Press release

Carbon Credit/Carbon Offset Market to Reach US$ 2,507.1 Bn by 2032 Fueled by 12.1% CAGR Growth - Persistence Market Research

➤ Overview of the MarketThe carbon credit/carbon offset market has emerged as one of the most influential instruments in combating climate change by enabling companies, governments, and individuals to compensate for their carbon emissions. Through regulated and voluntary trading schemes, organizations can purchase credits generated by verified emission reduction projects such as reforestation, renewable energy installations, and methane capture initiatives. The strong growth of the market reflects a rising urgency among stakeholders worldwide to align with net-zero targets, comply with regulatory frameworks, and meet consumer demand for sustainable business practices.

According to the latest study by Persistence Market Research, the global carbon credit/carbon offset market is projected to grow from US$ 1,124.4 Bn in 2025 to US$ 2,507.1 Bn by 2032, at an impressive CAGR of 12.1%. The voluntary carbon offset segment has gained significant traction, largely due to increasing participation by corporations committed to ESG (environmental, social, and governance) standards. From a geographical perspective, Europe leads the market, supported by stringent EU emission trading systems (ETS) and robust regulatory frameworks. Meanwhile, North America and Asia Pacific are also witnessing strong momentum as governments adopt carbon pricing mechanisms and corporations pursue sustainability strategies.

🔗Dive deeper into the market data: https://www.persistencemarketresearch.com/market-research/carbon-credit-carbon-offset-market.asp

➤ Key Market Insights

• Voluntary carbon markets are expanding as corporations commit to carbon neutrality and ESG targets.

• Renewable energy and forestry projects dominate as key sources of carbon credits.

• Europe remains the largest regional market due to strict climate policies and carbon pricing regulations.

• Corporate buyers, especially in technology and finance sectors, are driving demand for offsets.

• Increasing transparency and digitization of carbon trading platforms are improving credibility and accessibility.

➤What is the main purpose of carbon credits in climate change mitigation?

Carbon credits serve as a market-based mechanism to reduce greenhouse gas emissions by allowing organizations to offset their carbon footprint. Each credit represents the removal or avoidance of one metric ton of CO2 or equivalent gases. Companies purchase these credits to meet compliance requirements or achieve voluntary sustainability goals. The system incentivizes investment in renewable energy, forest conservation, and carbon capture projects while creating a financial value for emission reductions. In essence, carbon credits not only help businesses move closer to carbon neutrality but also accelerate the global transition to a low-carbon economy.

➤ Market Dynamics

Drivers: The primary drivers of this market include stringent government climate policies, the rise of corporate sustainability commitments, and the growing popularity of voluntary carbon markets. Heightened awareness of climate risks among investors and consumers further accelerates demand for credible carbon offsetting solutions.

Market Restraining Factor: The market faces challenges from inconsistent regulatory frameworks, limited verification standards, and risks of greenwashing. The lack of uniformity across jurisdictions and varying quality of credits can undermine market credibility and hinder large-scale adoption.

Key Market Opportunity: A major opportunity lies in the integration of blockchain and digital platforms to enhance transparency and trust in credit trading. Additionally, emerging economies present vast opportunities as they develop renewable energy and reforestation projects capable of generating significant carbon credits.

🔗Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/33769

➤ Market Segmentation

The carbon credit/carbon offset market can be segmented by type, project category, and end-use sector. By type, the market is categorized into compliance credits and voluntary credits. Compliance credits are governed by regulatory schemes such as the EU Emission Trading System and California's cap-and-trade program. They are purchased by organizations legally bound to reduce emissions. On the other hand, voluntary credits are driven by corporate sustainability commitments and consumer-facing brands seeking to strengthen their environmental credentials. The voluntary segment is growing faster due to increasing corporate pledges toward net-zero emissions.

By project category, credits are primarily generated from renewable energy, forestry and land use, methane capture, and others. Renewable energy projects such as wind, solar, and hydro dominate the segment, followed by forestry projects that focus on reforestation and avoided deforestation. Forestry credits, in particular, are gaining global attention as they not only reduce carbon but also support biodiversity and local community development. Methane capture projects in agriculture and waste management are also emerging as lucrative contributors to carbon offset programs. This diverse segmentation ensures that organizations can align credit purchases with their sustainability objectives while contributing to global emission reduction goals.

➤ Regional Insights

Europe dominates the global carbon credit/carbon offset market due to its long-standing leadership in climate policies and carbon pricing mechanisms. The EU Emission Trading System (ETS) has set a strong precedent, making Europe a hub for both compliance and voluntary credit trading. North America follows closely, with the U.S. and Canada adopting state-level and federal initiatives to curb emissions. Asia Pacific is emerging as the fastest-growing region, led by China's national carbon market and increasing participation from Japan, South Korea, and India. Latin America and Africa are positioned as key suppliers of credits, particularly through forestry and renewable energy projects, offering global buyers diverse offsetting options.

➤ Competitive Landscape

The market is moderately fragmented, with global players and regional project developers working together to meet rising demand. Companies are expanding through acquisitions, partnerships, and investments in technology-driven trading platforms.

➤ Company Insights

✦ South Pole Group

✦ Verra

✦ Gold Standard Foundation

✦ ClimeCo

✦ Climate Impact Partners

✦ 3Degrees Group Inc.

✦ Carbon Credit Capital

✦ NativeEnergy

✦ Biofílica Ambipar Environment

✦ EcoAct (Atos SE)

🔗For Customized Insights on Segments, Regions, or Competitors, Request Personalized Purchase Options @ https://www.persistencemarketresearch.com/request-customization/33769

➤ Key Industry Developments

In recent years, the industry has witnessed the rapid rise of digital carbon credit marketplaces aimed at increasing transparency and reducing transaction inefficiencies. Companies like Verra and Gold Standard are strengthening verification standards to improve the integrity of voluntary credits. Strategic collaborations between corporations and project developers are increasing, with firms like Microsoft, Amazon, and Google investing in large-scale forestry and carbon capture projects to achieve long-term net-zero goals.

Additionally, financial institutions are entering the carbon offset market, treating credits as investment-grade assets. The growing involvement of banks and asset managers is professionalizing the sector and unlocking new sources of funding for emission reduction projects. This trend is expected to accelerate as carbon markets mature and expand globally.

➤ Innovation and Future Trends

Innovation in the carbon credit/carbon offset market is largely centered around digitalization, blockchain integration, and AI-powered monitoring systems. Blockchain ensures traceability of carbon credits, preventing double counting and fraud. Advanced satellite imaging and AI-driven analytics are being deployed to validate forest and land-use projects more accurately, thereby improving credibility.

Looking ahead, the market is expected to evolve with the integration of carbon removal technologies such as direct air capture (DAC) and bioenergy with carbon capture and storage (BECCS). These projects are gaining momentum as businesses seek permanent carbon reduction solutions. As regulatory frameworks strengthen and voluntary commitments increase, the carbon credit/carbon offset market is poised to become a cornerstone of global climate action, connecting environmental responsibility with economic opportunity.

➤Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

➤About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Credit/Carbon Offset Market to Reach US$ 2,507.1 Bn by 2032 Fueled by 12.1% CAGR Growth - Persistence Market Research here

News-ID: 4188019 • Views: …

More Releases from Persistence Market Research

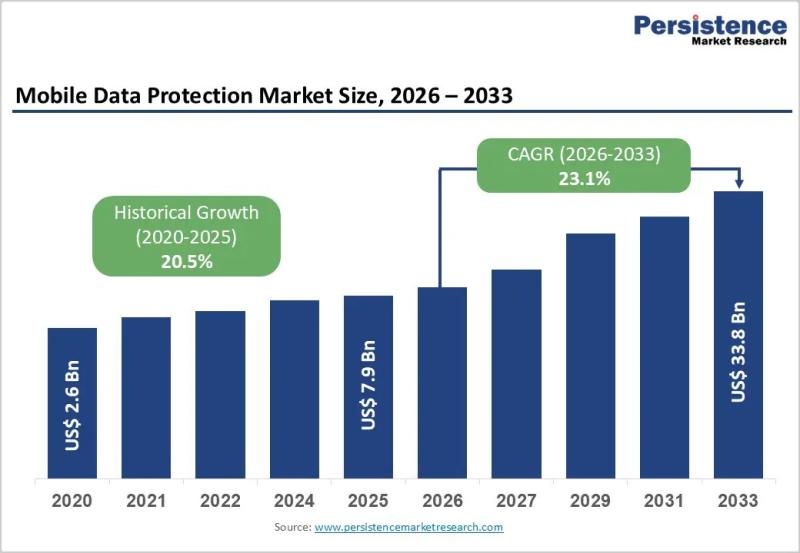

Mobile Data Protection Market Set for Rapid Growth Amid Rising Cyber Threats

Mobile devices have become the backbone of modern digital ecosystems. From enterprise communications and cloud access to mobile payments and healthcare workflows, smartphones and tablets now handle vast volumes of sensitive data. While this shift has dramatically improved productivity and connectivity, it has also exposed organizations to unprecedented cybersecurity risks. As mobile endpoints proliferate across corporate networks-often outside traditional security perimeters-the need for robust mobile data protection has become mission-critical.

The…

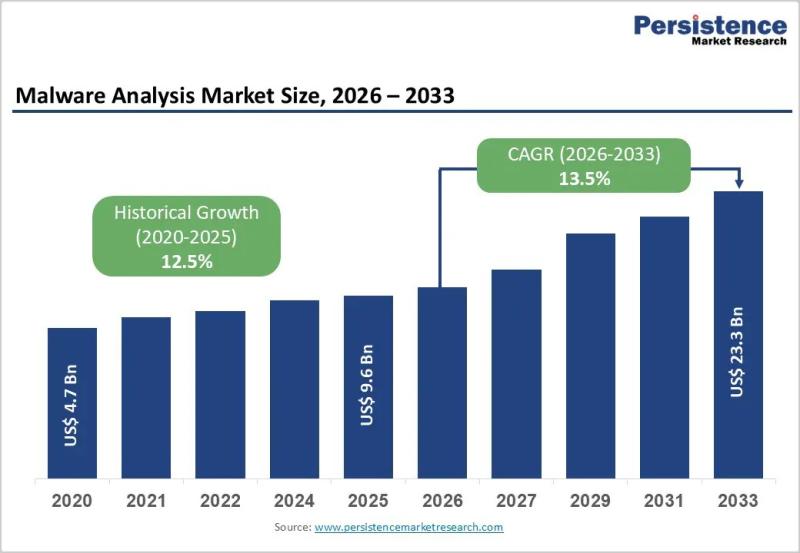

Malware Analysis Market Growth Accelerates as Cyber Threats Become More Sophisti …

The global cybersecurity landscape is undergoing a dramatic transformation as threat actors deploy increasingly sophisticated malware designed to evade traditional defense mechanisms. In this rapidly evolving environment, malware analysis has emerged as a cornerstone of modern cybersecurity strategies, enabling organizations to identify, understand, and neutralize malicious software before it can cause widespread damage. As cyberattacks become more frequent, targeted, and destructive, the demand for advanced malware analysis solutions is accelerating…

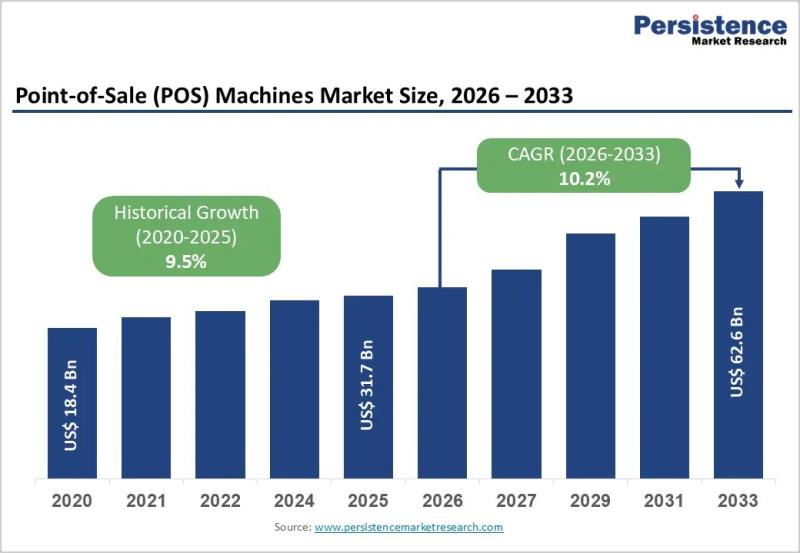

POS Machines Market on the Fast Track as Contactless Payments Redefine Global Co …

The global point-of-sale (POS) machines market is undergoing a powerful transformation as businesses across retail, hospitality, healthcare, and services embrace digital-first transaction models. POS machines have evolved from basic billing terminals into intelligent, cloud-connected platforms that support payments, inventory tracking, customer analytics, and omnichannel integration. As consumer expectations shift toward speed, convenience, and contactless experiences, POS systems have become central to modern commerce infrastructure.

In 2026, the POS machines market is…

Digital Marketing Services Market on a Trillion-Dollar Trajectory as Brands Go A …

The digital marketing services market has become one of the most influential pillars of the modern global economy, reshaping how brands connect, engage, and convert customers. As businesses move away from traditional advertising models, digital-first strategies are now central to customer acquisition, retention, and brand building. From search engines and social media platforms to content-driven and performance-based campaigns, digital marketing services are deeply embedded in enterprise growth strategies.

According to recent…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…