Press release

New York Foreign Investment Lawyer Natalia A. Sishodia Explains FIRPTA Withholding Rules for Non-Citizen Home Sellers

Navigating federal tax requirements when selling real estate as a non-citizen in New York can be complex. Natalia A. Sishodia (https://sishodia.com/should-i-withhold-firpta-at-closing-on-sale-of-ny-home-if-i-am-not-a-citizen/), a New York foreign investment lawyer at Sishodia PLLC, offers guidance for buyers and sellers dealing with the Foreign Investment in Real Property Tax Act (FIRPTA). FIRPTA mandates that a portion of the sale proceeds be withheld when a foreign person sells U.S. property, and Natalia A. Sishodia works with clients to ensure compliance and avoid costly penalties.For those involved in transactions with non-citizen sellers, FIRPTA requires buyers to withhold 15% of the gross sale price and submit the amount to the IRS. A New York foreign investment lawyer can provide direction on documentation, deadlines, and legal steps to ensure both parties meet federal requirements. Natalia A. Sishodia explains that this process includes filing IRS Forms 8288 and 8288-A within 20 days of the property transfer, a deadline that often surprises unprepared buyers and sellers.

Every transaction involving a foreign seller brings a different set of conditions. Natalia A. Sishodia, a New York foreign investment lawyer, stresses the importance of confirming seller status early and ensuring all paperwork is in order before closing. If the seller qualifies as a foreign person under FIRPTA, failure to withhold the correct amount could lead to financial consequences for the buyer. Title and escrow companies may assist in logistics, but legal liability falls on the buyer.

According to Natalia A. Sishodia, FIRPTA withholding is based on the amount realized-not the seller's profit. In most cases, this means 15% of the gross sales price. However, if the buyer intends to use the property as a residence and the purchase price is between $300,000 and $1,000,000, a 10% withholding rate may apply. For sales under $300,000 with an intent to reside at the property, withholding may not be required. A New York foreign investment lawyer can help determine which rate applies and assist in meeting the requirements.

For buyers, confirming whether the seller is a foreign person is a legal responsibility. Natalia A. Sishodia notes that a foreign person may be a nonresident alien individual, a foreign corporation, partnership, trust, or estate. If the seller is not a foreign person, a certification of non-foreign status-such as a completed IRS Form W-9-should be obtained and retained. This document must be kept for five years after the transaction.

Delays in securing taxpayer identification numbers can disrupt the closing process. Natalia A. Sishodia, a New York foreign investment lawyer, advises foreign sellers to ensure that all tax identification documents are valid before initiating the transaction. Expired Individual Taxpayer Identification Numbers (ITINs) can lead to rejected applications and delayed processing of Form 8288-B, which requests a reduced withholding amount.

A properly completed Form 8288-B can delay payment until the IRS decides on the withholding certificate. However, errors or incomplete information can result in rejection. Natalia A. Sishodia emphasizes filing early and including accurate information to minimize the risk of unnecessary withholding. If the IRS has not responded by the time of closing and no certificate is issued, the full withholding amount must be submitted by the buyer.

Penalties for failing to withhold when required under FIRPTA are significant. The IRS may hold the buyer personally liable for the unpaid tax, in addition to charging interest and penalties. Natalia A. Sishodia warns that willful failure to comply may lead to penalties of up to $10,000 and, in extreme cases, charges of tax evasion. For sellers, failing to report income or filing incorrect returns can trigger audits and additional financial liabilities.

A withholding certificate may adjust or eliminate the required amount if the IRS determines the tax liability is lower than the standard withholding. Natalia A. Sishodia works with clients to ensure timely submission and accurate documentation to avoid disruptions to the transaction. If a certificate is applied for, funds must still be submitted within 20 days of receiving the IRS response.

FIRPTA compliance requires early planning and precise execution. Working with a New York foreign investment lawyer ensures that buyers and sellers understand their obligations, timelines, and documentation requirements. Natalia A. Sishodia helps clients minimize legal exposure and complete real estate transactions without unnecessary delay or risk.

The risks of noncompliance can be avoided with early preparation and guidance. FIRPTA withholding rules may be confusing, but legal support from a New York foreign investment lawyer such as Natalia A. Sishodia can ensure the transaction proceeds smoothly and lawfully. Legal guidance can help confirm the seller's status, file proper forms, and coordinate with title companies to release funds accurately at closing.

For foreign investors selling or buying property in New York, understanding FIRPTA is critical. Natalia A. Sishodia helps clients manage timelines, gather documentation, and complete IRS filings, reducing the risk of penalties and ensuring compliance with federal regulations.

About Sishodia PLLC:

Sishodia PLLC is a New York-based real estate law firm led by Natalia A. Sishodia. The firm serves both domestic and international clients in high-end real estate transactions. Services include legal support for property purchases, sales, estate planning, and multi-jurisdictional tax planning. The firm is committed to offering clear legal guidance for individuals and businesses operating in the New York real estate market.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=_Y2XBe3fZUU

GMB: https://www.google.com/maps?cid=12450537318741950980

Email and website

Email: natalia@sishodialaw.com

Website: https://sishodia.com/

Media Contact

Company Name: Sishodia PLLC

Contact Person: Natalia A. Sishodia

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-york-foreign-investment-lawyer-natalia-a-sishodia-explains-firpta-withholding-rules-for-noncitizen-home-sellers]

Phone: (833) 616-4646

Address:600 3rd Ave 2nd floor

City: New York

State: New York 10016

Country: United States

Website: https://sishodia.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New York Foreign Investment Lawyer Natalia A. Sishodia Explains FIRPTA Withholding Rules for Non-Citizen Home Sellers here

News-ID: 4183581 • Views: …

More Releases from ABNewswire

Mind Above Matter Expands Access to Mental Health Support with Virtual Group The …

Mind Above Matter in Keller, TX, is enhancing access to mental health care by offering virtual group therapy sessions. This expansion allows individuals to receive professional support from the comfort of their homes, making mental health services more accessible and convenient for the community.

Keller, TX - Dec 19, 2025 - Mind Above Matter, a leading provider of outpatient group treatment services in Keller, TX, is expanding its mental health support…

Mahogany Kitchens Discusses the Growing Demand for Custom Cabinetry in Palm Beac …

Mahogany Kitchens highlights the growing preference for tailored cabinetry in Palm Beach County, covering local trends in kitchen remodeling and handcrafted woodwork solutions.

Palm Beach County has seen a notable shift in how homeowners approach interior design, with a growing preference for custom cabinetry that reflects personal style and functional needs. Mahogany Kitchens, a Boynton Beach-based woodwork company, has observed this trend firsthand while serving clients throughout South Florida. The increased…

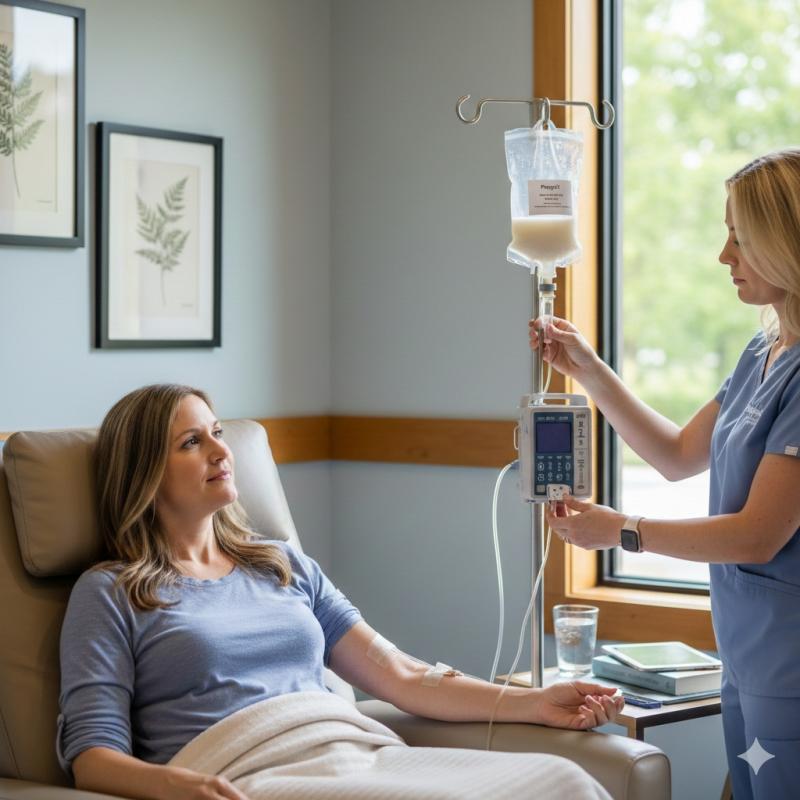

Prince Health Introduces PlaqueX IV Therapy in The Woodlands for Cardiovascular …

Prince Health in The Woodlands, TX, announces the launch of PlaqueX IV therapy, a non-surgical functional medicine treatment designed to support heart health and reduce arterial plaque. Led by Dr. Ashley Prince, DC, the practice offers this advanced phosphatidylcholine infusion to help patients improve circulation and lipid metabolism. This proactive cardiovascular solution is now available to residents in the Greater Houston area.

THE WOODLANDS, Texas - December 19, 2025 - Prince…

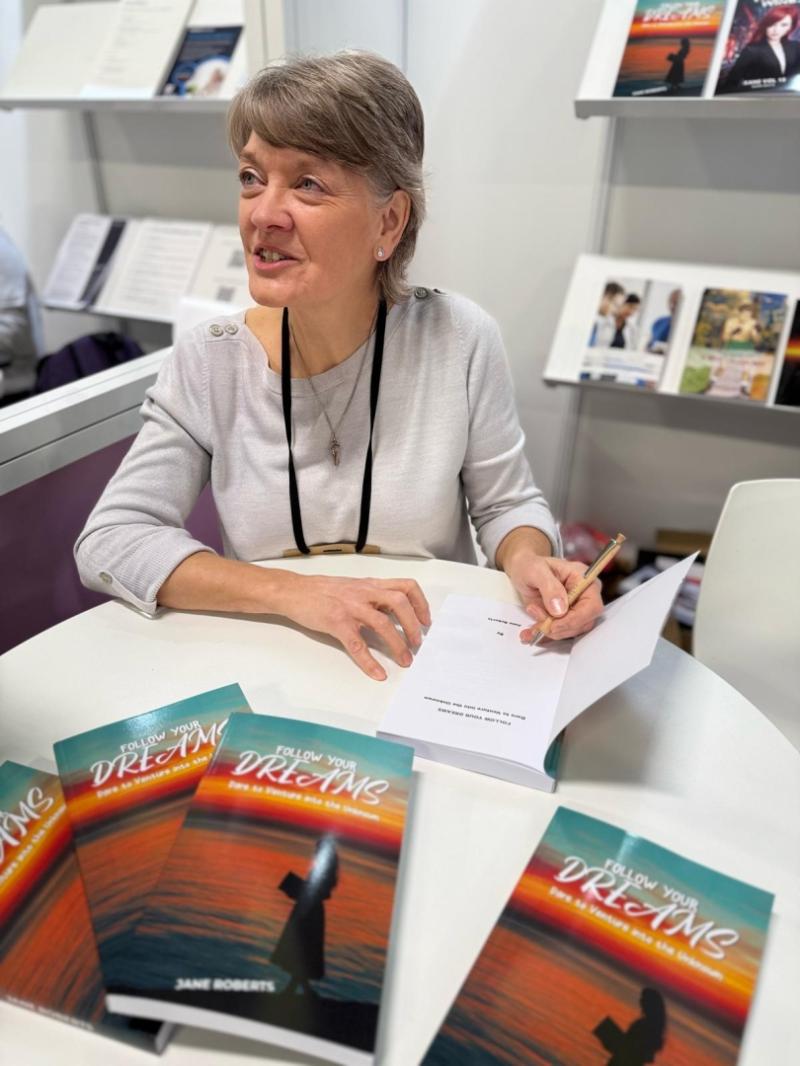

From London Comforts to Vietnamese Chaos: Author Jane Roberts Unveils the Gritty …

When a high-stakes job offer in Hanoi disrupts a settled life in the UK, one woman abandons her safety net to build a market-leading empire amidst humidity, hardship, and the unknown-proving that true transformation only happens when you stop playing it safe.

In her powerful debut, Follow Your Dreams: Dare to Venture into the Unknown, Jane Roberts brings us a compelling narrative about the transformative power of chasing your dreams, even…

More Releases for Sishodia

Manhattan Deed Transfer Lawyer Natalia A. Sishodia Clarifies New York Transfer T …

Transferring real estate in New York requires careful attention to legal and tax obligations that can have long-term consequences. Natalia A. Sishodia (https://sishodia.com/do-i-need-to-pay-transfer-taxes-when-transferring-title/), a Manhattan deed transfer lawyer at Sishodia PLLC, outlines key considerations property owners should understand when changing a property's title through sale, inheritance, gift, or restructuring. In New York, real estate transfers typically involve the payment of transfer taxes, which can significantly affect the cost and timeline…

NYC Condo Attorney Natalia Sishodia Provides Insights on Manhattan Real Estate T …

NYC condo attorney [https://sishodia.com/manhattan-condo-real-estate-attorney/] Natalia Sishodia discusses key aspects of Manhattan real estate transactions, helping buyers and sellers navigate purchasing or selling a condominium in the city. With the competitive nature of the real estate market, having an understanding of legal requirements and potential challenges is essential. Sishodia PLLC provides guidance on contract negotiations, due diligence, and closing processes for those involved in condo transactions.

As an NYC condo attorney, Natalia…

Manhattan Deed Transfer Lawyer Natalia Sishodia Releases Insightful Article on P …

Manhattan deed transfer lawyer Natalia Sishodia (https://sishodia.com/manhattan-deed-transfer-lawyer/), of Sishodia PLLC, highlights the essential role of deed transfers in real estate transactions. A deed, which serves as the official document transferring property ownership from one party to another, is foundational in establishing clear and lawful property rights. Handling these transfers properly is critical to avoiding costly disputes or legal challenges.

A deed transfer is not just about signing paperwork. As Manhattan deed…

New York Estate Probate Lawyer Natalia Sishodia Explains the Probate Sale Proces …

Probate sales play an important role in settling estates after the death of a loved one. According to New York estate probate lawyer Natalia Sishodia (https://sishodia.com/what-is-a-probate-sale/) of Sishodia PLLC, a probate sale involves selling property under court supervision to meet the financial obligations of the deceased, such as debts and taxes, before distributing any remaining assets to beneficiaries. This legal process ensures that everything is conducted fairly, especially when real…

Real Estate Attorney NYC Natalia Sishodia Offers Insightful Legal Guidance for P …

Natalia Sishodia, the leading attorney at Sishodia PLLC, continues to establish herself as a prominent real estate attorney NYC [https://sishodia.com/]. With her deep understanding of New York's complex real estate market, Natalia Sishodia is known for offering comprehensive legal guidance to individuals and businesses navigating property transactions throughout the city. Her ability to effectively communicate with clients and handle both residential and commercial real estate matters has helped her and…

New York Estate Probate Lawyer Natalia Sishodia Explains the NY Estate Probate P …

New York estate probate lawyer Natalia Sishodia (https://sishodia.com/new-york-estate-probate-lawyer/) releases a new article explaining the NY estate probate process. The lawyer mentions that the probate process refers to the transfer of property from a person to their heirs. Going through the probate process can be lengthy and complicated, especially after losing a loved one.

"A Will or a Last Will and Testament is a written document detailing what a person wants to…