Press release

Life Reinsurance Market Projected to Grow at 10.94% CAGR During 2023-2029

Life Reinsurance Market size was valued at USD 221.95 Billion in 2022 and the total Life Reinsurance Market revenue is expected to grow at a CAGR of 10.94% from 2023 to 2029, reaching nearly USD 459.06 Billion.Life Reinsurance Market Overview:

The Life Reinsurance market plays a crucial role in the global insurance ecosystem by enabling primary insurers to mitigate risks associated with life insurance policies. Life reinsurers provide financial protection to insurance companies against high-value claims, large-scale mortality events, and unexpected financial liabilities. This risk-transfer mechanism allows insurers to maintain solvency, stabilize earnings, and expand underwriting capacity. The market is witnessing significant growth due to increasing awareness of life insurance products, rising healthcare expenditures, and the growing need for risk management in both developed and emerging economies. Additionally, demographic trends such as aging populations and increasing life expectancy are driving demand for life insurance coverage, indirectly boosting the life reinsurance sector. With innovative products such as mortality risk pooling, catastrophe coverage, and longevity risk solutions, the Life Reinsurance market is evolving to meet the complex financial and regulatory demands of insurers worldwide.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/189286/

Life Reinsurance Market Outlook and Future Trends:

The outlook for the Life Reinsurance market is highly promising as insurers seek enhanced risk management strategies and capital efficiency. Future trends indicate a growing focus on data-driven underwriting, where AI and predictive analytics are used to assess mortality risks, optimize pricing, and improve portfolio management. There is also a shift toward alternative reinsurance solutions, including insurance-linked securities (ILS) and longevity swaps, which allow insurers to diversify risk while freeing up capital. The adoption of digital platforms is transforming policy administration, claims processing, and actuarial analysis, increasing efficiency across the reinsurance value chain. Moreover, the global expansion of life insurance penetration, particularly in emerging markets, is expected to drive higher demand for reinsurance coverage. Regulatory changes and solvency requirements are further encouraging insurers to partner with reinsurers, positioning the Life Reinsurance market for sustained growth in the coming years.

Life Reinsurance Market Dynamics:

The dynamics of the Life Reinsurance market are shaped by risk management needs, regulatory requirements, technological advancements, and demographic trends. Key drivers include increasing life insurance adoption, rising mortality risks due to pandemics and chronic diseases, and the need for capital optimization by primary insurers. On the other hand, challenges such as market volatility, natural disasters, and unforeseen claim surges can impact profitability and risk assessment. The integration of advanced analytics, machine learning, and big data is enabling reinsurers to improve risk modeling, pricing strategies, and underwriting accuracy. Partnerships, mergers, and acquisitions are common strategies to expand geographical reach and enhance product portfolios. The market is also witnessing innovations in product offerings, such as hybrid life insurance and longevity risk solutions, allowing insurers to cater to evolving customer needs. These dynamics collectively reflect a robust growth trajectory for the Life Reinsurance market globally.

Life Reinsurance Market Key Recent Developments:

Recent developments in the Life Reinsurance market underscore innovation, digital transformation, and strategic collaborations. Leading reinsurers are increasingly leveraging AI-powered predictive analytics to assess mortality and longevity risks, streamline underwriting, and enhance portfolio performance. Cloud-based platforms and digital tools are improving claims processing, risk monitoring, and reporting efficiency. Strategic partnerships between reinsurers and insurance technology providers are expanding service offerings and enabling access to emerging markets. The market is also seeing increased focus on alternative reinsurance instruments, such as catastrophe bonds and longevity swaps, to diversify risk exposure. Regulatory compliance remains a critical factor, with reinsurers ensuring adherence to solvency and capital adequacy requirements. Additionally, demographic shifts and heightened awareness of life insurance products are driving growth across both developed and developing regions. These developments highlight the Life Reinsurance market's evolution toward data-driven, innovative, and resilient risk management solutions.

Life Reinsurance Market Outlook and Future Trends

The outlook for the Life Reinsurance market is highly positive, driven by increasing demand for risk mitigation and capital optimization among primary insurers. Future trends indicate that data-driven underwriting and predictive analytics will play a pivotal role in assessing mortality, longevity, and catastrophic risks more accurately. Artificial intelligence and machine learning are expected to enhance portfolio management, pricing strategies, and fraud detection, while digital platforms streamline claims processing and administrative workflows. The adoption of alternative reinsurance solutions, including insurance-linked securities (ILS), longevity swaps, and catastrophe bonds, is rising, offering insurers diversified risk transfer mechanisms. Furthermore, growing life insurance penetration in emerging markets, coupled with regulatory frameworks emphasizing solvency and capital adequacy, is projected to expand market opportunities. These developments suggest that the Life Reinsurance market will continue to evolve into a technologically advanced, data-driven, and resilient sector, supporting sustainable growth and enhanced financial security for insurers globally.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/189286/

Life Reinsurance Market Segmentation:

by Type

1. Facultative Reinsurance

2. Treaty Reinsurance

by Product

1.. Disease Insurance

2. Medical Insurance

by Distribution Channel

1. Direct Writing

2. Agent and Broker

3. Bank

by Category

1. Recurring reinsurance

2. Portfolio reinsurance

3. Retrocession reinsurance

by End-Users

1. Children

2. Adults

3. Senior Citizens

Some of the current players in the Life Reinsurance Market are:

North America

1. Alleghany

2. Berkshire Hathaway Life

3. Everest Re Group, Ltd.

4. Fairfax

5. Great-West Lifeco

6. Maiden Re

7. PartnerRe

8. RGA Reinsurance Company

9. SCOR SE

10. Sompo

11. Talcott Resolution

12. The Canada Life Assurance Company

13. Atlas Mag

Asia Pacific

1. China RE

2. Korean Re

3. Mitsui Sumitomo

4. Tokio Marine

5. Pacific Life Re

6. The Toa Reinsurance Company, Limited.

7. General Insurance Corporation of India Limited

Europe

1. AXIS

2. GIC Re

3. Hannover Re

4. Lloydâs

5. Mapfre

6. Munich Re

7. Swiss Re

8. XL Catlin

Middle East and Africa

1. African Reinsurance Corporation

2. Arch Capital Group Ltd.

3. Guy Carpenter & Company, LLC

4. OdysseyRe.

5. Aon plc

6. Mitsui Sumitomo Insurance Co., Ltd

South America

1. Constellation Insurance, Inc.

2. BMS Group

3. Odyssey Re

4. Allianz Group

5. Arch Reinsurance Ltd.

6. Kennedys

7. QBE Re

8. Chesterfield Group South America

For additional reports on related topics, visit our website:

♦ Hydrocarbon Storage Tank Cleaning Service Market https://www.maximizemarketresearch.com/market-report/hydrocarbon-storage-tank-cleaning-service-market/70755/

♦ Tumblers Market https://www.maximizemarketresearch.com/market-report/global-tumblers-market/32159/

♦ Gas Cutting Machine Market https://www.maximizemarketresearch.com/market-report/gas-cutting-machine-market/77015/

♦ Egg Processing Equipment Market https://www.maximizemarketresearch.com/market-report/global-egg-processing-equipment-market/23416/

♦ Global Industrial Remote Control Market https://www.maximizemarketresearch.com/market-report/global-intelligent-pump-market/24796/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading consulting and market intelligence company, recognized for providing in-depth insights and data-driven strategies across industries including healthcare, automotive, technology, and pharmaceuticals. With a strong focus on comprehensive research, future trend analysis, and competitive evaluation, the firm supports businesses in identifying opportunities, minimizing risks, and achieving long-term growth. Its expertise lies in equipping organizations with the knowledge and tools they need to enhance decision-making, optimize performance, and expand their market footprint effectively.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Life Reinsurance Market Projected to Grow at 10.94% CAGR During 2023-2029 here

News-ID: 4183712 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

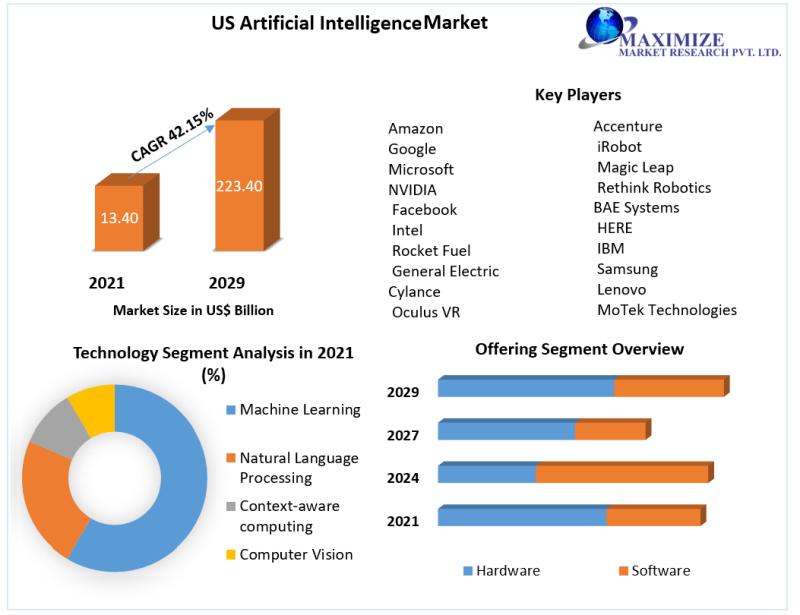

United States Artificial Intelligence (AI) Market Trends Reshaping Technology, M …

The United States Artificial Intelligence (AI) Market is not just expanding-it's redefining the global technology landscape. As the home to leading AI innovators, cloud giants, and advanced research institutions, the U.S. continues to dominate AI development and adoption. From healthcare and finance to defense, retail, and manufacturing, AI is transforming how businesses operate and how decisions are made.

Market Overview & CAGR

The U.S. AI market is witnessing extraordinary growth, driven by…

Golf Apparel Market Trends Transforming the Global Sportswear Industry

The Golf Apparel Market has evolved far beyond traditional polo shirts and khaki pants. Today, it represents a dynamic blend of performance wear, lifestyle fashion, and premium athleisure, appealing not only to professional golfers but also to everyday consumers. With golf gaining renewed popularity worldwide and fashion-forward designs redefining the sport, the golf apparel market is teeing up for impressive growth.

Golf Apparel Market Overview & CAGR

The global golf apparel market…

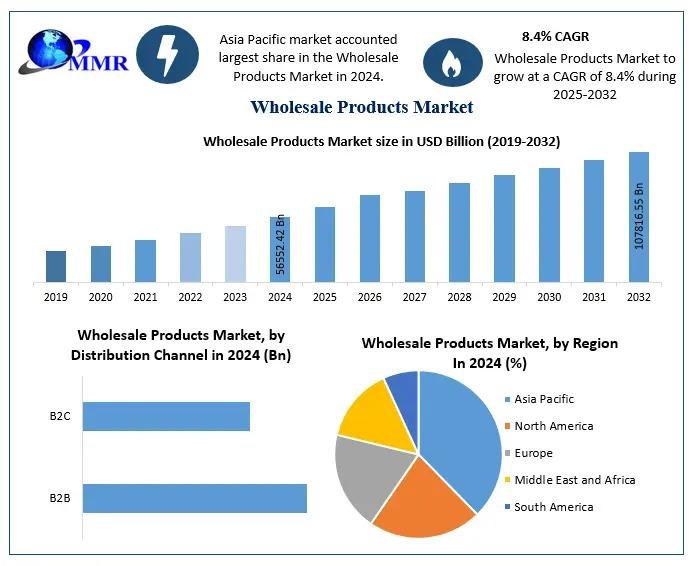

Wholesale Products Market to Reach USD 107,816.55 Billion by 2032, Growing at 8. …

Wholesale Products Market: Growth, Dynamics, and Future Outlook

The Wholesale Products Market size was valued at USD 54.82 Billion in 2024, and the total Wholesale Products Market revenue is expected to grow at a CAGR of 5.4% from 2025 to 2032, reaching nearly USD 83.12 Billion.

Market Overview

The Wholesale Products Market plays a critical role in the global supply chain, acting as a bridge between manufacturers and retailers, institutional buyers, and businesses.…

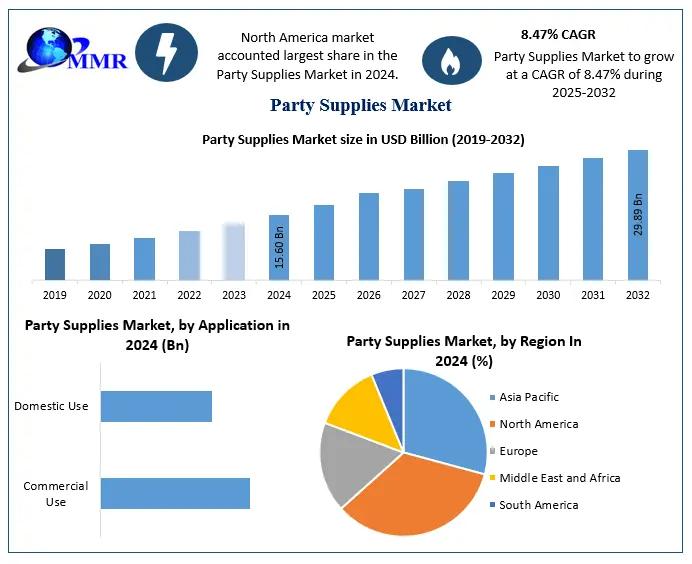

Party Supplies Market Growth Driven by Themed Events and Online Retail Expansion

The Party Supplies Market is more than just balloons and banners-it's a fast-growing global industry powered by celebrations, emotions, and experiences. From birthday parties and weddings to corporate events and festive gatherings, party supplies have become essential to modern celebrations. With rising disposable incomes, booming e-commerce platforms, and a growing appetite for themed and personalized events, the market is on a strong upward trajectory and shows no signs of slowing…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…