Press release

Rising Awareness About Financial Stress To Drive Market Growth: Strategic Insights Driving Financial Wellness Program Market Momentum in 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Financial Wellness Program Market Size By 2025?

The market size of the financial wellness program has seen a speedy expansion in the past few years. The market will escalate from a worth of $2.33 billion in 2024 to $2.66 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 14.3%. The factors contributing to this growth during the historic period include workforce productivity concerns, escalating healthcare expenses, employee retention tactics, a shift in retirement strategies, along with the rise in student loan debt.

How Big Is the Financial Wellness Program Market Size Expected to Grow by 2029?

The market size for financial wellness programs is anticipated to experience a significant surge in the ensuing years, reaching a size of $4.38 billion by 2029, growing at a compound annual growth rate (CAGR) of 13.3%. The expansion during the forecast period can be credited to factors such as gaps in financial literacy, worldwide economic instability, the advancement of remote and hybrid work structures, confluence with mental health initiatives, and personalized financial management strategies. Some of the major trends during the projected period entail the use of AI for financial coaching, application of blockchain for financial dealings, amalgamation with ESG, and the use of gamification for financial education.

View the full report here:

https://www.thebusinessresearchcompany.com/report/financial-wellness-program-global-market-report

Which Key Market Drivers Powering Financial Wellness Program Market Expansion and Growth?

The predominant trend emerging in the financial wellness program market is the heightened awareness of financial stress. Financial stress arises from monetary or economic incidents that trigger anxiety, fear, or a feeling of scarcity. Financial wellness programs help alleviate financial stress and augment overall financial health. Various services and resources provided by these programs address several elements of effective financial management, like budgeting, saving, debt management, and financial education. For instance, CNBC's April 2023 survey among 4,336 adults regarding financial confidence showed that 70% of Americans are grappling with financial stress, and 52% reported their financial stress has worsened since the advent of the COVID-19 pandemic. Consequently, the escalating awareness of financial stress is set to stimulate the financial wellness program market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12691&type=smp

What Are the Key Trends Driving Financial Wellness Program Market Growth?

Major firms in the financial wellness program sector are concentrating on the creation of novel solutions, such as cost-free nationwide financial wellness programs, to meet various critical sector needs. These free nationwide programs offer financial education and resources to people all over the nation without any charges. For example, in August 2024, Money Roots was introduced by Ally Financial Inc., a bank holding organization based in the United States. Money Roots is a unique nationwide initiative that concentrates on the mental aspects of money management. This includes four online workshops aimed at assisting attendees in examining their feelings, values, and initial monetary experiences to ultimately promote healthier financial habits. Recent survey data indicates that many people in the United States have difficulty managing emotional influences on their expenditure and frequently resist seeking assistance. Ally's objective, by dealing with the emotional origins of financial behavior, is to empower people and encourage improved financial well-being nationwide.

What Are the Emerging Segments in the Financial Wellness Program Market?

The financial wellness programmarket covered in this report is segmented -

1) By Type: For Employers, For Employees

2) By Program: Financial Planning, Financial Education And Counseling, Retirement Planning, Debt Management, Other Programs

3) By Application: Large Enterprises, Small And Medium Enterprises

Subsegments:

1) By For Employers: Comprehensive Financial Wellness Platforms, Financial Education Workshops, Employee Assistance Programs (EAPs)

2) By For Employees: Budgeting And Saving Tools, Retirement Planning Resources, Debt Management Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=12691&type=smp

Who Are the Global Leaders in the Financial Wellness Program Market?

Major companies operating in the financial wellness program market include Bank of America, Empower Retirement, Prudential Financial Inc., Nationwide Mutual Insurance Company, Morgan Stanley, TIAA, The Massachusetts Mutual Life Insurance Company, Fidelity Investments, Charles Schwab Corporation, Financial Fitness Group, Principal Financial Group, Key Corp Limited, Voya Financial, Edukate Inc., Paychex, Automatic Data Processing Inc. (ADP), John Hancock, Mercer LLC, Alight Solutions, Ramsey Solutions, AIG Retirement Services, PayActiv Inc., My Secure Advantage Inc., Wellable LLC, Transamerica Corporation, LearnLux, Best Money Moves, Bridge Credit Union, BrightDime, Enrich Financial Wellness, LifeCents

Which are the Top Profitable Regional Markets for the Financial Wellness Program Industry?

North America was the largest region in the financial wellness program market in 2024. The regions covered in the financial wellness program market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12691

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Awareness About Financial Stress To Drive Market Growth: Strategic Insights Driving Financial Wellness Program Market Momentum in 2025 here

News-ID: 4191374 • Views: …

More Releases from The Business Research Company

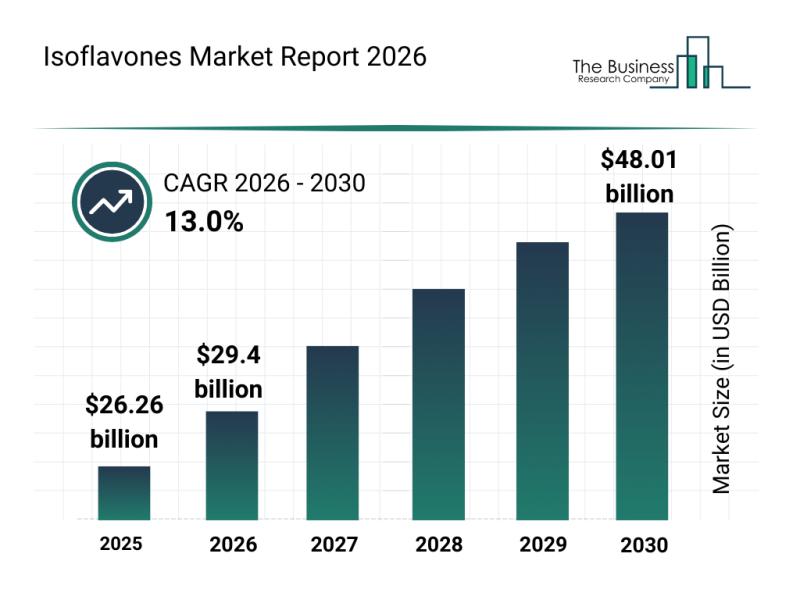

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

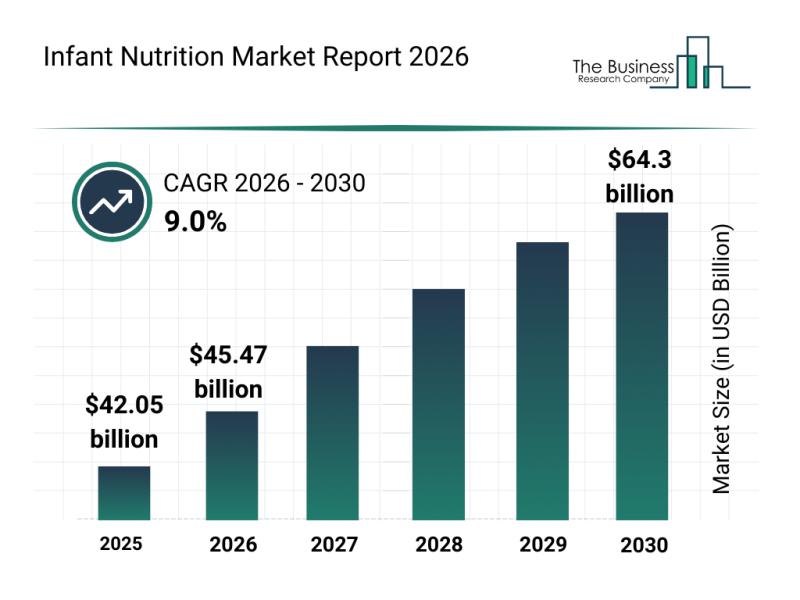

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

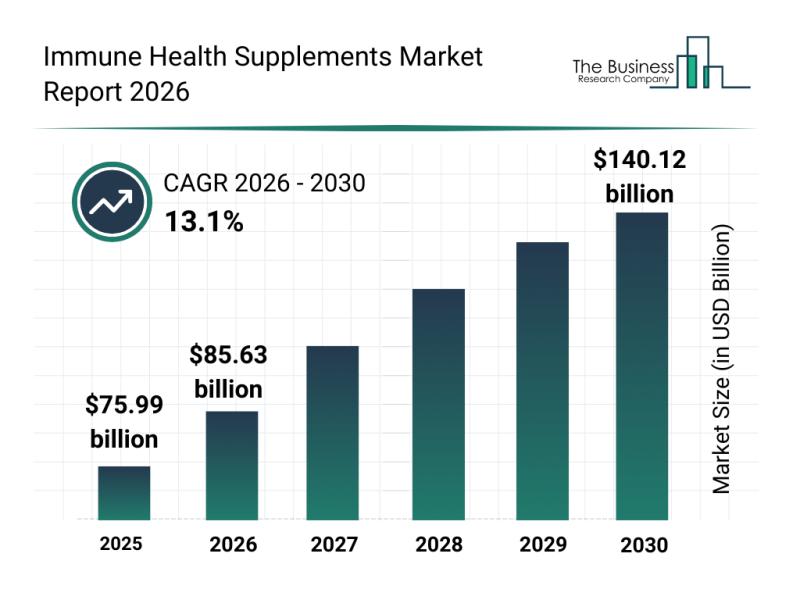

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

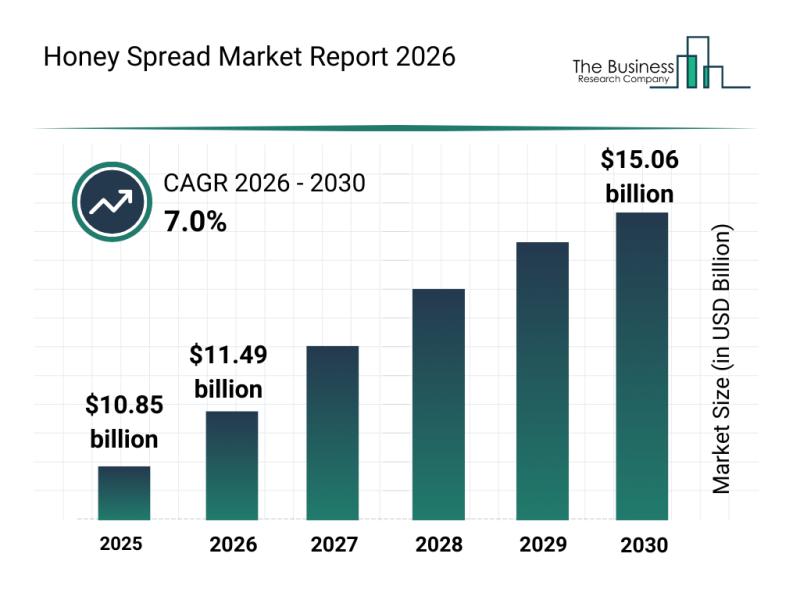

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…