Press release

North America Farming & Agriculture Finance Market Expansion Fueled by AgTech & Rural Credit Growth | Major Players: Rabobank Group, Wells Fargo & Company, Bank of America Corporation, JPMorgan Chase & Co., The Goldman Sachs Group, Inc.

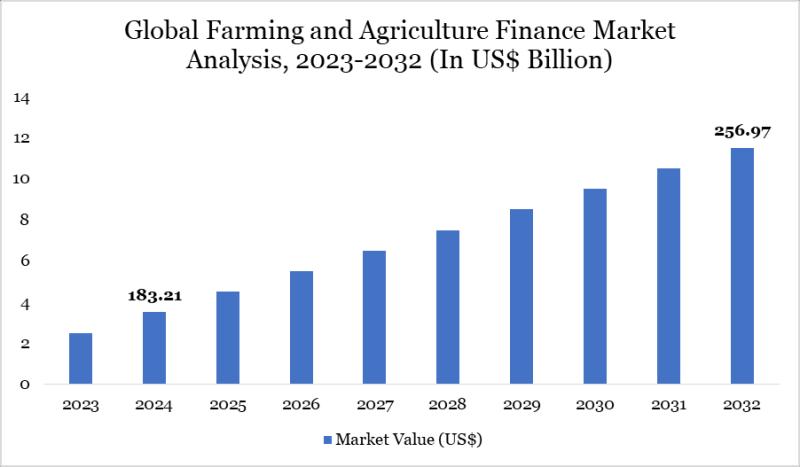

Global farming and agriculture finance market size reached US$ 183.21 billion in 2024 and is expected to reach US$ 256.97 billion by 2032, growing with a CAGR of 4.32% during the forecast period 2025-2032.The Farming and Agriculture Finance market analysis by DataM Intelligence delivers authoritative insights into the sector's growth, offering geographic coverage, demand outlook, and strategic trends that highlight both regional dominance and emerging opportunities. Beyond a surface-level overview, the research explores underlying drivers, breakthrough innovations, and market dynamics that could transform the Farming and Agriculture Finance industry during the forecast period. Backed by in-depth data and expert evaluation, this study empowers stakeholders with reliable, actionable intelligence to navigate challenges, capture growth opportunities, and make informed decisions in a competitive global landscape. Will the Farming and Agriculture Finance market emerge as the sector's next major growth frontier? The projections reveal the answer.

Request Sample Report to Access Investor Opportunity Matrix - Farming and Agriculture Finance Market Deals & Growth Hotspots: https://www.datamintelligence.com/download-sample/farming-and-agriculture-finance-market?ophp

DataM Intelligence profiles some of the most reputed organizations present in the Farming and Agriculture Finance market. They are as follows: Rabobank Group, Wells Fargo & Company, Bank of America Corporation, JPMorgan Chase & Co., The Goldman Sachs Group, Inc., BNP Paribas SA, Deutsche Bank AG, Barclays PLC, Mitsubishi UFJ Financial Group, Inc., and Australia and New Zealand Banking Group Limi

Agriculture finance provides loans, credit, and insurance tailored to farmers and agribusinesses, supporting productivity and resilience. The market is growing with digital fintech solutions and sustainability-linked financing. In 2025, U.S. banks rolled out AI-driven lending platforms to streamline farm credit approvals.

Farming and Agriculture Finance Market Dynamics:

Growth Driver in Farming and Agriculture Finance Market: Rising demand for agricultural modernization and government support programs drive agri-finance growth.

Restraints in Farming and Agriculture Finance Market: Credit risks, smallholder farmer challenges, and limited rural banking infrastructure restrain adoption.

Farming and Agriculture Finance Market Opportunities: Digital lending platforms, crop insurance, and microfinance initiatives offer growth potential.

Farming and Agriculture Finance Market Challenges: Climate risks, repayment defaults, and policy variability remain challenges.

Segment Covered in the Farming and Agriculture Finance Market:

By Type: Lease, Loan, Line of Credit

By Farm: Size Small, Medium, Large.

By Distribution Channel: Brokers, Agents, Banks and Others.

United States: Recent Industry Developments

✅ In September 2025, USDA announced expanded low-interest loan programs for small and mid-sized farmers to adopt precision agriculture and sustainable farming practices.

✅ In August 2025, Rabobank USA launched digital lending platforms for agricultural startups, streamlining access to working capital and equipment financing.

✅ In July 2025, AgriFinance Inc. rolled out crop insurance-linked loans, offering farmers protection against climate-related yield losses.

✅ In June 2025, farm credit cooperatives expanded green financing options for renewable energy installations on farms.

✅ In May 2025, U.S. fintech startups introduced AI-powered farm finance platforms, enabling predictive cash flow and credit management for farmers.

Europe: Recent Industry Developments

✅ In September 2025, the European Investment Bank provided €200 million in low-interest loans for smallholder farmers to invest in climate-smart agriculture.

✅ In August 2025, Rabobank Europe launched a digital financing platform for EU farmers adopting regenerative agriculture practices.

✅ In July 2025, Germany introduced a subsidy program linked with agricultural loans to incentivize carbon-neutral farm operations.

✅ In June 2025, France-based fintechs rolled out crop and livestock insurance-integrated financing, reducing farmer risk exposure.

✅ In May 2025, the UK's Green Finance Institute partnered with banks to expand sustainable agri-loans supporting soil health and water efficiency projects.

Japan: Recent Industry Developments

✅ In September 2025, Japan Finance Corporation increased low-interest loans for smart farming technologies, including autonomous tractors and drones.

✅ In August 2025, Mitsubishi UFJ Financial Group launched digital farm finance platforms, offering real-time credit assessment and disbursement.

✅ In July 2025, the Japanese government expanded subsidized financing programs for small-scale farmers adopting vertical and hydroponic farming.

✅ In June 2025, Sumitomo Mitsui Banking Corporation introduced climate-linked agri-loans, rewarding sustainable practices with lower interest rates.

✅ In May 2025, Japanese fintech startups piloted AI-powered predictive loan models to improve farm cash flow management and reduce defaults.

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=farming-and-agriculture-finance-market

Regional Analysis:

The global Farming and Agriculture Finance Market report focuses on six major regions: North America, South America, Europe, Asia Pacific, the Middle East, and Africa.

The report delivers in-depth insights into new product launches, technological advancements, innovative services, and ongoing R&D activities shaping the industry. The study combines qualitative and quantitative analysis, incorporating tools such as PEST, SWOT, and Porter's Five Forces to evaluate the market landscape. In addition, the report highlights essential aspects including raw material sourcing, distribution channels, production capacities, supply chain structures, and detailed product specifications.

Points Covered in this Report:

📌 Market Overview: This section outlines five key chapters, covering research scope, leading manufacturers, market segments, Farming and Agriculture Finance market categories, study objectives, and the timeline considered for analysis.

📌 Market Landscape: Provides an evaluation of the competitive environment in the global Farming and Agriculture Finance market, analyzing value, revenue, turnover, and market share by company, along with growth trends, recent transactions, sales performance, and competitive developments.

📌 Company Profiles: Examines the top players in the global Farming and Agriculture Finance market, focusing on their sales performance, core products, pricing strategies, revenue, gross profit margins, and production growth.

📌 Regional Market Outlook: Offers a detailed breakdown of sales, revenue, supply, gross margin, CAGR, market share, and overall size across regions including North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

📌 Market Segmentation: Presents in-depth research into how various applications, end-users, and product types contribute to overall market growth in the Farming and Agriculture Finance market.

📌 Market Forecast - Production Side: Highlights projections for production volumes and values, forecasts for leading producers, and production trends by product type.

📌 Research Findings: Summarizes the key results and insights uncovered throughout the study.

📌 Conclusion: Concludes the report with final observations and insights drawn from the overall analysis.

Request Customized Market Entry Assessment for North America, EU, APAC: https://www.datamintelligence.com/customize/farming-and-agriculture-finance-market?ophp

People Also Ask:

Q.1. What are the key driving forces behind the growth of the Farming and Agriculture Finance industry?

Q.2. Which factors are supporting market expansion, and which challenges are hindering the Farming and Agriculture Finance market?

Q.3. What is the overall structure of the market, and what risks and opportunities does it present?

Q.4. How do pricing, revenue, and sales performance compare among the leading companies in the Farming and Agriculture Finance market?

Q.5. What are the major market segments, and how is the Farming and Agriculture Finance market categorized?

Q.6. Which companies hold a dominant position in the market, and what share do they command?

Q.7. What current and emerging trends are shaping the Farming and Agriculture Finance market landscape?

Get Corporate Access to Live Farming and Agriculture Finance Industry Intelligence Database: https://www.datamintelligence.com/reports-subscription

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release North America Farming & Agriculture Finance Market Expansion Fueled by AgTech & Rural Credit Growth | Major Players: Rabobank Group, Wells Fargo & Company, Bank of America Corporation, JPMorgan Chase & Co., The Goldman Sachs Group, Inc. here

News-ID: 4186326 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Silk Market to Grow at 3.2% CAGR Through 2031 | Asia-Pacific Leads …

Market Overview

The Global Silk Market is projected to grow at a CAGR of 3.2% during the forecast period 2024-2031. Mulberry silk dominates global production, accounting for the majority of commercially produced silk, with governments promoting its cultivation to meet rising demand. While China remains the largest silk producer, India's climatic conditions are particularly favorable for mulberry silk cultivation, offering significant growth potential.

Get a Free Sample PDF Of This Report (Get…

Sericulture Market to Reach USD 468.4 Billion by 2031 | CAGR 8.1% | Asia-Pacific …

Sericulture Market Overview

The Global Sericulture Market reached US$ 251.2 billion in 2022 and is projected to reach US$ 468.4 billion by 2031, growing at a CAGR of 8.1% during the forecast period 2024-2031. Traditionally focused on textiles, the sericulture market is witnessing significant product diversification, with silk being used in cosmetics, medical devices, and industrial applications. This expansion beyond conventional fabrics is a key trend supporting market growth, as it…

Advanced Carbon Materials Market to Reach USD 26.8 Billion by 2031 | CAGR 8.8% | …

Advanced Carbon Materials Market Overview

The Global Advanced Carbon Materials Market reached US$ 15.9 billion in 2023 and is projected to reach US$ 26.8 billion by 2031, growing at a CAGR of 8.8% during the forecast period 2024-2031. Advanced carbon materials such as graphite, carbon fiber, carbon nanotubes, graphene, and diamond are widely used across multiple industries due to their exceptional mechanical strength, stiffness, thermal stability, and low density. Their superior…

High Early Strength Cement (HE) Market to Reach USD 2.3 Billion by 2031 | CAGR 4 …

Market Size & Overview

The Global High Early Strength Cement (HE) Market reached US$ 1.5 billion in 2022 and is projected to reach US$ 2.3 billion by 2031, growing at a CAGR of 4.7% during the forecast period 2024-2031. High early strength cement is a specialized cement variant designed to achieve faster setting and early strength development, making it ideal for projects requiring quick construction or maintenance. It is extensively used…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…