Press release

Global Autonomous Freight Trucks Market to Reach USD 1489 Million by 2031 at 21.1% CAGR Driven by Volvo and Daimler

According to the latest industry outlook from QYResearch, the global autonomous freight trucks market is expected to grow from US$398 million in 2024 to US$1,489 million by 2031, at a 21.1% CAGR (2025-2031). The period of 2024-2025 has marked a transition from extended pilot programs to the first waves of commercial deployment. This shift is underscored by the launch of driverless freight services, factory production of autonomous-ready platforms, and accelerated adoption in logistics and port operations.Recent guidance puts revenue at US$0.65-0.85 per mile for Driver-as-a-Service. Using public breakdowns, a reasonable early-scale cost stack is roughly US$0.25-0.50 per mile (hardware & redundancy amortization ≈ $0.10-0.20/mi; remote/onsite support ≈ $0.05-0.20/mi; connectivity/maps/insurance/admin ≈ $0.05-0.10/mi). That implies gross profit of about US$0.15-0.60 per mile and a gross margin band of ~25%-60% (most likely 35%-45% near-term, with room to expand as sensor costs fall and support ratios improve).

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample/4819708

Leading Companies

Volvo

Daimler

TuSimple

Tesla

Waymo

Westwell

PlusAI

Pony.ai

Kodiak Robotics

Suzhou Zhitu Technology

Inceptio Technology

BYD

Applications

Logistics

Port

Other

Classification

New Energy Trucks

Traditional Fuel Trucks

Latest Data

• Market size: US$398 million in 2024, projected to reach US$1,489 million by 2031

• CAGR: 21.1% (2025-2031)

• Regional expansion across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

• Segment coverage: by Type (New Energy vs. Traditional Fuel) and by Application (Logistics, Port, Other)

• Leading companies capturing the majority of market share, with Volvo at the forefront of 2024 sales

Five Company Product Profiles

Volvo - Volvo VNL Autonomous

• Integrated with the Aurora Driver autonomy stack

• Equipped with long-range lidar (~500 m), radar, and camera systems

• Pilot production initiated at the New River Valley plant for factory calibration and process validation

• Commercial debut in May 2024 with scaling planned through 2025

Daimler - Autonomous-Ready Freightliner Cascadia

• Fifth-generation model with redundant braking and steering systems

• Production-intent autonomy hardware directly installed during manufacturing

• Active testing on Southwest U.S. routes, including Laredo-Dallas lanes

• Market entry for SAE Level 4 hub-to-hub trucking targeted for 2027

Kodiak Robotics - Sixth-Generation Autonomous Truck

• Production-ready platform revealed at CES 2024

• Deployed in Atlas Energy Solutions' customer-owned "RoboTruck" fleet

• Completed over 100 fully driverless commercial deliveries in early 2025

• Expansion to near 24/7 operations in Permian Basin freight lanes

Westwell - Q-Truck Autonomous Tractor

• Port-focused electric and autonomous tractor for container handling

• Achieved more than 334,000 container moves at Hutchison Ports' Laem Chabang terminal

• 2025 marked by repeat orders and new trials at CSP ADT and HIT terminals

• Energy-efficient operation with measurable reductions in per-container costs

Inceptio Technology - Xuanyuan Platform

• Recorded over 200 million kilometers of supervised commercial operations by late 2024

• Collaborative deliveries with Dongfeng Trucks into major express fleets, including STO Express

• Expanding large-scale supervised autonomy to accelerate validation for Level 4 readiness

• Positioned as one of China's largest data-driven platforms for heavy truck autonomy

Downstream Customers

Atlas Energy Solutions

Uber Freight

Hirschbach Motor Lines

Schneider National

C.R. England

J.B. Hunt Transport Services

Werner Enterprises

FedEx

UPS

PSA International

Hutchison Ports

STO Express

JD Logistics

ZTO Express

Nestlé China

Market Trends

Commercial Driverless Becomes Reality

In 2025, the industry witnessed the launch of the first commercial driverless freight lanes. Aurora began driverless operations between Dallas and Houston, with plans to expand to El Paso and Phoenix by year-end. The company has reported more than 10,000 customer loads and over three million supervised autonomous miles leading up to the driver-out milestone, signaling the maturity of its operational model.

Customer-Owned Driverless Fleets

For the first time, customer-owned driverless fleets entered revenue service. Kodiak Robotics and Atlas Energy Solutions launched a dedicated fleet of RoboTrucks, completing 100 fully driverless loads in Texas. Additional trucks delivered in mid-2025 enabled nearly continuous service windows, showing that autonomous freight is no longer just operator-led but part of customer capital investments.

Factory Integration of Autonomy

Volvo and Daimler both transitioned from retrofits to factory-installed autonomous systems. Volvo began pilot production of its VNL Autonomous at the New River Valley plant, focusing on calibration and redundancy. Daimler introduced the autonomous-ready Freightliner Cascadia, equipped with redundant safety systems and production-intent autonomy hardware. This step reduces aftermarket complexity and ensures scalability in manufacturing.

Hub-to-Hub Operations

Hub-to-hub corridors continue to dominate deployment strategies. Aurora's Dallas-Houston route, Daimler and Torc's Laredo-Dallas lane, and Kodiak's industrial sand transport routes illustrate that repeatable, high-volume logistics lanes provide the most efficient and controlled environment for autonomy. These routes bypass urban density and focus on long-haul efficiencies.

Ports as Early Adopters

Ports remain the most advanced environments for autonomous truck deployment. Westwell's Q-Truck has moved over 334,000 containers in Laem Chabang since 2020, and 2025 saw repeat orders and trials at major terminals. Port environments offer controlled conditions, predictable duty cycles, and ideal conditions for combining electrification with autonomy.

Scale of Supervised Autonomy in China

In China, Inceptio Technology expanded its supervised operations to more than 200 million commercial kilometers by 2024. Partnering with OEMs such as Dongfeng and customers like STO Express, the company is leveraging L2+/L3 operations at scale to shorten the validation curve for Level 4 readiness. This model highlights how large supervised datasets reduce edge-case risks.

Industry Consolidation

The competitive landscape has narrowed. Some early entrants have paused or withdrawn their programs, leaving a more concentrated set of players such as Aurora, Volvo, Daimler/Torc, Kodiak, and Inceptio. This consolidation directs capital and expertise toward a smaller number of commercialization strategies, improving clarity in market direction.

Regulation and Safety Standards

Texas continues to lead as the most permissive jurisdiction for driverless trucking. At the same time, new oversight in 2025 has introduced reporting requirements, cybersecurity standards, and operational domain rules. Companies now routinely publish detailed safety case documentation, improving transparency and reinforcing trust among regulators and shippers.

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4819708

Convergence of Autonomy and Electrification

Beyond diesel platforms, manufacturers are exploring the integration of zero-emission powertrains with autonomy. Daimler demonstrated an autonomous eCascadia concept, highlighting a future where electric drivetrains align with autonomy in middle-mile and port applications. This convergence points to sustainability benefits as regulatory pressure on emissions grows.

Conclusion

The year 2025 marks a turning point for autonomous freight trucks. Commercial driverless launches, customer-owned fleets, OEM factory production, and large-scale data operations in China have accelerated industry confidence. With growth expected to multiply nearly fourfold by 2031, the market now moves beyond speculation into tangible adoption. Logistics and port applications are leading the way, while hub-to-hub operations and OEM readiness create a roadmap for the next phase of freight automation worldwide.

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Details

Tel: +1 626 2952 442 ; +41 765899438(Tel & Whatsapp); +86-1082945717

Email: john@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Autonomous Freight Trucks Market to Reach USD 1489 Million by 2031 at 21.1% CAGR Driven by Volvo and Daimler here

News-ID: 4188771 • Views: …

More Releases from QYResearch Europe

Global Aerospace Grade Smart Assembly Lines Market 2024 USD 4251 Million to 2031 …

According to recent report from QYResearch, the global market for aerospace-grade smart assembly lines stood at US$4,251 million in 2024 and is projected to reach US$8,712 million by 2031 at a 10.2% CAGR (2025-2031). In 2024, approximately 670 lines were produced globally at an average selling price (ASP) of about US$6.343 million per line. These highly automated systems integrate AI, industrial robotics, advanced sensing, and digital control to deliver repeatable,…

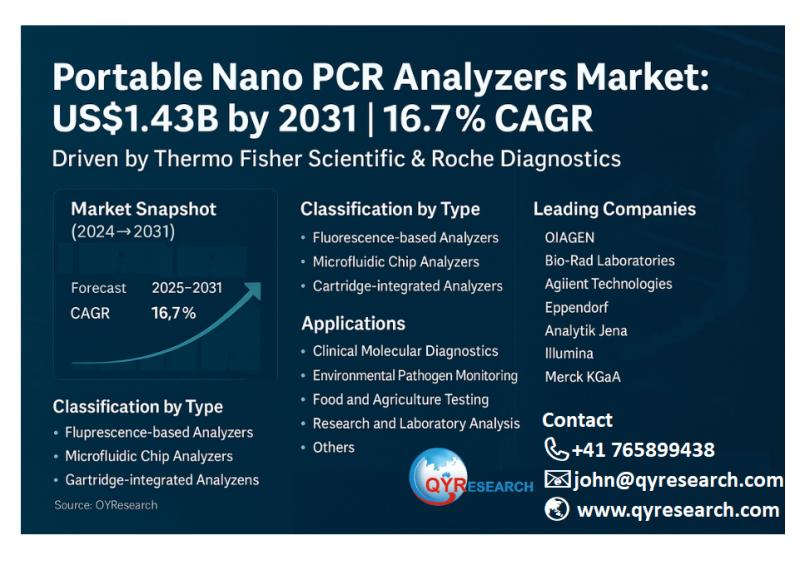

Portable Nano PCR Analyzers Market Growth to US$1.43 Billion by 2031 with 16.7% …

According to the latest QYResearch Report, the global market for Portable Nano PCR Analyzers was valued at US$484 million in 2024 and is expected to reach US$1,427 million by 2031, growing at a CAGR of 16.7% during the forecast period of 2025-2031. Global production in 2024 reached around 96,800 units, with an average price of about US$5,000 per unit. These portable devices utilize nanotechnology-enhanced PCR processes for rapid on-site genetic…

Global Multiphase Flow Conveying Equipment Market to Reach USD 10.88 Billion by …

The global market for Multiphase Flow Conveying Equipment is transitioning from a specialized engineering niche to a core enabler of industrial efficiency across upstream energy, chemicals, mining, and wastewater sectors. According to QYResearch 2025 edition of Multiphase Flow Conveying Equipment - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031, the market was valued at US$7,380 million in 2024 and is projected to reach US$10,879 million by 2031,…

Global Smart Eye-Tracking Medical Devices Market Size Reaches US$3.0 Billion by …

The global Smart Eye-Tracking Medical Devices market has entered a stage of accelerated clinical adoption and product diversification. According to QYResearch 2025 Global Smart Eye-Tracking Medical Devices Market Research Report, the market was valued at US$973 million in 2024 and is projected to reach US$3,009 million by 2031, growing at a CAGR of 17.5% from 2025 to 2031. Global output in 2024 reached approximately 64,900 units, with an average price…

More Releases for Truck

Food Truck Market Size, Share Projections 2032 by Key Manufacturer- Prestige Cus …

USA, New Jersey: According to Verified Market Research analysis, the global Food Truck Market size was valued at USD 4.52 Billion in 2024 and is projected to reach USD 7.15 Billion by 2031, growing at a CAGR of 5.90% from 2024 to 2031.

How AI and Machine Learning Are Redefining the Future of Food Truck Market?

The integration of AI and machine learning is rapidly transforming the Food Truck Market by enabling…

Hydrogen Fuel Cell Truck Market By Truck Type (Light Duty Truck, Medium Duty Tru …

Hydrogen Fuel Cell Truck Market Size

By truck type, the heavy duty truck segment was the highest revenue contributor to the market, and is estimated to reach $1,763.4 million by 2032, with a CAGR of 32.9%.

Get Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0H932/Hydrogen_Fuel_Cell_Truck_Market_By_Truck_Type_Light_Duty_Truck_Medium_Duty_Truck_Heavy_Duty_Truck_By_Range_Below_400_Km_Above_400_km_By_Power_Output_Below_150_KW_151_250_KW_Above_250_KW_Global_Opportunity_Analysis_and_Industry_Forecast_2023_2032

Hydrogen Fuel Cell Truck Market By Truck Type (Light Duty Truck, Medium Duty Truck, Heavy Duty Truck), By Range (Below 400 Km, Above 400 km), By Power Output (Below 150 KW, 151 -…

Freight Trucking Market : Dry van & box truck, Refrigerated truck, Tanker truck …

The global freight trucking market was valued at $2,732 billion in 2021, and is projected to reach $4,457.4 billion by 2031, growing at a CAGR of 5.1% from 2022 to 2031.

Asia-Pacific is expected to dominate the global freight trucking market in 2021. The growth of the market in Asia-Pacific is majorly attributed to the booming e-commerce industry in emerging economies in the region. High government support for development of logistics…

Freight Trucking Market : Dry van & box truck, Refrigerated truck, Tanker truck …

According to a new report published by Allied Market Research, titled, "Freight Trucking Market," The freight trucking market was valued at $2,732.00 billion in 2021, and is estimated to reach $4,457.4 billion by 2031, growing at a CAGR of 5.1% from 2022 to 2031.

Asia-Pacific is expected to dominate the global freight trucking market in 2021. The growth of the market in Asia-Pacific is majorly attributed to the booming e-commerce industry…

Commercial Truck Leasing Market Report- Applications, Type, Deployment, Organiza …

The Commercial Truck Leasing Market research report presents an intensive and coordinated exploration of the current circumstance, market key elements, Commercial Truck Leasing Market methodologies, and central participants' development in the business. The investigation helps controllers and corporate leaders in developing cost-effective decisions. Commercial Truck Leasing Market provides an evenhanded and extensive assessment of existing examples, factors, obstacles, limits, headway, possibilities/quick development areas that will help partners create business plans…

Semi-Autonomous Truck Truck Market to Witness Robust Expansion by 2025

LP INFORMATION recently released a research report on the Semi-Autonomous Truck Truck market analysis, which studies the Semi-Autonomous Truck Truck's industry coverage, current market competitive status, and market outlook and forecast by 2025.

Global "Semi-Autonomous Truck Truck Market 2020-2025" Research Report categorizes the global Semi-Autonomous Truck Truck market by key players, product type, applications and regions,etc. The report also covers the latest industry data, key players…