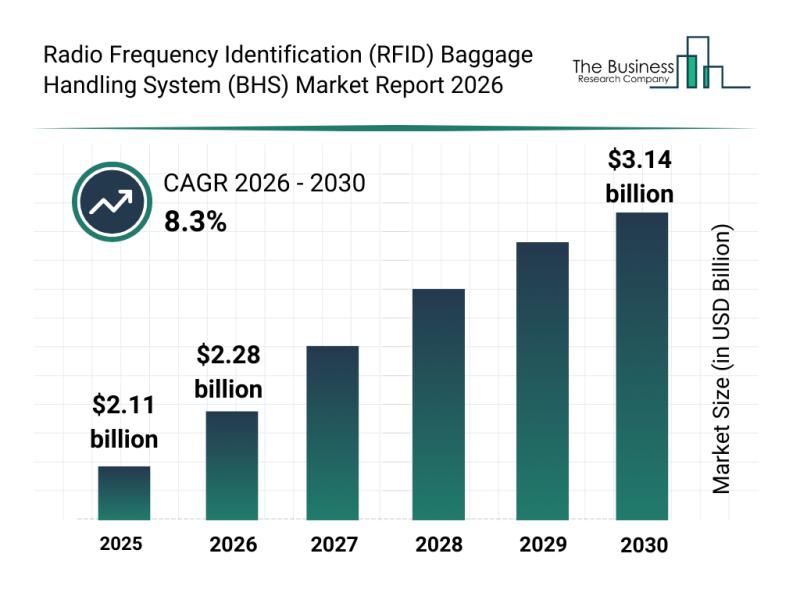

The radio frequency identification (RFID) baggage handling system (BHS) market is set to experience significant growth over the coming years, driven by advancements in airport technology and evolving passenger needs. As airports continue to modernize and automate their operations, the demand for efficient baggage handling solutions is increasing rapidly. This overview explores the market's size, influential players, emerging trends, and key segments shaping its future.

Projecting the Radio Frequency Identification Baggage…

Leading Industry Participants Reinforce Their Presence in the Process Informatio …

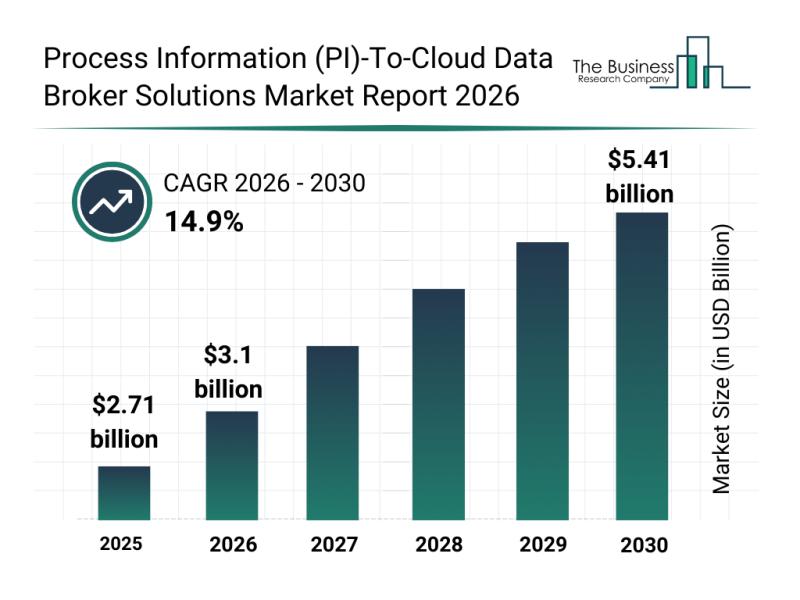

The process information (PI)-to-cloud data broker solutions industry is positioned for significant expansion as digital transformation accelerates across industrial sectors. Increasing demand for real-time data access and seamless integration between operational technology (OT) and information technology (IT) systems is driving rapid innovations and investments. Let's explore the market size projections, key players, emerging trends, and segment insights shaping this evolving landscape.

Projected Market Size Growth in the Process Information (PI)-To-Cloud Data…

Future Perspective: Key Trends Shaping the Policy Management Telecom Market Up t …

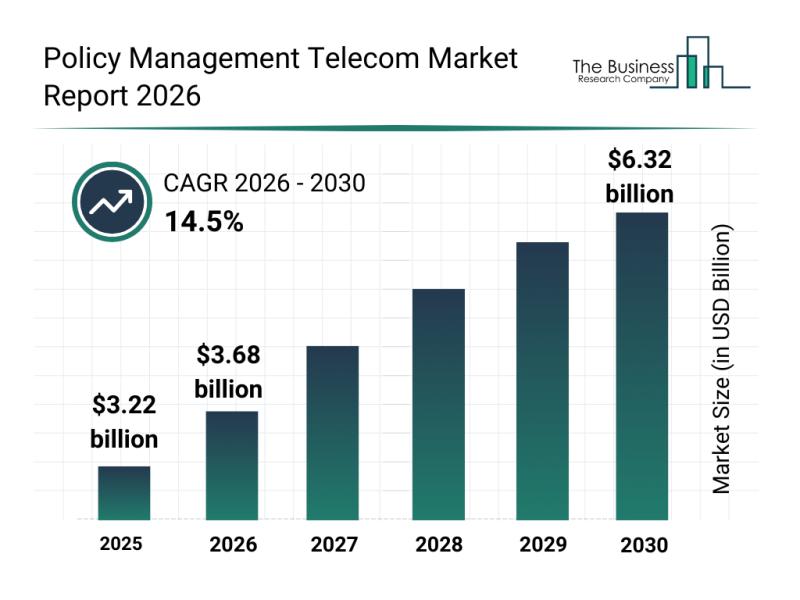

The policy management telecom sector is set to experience significant expansion over the coming years, driven by technological advances and growing network demands. This evolving market is playing a crucial role in supporting the complex needs of modern telecom operators, enabling more efficient management and automation of network policies. Below, we explore the current market size projections, leading companies, key trends, and segmentation details that define this dynamic industry.

Strong Growth…

Competitive Analysis: Key Market Leaders and New Entrants in the Pantyhose and T …

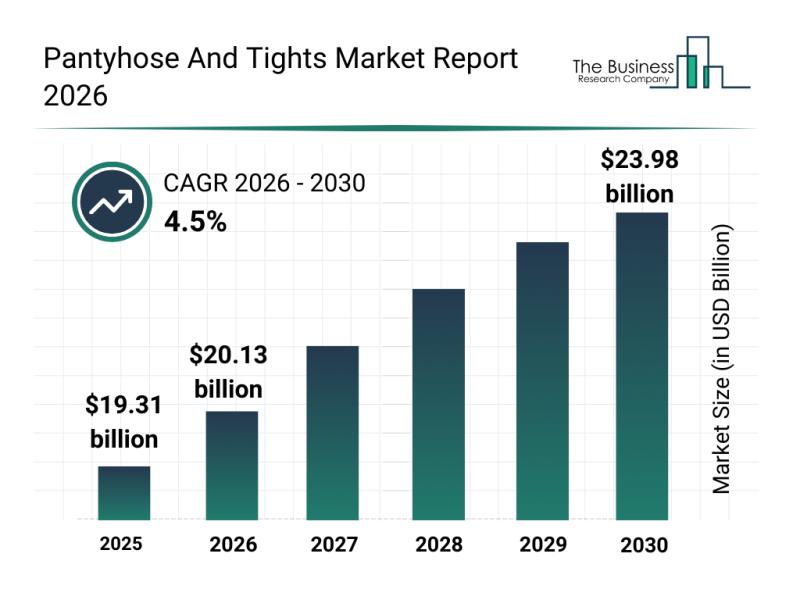

The pantyhose and tights market is set to witness consistent growth as consumer preferences evolve and new trends gain traction. With increasing emphasis on sustainability, comfort, and style, this sector is poised for meaningful expansion through 2030. Let's dive into the market's valuation, key players, emerging trends, and segmentation to understand the trajectory of this dynamic industry.

Forecasted Market Value and Growth Rate of the Pantyhose and Tights Market

The…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…