Press release

Automotive Usage-based Insurance Market to Reach US$ 270.3 Bn by 2032, Rising at a CAGR of 21.3% | Persistence Market Research

The global automotive usage-based insurance (UBI) market has emerged as a revolutionary segment in the insurance industry, reshaping traditional models with the integration of telematics and data-driven insights. This market is estimated to reach a size of US$ 69.8 Bn in 2025 and is projected to expand at a CAGR of 21.3%, attaining US$ 270.3 Bn by 2032. Unlike conventional policies that rely heavily on static factors such as driver age, vehicle type, and geographical location, UBI leverages real-time data to evaluate premiums. Driving behavior, mileage, and vehicle usage trends are becoming the core determinants of premium pricing, offering fairer and more personalized solutions to policyholders.The adoption of connected cars, increasing deployment of telematics devices, and government backing for such technologies are major catalysts driving market growth. Among the different models, the pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) segments are gaining substantial traction due to their appeal among cost-conscious consumers. North America has been identified as the leading region for the market, mainly due to high penetration of telematics-based insurance programs, strong regulatory support, and consumer awareness. The region's technological maturity and wide-scale adoption of connected vehicles provide fertile ground for expansion. Europe follows closely, while Asia-Pacific is projected to record the fastest growth owing to increasing vehicle sales and a growing demand for digital insurance solutions.

Explore a wide range of in-depth market insights and detailed reports available on our website for further information and analysis: https://www.persistencemarketresearch.com/market-research/automotive-usage-based-insurance-market.asp

Key Highlights from the Report

➤ The global automotive usage-based insurance market is expected to reach US$ 69.8 Bn in 2025.

➤ The market is projected to grow at a CAGR of 21.3% during the assessment period.

➤ By 2032, the industry is set to attain a value of US$ 270.3 Bn.

➤ Pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) models dominate the market landscape.

➤ North America holds the leading regional share, supported by technological adoption and government policies.

➤ Increasing demand for connected cars and telematics devices fuels global market expansion.

Market Segmentation

Market segmentation in the automotive usage-based insurance industry revolves primarily around product type, pricing model, and end-user application. The two most prominent models are PAYD (Pay-as-you-drive) and PHYD (Pay-how-you-drive), each appealing to different segments of consumers. PAYD is particularly popular among low-mileage drivers who want to save costs based on actual usage, while PHYD appeals to responsible drivers with safe driving habits. A third category, Manage-how-you-drive (MHYD), is gradually entering the landscape, emphasizing behavioral insights and offering broader benefits, including gamified driving experiences and coaching.

End-user segmentation highlights individual private drivers as the dominant group adopting UBI. However, fleet operators and commercial vehicle owners are emerging as a significant customer base due to the advantages of reducing accident risks, lowering operational expenses, and improving fleet management. Insurance providers targeting these segments offer customized solutions tailored to fleet dynamics, which is expected to enhance market penetration in the coming years.

Regional Insights

North America continues to be the largest regional market, driven by early adoption of telematics technology, favorable government regulations, and insurance companies eager to offer personalized products. The U.S., in particular, has seen rapid growth due to widespread consumer awareness, robust infrastructure for connected vehicles, and an emphasis on road safety. The presence of established insurance providers further boosts adoption rates in the region.

Meanwhile, Asia-Pacific is expected to demonstrate the highest growth potential during the forecast period. Rising vehicle sales in markets like China and India, coupled with increasing digitization and smartphone penetration, are creating a fertile ground for UBI adoption. Insurers in this region are collaborating with automakers and telematics providers to expand their offerings, while the younger demographic shows strong preference for flexible and digitally enabled insurance policies.

Market Drivers

One of the strongest drivers of the automotive UBI market is the rapid proliferation of connected vehicles and telematics systems. These technologies provide insurers with accurate and real-time insights into driving behavior, which allows for fairer premium calculations. Governments across regions are also supporting telematics adoption to enhance road safety and curb insurance fraud. Moreover, customers are increasingly drawn to the financial advantages of UBI policies, particularly those who drive fewer miles or maintain safe driving habits. This personalization and cost-efficiency make UBI especially attractive compared to conventional models.

Additionally, rising concerns about vehicle theft and fraud are accelerating demand. UBI platforms often integrate tracking systems, enabling theft recovery and fraud prevention, which enhances customer trust. As insurance companies embrace digital transformation, UBI emerges as a natural progression toward customer-centric offerings. Growing environmental consciousness also plays a role, as UBI indirectly encourages reduced vehicle usage and safer, eco-friendly driving patterns.

Market Restraints

Despite its promising outlook, the automotive usage-based insurance market faces challenges that could slow adoption. Privacy concerns remain a major restraint, as telematics requires constant tracking and data collection, which raises consumer apprehensions about misuse of personal information. While insurers assure data security, building trust remains a long-term challenge.

The high cost of telematics devices and lack of standardized regulations across markets also hinder growth. In developing regions, limited infrastructure and awareness levels act as barriers, restricting UBI's adoption to urban and tech-savvy consumers. Insurance companies also face challenges in integrating telematics data into existing systems and ensuring seamless customer experiences. Finally, the reluctance of traditional insurers to transition to a data-driven model adds another layer of complexity in some regions.

Get a Sample Copy of Research Report (Use Corporate Mail id for Quick Response): https://www.persistencemarketresearch.com/samples/29038

Market Opportunities

The automotive UBI market holds substantial opportunities in emerging economies where vehicle ownership is rising rapidly, and digital ecosystems are maturing. Collaboration between insurers, automakers, and technology providers presents new avenues for growth, particularly in creating integrated platforms that combine insurance, telematics, and mobility services.

Opportunities also exist in the fleet management segment, where cost savings and safety enhancements can be transformative. Insurers that develop specialized solutions for commercial vehicles stand to gain a significant competitive advantage. Furthermore, the growing shift toward electric vehicles opens another opportunity for tailored UBI policies, as EV users often require specialized coverage. With AI and big data analytics advancing, insurers can further refine UBI models, offering gamified experiences and personalized coaching, thereby increasing consumer engagement and loyalty.

Reasons to Buy the Report

✔ Gain a comprehensive understanding of the global automotive usage-based insurance market dynamics.

✔ Identify growth drivers, restraints, and emerging opportunities shaping industry expansion.

✔ Access detailed insights on market segmentation, leading regions, and key product models.

✔ Evaluate competitive strategies and recent developments by leading players in the industry.

✔ Leverage forecast data to make informed business and investment decisions through 2032.

Company Insights

Leading players operating in the automotive usage-based insurance market include:

• Progressive Corporation

• Allstate Corporation

• State Farm Mutual Automobile Insurance Company

• Liberty Mutual Insurance

• Nationwide Mutual Insurance Company

• American Family Insurance

• Esurance (a subsidiary of Allstate)

• Metromile

• Root Insurance

• Aviva

Recent Developments

• Several insurance providers have expanded partnerships with telematics companies to enhance customer data insights and deliver more accurate premium models.

• Automakers are increasingly integrating UBI solutions into connected vehicle platforms, offering customers bundled options directly at the point of purchase.

Explore more related market insights and reports by visiting our website.

Autonomous Cranes Market Share: https://www.persistencemarketresearch.com/market-research/autonomous-cranes-market.asp

Automotive Smart Antenna Market Share: https://www.persistencemarketresearch.com/market-research/automotive-smart-antenna-market.asp

Commercial Vehicle Automotive Thermal System Market Share: https://www.persistencemarketresearch.com/market-research/commercial-vehicle-automotive-thermal-system-market.asp

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Usage-based Insurance Market to Reach US$ 270.3 Bn by 2032, Rising at a CAGR of 21.3% | Persistence Market Research here

News-ID: 4184717 • Views: …

More Releases from Persistence Market Research

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

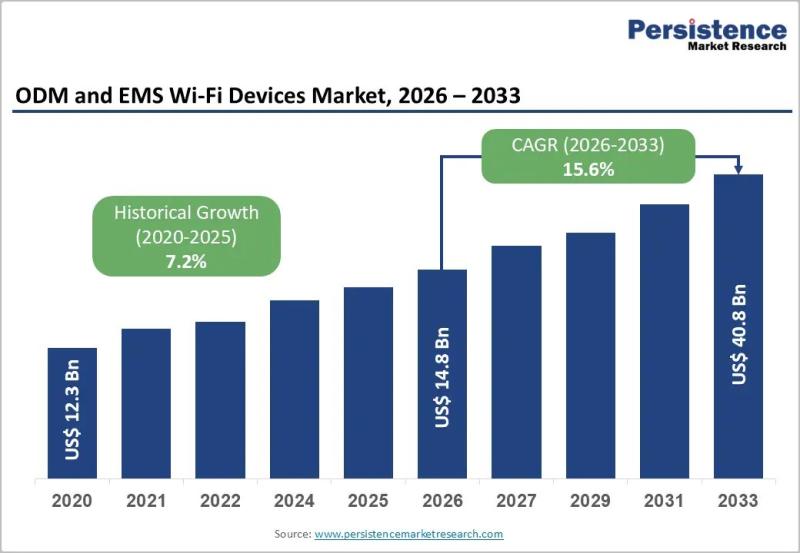

ODM and EMS Wi-Fi Devices Market to Reach US$ 40.8 Billion by 2033 at 15.6% CAGR

The global ODM and EMS Wi-Fi devices market is projected to be valued at US$ 14.8 billion in 2026 and is forecast to surge to US$ 40.8 billion by 2033, registering a robust CAGR of 15.6% between 2026 and 2033. This rapid growth reflects the accelerating demand for advanced wireless connectivity solutions across residential, enterprise, and industrial environments. The expansion of 5G infrastructure, enterprise digital transformation strategies, and large-scale IoT…

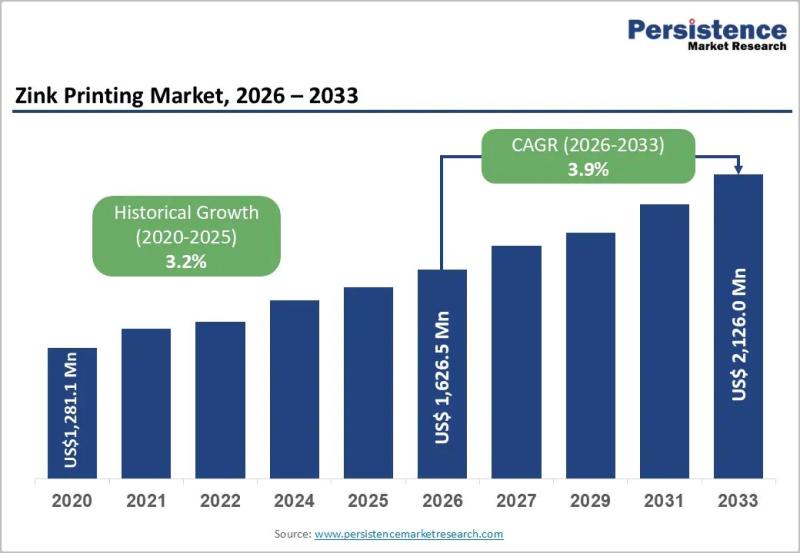

Zink Printing Market to Reach US$ 2,126.0 Million by 2033 at 3.9% CAGR

Zink Printing Market Size and Trends Analysis

The global Zink printing market is projected to be valued at US$ 1,626.5 million in 2026 and is expected to reach US$ 2,126.0 million by 2033, expanding at a CAGR of 3.9% between 2026 and 2033. Zink (Zero Ink) printing technology eliminates the need for ink cartridges by using heat-activated color crystals embedded within specialized paper. This innovation has positioned Zink printers as a…

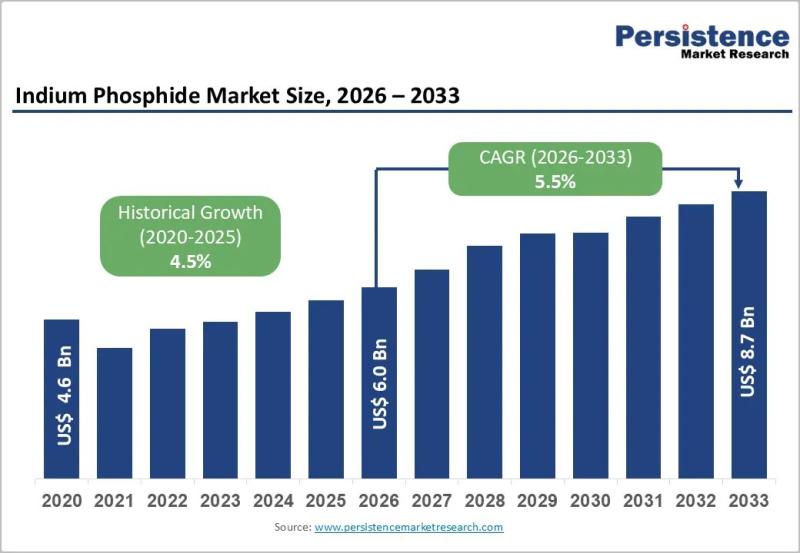

Indium Phosphide Market to Reach US$ 8.7 Billion by 2033 at 5.5% CAGR

The global Indium Phosphide (InP) market is poised for steady expansion, with its valuation expected to reach US$ 6.0 billion by 2026 and further grow to US$ 8.7 billion by 2033, registering a CAGR of 5.5% between 2026 and 2033. Indium phosphide, a high-performance compound semiconductor material, is widely used in optoelectronics, high-frequency electronics, and photonic integrated circuits (PICs). The market growth is largely fueled by the accelerating deployment of…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…