Press release

Voice Banking Market Size, Share, and Growth Forecast (2025-2032)

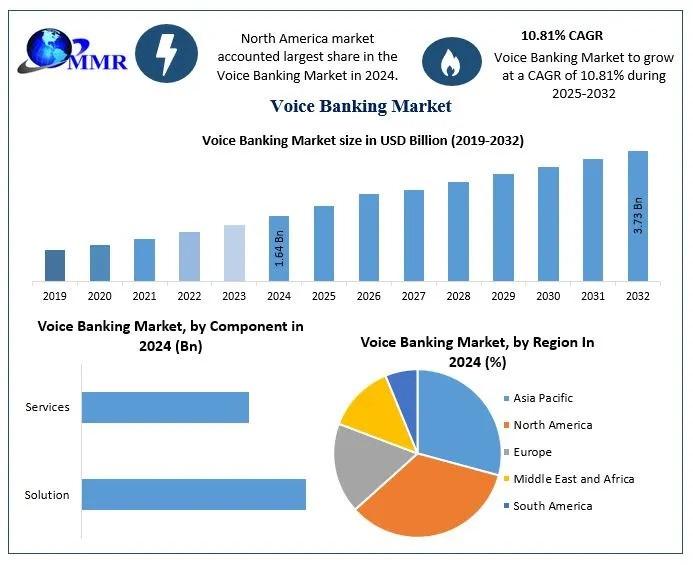

Voice Banking Market size was valued at USD 1.64 Billion in 2024 and the total Voice Banking revenue is expected to grow at a CAGR of 10.81% from 2025 to 2032, reaching nearly USD 3.73 Billion.Voice Banking Market Overview:

The voice banking market is gaining strong momentum as digital transformation reshapes customer interaction in financial services. With the rise of artificial intelligence (AI), natural language processing (NLP), and speech recognition technologies, banks are integrating voice-enabled solutions to improve accessibility, convenience, and personalization. Customers can now perform essential banking tasks such as checking balances, transferring funds, or managing transactions using voice commands. The increasing adoption of smart devices and virtual assistants is accelerating this trend, offering users a more intuitive experience while enhancing operational efficiency for financial institutions across retail, commercial, and investment banking segments.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/169729/

Voice Banking Market Outlook and Future Trends:

The future of the voice banking market looks promising, driven by the growing demand for hands-free, secure, and fast financial transactions. As financial institutions prioritize customer-centric services, voice biometrics is expected to play a significant role in strengthening authentication and fraud prevention. Integration with advanced AI will allow banks to deliver hyper-personalized recommendations, financial planning advice, and real-time customer support. Emerging economies are likely to witness rapid adoption due to increasing smartphone penetration and digital banking initiatives. Furthermore, partnerships between banks and technology providers will expand service portfolios, paving the way for innovative use cases and widespread voice banking adoption.

Voice Banking Market Dynamics:

The dynamics of the voice banking market are influenced by a mix of drivers, challenges, and opportunities. On the one hand, rising consumer expectations for faster and more convenient services are pushing banks to adopt voice technologies. Cost efficiency and operational automation also make voice banking appealing to financial institutions. However, challenges such as privacy concerns, data security risks, and the complexity of integrating voice systems with legacy infrastructure continue to restrain growth. Despite these hurdles, the adoption of robust encryption methods and AI-based security frameworks is helping overcome barriers, creating a favorable environment for long-term market expansion.

Voice Banking Market Key Recent Developments:

Recent developments in the voice banking market highlight significant advancements in both technology and strategic collaborations. Leading banks are increasingly adopting voice biometrics to enhance customer authentication and reduce fraud risks. Several financial institutions have introduced voice-enabled virtual assistants integrated with mobile banking apps, enabling seamless, 24/7 support. Partnerships between banks and fintech firms are expanding the scope of voice-driven services, from payments to investment advice. Additionally, advancements in multilingual voice recognition are making services more inclusive across diverse regions. These innovations reflect a growing focus on improving customer experience, security, and accessibility in the rapidly evolving financial landscape.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/169729/

Voice Banking Market Segmentation:

by Component

Solution

Services

by Deployment Mode

On-Premise

Cloud

by Technology Large

Enterprises

Small and Medium-sized Enterprises

by Application

Banks

NBFCs

Credit Unions

Others

by Technology

Machine Learning

Deep Learning

Natural Language Processing

Others

Some of the current players in the Voice Banking Market are:

1. U.S. Bank (US)

2. Citigroup (US)

3. Axis Bank(India)

4. HSBC (UK)

5. NatWest Group (UK)

6. IndusInd Bank (India)

7. BankBuddy (India)

8. Central 1 Credit Union (Canada)

9. ICICI bank (India)

10. United Bank of India (India)

11. DBS Bank (Singapore)

12. Acapela Group. (Belgium)

13. Emirates NBD Bank (UAE)

For additional reports on related topics, visit our website:

♦ Global Flexible Plastic Conduit Market https://www.maximizemarketresearch.com/market-report/global-flexible-plastic-conduit-market/43131/

♦ Global UAV payload subsystems Market https://www.maximizemarketresearch.com/market-report/uav-payload-subsystems-market/54457/

♦ Global High Reliability Semiconductor Market https://www.maximizemarketresearch.com/market-report/high-reliability-semiconductor-market/115921/

♦ Distribution Panel Market https://www.maximizemarketresearch.com/market-report/distribution-panel-market/11242/

♦ Global Hybrid Fiber Coaxial Market https://www.maximizemarketresearch.com/market-report/global-hybrid-fiber-coaxial-market/64672/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a leading consulting and market intelligence company, recognized for providing in-depth insights and data-driven strategies across industries including healthcare, automotive, technology, and pharmaceuticals. With a strong focus on comprehensive research, future trend analysis, and competitive evaluation, the firm supports businesses in identifying opportunities, minimizing risks, and achieving long-term growth. Its expertise lies in equipping organizations with the knowledge and tools they need to enhance decision-making, optimize performance, and expand their market footprint effectively.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Market Size, Share, and Growth Forecast (2025-2032) here

News-ID: 4182817 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

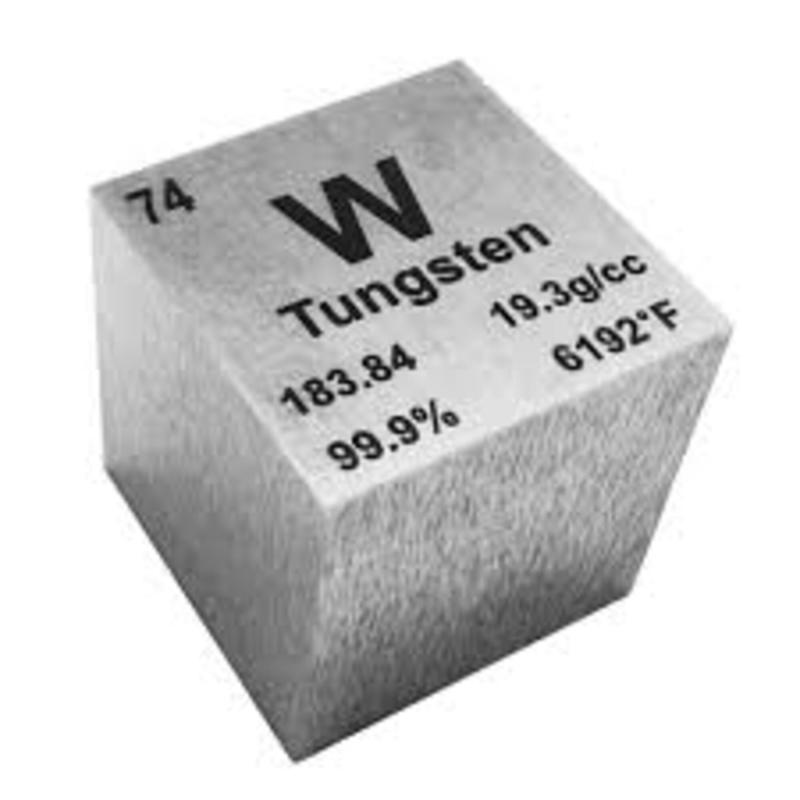

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…