Press release

UV Blocking Transparent Film Market to Reach CAGR 8,4% by 2031 Top 10 Company Globally

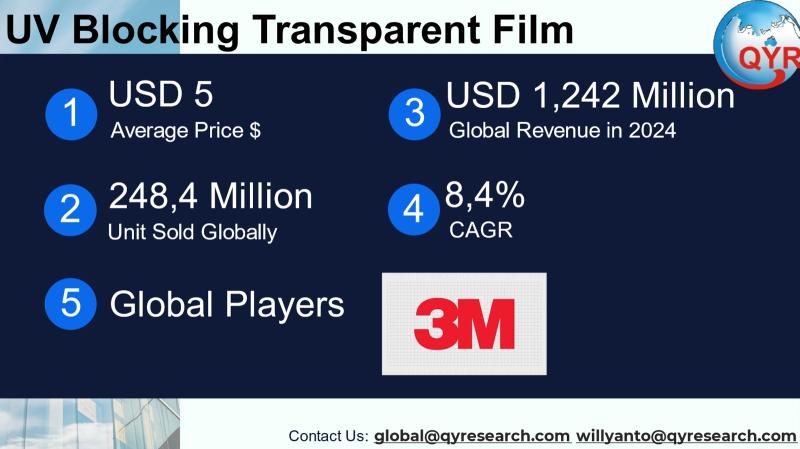

UV blocking transparent films are engineered polymer and composite films that selectively block ultraviolet (UV) radiation while preserving high visible-light transmission, and they are used across architectural glazing, automotive glass, display and device protection, clear packaging and specialty industrial applications where UV-sensitive materials or occupants need protection. These films achieve UV attenuation via UV absorbers, stabilized coatings, multilayer optical stacks or embedded nanoparticles, and they are offered in roll, cut-sheet and pressure-sensitive adhesive formats for retrofitting as well as lamination-ready grades for new-glass production. Suppliers therefore sell a mix of commodity PET/PVC-based UV-filter layers and higher-value specialty films with scratch coatings, IR rejection, anti-glare or optical clarity properties; customers range from window-film installers and automakers to food-packagers, museums, and electronics assemblers that need to protect components and goods from UV-induced degradation. The value pool includes both product revenue and recurring installation/retrofit service streams where installers bundle film supply with labor and warranty services.The UV-blocking film market at about USD 1,242 million in 2024, and projected to reach USD 2,190 million in 2031 with a central compound annual growth rate of 8,4% to 2031, which captures rising building and vehicle retrofit interest, growing protective packaging demand and expanding adoption in APAC device and display protection applications. The average selling price (ASP) of USD 5 per sq mt implies an implied global shipment of 248,4 million sq mt in 2024.

Latest Trends and Technological Developments

The UV blocking film market is evolving on three linked fronts: (1) higher-performance multilayer films that block near-UV while preserving very high visible transmittance and offering additional IR control, (2) chemistry and additive advances that improve long-term UV durability without yellowing, and (3) sustainability and bio-based alternatives to petroleum polymers. Notable dated developments include industry-scale material rollouts and formulation advances reported in 2024 to 2025: Plastics Technology highlighted a newly developed UV barrier for clear packaging films reported around NPE 2024 (coverage noting enhanced UV blocking performance and suitability for clear packaging). A market analysis platform published a recent UV-resistant films outlook (JuneJuly 2025) that reiterates Asia Pacifics leadership and forecasts sustained mid-single-digit to high-single-digit growth driven by automotive and construction retrofit demand. In advanced materials research, very recent scientific work (published and covered in August 2025) demonstrated nanocellulose-based films enhanced with plant-derived dyes that block UV up to 400 nm while maintaining high visible transparency; this points to emerging biodegradable or lower-carbon UV film alternatives that could disrupt some packaging and PV-protective film applications if scaled. These dated items NPE/Plastics Technology coverage (2024), industry market updates in 2025 and the nanocellulose research reported August 2025 show both near-term commercial product improvements and a medium-term materials shift toward more sustainable UV blocking solutions.

Asia Pacific is the dominant regional market for UV blocking transparent films in 2024 because it hosts large volumes of automotive glass assembly, window-film installation activity, electronics and display manufacturing and substantial packaging conversion capacity. Regional market studies repeatedly show APAC leading share due to Chinese and Southeast Asian manufacturing scale, high levels of building retrofit activity in urban centres, and strong demand from automotive OEMs in Japan, Korea and China for UV-protective glazing films. In addition, many film producers and converters in Taiwan, China and Korea supply both domestic installers and export channels, which concentrates high unit volumes and local price pressure in APAC while supporting rapid innovation cycles for advanced, thin, high-clarity UV films used in displays and device protection. These patterns are visible in regional breakdowns across UV-film and window-film market analyses.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5049074

UV Blocking Transparent by Type:

UV Absorber Coated Films

Nano Composite Films

Low Emissivity UV Films

Multi Layer Laminated Films

Others

UV Blocking Transparent by Application:

Packaging

Automotive

Construction

Electronics

Others

Global Top 10 Key Companies in the UV Blocking Transparent Film Market

3M Company

Jognson Window Films

Window Film Depot

Scalasol

Inano Film Ltd

Saint Gobain

Tint Depot

Garware Hi Tech Films Ltd

Cosmo Consumer

Opalux Window Films

Regional Insights

Southeast Asia is a fast-growing submarket with distinct dynamics: ASEAN countries are increasing adoption of retrofit UV/solar films for buildings and vehicles in urbanised cities, while demand for UV-protective packaging is rising with the growth of food delivery, refrigerated logistics and higher-value retail packaged goods. Indonesia, as the largest ASEAN population and a major regional market for consumer electronics and packaged goods, is experiencing expanding demand for both retrofit window films and packaging films that preserve product quality in tropical UV-intense conditions; regional distributors report higher demand for commodity PET UV films for packaging and for mid-range window films in Indonesias retail and automotive segments. ASEANs mix skews toward price sensitivity relative to East Asia, so many buyers in Indonesia and neighboring countries prioritize cost-effective UV protection (bulk PET film or laminated packaging films) before transitioning to premium ceramic or multi-function films. Local converting and distribution partnerships are therefore key go-to-market levers for suppliers targeting Indonesia and ASEAN.

The category faces several structural constraints that moderate growth and shape competitive strategy. First, product commoditization: low-cost PET grades and imported rolls create price pressure in retrofit and packaging channels, squeezing margins for branded specialty films. Second, performance trade-offs: some high-UV performance chemistries can accelerate yellowing or impair optical clarity unless premium stabilizers and coatings are used, which raises cost. Third, regulatory and health scrutiny: migration limits for certain UV absorbers and tight food-contact regulations in packaging markets require validated formulations and sometimes region-specific approvals. Fourth, sustainability pressure: many buyers now demand recycled content or bio-based alternatives, but replacements must match UV performance and durability at similar price points an unresolved materials challenge at scale. Fifth, installation quality and perception: retrofit window film performance depends heavily on installation quality and warranty support, creating a channel where trained installers and service networks are as important as film technical specs. These challenges are widely documented in sector analyses and supplier notices.

Suppliers that will capture durable value combine strong material formulation IP (UV stabilizers and non-yellowing chemistries) with scale in roll manufacture and local converting capability in APAC/ASEAN so they can meet both volume and regulatory needs quickly. Product strategies that add value include bundling UV blocking with IR/thermal control, scratch-resistant coatings for device displays, and certified food-contact grades for packaging; service strategies that increase stickiness include installation training networks, longer warranties tied to in-field monitoring, and retrofit inspection programs for commercial real-estate portfolios. In ASEAN and Indonesia specifically, partnering with local converters and distributors to offer tested, food-safe UV films and low-cost bulk rolls for packaging provides the fastest path to volume, while premium architectural projects and automotive OEM contracts will reward suppliers that can certify long-term UV durability and non-yellowing performance. Investing in sustainable film R&D (bio-derived or recycled feedstocks) is a medium-term defensive and offensive move as corporate procurement and regulators tighten sustainability expectations.

Product Models

UV blocking transparent films are advanced materials designed to protect surfaces, devices, and interiors from harmful ultraviolet (UV) radiation while maintaining high optical clarity. These films are widely applied in architecture, automotive, electronics, and packaging to enhance durability, safety, and energy efficiency.

UV Absorber Coated Films these films use a special coating that absorbs harmful UV rays, protecting interiors, displays, and surfaces without affecting transparency. Notable products include:

3M Prestige Window Film 3M: Coated with UV-absorbing layers, reducing up to 99% UV rays while keeping transparency.

Saint-Gobain Solar Gard Films Saint-Gobain: Advanced UV-protection coatings for building glass and automotive use.

Madico UV Gard Film Madico Inc.: UV-coated protective film designed for museums, retail displays, and offices.

Eastman LLumar UVShield Eastman Chemical Company: UV absorber coated window film offering fade protection for interiors.

Toray Lumirror UV Film Toray Industries: Polyester-based coated film with strong UV-blocking and optical clarity.

Nano Composite Films made with embedded nanoparticles, they block UV radiation while also improving durability, clarity, and sometimes heat rejection. Examples include:

Nitto Denko UV Cut Nano Film Nitto Denko: Nano-structured particles embedded for high UV absorption and clarity.

3M Ceramic IR Nano Film 3M: Combines UV protection with infrared heat rejection using nano-composite tech.

Toray Nano Shield Film Toray Industries: Nano-engineered transparent film with strong UV cut and durability.

Eastman SunTek Ultra Nano Film Eastman: Nanotechnology-based UV film for energy efficiency and protection.

Saint-Gobain Solar Gard Nanotech Series Saint-Gobain: Multi-purpose UV and solar protection with nano-composite layers.

Low-Emissivity (Low-E) UV Films designed to block UV rays while also reducing heat transfer, making them ideal for energy-efficient buildings and glass applications. Notable products include:

3M Thinsulate Low-E Window Film 3M: Provides UV blocking, insulation, and solar control in one film.

Eastman LLumar Low-E Film Eastman Chemical Company: Combines UV blocking with energy savings for buildings.

Saint-Gobain Solar Gard Ecolux Low-E Saint-Gobain: Premium low-emissivity film with UV blocking for architecture.

Madico Sunscape Low-E Series Madico Inc: Energy-efficient film with strong UV protection for residential and commercial glass.

Toray Low-E UV Blocking Film Toray Industries: Designed for energy-efficient glazing with UV absorption.

Multi-Layer Laminated Films built from multiple thin layers, they provide strong UV protection along with added strength, safety, and long-term durability:

Madico Advanced Laminated UV Film Madico Inc.: Combines multiple polymer layers for high strength and UV defense.

Teijin Multi-Laminate UV Film Teijin Limited: Used in electronics and automotive glazing with durable UV protection.

KDX Multi-Layer Nano Laminated Film Kangdexin (KDX): Laminated construction with nano-composite particles for UV absorption.

Nitto Denko Multi-Laminate UV Film Nitto Denko: Japanese engineered laminated film for industrial and architectural use.

SolarFree Multi-Layer Laminated UV Film SolarFree: Budget-friendly laminated UV blocking film for buildings and cars.

UV blocking transparent films are a pragmatic, multi-use materials category that protects people, products and equipment from harmful solar UV while enabling visible transparency. Using reconciled public sources we estimate the market at about USD 1,242 million in 2024 with a modeled 8,4% CAGR to 2031, implying meaningful expansion driven by retrofit building programs, automotive glazing, protective packaging and growth in device/display protection in APAC. Unit volumes measured in square metres depend heavily on product mix; with a mid-case ASP of USD 5 per sq mt the implied global shipment in 2024 is 248,4 million sq mt. Asia Pacific leads demand and manufacturing, while ASEAN is a fast-growing, price-sensitive volume market that favors local converters and cost-efficient film grades. Key industry drivers for the next five years will be sustainability innovations, improved non-yellowing UV chemistries, and stronger installer/service networks that convert film supply into durable installed base and recurring warranty income.

Investor Analysis

For investors the what is a resilient materials market exposed to secular drivers building energy efficiency, occupant health awareness, automotive UV/solar control needs and protective packaging for temperature/UV-sensitive goods. The how value is captured through vertical positions that combine film formulation IP with converting capacity and regional distribution: companies that own formulation patents or exclusive additive supply can command price premia, while converters with local installation networks (APAC/ASEAN) convert commodity film into higher-margin installed services. The why is that modest capital intensity, recurring replacement cycles (film lifespan and packaging turnover), and increasing regulatory emphasis on product protection create multi-year demand visibility while allowing consolidation via rollups of converters and installer networks. Diligence focus should include product testing (UV blocking spectra and yellowing over time), food-contact and chemical migration certifications for packaging grades, installed-base measurement capability (warranty and replacement rates), and supplier exposure to recycled/bio-based feedstock pathways these factors materially shape long-term margins and downside risk.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5049074

5 Reasons to Buy This Report

It reconciles disparate public market estimates into a defensible 2024 baseline and provides a transparent CAGR to 2031 for reliable financial modelling and scenario planning.

It converts dollars into practical area-based volumes using a clear ASP sensitivity so procurement, converting and logistics teams can model capacity and stock needs.

It captures dated, material technology and materials signals that change supplier and product choices.

It delivers regional granularity for APAC and ASEAN so investors and suppliers can prioritize converting partnerships and installer networks for fastest go-to-market.

It profiles the competitive landscape and strategic levers formulation IP, coating capability, installer networks and sustainability pathway that determine who will capture premium margins.

5 Key Questions Answered

What is a defensible 2024 market size for UV blocking transparent film and what CAGR should be used to model growth to 2031?

What are realistic price-per-square-metre bands for commodity vs premium UV films and what global area shipments did 2024 revenue imply under low/mid/high ASP scenarios?

Which recent dated technology or product developments (20242025) materially change film performance, sustainability or packaging suitability?

How do APAC and ASEAN differ in demand profile, price sensitivity and supplier strategies and which regional go-to-market moves shorten time to scale?

Which supplier capabilities most reliably translate into premium pricing and repeat business?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UV Blocking Transparent Film Market to Reach CAGR 8,4% by 2031 Top 10 Company Globally here

News-ID: 4183651 • Views: …

More Releases from QY Research

Market Overview - Alkali Borosilicate Glass

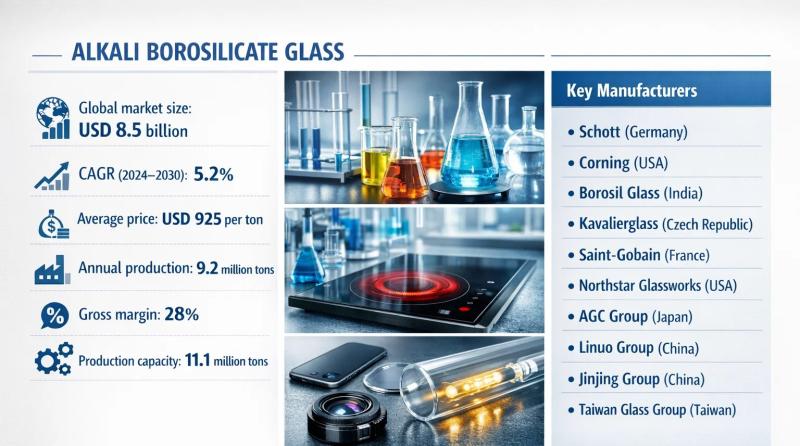

QY Research has recently published a comprehensive market study on Alkali Borosilicate Glass, a widely used technical glass material combining good thermal stability, chemical resistance, and cost efficiency. Positioned between soda-lime glass and high-boron borosilicate glass, alkali borosilicate glass is extensively applied in pharmaceutical packaging, laboratory ware, lighting, display components, and industrial glass assemblies.

The market is transitioning from commodity glass supply toward application-specific formulations optimized for thermal shock resistance, ion…

Global and U.S. Spot Meters Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Spot Meters, are handheld or portable light-measuring instruments designed to measure the intensity of light from a very small, specific area (or "spot") within a scene. Using a narrow measurement angle, they allow precise evaluation of luminance or illuminance from targeted points, making them especially useful in photography, cinematography, lighting design, display calibration, and industrial inspections where accurate exposure or…

Global and U.S. Intralogistics Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Intralogistics Robots, automated robotic systems designed to handle internal material movement, storage, picking, sorting, and palletizing within warehouses, distribution centers, and manufacturing facilities. Intralogistics robots form the physical execution layer of smart logistics, integrating closely with WMS, MES, and ERP platforms to enable high-throughput, flexible, and data-driven material flows. As labor shortages, SKU complexity, and fulfillment speed requirements intensify, this…

Top 30 Indonesian Personal Care Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Unilever Indonesia Tbk (UNVR) personal care leader

PT Victoria Care Indonesia Tbk (VICI) cosmetics & body care

PT Kino Indonesia Tbk (KINO) wide personal care portfolio

PT Mandom Indonesia Tbk (TCID) grooming & cosmetics

PT Mustika Ratu Tbk (MRAT) heritage cosmetics & herbal

PT Martina Berto Tbk (MBTO) cosmetics manufacturer

PT Akasha Wira International Tbk (ADES) …

More Releases for Film

Introducing heat sealable bopp film: Cloud Film Unveils Revolutionary Heat Seala …

Qingdao Cloud Film Packaging Materials Co., Ltd., a leading innovator in the packaging industry, is thrilled to announce the launch of heat sealable bopp film, a breakthrough heat sealable BOPP film set to revolutionize flexible packaging and labeling applications globally. This exciting development represents a significant advancement in packaging technology and underscores Qingdao Cloud Film's commitment to delivering cutting-edge solutions to its customers worldwide.

In a world where packaging integrity and…

Film Marketing & Film Financing

Film Sales Agency TheMovieAgency.com is now offering extra assistance to filmmakers. If you are looking for raising funds for your next feature film or simply looking for assistance in marketing your completed feature film on the road to distribution, The Movie Agency might be able to help you with no upfront fee and no hidden fee!!!

We offer:

Free consultation.

Sourcing investors and future distributors, film buyers.

North American Distribution for the feature…

Winter Film Awards International Film Festival Returns for 10th Annual Celebrati …

New York City's Winter Film Awards showcases films from emerging filmmakers from around the world in all genres, with a special emphasis on highlighting the work of women and under-represented filmmakers. The 10th annual Festival runs September 23-October 2 in New York City. The lineup includes 91 fantastic films from 28 countries, 7 free education sessions and amazing parties.

Winter Film Awards International Film Festival, which was one of NYC's last…

Global Film Capacitors Market 2021 Applications, Leading Manufacturers, Analysis …

Syndicate Market Research recently launched a study report on the global Film Capacitors market project light on the significant drifts and vigorous cannon into the evolution of the trade, which includes the restraints, market drivers, and opportunities. The report talks about the competitive environment prevailing in the Film Capacitors market worldwide. The report lists the key players in the market and also provides insightful information about them such as their…

Biaxially Oriented Polyester (BoPET) Market Share: Key players, Application, Foc …

Biaxially Oriented Polyester (BoPET) Market report provides Six-Year forecast 2019-2025 with Overview, Classification, Industry Value, Price, Cost and Gross Profit. The prime objective of this report is to help the user understand the market in terms of its definition, segmentation, market potential, influential trends, and the challenges that the market is facing. It also covers types, enterprises and applications. To start with, analytical view to complete information of Biaxially Oriented Polyester (BoPET) market. It offers market view…

Global Polyester Film (PET Film) Market Growth 2017-2022 Mitsubishi Polyester Fi …

PET or polyethylene terephthalate film is a thermoplastic polymer commonly referred to as polyester film. Like most thermoplastics, PET films can be biaxially oriented or bubble extruded. Polyester film is one of the most common substrates used in the converting industry because of its balance of properties in relation to other thermoplastic polymers.

Ask For Sample Copy of Report : http://bit.ly/2toHtBg

This report provides detailed analysis of worldwide markets for Polyester Film…