Press release

Switching Residential Voltage Regulators Market to Reach CAGR 8.1% by 2031 Top 20 Company Globally

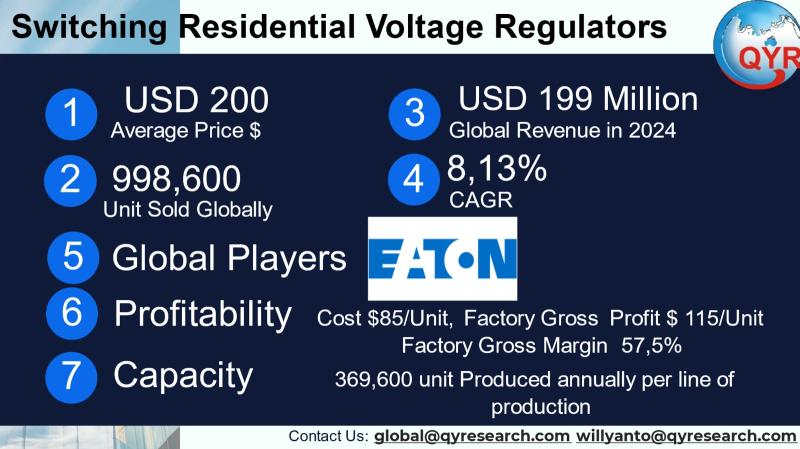

The Switching Residential Voltage Regulator industry sits at the intersection of power-electronics miniaturization and growing homeowner demand for stable, appliance-safe electricity; these devices use switching (DC-DC or AC-DC with switching stages) architectures to deliver higher efficiency and lower heat than linear alternatives while protecting residential equipment from brownouts, surges and line noise. The industrys end markets span stand-alone home voltage conditioners, integrated smart-home power modules, small generator AVRs, and distribution-level devices adapted for single-phase residential use, and it is shaped by semiconductor advances (GaN, SiC), smart controls, and increasing attention to energy efficiency and grid stability.The global switching residential voltage regulators market size is USD 199 million for 2024 and an 8.13% CAGR through 2031, the global Switching Residential Voltage Regulator sector is a focused, mid-scale specialty market within the broader voltage-regulator family, which itself is reporting multi-billion dollar totals across industrial and consumer segments. An average selling price is at USD 200. Total units sold globally in 2024 approximately at 998,600 units. An estimated cost of goods sold per unit of USD 85, producing an estimated factory gross profit per unit of USD 115 and a factory gross margin per unit of 57.5%. The assessed full-machine annual production capacity (global installed capacity across factories producing finished residential switching regulators) is estimated at 1,200,000 units per year.

Latest Trends and Technological Developments

The most recent public developments show continued product introductions and platform advances from major analog and power-semiconductor firms. On July 2025 Analog Devices highlighted its Silent Switcher 3 switching regulator technology positioned to reduce radiated noise while increasing conversion efficiency and shrinking solution size an innovation that translates directly into quieter, higher-efficiency residential power modules and tighter EMI performance for homes with many sensitive electronics. On March 2025 Texas Instruments announced new power-management chips focused on higher efficiency and protection for demanding applications (data centers and high-density power conversion), and TI has concurrently showcased multi-platform switching solutions at industry expos in 2025; while those launches are targeted broadly, the underlying efficiencies, GaN adoption and improved control telemetry are directly transferrable to residential switching regulator designs. These vendor moves reinforce two parallel trends: higher switching frequencies and new semiconductor materials (GaN/SiC) enabling smaller, more efficient modules and smarter telemetry/control layers for remote monitoring and grid-interactive behavior.

Asia accounts for a disproportionate share of both production and demand for residential switching regulators. Rapid urbanization, ongoing grid modernization projects, and high sensitivity to voltage quality in markets with mixed distribution infrastructure make the region a priority for both local manufacturers and global power-electronics suppliers. China, India and Japan are major demand centers for both component suppliers (ICs, power MOSFETs, GaN devices) and finished regulator assembly; contract manufacturers in East and Southeast Asia supply white-label and branded products for export as well as robust domestic channels. Cost-sensitive buyers in many Asian markets prefer compact, efficient switching solutions that are competitively priced, while premium segments (smart-home integrators, rooftop PV systems, hybrid backup systems) are adopting higher-value, telemetry-equipped regulators that command higher ASPs. Regional market trackers place a majority of growth expectations in Asia-Pacific through 2030, on the basis of both residential electrification and replacement cycles.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5050965

Switching Residential Voltage Regulators by Type:

Single Phase

Three Phase

Switching Residential Voltage Regulators by Application:

Appliance Protection

Consumer Electronic

Panel Level Protection

Others

Global Top 20 Key Companies in the Switching Residential Voltage Regulators Market

Analog Devices Inc

BTRAC Ltd

Eaton Corporation

General Electric

Infineon Technologies AG

Legrand

Maschinenfabrek Reinhausen GmbH

Microchip Technology Inc

NXP Semiconductors

MaxLinear

Purevolt

Ricoh USA Inc

ROHM Co.,Ltd

SMTECH

Siemens

Sollatek

STMicroelectronics

Torex Semiconductor Ltd

Vicor

Vishay Intertechnology Inc

Regional Insights

Within ASEAN, adoption is uneven but accelerating. Indonesia stands out because of its mix of rapidly growing urban demand, frequent local voltage variation in some distribution networks, and a large installed base of consumer electronics that benefit from voltage stabilization. Indonesias market growth is aided by rising middle-class appliance ownership and growing interest in hybrid backup systems for homes prone to outages; local distributors and installers often combine AVRs with generator sets and UPS systems. Southeast Asian markets also attract manufacturers seeking lower labor and assembly costs, creating regional clusters for finished-goods production that service both local markets and export lanes. Governments grid-resilience initiatives and incentives for energy-efficient appliances in a few ASEAN countries further support demand, though variability in regulation and procurement practices means channel strategies must be highly localized.

Manufacturers face margin pressure from commodity semiconductor price cycles and occasional supply chain tightening for power MOSFETs and magnetic components, making cost structure and supplier diversification crucial. Technical challenges include meeting increasingly stringent EMI and efficiency regulations while keeping unit price attractive for the mainstream residential segment. Another practical obstacle is after-sales service and channel fragmentation many sales in developing markets flow through small distributors and installers where warranty enforcement and quality control are inconsistent. Finally, the emergence of smart inverters, integrated UPS/ESS solutions and utility-grade distribution automation increases competition from adjacent product categories that can displace standalone regulators in some use cases.

Producers that vertically integrate power-IC selection, magnetics sourcing and firmware for telemetry gain competitive advantage because component selection (e.g., GaN vs. silicon MOSFETs) and thermal/EMI optimization materially affect product differentiation and gross margin. For distributors and OEM partners, offering installation, warranty and monitoring services creates recurring revenue and raises resale ASPs. From an investor perspective, companies with demonstrated design-wins for smart, grid-interactive residential controllers, diversified supply chains for high-value components, and scalable manufacturing footprints in Asia have the best risk-adjusted growth profiles. Strategic partnerships with semiconductor leaders and contract manufacturers in Southeast Asia accelerate time-to-market and control CapEx needs.

Product Models

Switching residential voltage regulators are key devices that stabilize voltage supply in homes, protecting appliances from fluctuations and improving energy efficiency.

Single-Phase models typically used for standard household applications. Notable products include:

APC Line-R LE1200 Schneider Electric: Protects household electronics with automatic voltage regulation.

Microtek EMR 2013 Microtek International: Popular home stabilizer for refrigerators and TVs.

V-Guard VG 400 V-Guard Industries: Designed for single-phase household applications like ACs.

Servokon AVR Single-Phase Servokon Systems: Used for home appliances requiring voltage stability.

Delta AVR-1P Delta Electronics: Provides reliable regulation for small residential systems.

Three-Phase models which are ideal for larger residences, villas, or residential complexes with higher power demands. Examples include:

Luminous 3-Phase Servo AVR Luminous Power Technologies: Designed for large households with three-phase air conditioning.

V-Guard Tri-Phase AVR V-Guard Industries: Balances voltage for residential lifts, ACs, and central systems.

Servokon 3-Phase AVR Servokon Systems: Indian-made regulator for villas and large residential complexes.

Controlled Power UltraLine 3-Phase AVR Controlled Power Company: Precision regulation for sensitive home and office electronics.

Ortea Orion AVR Ortea SpA: Premium servo voltage regulator used in European high-end homes.

The Switching Residential Voltage Regulators market is a growing, technically active niche: with a 2024 base of USD 199 million and an 8.13% CAGR through 2031, the sector is being reshaped by higher-efficiency switching semiconductors (including GaN/SiC), tighter EMI/thermal packaging, and embedded telemetry that supports smart-home and grid-interactive use cases. Asia, and within it Southeast Asia and Indonesia specifically, are key demand and production centers; firms that combine semiconductor partnerships, cost-effective manufacturing in Asia, and after-sales service will capture the most value as markets move from purely price-sensitive replacements to higher-value, smart energy solutions.

Investor Analysis

What: the report highlights addressable revenue (USD 199M in 2024), unit economics (price $200, COGS $85, gross profit $115/unit, gross margin 57.5%), and capacity dynamics (estimated annual capacity 1.2M units). How: investors can use these metrics to model company valuations under different market-share scenarios (e.g., a 5% share of this market equals roughly USD 9.95M revenue at current ASPs) and to stress-test margin resilience against component cost swings. Why: the combination of attractive per-unit margins (modeled at ~57.5% gross margin), a predictable hardware replacement cycle in homes, and accelerating adoption of higher-value smart regulators creates both recurring aftermarket revenue and opportunities for premiumization; this makes targeted investments in differentiated manufacturers, or in semiconductor/design firms with strong OEM relationships, potentially high-leverage plays. In short, the reports figures let investors build go-to-market and valuation scenarios, assess operational leverage (manufacturing capacity vs. forecast demand), and prioritize targets that can scale in Asia/ASEAN distribution channels.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5050965

5 Reasons to Buy This Report

It converts headline market value into practical unit economics (units sold, COGS, gross profit and margin) so you can model company-level P&Ls.

It focuses on Asia and ASEAN providing regional production and demand context not always present in broader voltage-regulator reports.

It synthesizes the latest product/technology news (supplier launches and platform advances through mid-2025) so buyers can assess tech timing and adoption.

It identifies top global players and maps where vertical integration and IP matter for margins and defensibility.

It offers strategic, investor-oriented insights (capacity vs. demand, channel dynamics, and aftermarket opportunities) to support acquisition or growth decisions.

5 Key Questions Answered

What is the 2024 market size and projected growth for switching residential regulators?

How many units were sold globally in 2024 and what are modeled per-unit economics (price, COGS, gross profit, margin)?

Which regions and countries are driving demand and why?

What are the latest technological developments and supplier announcements influencing product design and ASPs?

Who are the top five companies competing in this space and what capabilities make them leaders?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Switching Residential Voltage Regulators Market to Reach CAGR 8.1% by 2031 Top 20 Company Globally here

News-ID: 4190640 • Views: …

More Releases from QY Research

Top 30 Indonesian Coal Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Alamtri Resources Indonesia Tbk (formerly Adaro Energy)

PT Bumi Resources Tbk

PT Bayan Resources Tbk

PT Indo Tambangraya Megah Tbk

PT Bukit Asam Tbk (PTBA)

PT Golden Energy Mines Tbk (GEMS)

PT Dian Swastatika Sentosa Tbk (DSSA)

PT Indika Energy Tbk (INDY)

PT Akbar Indo Makmur Stimec Tbk (AIMS)

PT Atlas Resources Tbk (ARII)

PT Borneo Olah Sarana Sukses Tbk (BOSS)

PT Baramulti…

From Sugar to Profit: Economics of the Global Ready-to-Roll Icings Industry

Ready-to-roll icings (also known as rolled fondant or sugar paste) are pre-formulated sugar-based sheets used for cake covering, decorative modeling, and bakery finishing in commercial and artisan baking.

Products are supplied in bulk slabs, sheets, and blocks and are valued for: Consistent elasticity, Reduced preparation time, Uniform finish, Extended shelf stability.

Industrial buyers include industrial bakeries, frozen dessert processors, QSR chains, supermarkets, and cake studios.

Growing demand for celebration cakes, premium bakery products,…

Sustainable Staples: Why Investors Are Targeting Organic Pulse Processing

Organic dry pulses include organically cultivated lentils, chickpeas, peas, mung beans, pigeon peas, and dry beans produced without synthetic pesticides, fertilizers, or GMOs.

Industry benefits from: Rising plant-protein adoption, Gluten-free and clean-label trends, Soil-friendly nitrogen-fixing crop rotation, Government organic agriculture subsidies across Asia.

Global trade dominated by exporters in India, Australia, Canada, and Turkey

Growing consumption in China, Japan, Indonesia, and Vietnam.

Global Overview

Market size (2025): USD 5,266 million

Market size (2032): USD 8,231 million

CAGR…

Baby Care Boom: USD 9.1B Global Bath & Shower Market Driven by Asia Growth

Baby bath and shower products include liquid cleansers, tear-free shampoos, head-to-toe washes, soaps, bath oils, foam washes, and sensitive-skin dermatological formulations designed specifically for infants and toddlers.

Products emphasize mild surfactants, hypoallergenic formulations, pH-balanced systems (5.56.0), and natural/plant-derived ingredients to minimize irritation and comply with pediatric dermatology standards.

Demand is driven by rising hygiene awareness, premiumization of infant care, urban middle-class expansion, and increased birth rates in emerging Asia.

Strong shift from bar…

More Releases for Asia

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

South East Asia Business Jet Market And Top Key Players are Asia Corporate Jet, …

By 2022, the South East Asia Business Jet Markets estimated to reach US$ XX Mn, up from US$ XX Mn in 2016, growing at a CAGR of XX% during the forecast period. The Global Business Jet Market, currently at 21 million USD, contributes the highest share in the market and is poised to grow at the fastest rate in the future. The three broad categories of business jets are Small,…

LIXIL Asia Presents Asia Pacific Property Awards

Through its power brands GROHE and American Standard, LIXIL Asia signs a three-year deal to become the Headline Sponsor of the Asia Pacific Property Awards from 2019 until 2022.

23rd January 2019: The International Property Awards, first established in 1993, are open to residential and commercial property professionals from around the globe. They celebrate the highest levels of achievement by companies operating within the architecture, interior design, real estate and property…

PEOPLEWAVE WINS ASIA TECH PODCAST PITCHDECK ASIA 2019 AWARDS

15 January 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, won the Asia Tech Podcast (ATP) Pitchdeck Asia 2019 Awards, being awarded “Startup Most Likely to Succeed in 2019".

The 2019 Pitchdeck Asia Awards is an opportunity for the Asian Startup Ecosystem to shine a spotlight on some of its best startups. The awards were decided by a public vote. More than 7,200 votes were cast by registered LinkedIn…

Undersea Defence Technology Asia, UDT Asia 2011

Latest Military Diving Technologies featured in UDT Asia

Equipping Asia’s navies with the latest diving technology for asymmetric warfare and

operations

SINGAPORE, 17 October 2011 - Naval diving and underwater special operations is a field that is

seeing increased attention and investment amongst navies in Asia. Units such as the Indonesian Navy‟s KOPASKA, the Republic of Singapore Navy‟s Naval Diving Unit (NDU), the Royal Malaysian Navy‟s PASKAL are increasingly utilising specialised equipment for conducting…

Asia Diligence – Specialist Investigative Due Diligence for Asia & Beyond

Asia Diligence today announced the opening of its European Customer Services office in the United Kingdom. The office is to be managed by Steve Fowler and will focus on providing services to Asia Diligence’s European customers. Asia Diligence is also planning to open a US office in the near future, which will provide customer service to its US and North American clients.

Asked to comment on the move, Luke Palmer, the…