Press release

Asset Finance Software Market Poised for Growth at an 11.4% CAGR Over the Next Decade

The Asset Finance Software Market is poised for robust growth, driven by technological advancements and the increasing adoption of digital asset management solutions. According to Persistence Market Research, the global asset finance software market size is expected to grow from US$ 4,273.4 million in 2025 to US$ 9,098.5 million by 2032, registering a CAGR of 11.4% over the forecast period. Asset finance software has become indispensable for organizations that aim to streamline asset acquisition, optimize utilization, and integrate advanced analytics for informed financial decisions.The market growth is being fueled by the widespread shift toward subscription-based business models, usage-based billing systems, and Equipment-as-a-Service (EaaS) offerings. Leading segments include loan and lease management solutions, which dominate the market due to their critical role in asset lifecycle management. Geographically, North America is expected to lead the market, owing to the presence of technologically advanced financial institutions, high adoption of cloud-based software solutions, and favorable regulatory environments that encourage digital transformation.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/35431

Key Highlights from the Report

The market is projected to nearly double between 2025 and 2032, reflecting strong adoption of asset finance software.

Loan and lease management solutions are the leading product segment in the market.

Cloud-based deployment is increasingly preferred due to scalability and cost efficiency.

North America dominates the market due to technological readiness and regulatory support.

SMEs are adopting asset finance software to improve operational efficiency and financial visibility.

Integration of AI and analytics in asset finance software is reshaping decision-making processes.

Market Segmentation

The asset finance software market is segmented primarily based on product type and deployment. Product types include loan management software, lease management software, fleet management solutions, and equipment finance software. Loan and lease management solutions are currently leading due to the growing need for structured financing and compliance management across industries.

Deployment-wise, the market is divided into cloud-based and on-premise solutions. Cloud-based solutions are witnessing higher adoption, particularly among SMEs, due to reduced infrastructure costs, flexibility, and real-time analytics capabilities. End-users range from financial institutions, banks, leasing companies, equipment providers, to corporates managing large asset portfolios.

Regional Insights

North America remains the largest market for asset finance software, driven by high digital adoption and the presence of major software providers. Regulatory support and favorable economic conditions also accelerate technology investments in this region.

Europe follows closely, with strong demand from banks and leasing firms implementing digital solutions for asset lifecycle management. Emerging markets in Asia-Pacific are expected to register the highest growth rates due to expanding industrial infrastructure and rising adoption of cloud technologies.

Read More: https://www.persistencemarketresearch.com/market-research/asset-finance-software-market.asp

Market Drivers

The asset finance software market growth is primarily driven by the increasing digitization of financial services, the rise of subscription and usage-based business models, and the growing demand for real-time asset management solutions. These systems allow organizations to improve efficiency, reduce risks, and ensure compliance, making them a crucial part of financial operations.

Market Restraints

High implementation costs and complexity in integrating legacy systems with new software solutions pose challenges to market growth. Additionally, concerns over data security and regulatory compliance in emerging markets can hinder rapid adoption.

Market Opportunities

The integration of AI, IoT, and predictive analytics into asset finance software presents significant opportunities. Organizations can leverage these technologies to enhance asset tracking, optimize maintenance schedules, and deliver personalized financial products, opening new revenue streams and market expansion possibilities.

Reasons to Buy the Report

✔ Comprehensive analysis of market size, share, and growth projections.

✔ Detailed insights into key product segments and deployment models.

✔ Regional trends and forecasts for North America, Europe, and Asia-Pacific.

✔ Strategic recommendations for investors, software providers, and financial institutions.

✔ Analysis of emerging technologies and innovations reshaping the asset finance industry.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/35431

Frequently Asked Questions (FAQs)

How Big is the Asset Finance Software Market?

Who are the Key Players in the Global Asset Finance Software Market?

What is the Projected Growth Rate of the Market?

What is the Market Forecast for 2032?

Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

Key players operating in the asset finance software market include:

SAP SE

Oracle Corporation

FIS Global

Temenos AG

Sage Group Plc

Infor Inc.

Misys (Finastra)

IFM Business Solutions

LeaseWave

Recent Developments:

FIS Global launched an AI-powered lease management module in early 2025 to enhance predictive asset valuation.

Oracle Corporation expanded its cloud-based asset finance platform to Asia-Pacific markets, targeting SMEs with subscription-based solutions.

Related Reports:

Multi-Service Business Gateways Market https://www.persistencemarketresearch.com/market-research/multi-service-business-gateways-market.asp

Large Language Model Market https://www.persistencemarketresearch.com/market-research/large-language-model-market.asp

Data Center Precision Cooling Market https://www.persistencemarketresearch.com/market-research/data-center-precision-cooling-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset Finance Software Market Poised for Growth at an 11.4% CAGR Over the Next Decade here

News-ID: 4189639 • Views: …

More Releases from Persistence Market Research

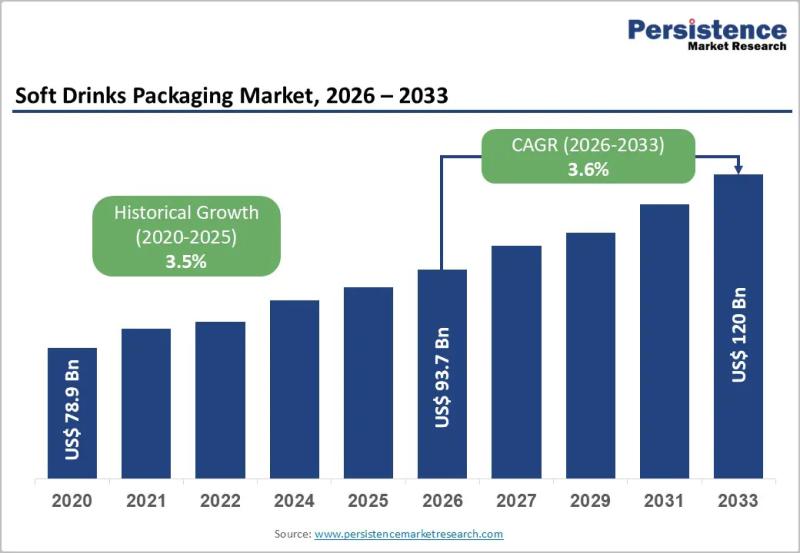

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

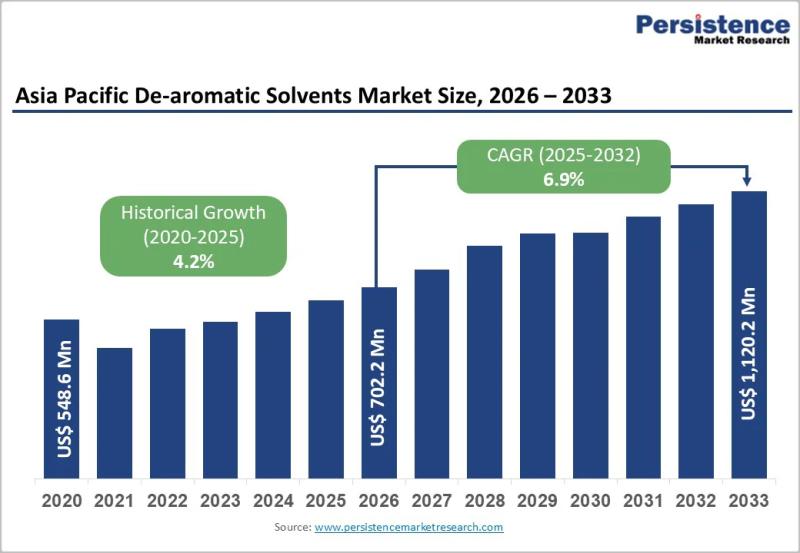

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…