Press release

Burial Insurance Market Insights, Size, and Demand Projections | Persistence Market Research

The global burial insurance market has been experiencing substantial growth over the past few years, fueled by a combination of demographic changes, financial challenges, and the rising cost of end-of-life services. This article explores the key dynamics of the burial insurance market, including its size, segmentation, key drivers, and regional insights. Furthermore, it sheds light on the trends reshaping this sector, providing a detailed overview of the challenges and opportunities facing industry players.Get a Sample Copy of Research Report (Use Corporate Mail id for Quick Response): https://www.persistencemarketresearch.com/samples/35169

Overview of the Burial Insurance Market

The burial insurance market has become a pivotal component in the broader insurance sector, primarily due to its role in easing the financial burden on families after the death of a loved one. As funeral costs continue to rise globally, more individuals, particularly seniors, are turning to burial insurance policies to ensure their families are not burdened with these significant expenses.

The market is projected to grow from a value of US$ 312 million in 2025 to US$ 449.4 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.4% from 2025 to 2032. According to Persistence Market Research, the aging global population, combined with the increasing prevalence of chronic health conditions, is one of the primary growth drivers of the burial insurance sector. This trend is especially notable in developed regions like North America and Europe, where pre-need funeral plans have gained significant traction.

In 2025, the modified death benefits segment is expected to dominate, with a market share of 44.7%. This is primarily due to the flexible premium adjustments offered by these plans, which are particularly appealing to seniors looking for manageable premium payments over time. The demand for burial insurance is also increasing among people aged 70 and above, who are more likely to experience serious health conditions, further driving the market.

Key Growth Drivers Behind the Market Growth

Several factors are contributing to the steady growth of the burial insurance market. Chief among these is the increasing awareness of funeral costs and the growing number of people seeking to ease the financial strain on their families. In regions such as the United States, where the average funeral cost is between US$ 7,000 and US$ 12,000, burial insurance has become an essential financial tool for individuals looking to secure their family's future.

Moreover, burial insurance has been increasingly integrated into life and health insurance packages, making it more accessible and appealing to a broader audience. The rise of online platforms and digital insurance services has also played a significant role in expanding the reach of burial insurance products, particularly to seniors who might otherwise struggle to secure traditional coverage.

Key Highlights from the Report

• The global burial insurance market is expected to grow at a CAGR of 5.4% from 2025 to 2032.

• The over-70 age group will account for 34.6% of the market share in 2025.

• North America is projected to hold 37.4% of the market share in 2025.

• The modified death benefits segment is expected to dominate the market with 44.7% in 2025.

• The online distribution channel for burial insurance is gaining significant traction.

• A rise in the prevalence of chronic illnesses among seniors is driving the demand for burial insurance.

Market Segmentation

By Product Type

The burial insurance market is segmented based on product type, with three key categories: level death benefits, modified or graded death benefits, and guaranteed acceptance. Each product type caters to specific customer needs.

Level Death Benefit: This plan provides a fixed premium and payout, making it a popular option for individuals seeking stability in their insurance coverage. This plan appeals particularly to people who want immediate coverage and assurance that the funeral expenses will be fully paid without a waiting period.

Modified or Graded Death Benefits: This segment is expected to dominate the market by 2025, accounting for 44.7% of the global market share. These policies offer flexible premium payments and attract customers who want the option to adjust their premiums after 5 to 10 years. However, these plans may not offer full coverage for the first 2 to 3 years, which makes them less appealing to those who require immediate financial assistance for funeral expenses.

Guaranteed Acceptance: This type of burial insurance requires no medical exam, making it particularly attractive to seniors or individuals with pre-existing health conditions who might struggle to find traditional insurance. It provides coverage for final expenses, with approval guaranteed, and is gaining popularity in the market due to its accessibility.

By End-User

The demand for burial insurance is also segmented by age group, with significant focus on the elderly population. In 2025, individuals aged over 70 are expected to hold a dominant share of the market. This demographic is particularly vulnerable to serious health conditions such as cardiovascular diseases, cancer, and diabetes, making them prime candidates for burial insurance policies. Many seniors opt for burial insurance as part of their end-of-life planning to alleviate the financial burden on their families.

Seniors aged 50 and over are also a key demographic, as many start considering burial insurance plans as they age. These individuals tend to look for affordable options, often choosing guaranteed acceptance policies or prepaid funeral plans. The over-80 age group, although smaller in number, is likely to increase the demand for modified or graded death benefit plans due to the higher premiums and limited coverage options associated with these policies.

Read Detailed Analysis: https://www.persistencemarketresearch.com/market-research/burial-insurance-market.asp

Regional Insights

North America

North America holds the largest share of the burial insurance market, with projections indicating it will account for 37.4% of the global market in 2025. This dominance is due to the well-established insurance infrastructure in countries like the U.S. and Canada, where burial insurance is an integral part of end-of-life financial planning. The Affordable Care Act (ACA) has contributed to the increased bundling of funeral expense coverage with other life and health insurance plans.

The rise of digital platforms and insurtech companies has further boosted the growth of burial insurance in North America. Companies like Colonial Penn, AARP, and Mutual of Omaha have tailored plans specifically for seniors, making it easier for them to access burial insurance policies. With funeral homes across North America offering pre-need insurance plans, the market is set to expand rapidly over the forecast period.

Europe

In Europe, the burial insurance market is characterized by the widespread adoption of group funeral insurance policies, which offer affordable coverage for funeral services and related expenses. Countries like Germany, France, and the U.K. have seen significant demand for group policies, which help mitigate the financial burden of funeral costs.

Insurers in Europe are increasingly using digital platforms to improve access to burial insurance. Companies like AXA, Allianz, and Aviva have led the way in offering competitive and cost-effective burial insurance solutions. Spain, where 60% of funerals are pre-planned, is an example of a market where burial insurance is gaining significant ground.

Market Drivers

The primary driver of the burial insurance market is the rising cost of funeral expenses. As the cost of funerals continues to escalate globally, individuals are seeking ways to mitigate these expenses and ensure their families are not left with financial strain. The U.S., for instance, has seen funeral costs soar to an average of US$ 7,848 in 2021, further reinforcing the demand for burial insurance policies.

The aging population is another significant growth driver. As people live longer and face increasing health issues, there is a growing need for burial insurance to cover final expenses. The elderly population, in particular, is more likely to seek out burial insurance as part of their financial planning, driving up demand.

Market Restraints

Despite its growth, the burial insurance market faces several challenges. One of the most pressing issues is the prevalence of misleading advertisements targeting seniors. Some companies use deceptive marketing tactics, such as offering burial insurance for "pennies a day," only to provide minimal coverage.

Another challenge is the complexity of insurance plans. Many consumers, especially seniors, struggle to navigate the various options available, which can lead to confusion and dissatisfaction. Therefore, educating consumers about the different types of burial insurance policies and their benefits is crucial to maintaining market growth.

Market Opportunities

The increasing demand for online and digital burial insurance platforms presents a significant opportunity for market expansion. Many insurers are turning to digital solutions to provide instant quotes, flexible coverage options, and a seamless application process. This trend is particularly beneficial for seniors, who can access burial insurance policies from the comfort of their homes.

Furthermore, the diversification of insurance products to cater to different burial practices across regions offers substantial growth opportunities. In Asia Pacific, for example, insurers are offering policies tailored to specific funeral customs, such as cremation in Japan and traditional Hindu ceremonies in India. This customization can help insurers tap into new markets and increase their customer base.

Request for Customization of the Research Report: https://www.persistencemarketresearch.com/request-customization/35169

Reasons to Buy the Report

• Gain a comprehensive understanding of market trends and key growth drivers.

• Identify the leading product types and end-users in the burial insurance market.

• Understand the regional dynamics and competitive landscape of the market.

• Evaluate the opportunities and challenges faced by industry players.

• Make informed business decisions backed by detailed market insights.

Frequently Asked Questions (FAQs)

• How Big is the Burial Insurance Market?

• Who are the Key Players in the Global Burial Insurance Market?

• What is the Projected Growth Rate of the Burial Insurance Market?

• What is the Market Forecast for Burial Insurance by 2032?

• Which Region is Estimated to Dominate the Burial Insurance Industry through 2032?

Company Insights

Key Players

• Baltimore Life Insurance Company

• United Home Life Insurance Company

• Allianz Life

• State Farm Mutual Automobile Insurance Company

• New York Life Insurance

• Gerber Life Insurance Company

• AAA Life Insurance Company

• Sagicor Life Insurance Company

• Globe Life and Accident Insurance Company

• Assurity Life Insurance Company

Recent Developments

• In December 2024, National Guardian Life Insurance Company (NGL) launched a dedicated funeral home support phone line to assist funeral directors with claims and operational inquiries.

• In October 2024, Sanlam Life Insurance Uganda introduced the Sanlam Comprehensive Life Program, offering an integrated funeral insurance plan for families aged 18 to 65.

The burial insurance market is poised for significant growth in the coming years. With rising funeral costs, an aging population, and the increasing adoption of digital platforms, the market presents numerous opportunities for insurers and consumers alike. However, industry players must address challenges such as misleading advertisements and complexity to ensure continued market expansion.

Read More Related Reports:

Combination Treatments For Scars Market https://www.persistencemarketresearch.com/market-research/combination-treatments-for-scars-market.asp

Animal Health Active Pharmaceutical Ingredients Market https://www.persistencemarketresearch.com/market-research/animal-health-active-pharmaceutical-ingredients-market.asp

Uterine Cancer Diagnostic Testing Market https://www.persistencemarketresearch.com/market-research/uterine-cancer-diagnostic-testing-market.asp

Veterinary Anti Infectives Market https://www.persistencemarketresearch.com/market-research/veterinary-anti-infectives-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Burial Insurance Market Insights, Size, and Demand Projections | Persistence Market Research here

News-ID: 4188883 • Views: …

More Releases from Persistence Market Research

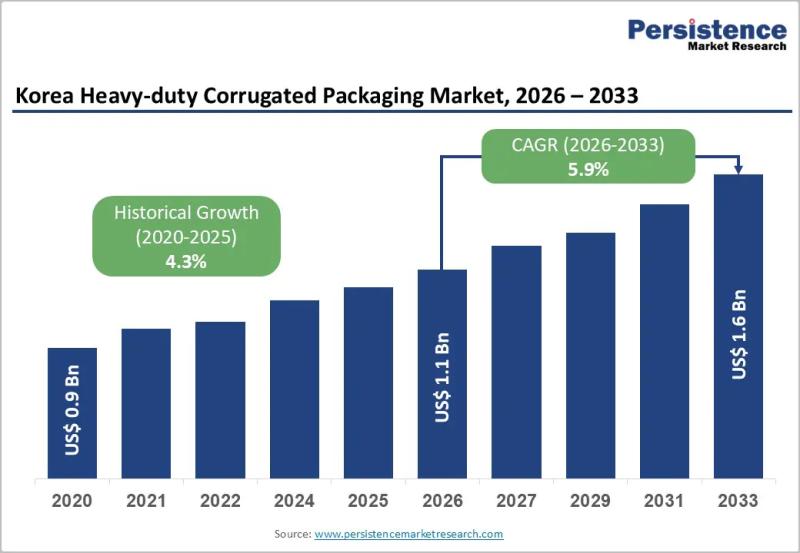

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…