Press release

Soaring Demand Set to Propel In-Vehicle Payment Services Market to $7.1 Billion by 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the In-Vehicle Payment Services Market Through 2025?

The market size for in-vehicle payment services has seen significant expansion over the recent years. The market is projected to expand from $4.27 billion in 2024 to a sizeable $4.71 billion in 2025, showing a compound annual growth rate (CAGR) of 10.3%. This expansion experienced in the past period can be linked to factors such as consumer convenience and the emergence of connected vehicles.

What's the Projected Size of the Global In-Vehicle Payment Services Market by 2029?

The market size for in-vehicle payment services is projected to experience a swift expansion in the coming years. By 2029, the market is forecasted to reach $7.1 billion, with a compound annual growth rate (CAGR) of 10.8%. This projected growth during the forecast period is largely due to advancements in connectivity, increased emphasis on enhancing security in in-car commerce, supportive regulation and standardization, and integration with smart cities. Some major trend predictions for the forecast period include advancement in mobile technology, strategic partnerships and collaborations, using blockchain for security, partnerships with fintech companies, and the growth of subscription-based models.

View the full report here:

https://www.thebusinessresearchcompany.com/report/in-vehicle-payment-services-global-market-report

Top Growth Drivers in the In-Vehicle Payment Services Industry: What's Accelerating the Market?

The rise in the adoption of contactless payments is substantially contributing to the expansion of the in vehicle payment services market. The COVID pandemic triggered a massive movement towards non-contact payments, supplemented by the sophisticated and seamless support from payment systems. For example, the U.S. government reported in June 2024 that the U.S. current-account deficit increased by $15.9 billion, reaching $237.6 billion in the first quarter of 2024, symptomatic of a larger goods trade deficit. This rise represented 3.4 percent of the current-dollar GDP, a rise from 3.2 percent in the previous quarter. The adjusted deficit for the fourth quarter was $221.8 billion. Thus, the growing tendency towards contactless payments is anticipated to further stimulate the growth of the in vehicle payment services market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6444&type=smp

What Trends Will Shape the In-Vehicle Payment Services Market Through 2029 and Beyond?

Leading businesses in the field of in-vehicle payment services are leveraging strategic alliances and affiliations to roll out innovative in-car payment service solutions and establish a domain monopoly. For instance, CarIQ Technologies Pvt. Ltd, a software firm from India, joined forces with the US-based credit card service provider Visa Inc., in July 2023, to unveil Vehicle Wallet. This service, known as Car IQ Pay, empowers automobiles to supervise payment accounts and transact with businesses sans any physical cards. In collaboration with Visa, the technology proliferates in the connected vehicle market, infusing personalized payment services by utilizing vehicle data. Its unique "Know Your Machine" attribute authenticates vehicle identity to enable secure, trouble-free transactions.

What Are the Main Segments in the In-Vehicle Payment Services Market?

The in-vehicle payment servicesmarket covered in this report is segmented -

1) By Mode Of Payment: QR Code Or RFID, App-Based Or E-Wallet, Credit Or Debit Card-Based, Other Modes

2) By Form Factor: Embedded System, Tethered System, Integrated System

3) By Vehicle Type: Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Automated Guided Vehicles

4) By Application: Shopping, Gas Or Charging Stations, Food And Beverages, Toll Collection, Parking, Other Applications

Subsegments:

1) By QR Code Or RFID: QR Code Payments, RFID Tags

2) By App-Based Or E-Wallet: Mobile Payment Apps, Digital Wallets

3) By Credit Or Debit Card-Based: Contactless Card Payments, Chip And PIN Transactions

4) By Other Modes: Biometric Payments, Cash Payments

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=6444&type=smp

Which Top Companies are Driving Growth in the In-Vehicle Payment Services Market?

Major companies operating in the in-vehicle payment services market include Mastercard Inc., The Mercedes-Benz Group AG, Jaguar Land Rover Automotive PLC, Honda Motor Co. Ltd., Hyundai Motor Company, ZF Friedrichshafen AG, Amazon. com Inc., Google LLC, International Business Machines Corporation, Telenav Inc., Xevo Inc., CarPay Diem Cerence Inc., PayPal Holdings Inc., Bayerische Motoren Werke AG, Ford Motor Company, General Motors Company, Volkswagen AG, VISA Inc., Harman International Industries Inc., Audi AG, Panasonic Corporation, CarIQ Technologies Pvt. Ltd., BlackBerry Limited, Parkwhiz, Rivian Automotive Inc., PayByCar

Which Regions Will Dominate the In-Vehicle Payment Services Market Through 2029?

North America was the largest region in the in vehicle payment services market in 2024. The regions covered in the in-vehicle payment services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6444

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Soaring Demand Set to Propel In-Vehicle Payment Services Market to $7.1 Billion by 2029 here

News-ID: 4191322 • Views: …

More Releases from The Business Research Company

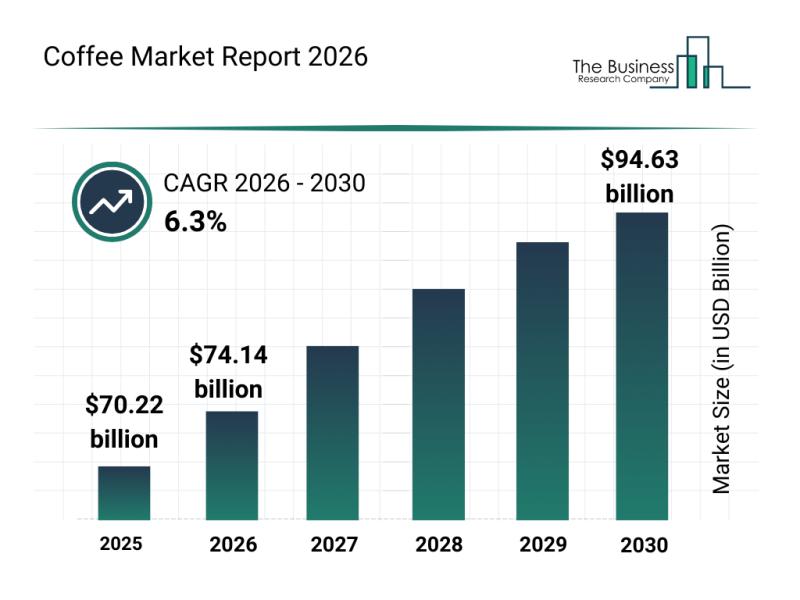

Key Strategic Developments and Emerging Changes Shaping the Coffee Market Landsc …

The coffee industry is on track for substantial growth, driven by evolving consumer preferences and innovative product developments. As coffee continues to hold a vital place in daily routines globally, the market is adapting to meet new demands and broaden its appeal. Let's explore the projected market size, key players, emerging trends, and detailed segments that define the coffee sector's trajectory.

Forecasted Expansion and Market Size of the Coffee Market by…

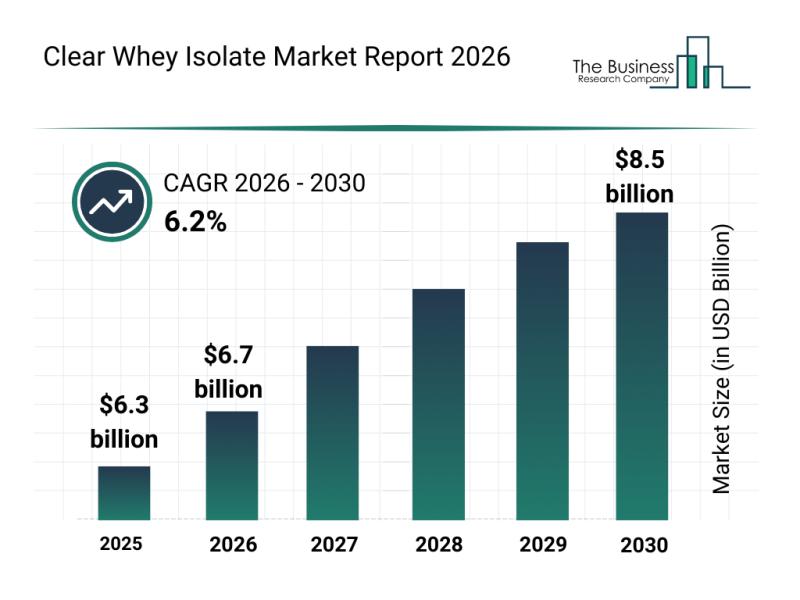

In-Depth Examination of Segments, Industry Developments, and Key Competitors in …

The clear whey isolate market is gaining significant traction as consumers increasingly seek high-quality protein options with clean labels and functional benefits. This market is set to experience notable growth driven by innovation in product formats and a growing preference for healthier nutrition solutions. Below, we explore the market outlook, key players, emerging trends, and segment dynamics shaping this industry's future.

Strong Growth Expected for the Clear Whey Isolate Market by…

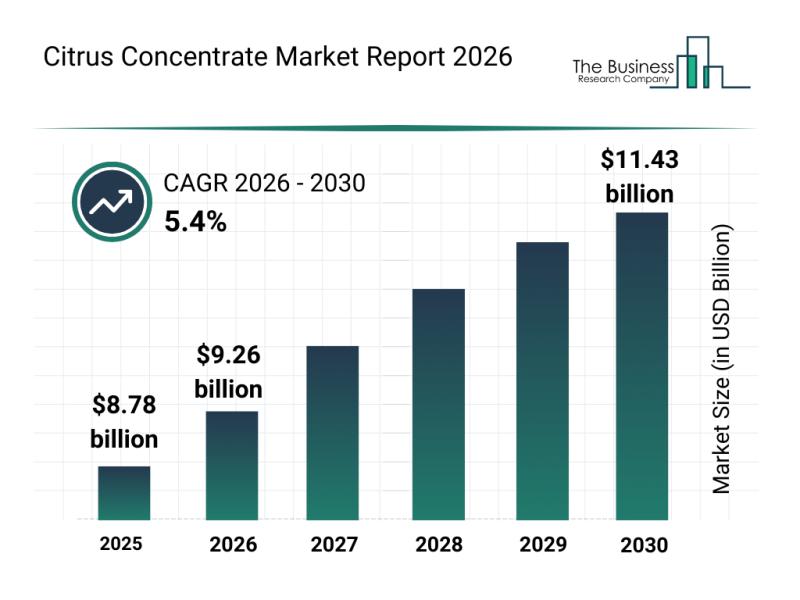

Leading Companies Fueling Growth and Innovation in the Citrus Concentrate Market

The citrus concentrate industry is set to witness significant expansion as consumer preferences evolve and demand for health-oriented products rises. With increasing interest in natural and functional ingredients, this sector is poised for noteworthy growth, driven by innovation and sustainability efforts. Let's delve into the market's size, key players, emerging trends, and segmentation to better understand its future trajectory.

Projected Growth of the Citrus Concentrate Market Through 2030

The citrus…

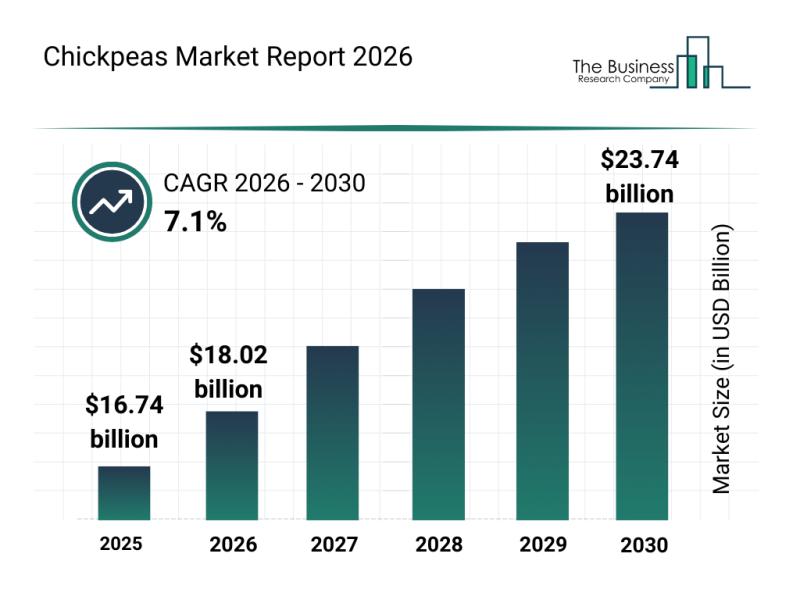

Key Strategic Developments and Emerging Changes Shaping the Chickpeas Market Env …

The chickpeas market is poised for significant expansion over the coming years, driven by evolving consumer preferences and growing applications across various food sectors. As plant-based diets gain popularity and product innovations continue to emerge, this market is set to capture increasing attention from both producers and consumers alike. Here's a comprehensive look at the current market size, key players, major trends, and segmentation within the chickpeas industry.

Expected Growth Trajectory…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…