Press release

Smart Digital Banking Market Is Going to Boom | Major Giants JPMorgan Chase, Citibank, Wells Fargo, HSBC, Barclays

HTF MI just released the Global Smart Digital Banking Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.Major Giants in Smart Digital Banking Market are:

JPMorgan Chase, Citibank, Wells Fargo, HSBC, Barclays, Deutsche Bank, Bank of America, BNP Paribas, Santander, ICICI Bank, State Bank of India, DBS Bank, Standard Chartered, ING, Credit Suisse, UBS, ANZ, MUFG, Goldman Sachs, Morgan Stanley

Request PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)👉 https://www.htfmarketintelligence.com/sample-report/global-smart-digital-banking-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

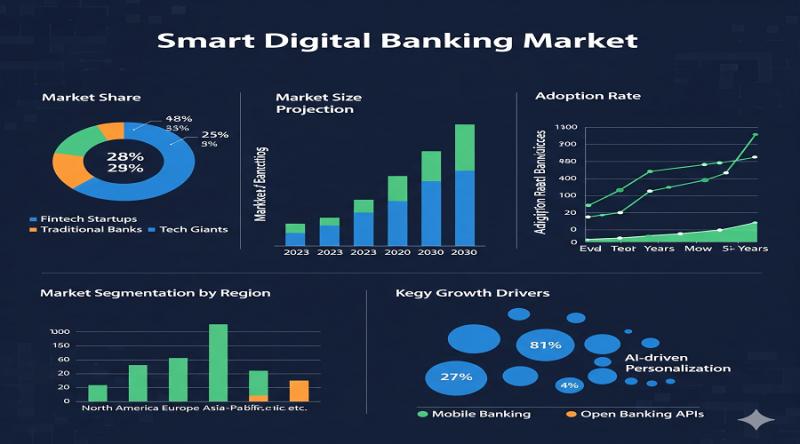

HTF Market Intelligence projects that the global Smart Digital Banking market will expand at a CAGR of 23.4% from 2025 to 2032, from USD 21.4 Billion in 2025 to USD 115.2 Billion by 2032.

Our Report Covers the Following Important Topics:

By Type:

Mobile banking, Internet banking, AI-powered banking, Blockchain-based banking, Open banking platforms

By Application:

Retail banking, Corporate banking, Wealth management, Payment services, Lending and mortgages

Smart digital banking integrates advanced technologies such as AI, blockchain, cloud computing, and big data into traditional and mobile banking systems to deliver seamless, secure, and personalized financial services. It provides consumers with digital-first experiences through online platforms, mobile apps, and open banking APIs. North America currently dominates due to strong fintech ecosystems and rapid adoption, while Asia-Pacific is the fastest-growing region driven by a tech-savvy population and supportive regulatory frameworks. The market is propelled by drivers such as contactless payments, mobile-first banking, and the growing demand for personalization. Trends include blockchain adoption, neobanks, biometric security, and cloud platforms. Key challenges include regulatory compliance, cybersecurity risks, and outdated IT infrastructure. Opportunities lie in expanding financial inclusion, embedded finance, fintech partnerships, and robo-advisory growth. Smart digital banking is becoming a cornerstone of the future financial ecosystem, reshaping customer expectations and industry competition.

Dominating Region:

North America

Fastest-Growing Region:

Asia-Pacific

Market Trends:

• Rise of neobanks and fintech partnerships is transforming the sector.

• AI-driven chatbots and digital advisors are becoming mainstream.

• Blockchain adoption in digital payments is gaining traction.

• Cloud-based banking platforms are scaling rapidly.

• Biometric authentication and cybersecurity innovations are expanding.

Market Drivers:

• Increasing adoption of mobile and online banking is driving growth.

• Rising demand for personalized financial services is accelerating innovation.

• Integration of AI and big data is enhancing customer engagement.

• Growth in contactless payments is expanding the market.

• Regulatory support for digital transformation is fostering adoption.

Market Challenges:

• Cybersecurity risks and fraud are increasing with digital expansion.

• Legacy IT systems hinder full-scale digital adoption.

• Regulatory compliance challenges create operational complexity.

• Customer trust issues in digital-only banks persist.

• Digital infrastructure gaps limit adoption in developing markets.

Market Opportunities:

• Expansion into underbanked regions creates new opportunities.

• Partnerships with fintech firms enable faster innovation.

• Use of AI for hyper-personalization increases customer satisfaction.

• Growth in embedded finance opens new revenue streams.

• Digital wealth management and robo-advisory services expand offerings.

Have a query? Ask Our Expert 👉 👉 https://www.htfmarketintelligence.com/enquiry-before-buy/global-smart-digital-banking-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Smart Digital Banking market segments by Types: Mobile banking, Internet banking, AI-powered banking, Blockchain-based banking, Open banking platforms

Detailed analysis of Smart Digital Banking market segments by Applications: Retail banking, Corporate banking, Wealth management, Payment services, Lending and mortgages

Global Smart Digital Banking Market -Regional Analysis

• North America: United States of America (US), Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia, and Brazil.

• Middle East & Africa: Kingdom of Saudi Arabia, United Arab Emirates, Turkey, Israel, Egypt, and South Africa.

• Europe: the UK, France, Italy, Germany, Spain, Nordics, BALTIC Countries, Russia, Austria, and the Rest of Europe.

• Asia: India, China, Japan, South Korea, Taiwan, Southeast Asia (Singapore, Thailand, Malaysia, Indonesia, Philippines & Vietnam, etc.) & Rest

• Oceania: Australia & New Zealand

Buy Now Latest Edition of Smart Digital Banking Market Report 👉 https://www.htfmarketintelligence.com/book-now?format=1&report=16320?utm_source=Nilesh_OpenPR&utm_id=Nilesh

Smart Digital Banking Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS:

Five forces analysis-the threat of new entrants, the threat of substitutes, the threat of competition, and the bargaining power of suppliers and buyers-are carried out to better understand market circumstances.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get 10-25% Discount on Immediate purchase 👉 https://www.htfmarketintelligence.com/request-discount/global-smart-digital-banking-market?utm_source=Nilesh_OpenPR&utm_id=Nilesh

Points Covered in Table of Content of Global Smart Digital Banking Market:

Chapter 01 - Smart Digital Banking Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Smart Digital Banking Market - Pricing Analysis

Chapter 05 - Global Smart Digital Banking Market Background or History

Chapter 06 - Global Smart Digital Banking Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Smart Digital Banking Market

Chapter 08 - Global Smart Digital Banking Market Structure & worth Analysis

Chapter 09 - Global Smart Digital Banking Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Smart Digital Banking Market Research Method Smart Digital Banking

Thank you for reading this post. You may also obtain report versions by area, such as North America, LATAM, Europe, Japan, Australia, or Southeast Asia, or by chapter.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Smart Digital Banking Market Is Going to Boom | Major Giants JPMorgan Chase, Citibank, Wells Fargo, HSBC, Barclays here

News-ID: 4184721 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Green Crypto-Mining Market is Booming Worldwide | Major Giants Terawulf, Bitmain …

HTF MI Research's most recent report of the global Green Crypto-Mining Market examines market size, trends, and projections through 2033. The Green Crypto-Mining Market study includes extensive research data and proofs to provide managers, analysts, industry experts, and other key personnel with an easy-to-access, self-analyzed study to help them understand market trends, growth drivers, opportunities, and upcoming challenges, as well as competitors.

Key Players in This Report Include: Bitmain, Marathon Digital,…

Intelligent Typesetting Service Platform Market is Going to Boom | Major Giants …

The latest analysis of the worldwide Intelligent Typesetting Service Platform market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Intelligent Typesetting Service Platform market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Pilot Training Simulation Systems Maket Great Impact in Near Future by 2030

HTF MI just released the Global Pilot Training Simulation Systems Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

CAE, FlightSafety, L3Harris, TRU…

Enterprise OKR Tools Market Is Going to Boom | Major Giants Quantive, WorkBoard

HTF MI just released the Global Enterprise OKR Tools Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

Quantive, WorkBoard, Betterworks, Lattice, Ally.io,…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…