Press release

RadCred Review 2025: Best $500 Payday Loan Guaranteed Approval

Image: https://www.abnewswire.com/upload/2025/09/9805636d6a707e3c2081846b9ae2d42f.jpgWhen your paycheck is still days away but your bills are due today, $500 can feel like $5,000. That emergency room visit your insurance barely covered, the car repair that came out of nowhere, or the rent that's suddenly overdue - these situations don't wait for convenient timing. RadCred has built their reputation on solving exactly this problem: connecting borrowers who need $500 fast with lenders who actually want to say yes.

In our comprehensive RadCred review, we'll examine whether this AI-powered platform truly delivers the guaranteed approval experience they promise for $500 payday loans, or if it's just another case of clever marketing masking mediocre results. We've tested their claims, analyzed their process, and dug into real customer experiences to give you the unvarnished truth about getting $500 when you need it most.

What is RadCred?

RadCred [https://radcred.com/]positions itself as the bridge between financial desperation and actual solutions. As a U.S.-based AI loan matching platform, they've abandoned the traditional "apply and pray" approach that leaves borrowers frustrated and empty-handed. Instead, their proprietary technology analyzes your financial situation and matches you with lenders who specifically want to work with borrowers in your exact circumstances.

This isn't your typical payday loan company. RadCred doesn't lend money directly - they've built something more valuable. Their platform connects borrowers with a curated network of state-licensed lenders who specialize in different types of financial situations. Whether you're dealing with bad credit, inconsistent income, or just need cash before Friday, their AI finds lenders who see opportunity where others see risk.

The company focuses heavily on $500 payday loans because they've identified this amount as the sweet spot for most financial emergencies. It's enough to handle serious problems but small enough to repay without destroying your budget. Their technology evaluates factors traditional lenders ignore - like your actual spending patterns, seasonal income fluctuations, and real-world repayment capacity based on your lifestyle, not just your credit score.

What makes RadCred different is their transparency. While most payday loan companies hide their worst terms until after you're approved, RadCred shows you everything upfront. APRs, fees, payment schedules, and total repayment amounts are all displayed before you commit to anything, giving you actual choice instead of desperate acceptance.

How RadCred $500 Payday Loans Work? (Step by Step Process)

RadCred has simplified the loan process into something that actually makes sense for people facing financial emergencies.

Complete the Smart Application - Their online form takes about three minutes and asks questions that matter. Instead of endless paperwork, you share basic information about your income, expenses, and why you need the money. The application works on any device and saves your progress if you need to step away.

AI Analysis and Soft Check - RadCred's system performs a soft credit pull that won't hurt your score while analyzing over 100 data points about your financial situation. This includes your income stability, spending patterns, existing obligations, and repayment likelihood based on borrowers with similar profiles.

Instant Lender Matching - Within minutes, their AI presents you with actual loan offers from multiple lenders. Each offer shows the complete terms - APR, monthly payment, total cost, and repayment timeline. You're not guessing about costs or hoping for the best.

Choose Your Best Option - Compare offers side-by-side and select the one that fits your situation. Some lenders offer lower rates, others provide more flexible payment schedules, and some specialize in weekend funding for urgent needs.

Get Your Money - Most approved loans are funded within hours through direct deposit. Many lenders offer same-day funding for weekday applications, with some providing weekend deposits for Saturday and Sunday emergencies.

What Makes RadCred Different From Other Direct Lenders?

Traditional $500 payday loan providers operate on a simple model: take whoever applies, charge maximum fees, and hope they can collect. RadCred flips this entirely by focusing on successful matches rather than volume processing.

Where traditional lenders use rigid algorithms that automatically reject anyone below arbitrary credit thresholds, RadCred's AI looks at the complete picture. Their system recognizes that a borrower with $3,000 monthly income and $2,800 in fixed expenses can safely handle a $500 loan, even with imperfect credit.

The transparency difference is stark. Traditional payday lenders often advertise low fees but pile on costs through rollover charges, late penalties, and processing fees. RadCred requires all network lenders to disclose complete costs upfront, including worst-case scenarios if you need payment extensions.

RadCred $500 Payday Loan Guaranteed Approval

The $500 Payday loan amount represented by Radcred [https://radcred.com/payday-loan/]is the financial sweet spot for American emergency borrowers. It covers most urgent situations - car repairs, medical bills, overdue utilities, or temporary income gaps - without creating overwhelming debt obligations that trap borrowers in cycles they can't escape.

RadCred's "guaranteed approval" approach focuses on finding the right lender match rather than convincing you to accept whatever terms are offered. Their AI pre-qualifies you with lenders who specifically want borrowers in your financial situation, dramatically increasing your actual approval odds compared to random applications.

Same-day funding availability sets RadCred apart from traditional banking options that treat $500 loans as inconvenient small-dollar requests. Multiple lenders in their network specialize in rapid processing for emergency situations, with electronic deposits often arriving within 2-4 hours of acceptance.

The guarantee isn't about automatic approval - no legitimate lender can promise that. Instead, it's about guaranteed access to lenders who are genuinely interested in approving borrowers like you, based on a comprehensive analysis of your complete financial profile rather than just credit scores.

Loan Features Reviewed Loan Amounts - Focused on Real Emergency Needs

While RadCred's network handles loans from $255 to $35,000, their $500 specialty reflects deep understanding of actual borrower needs. Most financial emergencies fall into this range - substantial enough to matter, manageable enough to repay without financial destruction.

Loan Terms - Flexible Beyond Traditional Payday

Repayment options range from traditional two-week payday terms to extended 24-month installment plans. This flexibility lets borrowers choose realistic payment schedules instead of accepting whatever terms are dictated by rigid lender policies.

APR and Fees - Complete Transparency

Interest rates typically range from 18% to 400% depending on loan terms and borrower profiles. Unlike hidden-fee competitors, RadCred displays total borrowing costs including origination fees, late charges, and potential rollover expenses before you accept any offer.

Funding Speed - Emergency-Focused Timing

Same-day funding is standard for complete applications submitted by 2 PM on weekdays. Weekend emergency funding through select lenders handles urgent Saturday and Sunday situations when traditional banks offer no solutions.

Repayment Flexibility - Aligned with Real Income

Payment schedules match actual payday timing - weekly for weekly workers, bi-weekly for salaried employees, monthly for irregular income. This alignment reduces payment conflicts that create unnecessary late fees and stress.

Network Quality - Licensed and Regulated

All lenders maintain state licensing and comply with local regulations. RadCred regularly audits network partners to ensure continued compliance and removes lenders who engage in predatory practices.

Types of Payday Loans Available on RadCred

Emergency $500 Payday Loans handle immediate crises with fast approval and same-day funding. These work best for urgent situations requiring rapid cash access with straightforward repayment terms.

Flexible Installment Options break $500 loans into smaller monthly payments over 6-24 months. This approach works better for borrowers who need manageable payment amounts that fit established budgets.

Weekend Emergency Loans provide Saturday and Sunday access when traditional lenders close their doors. These specialty loans ensure urgent needs don't wait until Monday regardless of timing.

Bad Credit Specialty Loans focus on current income rather than credit history, serving borrowers who traditional lenders automatically reject based solely on FICO scores.

Income-Based Approval Loans use alternative data including bank account analysis and spending patterns to qualify borrowers who don't fit traditional employment requirements.

RadCred Online Payday Loans Pros and Cons Pros

* Intelligent Pre-Qualification System - AI matching eliminates wasted time applying with lenders unlikely to approve your specific situation, focusing effort on realistic opportunities.

* Complete Cost Transparency - All fees, interest rates, and repayment amounts displayed clearly before acceptance, preventing surprise charges that trap unwary borrowers.

* Weekend and Holiday Access - Platform operates continuously with emergency funding available when traditional banks close, addressing real-world timing needs.

* Flexible Repayment Terms - Access to both traditional payday and installment options lets borrowers choose realistic payment schedules aligned with their income patterns.

* Licensed Lender Network - Partnerships with regulated, compliant lenders reduce risks associated with questionable online lending operations.

* Third-Party Dependency - Success depends on network lender decisions rather than RadCred's direct control, creating variability in final outcomes.

* Rate Limitations for Poor Credit - Borrowers with significant credit challenges may face elevated APRs, though transparent pricing enables informed decision-making.

* Geographic Restrictions - Some lenders limit availability by state, potentially reducing options for borrowers in certain locations.

Cons RadCred Reviews and Customer Feedback

Customer experiences consistently highlight RadCred's speed advantage over traditional lending channels. Multiple reviews mention receiving "funds within hours of application" for genuine emergencies, with "weekend funding" capability earning particular praise from borrowers facing Saturday or Sunday crises.

The pre-qualification system receives frequent positive mentions from customers who appreciate seeing their approval odds before formal applications. Many borrowers specifically value avoiding credit score damage from multiple hard inquiries when shopping for emergency loans.

Transparency in fee disclosure earns consistent customer approval, with many reviews comparing RadCred favorably to traditional payday lenders who hide costs until after approval. Borrowers frequently mention feeling more confident about their borrowing decisions when complete costs are visible upfront.

Negative feedback typically focuses on APR levels for borrowers with poor credit, though most reviews acknowledge that RadCred's transparent pricing allows informed choices rather than surprise discoveries after acceptance.

Weekend availability receives particularly strong reviews from customers who needed emergency funds during traditional banking off-hours, with many mentioning this capability as a key differentiator from bank-based lending options.

RadCred vs. Traditional Payday Loan Providers

Traditional $500 payday loan providers typically operate storefront locations with rigid business hours, limited weekend availability, and one-size-fits-all loan products that ignore individual borrower circumstances.

RadCred's online platform provides 24/7 access with weekend emergency funding capabilities, addressing real-world timing needs that traditional providers ignore. Their AI matching connects borrowers with lenders who specialize in their specific situations rather than generic approval processes.

Fee transparency represents a fundamental difference. Traditional payday lenders often advertise attractive initial rates but add costs through rollover fees, late penalties, and processing charges. RadCred requires complete upfront disclosure of all potential costs.

Repayment flexibility shows another clear advantage. While traditional payday loans typically require full repayment in two weeks regardless of borrower income timing, RadCred offers access to various repayment schedules aligned with actual payday patterns.

FAQs About RadCred

Is RadCred legit or a scam? RadCred operates as a legitimate finance technology platform connecting borrowers with licensed lenders. They maintain proper business registrations, use secure data handling, and partner only with state-regulated lending institutions.

Can I really get a $500 payday loan with guaranteed approval? RadCred's guarantee focuses on connecting you with interested lenders rather than automatic approval. Their AI matching significantly improves approval odds by targeting lenders who want borrowers in your specific situation.

Does applying for a loan on RadCred hurt my credit score? RadCred uses soft credit checks during matching that don't impact your FICO score. Individual lenders may perform hard inquiries after you accept specific offers, but the initial matching process protects your credit rating.

How fast can I get funds with a weekend payday loan? Many network lenders offer same-day weekday funding and weekend deposits for urgent needs. Timing depends on your bank's processing schedule, but emergency funding often arrives within hours of acceptance.

What types of loans can I apply for through RadCred? RadCred specializes in $500 payday loans but also provides access to installment loans, emergency loans, and larger personal loans up to $35,000 for qualified borrowers.

Final Verdict - Is RadCred the Best $500 Payday Loan Platform in 2025?

RadCred has successfully addressed the core problems that make traditional payday lending frustrating and often predatory. Their AI matching technology solves the biggest challenge facing emergency borrowers: finding lenders who actually want to approve your application instead of wasting time with guaranteed rejections.

The platform excels for borrowers who need $500 fast and value transparency over potentially lower rates that come with hidden costs. Weekend availability and same-day funding capabilities make RadCred particularly valuable for urgent situations when traditional banking options provide no solutions.

Their guaranteed approval approach - focused on intelligent matching rather than false promises - provides realistic hope for borrowers with credit challenges who traditional lenders automatically reject. The complete fee transparency eliminates surprise costs that trap borrowers in debt cycles.

RadCred works best for borrowers who understand they're trading potentially lower rates for significantly better approval odds, transparent pricing, and emergency access timing. For borrowers facing urgent $500 needs with limited traditional options, RadCred represents one of the most borrower-friendly platforms available in 2025.

The combination of AI technology, weekend availability, and complete transparency makes RadCred a great option for emergency borrowers who need reliable access to $500 loans when life doesn't wait for convenient timing.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: RadCred

Contact Person: Matthew Jackson

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=radcred-review-2025-best-500-payday-loan-guaranteed-approval]

City: New York

Country: United States

Website: https://radcred.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release RadCred Review 2025: Best $500 Payday Loan Guaranteed Approval here

News-ID: 4187127 • Views: …

More Releases from ABNewswire

ChatSpark Launches Unified Conversational AI Platform Combining Customer-Facing …

San Diego-based ChatSpark announces its Conversational AI platform featuring AI Agents, real-time AI Actions, and ChatSpark CoPilot, delivering measurable enterprise ROI through customer service automation and live API integrations.

San Diego, CA - March 3, 2026 - ChatSpark today announced the continued evolution of its Conversational AI platform, delivering both customer-facing AI Agents and ChatSpark CoPilot, a real-time AI assistant for internal teams. Together, the products create a unified system that…

Plumbers Expanding Reliable Service Coverage in Phoenix, AZ Through Somers Plumb …

Somers Plumbers - Phoenix Plumbing Company continues to serve as a steady resource for residential and emergency plumbing coverage across Phoenix. Through structured dispatch systems and neighborhood-focused service routes, Somers Plumbers - Phoenix Plumbing Company supports homeowners seeking consistent plumbing access in Phoenix. As infrastructure demands evolve, the company's maintained presence in Heritage Heights.

Plumbers [https://www.somersplumbers.net/#:~:text=Somers-,Plumbers,-is%20your%20trusted] in Phoenix, AZ are expanding reliable service coverage to meet rising residential and emergency plumbing…

NMIBC Market: Strong Pharma Growth Forecast Through 2034 - DelveInsight | Ferrin …

The Key Non-Muscle Invasive Bladder Cancer Companies in the market Ferring Pharmaceuticals/FKD Therapies Oy, ImmunityBio, CG Oncology, Pfizer, UroGen Pharma, Janssen Research & Development, LLC, Protara Therapeutics, Binhui Biopharmaceutical, SURGE Therapeutics, Pfizer, AstraZeneca, ImmunityBio, Inc., Guarionex J. Decastro, Janssen Research & Development, Tollys, Aura Biosciences, Theralase Technologies, BristolMyers Squibb, Asieris Pharmaceuticals, and others

DelveInsight's "Non-Muscle Invasive Bladder Cancer Market Insights, Epidemiology, and Market Forecast-2034 report offers an in-depth understanding of the…

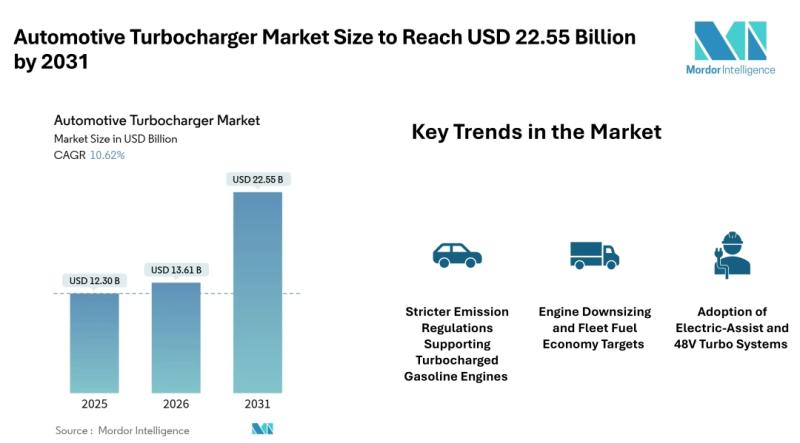

Automotive Turbocharger Market Size to Reach USD 22.55 Billion by 2031, Driven b …

Mordor Intelligence has published a new report on the automotive turbocharger market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Automotive Turbocharger Market Overview

According to Mordor Intelligence, the automotive turbocharger market size [https://www.mordorintelligence.com/industry-reports/automotive-turbocharger-market?utm_source=abnewswire] was valued at USD 12.30 billion in 2025 and is estimated to grow from USD 13.61 billion in 2026 to reach USD 22.55 billion by 2031, registering a CAGR of 10.62% during the forecast period.…

More Releases for RadCred

RadCred Announces Hiring For AI Analysts and Staff Engineer to Expand Fair Lendi …

Glendale, CA - November 10, 2025 - RadCred, an AI-powered loan marketplace, today announced three open positions: Staff Engineer, AI Operations Analyst, and AI Data Researcher. All roles are remote-first and support RadCred's mission to expand credit access through responsible AI lending.

As fintech lending increasingly relies on AI, regulators and market participants demand stronger guardrails around algorithmic fairness. RadCred [https://radcred.com/] is hiring deliberately to address this challenge, ensuring its platform…

58% of Gig Workers Seek Emergency Loans Quarterly, 2026 RadCred Survey Finds

Image: https://www.abnewswire.com/upload/2025/10/84373f9a9076b7ce6548fcc54534310a.jpg

Glendale, CA - Oct 31, 2025 - RadCred [https://radcred.com/], a leading AI-powered loan platform, today released a survey revealing that 58% of gig-economy workers seek emergency loans at least once every quarter. The findings highlight the financial strain caused by inflation, unstable income, and limited access to traditional credit among America's 70 million gig workers.

Inflation Drives Record Demand for Emergency Loans Among Gig Workers

According to RadCred's 2026 Gig Economy…

RadCred Highlights 2025 Fast Loan Advance Options for Borrowers with Bad Credit

Finding personal loans for bad credit can feel like searching for a needle in a haystack, especially when traditional banks keep slamming doors in your face. That's where lending networks like Fast Loan Advance come into play, promising to connect borrowers with lenders who actually want to work with imperfect credit scores. But with so many options out there, how do you know which platform will actually deliver on its…

Borrow Smarter: Radcred Highlights Lower Personal Loan Costs After Fed Rate Redu …

News broke in September 2025 that the Federal Reserve trimmed its benchmark rate by 25 basis points to 4.00-4.25 percent. This move ripples through credit card APRs, auto loans, and, most importantly, personal loan interest rates. Lower benchmark rates generally encourage lenders to reduce their APRs, creating a window of opportunity for borrowers to lock in affordable personal loans.

RadCred's AI-powered loan matching platform helps you act quickly, comparing hundreds of…