Press release

Flexible Glass for Flexible Electronics Market to Reach USD 2,621 Million by 2031 Top 20 Company Globally

Flexible glass (also described as ultra-thin or rollable glass) is a class of specialty glass substrates manufactured at paper-thin thicknesses (typically tens to a few hundred microns) and engineered to bend, spool or conform while retaining glasss optical clarity, chemical resistance and hermetic barrier properties. In flexible-electronics applications the material is used as a substrate or cover for foldable and rollable displays, wearable screens, flexible touch sensors, high-performance photovoltaic films, heads-up displays and certain medical and automotive surfaces where traditional flexible polymers lack the thermal, barrier or optical performance required by premium devices. The sector spans a supply chain that includes glass-melting and fusion-draw technologies, roll-to-roll handling and slitting, advanced coatings (anti-scratch, barrier, anti-reflection), and value-added conversion and integration services for display OEMs and contract manufacturers. Its economics therefore mix material-volume metrics (square metres of flexible glass sold) with higher value for coated/processed, display-grade rolls and sheet formats used in premium electronics.The flexible glass for flexible-electronics market in 2024 is approximately USD 1,845 million, with a modeled CAGR of 5.1% into 2031. Market size reaching USD 2,621 million by 2031. The flexible glass for flexible electronics 2024 ASP is around USD 150 per sq mt (reflecting commodity thin glass or uncoated industrial rolls) would imply about 12,3 million sq mt sold in 2024. With a cost of goods sold at USD 60 per sq mt, gross profit per sq mt is USD 90, corresponding to a 60% factory gross margin per sq mt. Typical single full production machine/line (full production capacity) is here stated as 20,000,000 sq mt per year.

Latest Trends and Technological Developments

Investment and product activity in 2023 to 2025 focused on roll-to-roll manufacturability, improved surface coatings, reduced total-thickness variation and upstream decarbonization of glass production. Cornings Willow Glass commercialization and sample programs (company product pages and rollout notices) have been repeatedly signposted by suppliers and analysts as enabling roll-to-roll processing for displays and sensors (Corning product material pages and sample announcements). On January 2025, SCHOTT announced recognition for production trials that used 100% hydrogen in optical-glass production an important sustainability development for specialty glass manufacturing that could reduce carbon intensity in future flexible-glass supply chains. In 2024 to 2025 several supplier and consortium initiatives accelerated demo lines and industrial trials: Future Market Insights and other reports cite Corning, AGC and Nippon Electric Glass expanding pilot capacity and collaborating with display OEMs to qualify roll-to-roll lines (FMI report, March 2025). A European consortial project (KONFEKT) involving SCHOTT, tesa SE and VON ARDENNE is actively developing roll-to-roll processing and coating tool chains for flexible glass (announced/covered in 2025). These dated items SCHOTTs January 2025 announcement, Cornings Willow Glass rollout activity (supplier news pages), and consortium initiatives in 2025 illustrate two linked dynamics: rapid industrialization of high-quality flexible glass substrata and attention to decarbonizing and scaling production to meet electronics OEM demand.

Asia-Pacific is the dominant manufacturing and consumption hub for flexible glass used in electronics because the region houses the worlds major display fabs, consumer-electronics OEMs, and precision-coating converters. Country breakdowns in leading trackers (FMI and others) show Japan, South Korea, China and Taiwan as centerpiece markets for R&D and pilot production, with major domestic producers (AGC, Nippon Electric Glass, Corning-partnered entities) investing in roll-to-roll capabilities. The regions scale advantages proximity to OLED/OLED-processing fabs, contract assemblers and device OEMs compress logistics and speed qualification cycles, making APAC the natural early adopter and volume engine for flexible glass substrates. Supplier disclosures and market mappings underscore that a disproportionate share of high-value flexible glass orders and pilot lines in 20242025 were concentrated in East Asia.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5049066

Flexible Glass for Flexible Electronics by Type:

Roll to Roll Flexible Glass

Panel Flexible Glass

Flexible Glass for Flexible Electronics by Application:

Consumer Electronics

Automotive

Medical Devices

Display Application

Others

Global Top 20 Key Companies in the Flexible Glass for Flexible Electronics Market

Corning Incorporated

AGC Inc

Nippon Electric Glass

Schott AG

Saint Gobain

Asahi Glass Co

BOE Technology Group

Apple Inc

Samsung Electronics

LG Display Co., Ltd.

Nippon Sheet Glass

Central Glass Co., Ltd

Noval Glass

Emerge Glass

Kyocera Corporation

Abrisa Technologies

Konshen Glass

Dupont De Nemoirs Inc

Kent Displays Inc

Materion Corporation

Regional Insights

ASEANs role in the flexible-glass value chain in 2024 is principally downstream demand and an emerging assembly hub for displays and wearables rather than a leading region for glass substrate manufacture. Nevertheless, as some display OEMs and contract assemblers look to diversify capacity beyond China, several Southeast Asian countries (Vietnam, Malaysia, Thailand and particularly Indonesia for large-scale assembly) are attracting investment in panel assembly and device finishing that increases local demand for spooled substrates and converted glass components. Indonesias large domestic market for consumer electronics and rapid expansion of electronics manufacturing zones makes it a natural growth corridor for unit volumes initially in lower-thickness, uncoated or lightly coated rolls for mid-tier devices and later for premium, fully processed sheets as local capability and supply-chain services mature. Market trackers and supplier tender notices in 20242025 show rising interest in regional distribution hubs and local converting services targeted at ASEAN device assemblers.

Flexible glass must cross several commercialization hurdles to reach mass adoption. First, manufacturing cost and yield: rolling fusion-draw processes and high-yield roll-to-roll handling are capital intensive and require stringent TTV (total thickness variation) control; until yields rise, ASPs for display-grade flexible glass remain high. Second, coatings and lamination: achieving robust anti-scratch, anti-reflection and flexible conductive coatings that survive folding cycles is non-trivial and adds processing steps and cost. Third, integration and device reliability: glasss superior barrier and thermal performance must be reconciled with bend radii, flex fatigue and lamination stacks used in flexible OLEDs and other devices device-level validation takes time. Fourth, supply concentration and trade/regulatory friction: a small number of specialized producers (Corning, AGC, NEG, SCHOTT) command expertise and capacity, creating potential supply risks and regulatory/antitrust attention in some jurisdictions. Finally, competition from advanced polymers (polyimide, PEN) remains a practical challenge where cost or extreme bendability trump glasss benefits; polymers can still be cheaper for many low-end flexible uses. These constraints explain why premium devices lead adoption initially and why scaling to mass consumer volumes remains a multi-year task.

Companies that will win combine (a) proven roll-to-roll manufacturing scale and yield improvement, (b) strong coating/lamination ecosystems (either in-house or via co-sourcing partners), and (c) tight partnerships with display OEMs to co-develop form-factors and qualification pathways. Vertical moves that secure upstream glass feedstock, invest in lower-carbon production (hydrogen trials such as SCHOTTs) and establish regional supply/distribution hubs for APAC and ASEAN will shorten lead times and reduce landed cost a key advantage as device OEMs shift assembly footprints. For product developers, focusing on substrate formats that enable lower lamination complexity (hermetic single-layer barriers, pre-coated rolls) will reduce integration cost and accelerate adoption. For buyers in ASEAN, early contracts for spooled flexible glass with local converting partners give cost and time-to-market advantages over ad-hoc imports.

Product Models

Flexible glass is an advanced material designed for next-generation flexible electronics, offering the durability of traditional glass while maintaining bendability and thinness. It is widely applied in foldable displays, wearable devices, solar cells, and sensors.

Roll-to-Roll Flexible Glass which enables continuous large-scale manufacturin. Notable products include:

Willow Glass Corning Inc.: Ultra-thin glass in roll form, engineered for flexible displays and solar cells.

SCHOTT Flexglass SCHOTT AG: German-engineered glass designed for roll-to-roll OLED and sensor production.

AGC Roll-Tech Flexible Glass Asahi Glass Company (AGC): High-transparency flexible substrate optimized for touch panels and lighting.

Nippon Electric Glass (NEG) Rollable Glass NEG: Thin, durable glass developed for flexible electronics manufacturing.

Xensation Flex Rollable Glass SCHOTT: Chemically strengthened glass with high bendability and scratch resistance.

Panel Flexible Glass which provides precision-cut sheets for high-end device applications. Examples include:

Huawei Flexible Cover Glass Huawei Technologies: Proprietary flexible panel glass used in Huawei foldable devices.

BOE Flexible Panel Glass BOE Technology Group: Panel substrate for foldable OLED displays manufactured in China.

Visionox Flexible Glass Panel Visionox: Used in foldable smartphones and flexible wearable displays.

TCL Flexible Display Glass TCL CSOT: Thin glass sheet integrated into TCL foldable display panels.

Royole Flexible Glass Sheet Royole Corporation: Developed for foldable smartphones and consumer electronics.

Flexible glass for flexible electronics is a high-value, fast-evolving materials market with a strong technology push from display OEMs and device makers. Using reconciled industry sources, we estimate the 2024 market at roughly USD 1,845 million and model a central CAGR of 5,1%, producing significant expansion by 2031 as premium foldable devices, AR/VR optics, automotive HUDs and industrial rollable displays scale. Asia-Pacific will remain the dominant region by value and capacity; ASEAN will grow faster in unit demand as local assembly and conversion expand. Adoption risks remain technological and commercial, but supplier investments, consortium efforts and nascent low-carbon production trials indicate a maturing industry structure oriented toward scaled roll-to-roll output.

Investor Analysis

What investors should note is that flexible glass is not a commodity paper-thin substrate but a materials platform that enables premium device features (folding, rollable, hermetic sensors) and therefore commands differentiated margins once volume and yield improve. How value accrues: investors can capture upside by backing companies that control specialized roll-to-roll manufacturing (high entry barriers), coating and conversion ecosystems (capture value add), or by financing regional converting hubs serving APAC/ASEAN OEMs (lower capex and faster payback). Why invest now: supplier moves, pilot-line expansions and sustainability-focused production improvements in 20242025 materially shorten the commercialization timetable; early strategic positions with major OEMs or in regional converting capacity can secure long-term offtake and margin capture. Key diligence points: demonstrated roll-to-roll yields at device-grade TTV, binding offtake agreements with display OEMs, coating IP and durability test data, and pathway to reduce unit cost

Request for Pre-Order Enquiry On This Report

http://qyresearch.com/customize/5049066

5 Reasons to Buy This Report

It reconciles multiple specialist market trackers into a defensible 2024 baseline and an explicit CAGR to support investment and procurement scenarios.

It translates dollars into practical material-volume ranges using transparent ASP sensitivities so manufacturers and integrators can model capacity and logistics.

It documents dated, commercial-grade industry developments that accelerate industrialization pathways.

It delivers Asia and ASEAN operational insight so go-to-market or capex plans can prioritize the right locations.

It profiles the supplier landscape and technical levers that determine which firms can capture premium margins and durable share.

5 Key Questions Answered

What is a defensible global market size for flexible glass used in flexible electronics in 2024 and what CAGR should be used to model growth to 2031?

What realistic ASP bands apply to flexible glass (USD/m2) and what implied square-metre shipment ranges did 2024 represent under low/mid/high scenarios?

Which dated supplier or industry events (20242025) materially reduce commercialization risk and accelerate scaled roll-to-roll production?

How will Asia and ASEAN demand and manufacturing footprints affect regional sourcing, conversion and logistics for flexible glass substrates?

Which supplier capabilities most reliably translate R&D into margin-rich commercial sales?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Flexible Glass for Flexible Electronics Market to Reach USD 2,621 Million by 2031 Top 20 Company Globally here

News-ID: 4188847 • Views: …

More Releases from QY Research

High Margins, High Growth: Inside the Global Luxury Beauty Opportunity

Luxury beauty encompasses premium skincare, cosmetics, fragrance, haircare, dermo-cosmetics, and prestige personal care products positioned with superior ingredients, branding, exclusivity, and high ASPs.

Core value drivers include brand heritage, innovation in active ingredients, dermatological efficacy, sustainability claims, and experiential retail.

Consumers increasingly view luxury beauty as self-care + wellness investment, not discretionary spending alone.

Distribution mix: specialty beauty retail, department stores, travel retail, e-commerce, brand boutiques, medical aesthetic clinics.

Global Market Snapshot

Market size (2025):…

Security Seals Market 20252032: Smart Tech, Recurring Revenue, and Investor Upsi …

Single use security seals are tamper-evident mechanical or plastic locking devices designed for one-time application to secure containers, trucks, meters, ballot boxes, airline carts, cash bags, and logistics assets

Core function: theft deterrence, chain-of-custody control, compliance with customs, transport, and regulated industries

Widely used in logistics, utilities, aviation catering, banking, postal, healthcare, and e-commerce fulfillment

Market characterized by high volume, low ASP consumables with recurring replacement demand

Global Overview

Global market size (2025): USD 352…

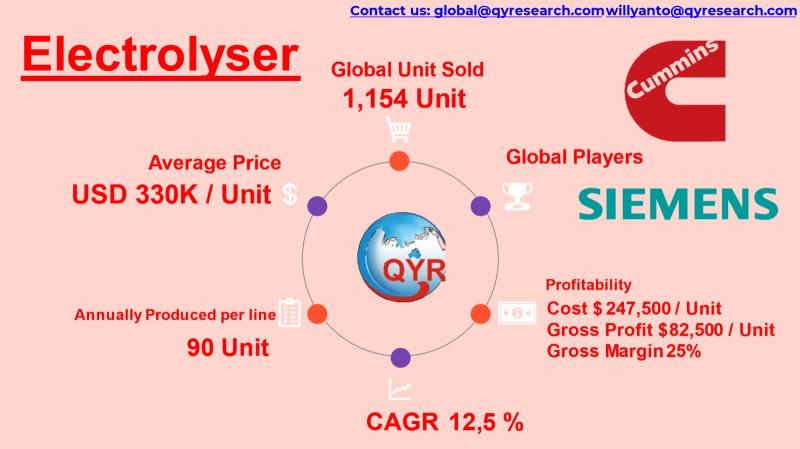

Hydrogen Infrastructure Surge: Why Electrolysers Are the Next Energy Investment …

Electrolyser systems are core equipment for producing green hydrogen through water electrolysis, converting electricity (increasingly renewable) into hydrogen and oxygen.

The industry underpins decarbonization across refining, fertilizers, steelmaking, mobility, and grid storage, making electrolysers a critical enabling technology for the global energy transition.

Technology categories include alkaline (AEL), proton exchange membrane (PEM), and solid oxide (SOEC), each optimized for different cost, efficiency, and operating profiles.

Global Market Overview

Global market size (2025): USD 381…

Top 30 Indonesian Dairy Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Indofood Sukses Makmur Tbk (INDF)

PT Indofood CBP Sukses Makmur Tbk (ICBP)

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ)

PT Cisarua Mountain Dairy Tbk (CMRY)

PT Diamond Food Indonesia Tbk (DMND)

PT Mulya Boga Raya Tbk

PT Campina Ice Cream Industry Tbk

PT Kurniamitra Duta Sentosa Tbk

PT Greenfields Indonesia

PT Indolakto (subsidiary/brand under Indofood)

PT Ultra Jaya Frozen Foods (group affiliate)

PT Heilala Dairy Indonesia (export arm/processing)

PT Diamond Milk Products (non-listed…

More Releases for Glass

Depression Glass Market 2023- Industry Revenue and Price | Hazel-Atlas Glass Com …

The Depression Glass market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Auto Glass Market Is Booming Worldwide | Fuyao Glass, Webasto, Xinyi Glass, Asah …

Advance Market Analytics published a new research publication on "Auto Glass Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Auto Glass market was mainly driven by the increasing R&D spending across the world. Some of the key players profiled…

Recycled Glass Market 2023 Business Strategies - Cap Glass, Glass Recycled Surfa …

Newly added by Fior Markets study on Global Recycled Glass Market 2023 contains a detailed analysis of data through industrial dynamics which has a major impact on the growth of the market. The report categorizes the global Recycled Glass market by segmented top key players, type, application, marketing channel, and regions. The report provides a complete understanding of the market in the coming years. It looks over the market with…

Glass Easy-clean Glass Market 2019| Pilkington Glass, PPG Industries, Ravensby W …

The global market status for Easy-clean Glass is precisely examined through a smart research report added to the broad database managed by Market Research Hub (MRH). This study is titled “Global Easy-clean Glass Market” Research Report 2019, which tends to deliver in-depth knowledge associated to the Easy-clean Glass market for the present and forecasted period until 2025. Furthermore, the report examines the target market based on market size, revenue and…

Insulated Glass Market Analysis: Top Companies Includes (Cardinal Glass Industri …

Insulated glass refers to two or more lites of glass sealed around the edges with an air space between, to form a single unit.

Insulating glass is a very effective way to reduce air-to-heat transfer through the glazing. When used in conjunction with low-E and/or reflective coatings, IG units perform even better for conserving energy and complying with local codes. The most common configuration of IG units for commercial building is…

Global Ground Glass Market 2017- CSG, XINYI Glass, JINJING Glass, SYP Glass, Yao …

The market research report by QY Research provides detailed study on the overall Ground Glass market size, its financial positions, its unique selling points, key products, and key developments. This research report has segmented the Ground Glass market based on the segments covering all the domains in terms of type, country, region, forecasting revenues, and market share, along with analysis of latest trends in every sub-segment.

CLICK HERE to Request Sample…