Press release

Premium Finance Market Outlook Highlighting Emerging Trends, Opportunities, and Future Expansion Potential

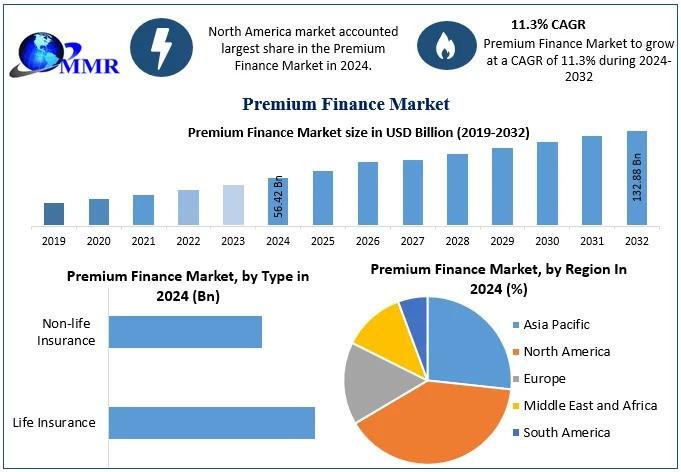

Premium Finance Market size was valued at USD 56.42 Bn in 2024 and is expected to reach USD 132.88 Bn by 2032, at a CAGR of 11.3 %.Premium Finance Market Overview:

The premium finance industry plays a pivotal role in helping businesses and individuals manage insurance costs by providing financing solutions for premium payments. Instead of making large lump-sum payments upfront, policyholders can spread the cost into manageable installments, improving cash flow and financial flexibility. This market is gaining traction due to the rising demand for insurance across industries, including healthcare, automotive, property, and life coverage. Increasing awareness about risk management, coupled with growing penetration of digital platforms, is further enhancing accessibility and convenience in premium financing. The presence of specialized financial institutions offering tailored products and services has expanded the scope of this sector. Additionally, the market is benefiting from the rising participation of small and medium-sized enterprises that require financial assistance for insurance coverage. With its ability to bridge gaps in affordability and ensure continued coverage, premium finance is emerging as a vital component in today's financial ecosystem.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/213507/

Premium Finance Market Outlook and Future Trends:

The outlook for premium finance is highly promising, supported by strong insurance adoption and evolving customer preferences. Technological innovations, such as AI-driven credit assessments and automated loan processing, are expected to streamline operations and enhance user experience. The growing preference for digital payment models is fueling opportunities for premium finance providers to expand their reach. In addition, increasing demand from SMEs, gig workers, and self-employed professionals who seek flexible insurance payment solutions will add momentum to the industry's growth. Emerging markets with a growing middle class are anticipated to present lucrative opportunities as awareness about insurance coverage continues to rise. Furthermore, the integration of premium financing into online insurance platforms and mobile apps is expected to make the process seamless and efficient. As sustainability and climate-related risks drive more insurance purchases, premium finance will be positioned as a facilitator for broader coverage adoption in the future.

Premium Finance Market Dynamics:

The dynamics of this sector are influenced by a combination of growth drivers, restraints, and opportunities. One of the key drivers is the rising demand for insurance across industries, supported by regulatory mandates in areas such as health, motor, and liability insurance. The need for financial flexibility encourages customers to opt for financing solutions, especially when managing high-value policies. However, challenges such as regulatory scrutiny, interest rate fluctuations, and potential credit defaults can restrain market expansion. Additionally, competition from traditional financial institutions and fintech players is intensifying, pushing companies to innovate and offer competitive rates. On the opportunity side, digitization and partnerships with insurers are expected to create new revenue streams. The integration of blockchain and secure digital contracts could reduce fraud risks and increase trust in the financing process. Overall, this market is expected to maintain strong momentum as evolving dynamics continue shaping its structure.

Premium Finance Market Key Recent Developments:

Recent developments in premium finance highlight the industry's shift toward digital innovation and strategic expansion. Several leading firms have invested in AI-powered underwriting and risk assessment tools to improve efficiency and reduce operational costs. Fintech collaborations with insurance companies are creating integrated platforms where customers can purchase policies and access financing in one streamlined process. Additionally, the rise of embedded finance is driving adoption, as insurance providers increasingly offer installment-based payment options directly through digital channels. Many companies are also focusing on expanding their presence in emerging economies, where insurance penetration remains relatively low but demand is growing rapidly. In developed regions, premium finance providers are introducing eco-friendly insurance financing products to support sustainability-focused businesses. Regulatory frameworks in multiple countries are being updated to ensure transparency and consumer protection in financial services, further strengthening trust in this sector. These advancements are laying the groundwork for sustained long-term growth.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/213507/

Premium Finance Market Segmentation:

by Type

Life Insurance

Non-life Insurance

by Interest Rate

Fixed Interest Rate

Floating Interest Rate

by Provider

Banks

NBFCs

Others

Some of the current players in the Premium Finance Market are:

1. Colonnade

2. Banking Truths Team

3. Insurance and Estate Strategies LLC

4. AGENTSYNC, INC.

5. The Annuity Expert

6. J.P. Morgan Private Bank

7. Tennessee

8. Capital for Life

9. Generational Strategies Group, LLC.

10. BNY Mellon Wealth Management

11. Byline Bank

12. Succession Capital Alliance

13. Symetra Life Insurance Company

14. Lions Financial

15. Wintrust

16. Evolution, Inc.

17. Parkway Bank & Trust Company

18. Agile Premium Finance

19. AFCO Insurance Premium Finance

20. BankDirect Capital Finance

21. Valley National Bank

22. ARI Financial Group

23. Peoples Premium Finance

24. FMG Suite

25. Schechter

26. US Premium Finance

27. Lincoln National Corporation

For additional reports on related topics, visit our website:

♦ Barbeque Grill Market https://www.maximizemarketresearch.com/market-report/barbeque-grill-market/208743/

♦ Global Interactive Kiosk Market https://www.maximizemarketresearch.com/market-report/global-interactive-kiosk-market/15155/

♦ Global Commercial Refrigeration Equipment Market https://www.maximizemarketresearch.com/market-report/global-commercial-refrigeration-equipment-market/35050/

♦ Esports Market https://www.maximizemarketresearch.com/market-report/global-esports-market/36686/

♦ Global Portable Ultrasound Device Marketr https://www.maximizemarketresearch.com/market-report/global-portable-ultrasound-device-market/31076/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading consulting and market intelligence company, recognized for providing in-depth insights and data-driven strategies across industries including healthcare, automotive, technology, and pharmaceuticals. With a strong focus on comprehensive research, future trend analysis, and competitive evaluation, the firm supports businesses in identifying opportunities, minimizing risks, and achieving long-term growth. Its expertise lies in equipping organizations with the knowledge and tools they need to enhance decision-making, optimize performance, and expand their market footprint effectively.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Premium Finance Market Outlook Highlighting Emerging Trends, Opportunities, and Future Expansion Potential here

News-ID: 4189774 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…