Press release

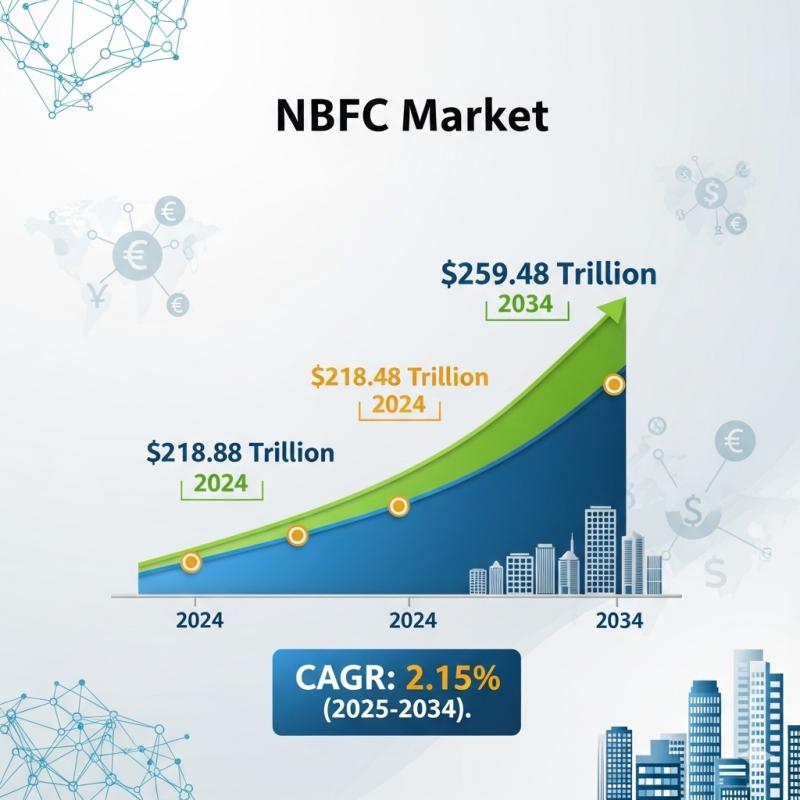

Global NBFC Market Size to Reach USD 259.48 Trillion by 2034, Growing at 2.15% CAGR

According to the latest analysis, the global Non-Banking Financial Company (NBFC) market was valued at approximately USD 218.88 trillion in 2024 and is projected to reach around USD 259.48 trillion by 2034, growing at a compound annual growth rate (CAGR) of approximately 2.15% between 2025 and 2034.Access key findings and insights from our Report in this Free sample -https://www.zionmarketresearch.com/sample/nbfc-market

NBFCs are vital financial intermediaries that provide banking-like services such as loans, asset financing, leasing, and investments but do not hold a banking license. They play a critical role in financial inclusion, SME lending, and credit penetration, especially in emerging markets.

Market Overview

NBFCs operate in various financial segments including consumer loans, infrastructure financing, asset management, microfinance, and insurance. Their ability to reach underserved areas and offer tailored solutions makes them indispensable to the global financial ecosystem.

Key growth drivers:

Financial inclusion initiatives in emerging economies.

Digital transformation enabling faster, more accessible lending.

Regulatory reforms promoting NBFC transparency and stability.

Growth of microfinance & SME lending due to high unmet credit demand.

Expansion of digital wallets, buy-now-pay-later (BNPL), and peer-to-peer lending platforms.

Market Segmentation

1. By Type of NBFC

Asset Finance Companies (AFCs)

Focus on loans for vehicles, equipment, and infrastructure projects.

Loan Companies

Provide unsecured personal and business loans.

Investment Companies

Specialize in investments in securities, bonds, and shares.

Infrastructure Finance Companies (IFCs)

Provide large-scale financing for infrastructure and public projects.

Microfinance Institutions (MFIs)

Offer small-ticket loans to low-income groups and rural populations.

Housing Finance Companies

Provide mortgage loans and housing credit.

Peer-to-Peer (P2P) Lending Platforms

Digital NBFC models connecting borrowers and investors.

2. By Service Offering

Consumer Lending (personal loans, education loans, consumer durable loans)

Business & SME Lending (working capital loans, trade finance)

Vehicle & Equipment Financing

Insurance & Asset Management Services

Microfinance & Financial Inclusion Products

3. By End-User

Retail Consumers

Small & Medium Enterprises (SMEs)

Corporates

Government & Infrastructure Projects

Regional Analysis

1. Asia-Pacific

Dominates the NBFC market, led by India, China, and Southeast Asia.

NBFCs are critical in bridging credit gaps and offering innovative fintech solutions.

India's NBFC sector is especially dynamic, covering microfinance, infrastructure lending, and digital NBFCs.

2. North America

Growth driven by fintech innovations, online lending platforms, and non-bank mortgage originators.

Increased focus on alternative lending and BNPL services.

3. Europe

Well-regulated NBFC environment focusing on asset management, leasing, and P2P lending.

Increasing participation of NBFCs in sustainable finance and ESG-focused investments.

4. Latin America

Emerging market for microfinance and digital lending, especially in Brazil and Mexico.

5. Middle East & Africa (MEA)

NBFCs filling gaps in credit availability where traditional banks are limited.

Growth in Islamic NBFC models offering Sharia-compliant products.

Access our report for a comprehensive look at key insights -https://www.zionmarketresearch.com/report/nbfc-market

Major Key Players in the Global NBFC Market

The NBFC market consists of a mix of traditional non-bank lenders and new-age fintech platforms. Key players include:

Bajaj Finance (India)

HDFC Ltd. (India)

L&T Finance (India)

Muthoot Finance (India)

Indiabulls Housing Finance (India)

American Express (US) - Non-bank card issuer with consumer lending arms.

Quicken Loans / Rocket Mortgage (US)

Funding Circle (UK)

Zopa (UK)

Kabbage/AmEx Business Loans (US)

Emerging players include fintech NBFCs focusing on P2P lending, BNPL, and microcredit.

Key Trends and Opportunities

Digital Lending Platforms: Rise of online NBFCs and app-based micro-lending services.

Financial Inclusion Programs: Government and NGO-backed initiatives enabling NBFC growth.

Partnerships Between NBFCs and Banks: Co-lending models improving credit access.

Alternative Credit Scoring: Use of big data and AI for underwriting customers without traditional credit histories.

Sustainable Finance: NBFCs entering green finance, renewable energy projects, and ESG-focused lending.

Challenges in the NBFC Market

Regulatory Scrutiny: Stricter compliance requirements and oversight to mitigate systemic risks.

Competition from Banks & Fintechs: Pressure on margins and customer retention.

Liquidity Risks: NBFCs' dependence on external borrowing makes them vulnerable to credit crunches.

Cybersecurity Threats: Digital NBFCs facing increased exposure to cyber fraud and data breaches.

Future Outlook (2025-2034)

The global NBFC market is expected to grow moderately at a CAGR of 2.15%, reaching USD 259.48 trillion by 2034.

Asia-Pacific will continue to dominate due to rapid digitalization and government support.

Fintech-NBFC convergence will drive new product innovations and partnerships.

Green and inclusive finance will become priority segments for NBFC expansion.

Conclusion

Non-Banking Financial Companies are set to remain a cornerstone of global financial intermediation, complementing banks and expanding access to credit. With continued digital transformation, diversification of offerings, and focus on financial inclusion, the NBFC market is positioned for steady growth over the next decade.

More Trending Reports by Zion Market Research -

Advanced Metering Infrastructure Market-https://www.zionmarketresearch.com/report/advanced-metering-infrastructure-ami-market

Video on Demand (VoD) Market-https://www.zionmarketresearch.com/report/video-on-demand-market

Aviation Security Market-https://www.zionmarketresearch.com/report/aviation-security-market

GPS Tracking Device Market-https://www.zionmarketresearch.com/report/gps-tracking-device-market

Passport Reader Market-https://www.zionmarketresearch.com/report/passport-reader-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1-855-465-4651

Email: sales@zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us-after all-if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global NBFC Market Size to Reach USD 259.48 Trillion by 2034, Growing at 2.15% CAGR here

News-ID: 4179406 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

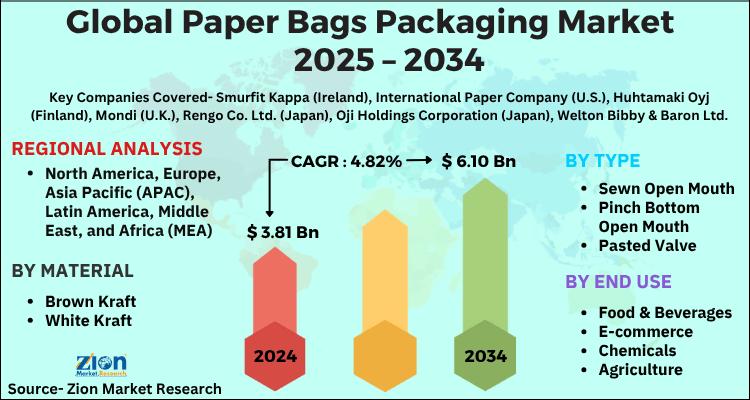

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

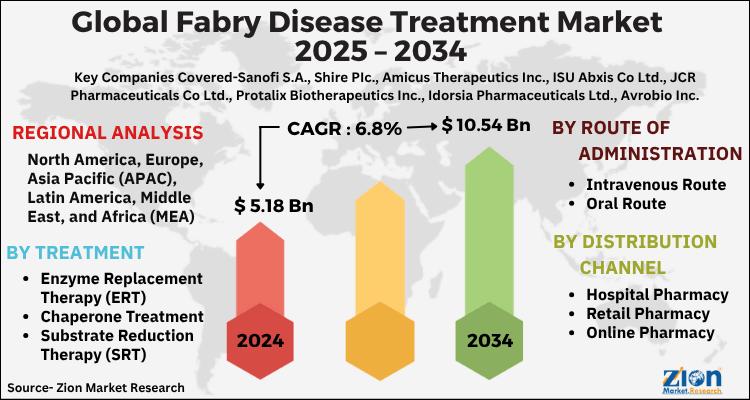

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for NBFC

Synnex® Recognizes ViVifi's FinTech Excellence with Best NBFC Award 2023

ViVifi is honored to receive the esteemed Best Fintech NBFC Award at the India NBFC Summit and Awards 2023, presented by Synnex® Group. This recognition underscores our commitment to innovation, excellence, and transformative contributions in FinTech Industry. Winning this award is a testament to the dedication and hard work of the entire ViVifi ,FlexSalary and FlexPay team.

Products of VIVIFI -

https://www.flexsalary.com

https://www.flexpay.in

Amid the high competition in Fintech NBFC category, this achievement is…

NBFC Market Comprehensive Analysis Of The Market Structure Along With Forecast 2 …

The NBFC Market is a thorough analysis of the current state of this business sector, as well as an overview of its segmentation. The study includes a near-perfect projection of the market scenario for the forecast period – market size in terms of valuation as sales volume.The study lends focus to detail about the top magnates which contribute up the competitive landscape of the NBFC market, as well as the…

NBFC Market Globally Expected to Drive Growth through 2025

A complete research offering of comprehensive analysis of the market share, size, recent developments, and trends can be availed in this latest report by Big Market Research.

As per the report, the Global NBFC Market is anticipated to witness significant growth during the forecast period from 2020 to 2025.

The report provides brief summary and detailed insights of the market by collecting data from the industry experts and several prevalent in the…

What's driving the Loan Servicing Software Market Trends 2027 | LLC, Nortridge S …

This Loan Servicing Software Market research report offers you an array of insights about ICT industry and business solutions that will support to stay ahead of the competition. Systematic investment analysis is also underlined in this Loan Servicing Software Market report which forecasts impending opportunities for the market players.This market report is the outcome of persistent efforts lead by knowledgeable forecasters, innovative analysts and brilliant researchers who carries out detailed…

Cashkumar receives NBFC-P2P certification from RBI

Press release for immediate publication

Cashkumar receives NBFC-P2P certification from RBI

Focused exclusively on short-term loans for salaried individuals, Cashkumar to expand operations

Mumbai, July 12, 2018: Cashkumar, among the only P2P lending platforms focused exclusively on short term loans for salaried individuals, today announced that it has received the NBFC-P2P license from RBI (Reserve Bank of India). The license marks Cashkumar’s entry to a set of four to five other leading fintech…

Exhilway To Shortlist Indian NBFC For Merger

California: Exhilway, the leading financial advisory firm, in an attempt to enhance its focus on the emerging markets of Asia will merge an Indian non-banking finance company (NBFC) with itself to carve a US listed business. The company is in the process of finalizing investment banking firm which can refer a potentially suitable client. The announcement may happen in January, 2017.

According to the sources, Exhilway is targeting a candidate which…