Press release

Insurance Platform Market - Industry Trends and Forecast to 2033

The insurance platform market was valued at USD 81.7 billion in 2023 and is projected to reach approximately USD 397.8 billion by 2033, growing at a CAGR of about 11.8% from 2024 to 2033.Insurance Platform Market Overview

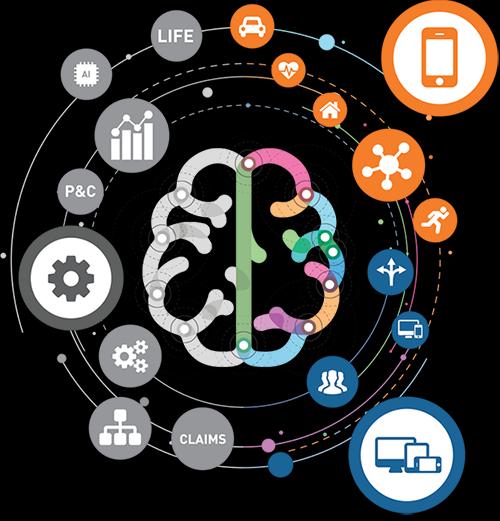

The insurance platform market refers to digital ecosystems and solutions that streamline insurance operations-combining functions like underwriting, claims management, policy administration, customer engagement, billing, and more-into integrated platforms. The push toward digital transformation in insurance has accelerated adoption of such platforms, driven by customer expectations for seamless, efficient, and omnichannel experiences. Technologies such as cloud computing, artificial intelligence, machine learning, data analytics, blockchain, and IoT are enabling insurers to reduce costs, improve accuracy, and innovate product offerings. Also, increased regulatory pressure, competitive threats from insurtechs, and the need for agile, scalable infrastructure are pushing incumbents to upgrade or replace legacy systems. Regionally, North America currently dominates the market, but Asia-Pacific and other emerging economies are expected to register the highest growth rates owing to rapid digitization and rising insurance penetration. As insurers continue to prioritize operational efficiency and customer experience, the demand for comprehensive insurance platform solutions is expected to grow strongly through 2033.

Request a sample copy of this report at: https://www.omrglobal.com/request-sample/insurance-platform-market

Advantages of requesting a Sample Copy of the Report:

1) To understand how our report can bring a difference to your business strategy

2) To understand the analysis and growth rate in your region

3) Graphical introduction of global as well as the regional analysis

4) Know the top key players in the market with their revenue analysis

5) SWOT analysis, PEST analysis, and Porter's five force analysis

The report further explores the key business players along with their in-depth profiling

Microsoft, IBM, Oracle, SAP, Salesforce, Pegasystems, Guidewire Software, and Cognizant

Insurance Platform Market Segments:

◘ By Type: cloud-based platforms and on-premises platforms

◘ By Application: life insurance, health insurance, property & casualty insurance, and others

Report Drivers & Trends Analysis:

The report also discusses the factors driving and restraining market growth, as well as their specific impact on demand over the forecast period. Also highlighted in this report are growth factors, developments, trends, challenges, limitations, and growth opportunities. This section highlights emerging Insurance Platform Market trends and changing dynamics. Furthermore, the study provides a forward-looking perspective on various factors that are expected to boost the market's overall growth.

Competitive Landscape Analysis:

In any market research analysis, the main field is competition. This section of the report provides a competitive scenario and portfolio of the Insurance Platform Market's key players. Major and emerging market players are closely examined in terms of market share, gross margin, product portfolio, production, revenue, sales growth, and other significant factors. Furthermore, this information will assist players in studying critical strategies employed by market leaders in order to plan counterstrategies to gain a competitive advantage in the market.

Regional Outlook:

The following section of the report offers valuable insights into different regions and the key players operating within each of them. To assess the growth of a specific region or country, economic, social, environmental, technological, and political factors have been carefully considered. The section also provides readers with revenue and sales data for each region and country, gathered through comprehensive research. This information is intended to assist readers in determining the potential value of an investment in a particular region.

» North America (U.S., Canada, Mexico)

» Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

» Asia-Pacific (China, India, Japan, Singapore, Australia, New Zealand, Rest of APAC)

» South America (Brazil, Argentina, Rest of SA)

» Middle East & Africa (Turkey, Saudi Arabia, Iran, UAE, Africa, Rest of MEA)

If you have any special requirements, Request customization: https://www.omrglobal.com/report-customization/insurance-platform-market

Key Benefits for Stakeholders:

⏩ The study represents a quantitative analysis of the present Insurance Platform Market trends, estimations, and dynamics of the market size from 2025 to 2032 to determine the most promising opportunities.

⏩ Porter's five forces study emphasizes the importance of buyers and suppliers in assisting stakeholders to make profitable business decisions and expand their supplier-buyer network.

⏩ In-depth analysis, as well as the market size and segmentation, help you identify current Insurance Platform Market opportunities.

⏩ The largest countries in each region are mapped according to their revenue contribution to the market.

⏩ The Insurance Platform Market research report gives a thorough analysis of the current status of the Insurance Platform Market's major players.

Key questions answered in the report:

➧ What will the market development pace of the Insurance Platform Market?

➧ What are the key factors driving the Insurance Platform Market?

➧ Who are the key manufacturers in the market space?

➧ What are the market openings, market hazards,s and market outline of the Insurance Platform Market?

➧ What are the sales, revenue, and price analysis of the top manufacturers of the Insurance Platform Market?

➧ Who are the distributors, traders, and dealers of Insurance Platform Market?

➧ What are the market opportunities and threats faced by the vendors in the Insurance Platform Market?

➧ What are deals, income, and value examination by types and utilizations of the Insurance Platform Market?

➧ What are deals, income, and value examination by areas of enterprises in the Insurance Platform Market?

Purchase Now Up to 25% Discount on This Premium Report: https://www.omrglobal.com/buy-now/insurance-platform-market?license_type=quick-scope-report

Reasons To Buy The Insurance Platform Market Report:

➼ In-depth analysis of the market on the global and regional levels.

➼ Major changes in market dynamics and competitive landscape.

➼ Segmentation on the basis of type, application, geography, and others.

➼ Historical and future market research in terms of size, share growth, volume, and sales.

➼ Major changes and assessment in market dynamics and developments.

➼ Emerging key segments and regions

➼ Key business strategies by major market players and their key methods

Contact Us:

Mr. Anurag Tiwari

Email: anurag@omrglobal.com

Contact no: +91 780-304-0404

Website: www.omrglobal.com

Follow Us: LinkedIn | Twitter

About Orion Market Research

Orion Market Research (OMR) is a market research and consulting company known for its crisp and concise reports. The company is equipped with an experienced team of analysts and consultants. OMR offers quality syndicated research reports, customized research reports, consulting and other research-based services. The company also offers Digital Marketing services through its subsidiary OMR Digital and Software development and Consulting Services through another subsidiary Encanto Technologies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Platform Market - Industry Trends and Forecast to 2033 here

News-ID: 4182826 • Views: …

More Releases from Orion Market Research

Hair Accessories Market Poised for Strong Growth Driven by Gen Z Trends and Sust …

Hair accessories market was valued at $23.8 billion in 2024 and is projected to reach $55.2 billion in 2035, growing at a CAGR of 8.2% during the forecast period (2025-2035). Generation Z, with significant disposable income, is transforming the hair accessories category in a major way. Their close connection to trends creates a unique feeling of urgency to self-express through fashion, such as clips, scrunchies, and barrettes. It has become…

Railway Management System Market Size Analysis, Competitive Insights, Leading Pl …

Railway System (or Railway Management System) market was valued at approximately USD 28.28 billion, and it is expected to reach about USD 45.19 billion by 2033, growing at a CAGR of around 4.8% from 2024 to 2033.

Railway Management System Market Overview

The Railway Management System market includes technologies and systems used to plan, monitor, and manage railway operations-everything from traffic and signaling systems to asset and maintenance management, passenger information,…

Monocalcium Phosphate Market Size Analysis, Competitive Insights, Leading Player …

Monocalcium Phosphate market was valued at about USD 4.2 billion, and it is anticipated to reach around USD 6.9 billion by 2033, growing at a CAGR of approximately 5% from 2023 to 2033.

Monocalcium Phosphate Market Overview

Monocalcium phosphate (MCP) is a calcium-phosphorus compound widely used in animal feed, fertilizers, and also in food and beverage applications (for example as leavening agent or acidity regulator), due to its solubility and bioavailability. The…

Automotive Lubricants Market Size Analysis, Competitive Insights, Leading Player …

Automotive Lubricants Market was valued at approximately USD 70.44 billion. By 2033, it is expected to reach around USD 107.09 billion, growing at a CAGR of about 3.3% from 2025 to 2033.

Automotive Lubricants Market Overview

The automotive lubricants market consists of products like engine oils, gear oils, greases, hydraulic fluids, and transmission fluids that reduce friction, wear and tear, and improve efficiency and lifespan of vehicle components. Demand is driven by…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…