Press release

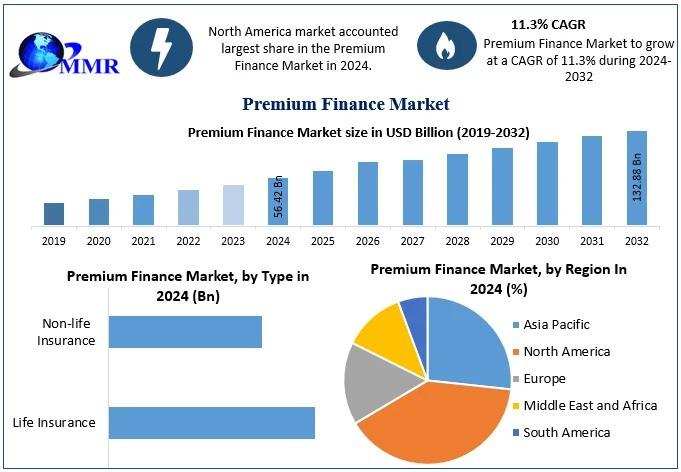

Premium Finance Market to Reach USD 132.88 Billion by 2032, Growing at 11.3% CAGR

Premium Finance Market size was valued at USD 56.42 Bn in 2024 and is expected to reach USD 132.88 Bn by 2032, at a CAGR of 11.3 %.Premium Finance Market Overview:

Research shows that premium finance has become an essential financial service, particularly for businesses and individuals seeking liquidity while maintaining comprehensive insurance coverage. The concept allows policyholders to finance large insurance premiums, thereby freeing up capital for other investments and operational needs. Studies highlight that the demand is growing as companies prioritize cash flow management and seek flexible financing options. For high-value insurance policies in sectors like real estate, healthcare, and manufacturing, premium financing reduces the burden of upfront payments. This solution ensures that clients can secure necessary protection without compromising their financial stability. From a purchasing perspective, it makes sense because it combines risk management with financial flexibility. By leveraging premium finance, organizations not only protect their assets but also optimize working capital. Research suggests this dual advantage of financial security and liquidity is one of the strongest reasons why adoption will continue to rise.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/213507/

Premium Finance Market Outlook and Future Trends:

The outlook for premium finance indicates steady growth, fueled by rising awareness of its benefits and increasing adoption across diverse industries. Research suggests that the market is expanding as businesses and high-net-worth individuals recognize the importance of maintaining uninterrupted insurance coverage. Future trends highlight the growing role of digital platforms, automation, and AI in simplifying loan processing and policy management, making premium financing more accessible. Additionally, the integration of flexible repayment models and tailored solutions is expected to attract more buyers. Another trend includes insurers and banks forming stronger partnerships to expand offerings globally. From a purchase perspective, this future growth ensures that customers will have more options, greater transparency, and improved cost efficiency. Investing in premium finance services today positions buyers ahead of the curve, as they benefit from evolving innovations while securing financial protection. Research clearly points to continued adoption as demand for financial flexibility grows.

Premium Finance Market Dynamics:

Several dynamic factors are driving the growth of premium finance. Research highlights that rising insurance costs, economic uncertainties, and the need for better capital allocation are pushing both individuals and organizations toward financing solutions. The competitive nature of the insurance sector is also encouraging financial institutions to offer more attractive terms, such as lower interest rates and customizable repayment plans. On the supply side, technological advancements are streamlining processes, reducing paperwork, and enhancing customer experience. On the demand side, businesses are increasingly looking for ways to balance risk management with liquidity. For buyers, this dynamic environment makes premium finance a strategic purchase, as it provides access to comprehensive coverage without straining resources. Research emphasizes that the value lies in maintaining protection while keeping capital free for growth opportunities. This balance of security and flexibility is why more organizations are choosing premium financing as a smart financial tool.

Premium Finance Market Key Recent Developments:

Recent developments in the premium finance industry highlight its growing sophistication and adaptability. Research shows that financial institutions are increasingly offering digital-first solutions, making premium finance quicker and more efficient. Key players have launched mobile apps and online platforms to simplify account management and payment scheduling. Partnerships between insurers and finance providers have also expanded, creating bundled offerings that add value for customers. In addition, regulatory frameworks in several regions are being updated to ensure transparency and protect borrowers, which strengthens consumer trust. Another development is the focus on sustainability, where institutions are aligning financing options with environmentally conscious insurance policies. For buyers, these changes translate into better service, improved accessibility, and greater confidence in premium finance solutions. Research underlines that purchasing premium finance today means benefiting from innovation, stronger compliance, and customer-centric models. These developments are shaping the industry into a more reliable and forward-looking financial service.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/213507/

Premium Finance Market Segmentation:

by Type

Life Insurance

Non-life Insurance

by Interest Rate

Fixed Interest Rate

Floating Interest Rate

by Provider

Banks

NBFCs

Others

Some of the current players in the Premium Finance Market are:

1. Colonnade

2. Banking Truths Team

3. Insurance and Estate Strategies LLC

4. AGENTSYNC, INC.

5. The Annuity Expert

6. J.P. Morgan Private Bank

7. Tennessee

8. Capital for Life

9. Generational Strategies Group, LLC.

10. BNY Mellon Wealth Management

11. Byline Bank

12. Succession Capital Alliance

13. Symetra Life Insurance Company

14. Lions Financial

15. Wintrust

16. Evolution, Inc.

17. Parkway Bank & Trust Company

18. Agile Premium Finance

19. AFCO Insurance Premium Finance

20. BankDirect Capital Finance

21. Valley National Bank

22. ARI Financial Group

23. Peoples Premium Finance

24. FMG Suite

25. Schechter

26. US Premium Finance

27. Lincoln National Corporation

For additional reports on related topics, visit our website:

♦ Contactless Payment Market https://www.maximizemarketresearch.com/market-report/global-contactless-payment-market/54899/

♦ Global Liquid Cooling System Market https://www.maximizemarketresearch.com/market-report/global-liquid-cooling-system-market/33838/

♦ Electronic Recycling Market https://www.maximizemarketresearch.com/market-report/global-electronic-recycling-market/33632/

♦ Global Smart Water Meter Market https://www.maximizemarketresearch.com/market-report/global-smart-water-meter-market/27725/

♦ Millimeter Wave Technology Market https://www.maximizemarketresearch.com/market-report/global-millimeter-wave-technology-market/65864/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading consulting and market intelligence company, recognized for providing in-depth insights and data-driven strategies across industries including healthcare, automotive, technology, and pharmaceuticals. With a strong focus on comprehensive research, future trend analysis, and competitive evaluation, the firm supports businesses in identifying opportunities, minimizing risks, and achieving long-term growth. Its expertise lies in equipping organizations with the knowledge and tools they need to enhance decision-making, optimize performance, and expand their market footprint effectively.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Premium Finance Market to Reach USD 132.88 Billion by 2032, Growing at 11.3% CAGR here

News-ID: 4189638 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Small Interfering RNA (siRNA) Therapeutics Market Poised for Strong Growth, Expe …

Precision gene silencing, expanded therapeutic indications, and delivery innovations set to redefine RNAi-based medicine by 2026

The global Small Interfering RNA (siRNA) Therapeutics Market is entering a transformative phase, driven by rapid scientific progress, regulatory momentum, and growing clinical validation of RNA interference (RNAi) technologies. According to industry analysis, the market is expected to expand at a robust compound annual growth rate (CAGR) of 17.5% from 2024 to 2030, reaching a…

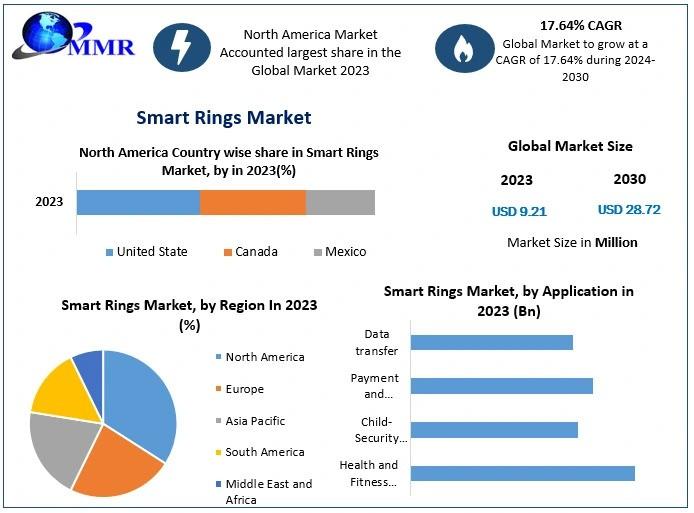

Smart Rings Market Size to Reach USD 39.74 Million by 2032, Growing at 17.64% CA …

Smart Rings Market size was valued at USD 10.83 Million in 2024 and the total Smart Rings revenue is expected to grow at a CAGR of 17.64% from 2025 to 2032, reaching nearly USD 39.74 Million.

The smart ring market is undergoing a rapid transformation from a niche wearable segment into a mainstream health-tech category, significantly bolstered by the entry of major technology giants like Samsung alongside established pioneers such as…

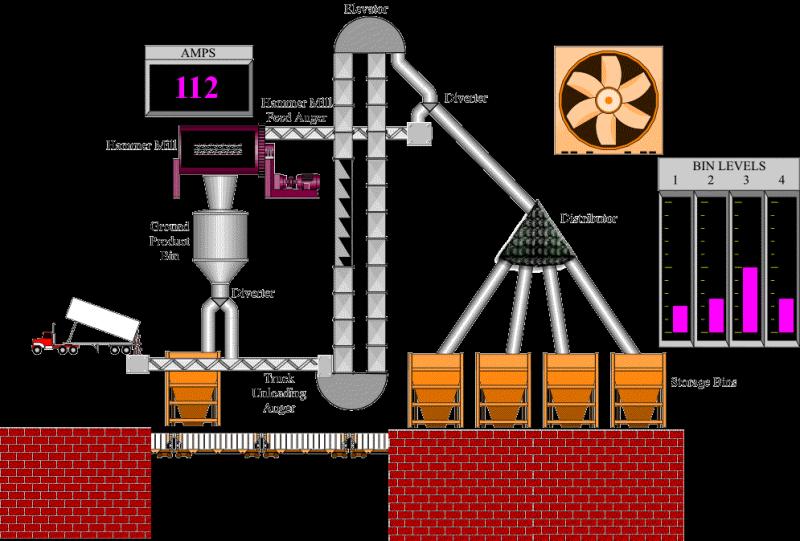

Industrial Automation Market Assessment: Strategic Insights and Competitive Land …

Industrial Automation Market size was valued at USD 184.43 Billion in 2025 and the total Industrial Automation revenue is expected to grow at a CAGR of 8.5% from 2025 to 2032, reaching nearly USD 326.48 Billion by 2032.

The industrial automation market is currently pivoting from traditional mechanization to a highly sophisticated era of "cognitive manufacturing," driven by the global imperative to minimize downtime and optimize resource allocation. As industries face…

Coffee Machine Market Worth $10.72 Billion by 2032: Industry Trends & Analysis

Coffee Machine Market size was valued at USD 6.52 Billion in 2025 and the total Coffee Machine revenue is expected to grow at a CAGR of 7.35% from 2025 to 2032, reaching nearly USD 10.72 Billion by 2032.

The global coffee machine market is experiencing a robust expansion, fundamentally driven by the "third wave" coffee movement which has elevated consumer expectations from simple caffeine consumption to an appreciation of artisanal quality…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…