Press release

Carbon Finance Market Technological Advancements in Carbon Accounting and Digital Verification Tools

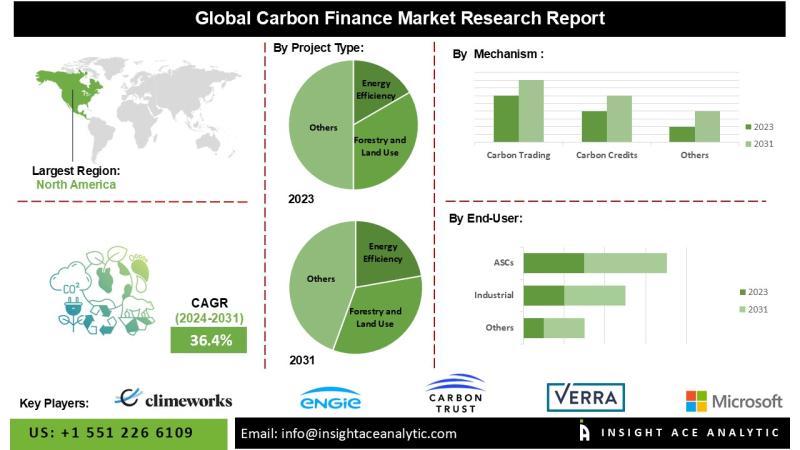

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " Carbon Finance Market - (By Mechanism (Carbon Trading, Carbon Credits, Carbon Taxation, Cap-and-Trade, Carbon Offset Projects), By Project Type (Renewable Energy Projects, Energy Efficiency, Forestry and Land Use, Carbon Capture and Storage (CCS), Waste Management), By End User (Industrial, Transportation, Energy Sector, Agriculture and Forestry, Government and Regulatory Bodies, Financial Institutions)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."According to the latest research by InsightAce Analytic, the Carbon Finance Market is expected to grow with a CAGR of 36.5% during the forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2912

Carbon finance serves as a strategic economic mechanism designed to encourage the reduction of carbon dioxide emissions by providing financial incentives to organizations that implement carbon mitigation or sequestration initiatives. The global carbon finance market is experiencing robust growth, driven by advancements in carbon capture and storage (CCS) technologies and increasing demand from enterprises seeking carbon credits to achieve sustainability objectives.

Market expansion is further supported by rising investments in energy efficiency measures and the implementation of stricter global carbon emissions regulations. The transition to renewable energy sources-particularly hydropower and other low-carbon generation systems-is contributing to reduced dependence on fossil fuels, lower overall energy consumption, and decreased greenhouse gas emissions. These renewable projects frequently generate tradable carbon credits, offering both environmental benefits and financial returns.

Moreover, the growth of carbon markets is being reinforced by international climate agreements and regulatory frameworks that promote low-carbon economic models. Both public and private sector stakeholders are intensifying investments in clean energy and energy-efficient technologies as part of broader sustainability strategies. These initiatives not only strengthen environmental resilience but also attract investors prioritizing environmental, social, and governance (ESG) considerations, collectively sustaining the upward trajectory of the global carbon finance market.

List of Prominent Players in the Global Carbon Finance Market:

• BP plc

• Shell Global

• Verra,

• Gold Standard

• South Pole

• ENGIE

• Climeworks

• Carbon Trust

• Microsoft Corporation

• Equinor ASA

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics

Drivers:

The carbon finance market is experiencing significant expansion, driven largely by increasing corporate commitments to mitigate greenhouse gas emissions and the rapid advancement of carbon management technologies. The deployment of artificial intelligence (AI) and sophisticated data analytics is enhancing the precision of carbon footprint measurement, monitoring, and verification processes.

These innovations improve the efficiency and reliability of carbon credit validation, ensuring regulatory compliance and bolstering the credibility of emission reduction initiatives. In addition, developments in environmental reporting and disclosure tools are fostering greater transparency, encouraging heightened corporate participation in climate finance and carbon credit acquisition. Overall, the integration of advanced digital technologies is strengthening trust in carbon accounting and supporting sustained market growth.

Challenges:

Despite robust growth, the carbon finance market faces several notable challenges. Key concerns include the authenticity and reliability of carbon credits, with risks of fraud and misrepresentation posing barriers to widespread adoption. The market is further exposed to cybersecurity threats, geopolitical uncertainties, and the lack of standardized protocols across different carbon trading platforms.

For instance, carbon credits linked to sectors such as maritime operations require stringent cybersecurity measures to safeguard documentation and prevent fraudulent activity. Additionally, global disruptions, such as those caused by the COVID-19 pandemic, have historically impacted market momentum through temporary operational slowdowns.

Regional Trends:

North America is expected to retain a substantial share of the global carbon finance market, supported by rapid urbanization, increased construction spending, and significant investments in energy efficiency, transportation, aviation, and public infrastructure. Concurrently, Europe continues to play a leading role, driven by strong research and development funding, technological innovation, and infrastructure modernization efforts. The region's strategic focus on sustainable construction practices and optimized resource management further reinforces its position as a key contributor to global market growth in carbon finance.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2912

Segmentation of Global Carbon Finance Market-

By Mechanism-

• Carbon Trading

• Carbon Credits

• Carbon Taxation

• Cap-and-Trade

• Carbon Offset Projects

By Project Type-

• Renewable Energy Projects

• Energy Efficiency

• Forestry and Land Use

• Carbon Capture and Storage (CCS)

• Waste Management

By End User-

• Industrial

• Transportation

• Energy Sector

• Agriculture and Forestry

• Government and Regulatory Bodies

• Financial Institutions

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/carbon-finance-market/2912

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Finance Market Technological Advancements in Carbon Accounting and Digital Verification Tools here

News-ID: 4185969 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

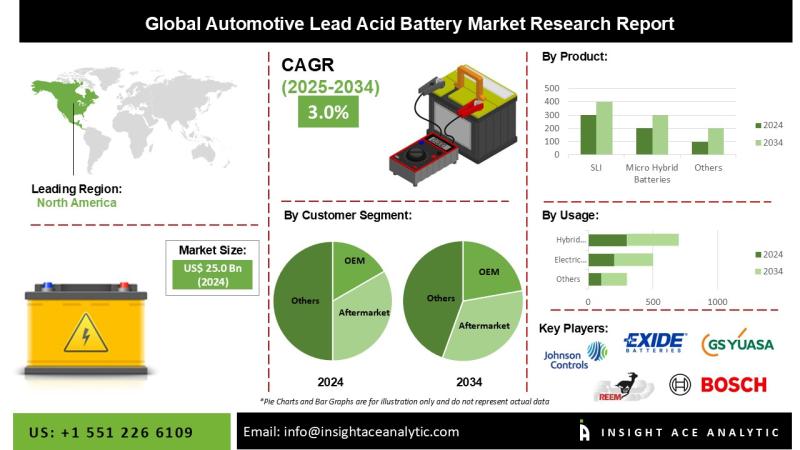

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

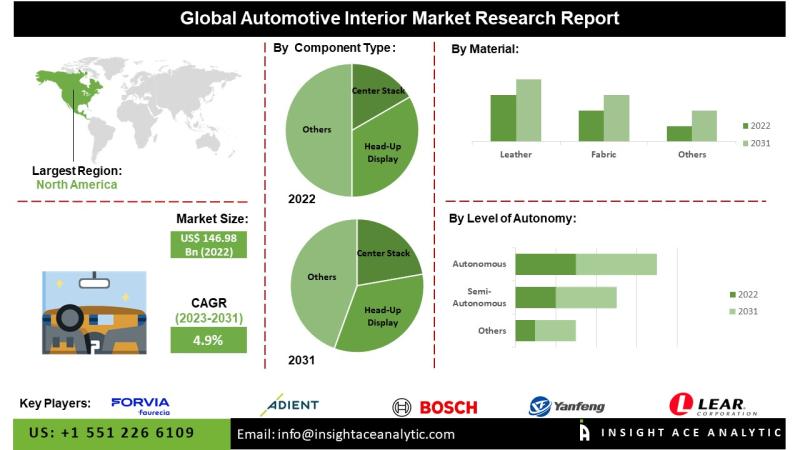

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

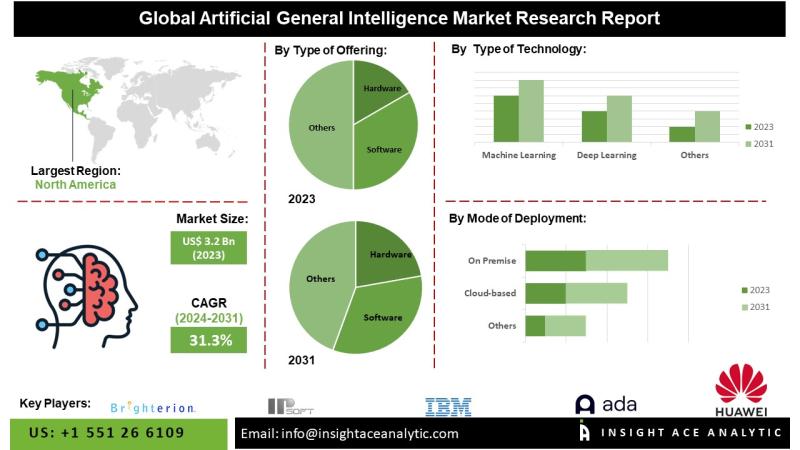

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

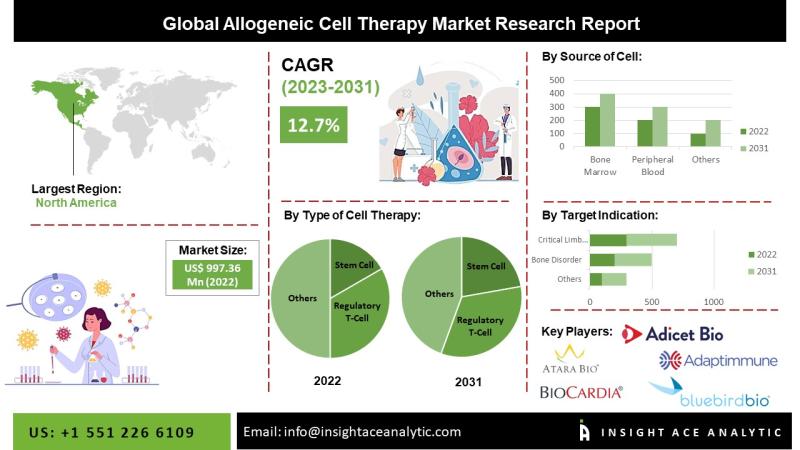

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…