Press release

Global Usage-Based Insurance (UBI) Market Outlook | Pay-How-You-Drive & Pay-As-You-Go Models

According to DataM Intelligence has released its latest research report on "Usage-Based Insurance Market Size 2025," offering in-depth insights into key growth factors such as regional performance, market segmentation, CAGR trends, revenue analysis of leading players, and major drivers shaping the industry. This report provides a clear and forward-looking perspective on market size (both value and volume), emerging opportunities, and current development status helping businesses identify growth potential and make informed strategic decisionsAccording to the WHO, road traffic crashes claim approximately 1.35 million lives each year, while an additional 20-50 million individuals suffer non-fatal injuries, many of which lead to long-term disabilities. In several countries, these crashes account for nearly 3% of their gross domestic product. Meanwhile, Usage-Based Insurance (UBI) solutions, particularly those utilizing OBD dongles, are gaining significant traction. By 2020, OBD dongles were installed in about 27 million vehicles, creating a $475 million annual market for manufacturers a figure projected to rise further, fueling market growth over the forecast period.

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/usage-based-insurance-market?kb

The U.S. leads the market, with projections indicating over 330 million connected vehicles by 2035 through embedded, tethered, or smartphone integration. With an estimated 97% penetration rate, the U.S. is expected to maintain the highest adoption of connected vehicles during the forecast period.

Top Key Players:

Cambridge Mobile Telematics, Allianz SE, AXA, Aviva, Allstate Corporation, Insure The Box Limited, Liberty Mutual Insurance, Progressive corporation, UNIPOLSAI ASSICURAZIONI S.P.A, Nationwide Mutual Insurance Company

Growth Projection:

The Global Usage-Based Insurance Market is set to witness significant growth between 2025 and 2032. While 2024 reflects steady progress, the increasing adoption of innovative strategies by leading players is expected to accelerate growth across the projected horizon. This creates a strong landscape of opportunities for businesses looking to expand, invest, and stay competitive in a rapidly evolving market.

Research Process:

The Usage-Based Insurance Market research report by DataM Intelligence leverages both primary and secondary data sources to deliver deep insights. It explores a wide range of factors shaping the industry from government regulations, market conditions, and competitive dynamics to historical trends, technological advancements, upcoming innovations, and potential challenges. This comprehensive analysis highlights growth prospects while addressing barriers, helping businesses navigate volatility and seize new opportunities

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=usage-based-insurance-market

Market Segmentation:

By Type: (Pay-as-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD), Distance-Based Insurance, Others)

By Vehicle Type: (Passenger Vehicles, Commercial Vehicles)

By Technology: (OBD I-II, Smartphones, Black Box, Hybrid, Others)

By Application: (IoT Based Fleet Management, Semi-Autonomous & Autonomous Car, Artificial Intelligence and HMI in Transportation, Others)

Top Growth Regions:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

Chapter 1: Introduces the report with an overview of coverage summarizing key market segments by region, product type, and application. It offers a clear snapshot of market size, segment-wise growth potential, and both short- and long-term industry outlook.

Chapter 2: Brings forward the most valuable market insights and reveals the game-changing emerging trends shaping the industry's future.

Chapter 3: Provides a detailed analysis of the competitive landscape among Usage-Based Insurance covering revenue shares, strategic initiatives, and the latest mergers & acquisitions.

Chapter 4: Delivers comprehensive profiles of top players, including revenue, profit margins, product lines, and company milestones.

Chapters 5 & 6: Break down revenue performance across regions and countries, offering a precise view of market sizes, opportunities, and development prospects worldwide.

Chapter 7: Examines segmentation by type, revealing the size and potential of each category guiding businesses toward untapped, high-impact areas.

Chapter 8: Focuses on applications, evaluating how different downstream markets are growing and identifying promising sectors for expansion.

Chapter 9: Maps the entire industry supply chain, detailing both upstream and downstream activities for a holistic understanding.

Chapter 10: Concludes with key findings and the most critical takeaways giving stakeholders a clear direction for future strategies.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/usage-based-insurance-market?kb

FAQ's

Q1: How fast is the Usage-Based Insurance Market growing?

A: The Market is on a robust growth path, expected to expand at a CAGR of 24.1% between 2025 and 2032.

Q2: Which Regions dominate the Usage-Based Insurance Market?

A: Currently, North America holds the largest share of the Usage-Based Insurance (UBI) market.

Request 2 Days Free Trials with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Usage-Based Insurance (UBI) Market Outlook | Pay-How-You-Drive & Pay-As-You-Go Models here

News-ID: 4186193 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

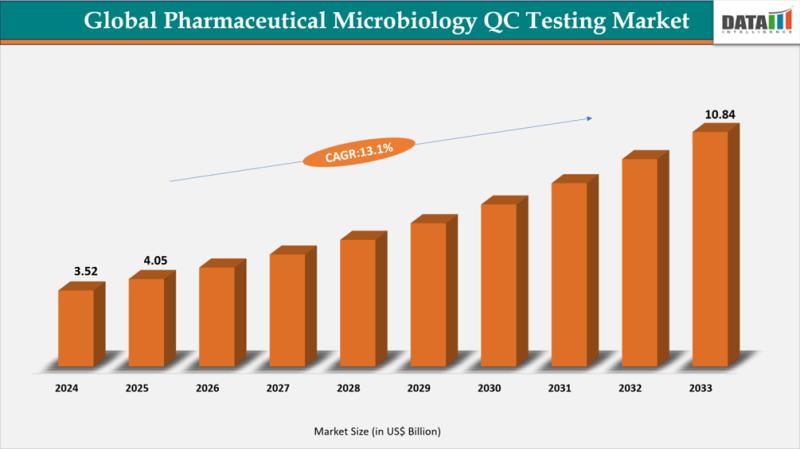

Pharmaceutical Microbiology QC Testing Market US$10.84 Billion by 2033 at a 13.1 …

Market Size and Growth (2026)

pharmaceutical microbiology QC testing market reached US$3.52 Billion in 2024, rising to US$4.05 Billion in 2025 and is expected to reach US$10.84 Billion by 2033, growing at a CAGR of 13.1% from 2026 to 2033.

Download Free Sample PDF Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/pharmaceutical-microbiology-qc-testing-market?kb

United States: Recent Industry Developments

✅ February 2026: Charles River Laboratories expanded its microbiology testing services for biopharmaceutical manufacturers to support…

Middle East and North Africa Urban Planning Market expected to reach US$ 4.9 bil …

Market Size and Growth

Middle East and North Africa Urban Planning Market reached US$ 3.8 billion in 2023 and is expected to reach US$ 4.9 billion by 2031, growing with a CAR of 3.2% during the forecast period 2024-2031.

Download Free Sample PDF Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/middle-east-and-north-africa-urban-planning-market?kb

Saudi Arabia: Recent Industry Developments

✅ February 2026: Saudi Arabia unveiled new smart city frameworks integrating AI-driven traffic and energy management systems.

✅…

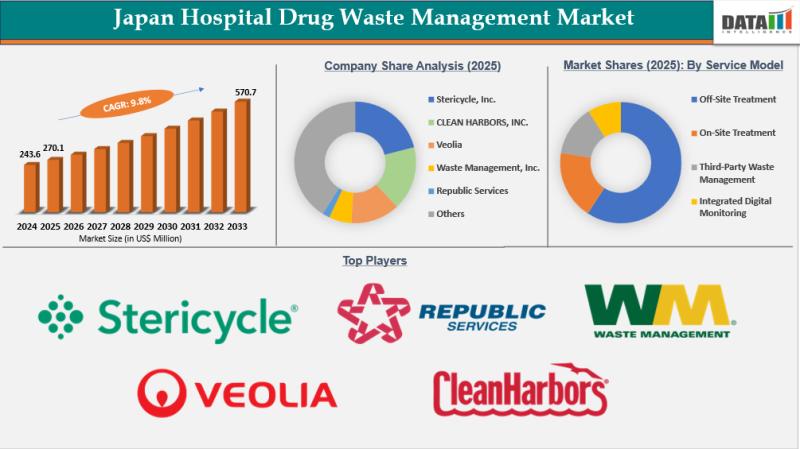

Japan Hospital Drug Waste Management Market to Reach US$570.7 Million by 2033 at …

Market Size and Growth

Japan hospital drug waste management market reached US$243.6 Million in 2024, rising to US$270.1 Million in 2025, and is expected to reach US$570.7 Million by 2033, growing at a CAGR of 9.8% from 2026 to 2033.

Download Free Sample PDF Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/japan-hospital-drug-waste-management-market?kb

Recent Industry Developments

✅ December 2025: Japanese hospitals adopted smart drug disposal systems integrating barcodes and IoT tracking to improve compliance…

Ambient Clinical Intelligence (Voice AI for EHR) Market (2026)., North America h …

Market Size and Growth

Ambient Clinical Intelligence (Voice AI for EHR) Market, a cutting-edge Voice AI technology that's transforming healthcare. ACI systems "listen" to clinical conversations in real-time, using advanced natural language processing (NLP) to automate documentation. The booming ACI market, exploring its explosive growth, key drivers

Download Free Custom Research: https://www.datamintelligence.com/custom-research?kbaci

United States: Recent Industry Developments

✅ February 2026: Nuance Communications (Microsoft) introduced updated ambient clinical AI tools for improved EHR documentation and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…