Press release

United States Buy Now Pay Later Market Soars: Revolutionary Financing Trends Reshape Global Consumer Spending in 2025 | Top key players - Affirm, Inc., Klarna Inc., Splitit USA Inc.

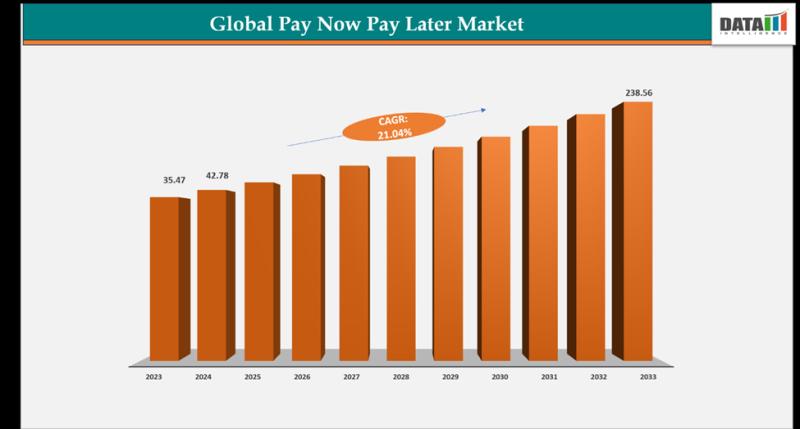

Market Size and Growth:The Global Buy Now Pay Later Market size reached US$ 35.47 billion in 2023, with a rise to US$ 42.78 billion in 2024, and is expected to reach US$ 238.56 billion by 2033, growing at a CAGR of 21.04% during the forecast period 2025-2033.

The Buy Now Pay Later Market report by DataM Intelligence provides insights into the latest trends and developments in the market. This report identifies the key growth opportunities in the market and provides recommendations for market participants to capitalize on these opportunities. Overall, the Buy Now Pay Later market report is an essential resource for market participants who are looking to gain a comprehensive understanding of the market and identify opportunities for growth.

Download a Free sample PDF (Use Corporate email ID to Get Higher Priority) at: https://datamintelligence.com/download-sample/buy-now-pay-later-market?sz

The Buy Now Pay Later (BNPL) Market refers to the financial services sector offering short-term, interest-free installment payment options for consumers purchasing goods or services. It enables buyers to split payments over a defined period, enhancing affordability and convenience. The market includes providers, technology platforms, and partnerships with retailers, driven by rising e-commerce adoption and consumer preference for flexible payment solutions.

Recent Key Developments of United States (U.S):

Klarna's U.S. IPO: On September 10, 2025, the Swedish BNPL company Klarna had the largest U.S. IPO of the year, raising $1.37 billion. This move signals a strong focus on the American market for future growth.

FICO BNPL Credit Scores: In June 2025, FICO announced the introduction of FICO Score 10 BNPL and Score 10 T BNPL. These new scores will incorporate BNPL loan data into creditworthiness assessments, increasing transparency and improving risk evaluation for lenders.

Klarna Debit Card Launch: In June 2025, Klarna launched a pilot debit card in the U.S. in partnership with Visa and WebBank. The card allows users to make instant payments or choose interest-free installment plans for purchases, blurring the line between traditional banking and BNPL services.

Major Retailer Adoption: In May 2025, Costco partnered with Affirm to allow U.S. online shoppers to break up purchases over $500 into monthly payments. This follows a similar integration with DoorDash and Klarna in March 2025, indicating a continued expansion of BNPL into new sectors and with major retailers.

Rising Delinquencies and Regulation: Reports from August 2025 show a surge in late payments, with 24% of BNPL users having made a late payment, up from 18% in 2023. This trend, coupled with increasing consumer debt concerns and growing regulator scrutiny, is forcing providers to tighten approval criteria and focus on responsible lending.

Key Players:

Affirm, Inc.

Klarna Inc.

Splitit USA Inc.

Sezzle

Perpay Inc.,

Zip Co, Ltd

Afterpay

Openpay

PayPal Holdings, Inc.

LatitudePay Financial Services.

This Report Covers:

✔ Go-to-market Strategy.

✔ Neutral perspective on the market performance.

✔Development trends, competitive landscape analysis, supply side analysis, demand side analysis, year-on-year growth, competitive benchmarking, vendor identification, and other significant analysis, as well as development status.

✔Customized regional/country reports as per request and country level analysis.

✔ Potential & niche segments and regions exhibiting promising growth covered.

✔ Analysis of Market Size (historical and forecast), Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM), Market Growth, Technological Trends, Market Share, Market Dynamics, Competitive Landscape and Major Players (Innovators, Start-ups, Laggard, and Pioneer).

Looking For Full Report? Get it Here: https://www.datamintelligence.com/buy-now-page?report=buy-now-pay-later-market

Market Segmentation:

By Channel: Online, POS.

By Enterprises Size: Large Enterprises, SME's.

By End-User: BFSI, Consumer Electronics, Fashion & Lifestyle, Healthcare, Retail, Media and Entertainment, Others.

Regional Analysis:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Speak to Our Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/buy-now-pay-later-market?sz

Chapter Outline

⏩ Market Overview: It contains five chapters, as well as information about the research scope, major manufacturers covered, market segments, Buy Now Pay Later market segments, study objectives, and years considered.

⏩ Market Landscape: The competition in the Global Buy Now Pay Later Market is evaluated here in terms of value, turnover, revenues, and market share by organization, as well as market rate, competitive landscape, and recent developments, transaction, growth, sale, and market shares of top companies.

⏩ Companies Profiles: The global Buy Now Pay Later market's leading players are studied based on sales, main products, gross profit margin, revenue, price, and growth production.

⏩ Market Outlook by Region: The report goes through gross margin, sales, income, supply, market share, CAGR, and market size by region in this segment. North America, Europe, Asia Pacific, Middle East & Africa, and South America are among the regions and countries studied in depth in this study.

⏩ Market Segments: It contains the deep research study which interprets how different end-user/application/type segments contribute to the Buy Now Pay Later Market.

⏩ Market Forecast: Production Side: In this part of the report, the authors have focused on production and production value forecast, key producers forecast, and production and production value forecast by type.

⏩ Research Findings: This section of the report showcases the findings and analysis of the report.

⏩ Conclusion: This portion of the report is the last section of the report where the conclusion of the research study is provided.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

People Also Ask:

◆ How big is the Buy Now Pay Later Market in 2025?

◆ What is the projected growth rate of the Buy Now Pay Later Market through 2033?

◆ Who are the key players in the Buy Now Pay Later Market?

◆ Which region is expected to dominate the industry during the forecast period?

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Buy Now Pay Later Market Soars: Revolutionary Financing Trends Reshape Global Consumer Spending in 2025 | Top key players - Affirm, Inc., Klarna Inc., Splitit USA Inc. here

News-ID: 4178884 • Views: …

More Releases from DataM Intelligence 4Market Research

Pelvic Organ Prolapse Devices Market Set for Rapid Growth: Innovations 2026 | Ma …

Market Overview:

Pelvic Organ Prolapse Devices Market is estimated to reach at a CAGR of 3.10% during the forecast period (2024-2031).

DataM Intelligence has published a new research report on "Pelvic Organ Prolapse Devices Market Size 2026". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic…

Industrial Control Systems (ICS) Security Market is expected to reach US$ 20,500 …

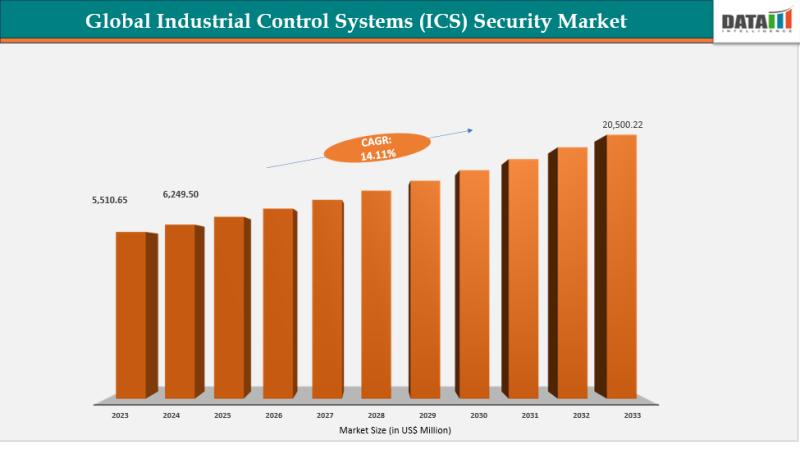

Market Size and Growth:

The Global Industrial Control Systems (ICS) Security Market size reached US$ 5,510.65 million in 2023, with a rise to US$ 6,249.50 million in 2024, and is expected to reach US$ 20,500.22 million by 2033, growing at a CAGR of 14.11% during the forecast period 2025-2033.

DataM Intelligence has published a new research report on "Industrial Control Systems (ICS) Security Market Size 2026". The report explores comprehensive and insightful…

Smart Baby Thermometers Market is expected to reach US$ 918.12 by 2033 | North A …

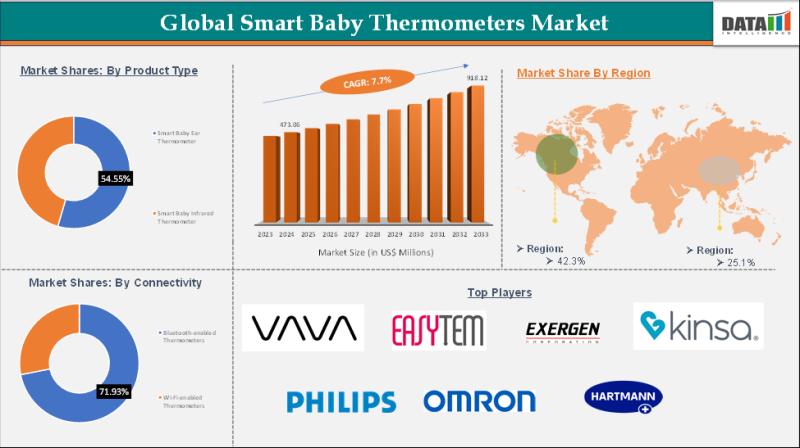

Market Size and Forecast:

The Smart Baby Thermometers Market size reached US$ 473.06 Million in 2024 and is expected to reach US$ 918.12 by 2033, growing at a CAGR of 7.7% during the forecast period 2025-2033.

DataM Intelligence has published a new research report on "Smart Baby Thermometers Market Size 2026". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top…

Sterile Injectables CMO Market is expected to reach US$ 42.97 Billion by 2033 | …

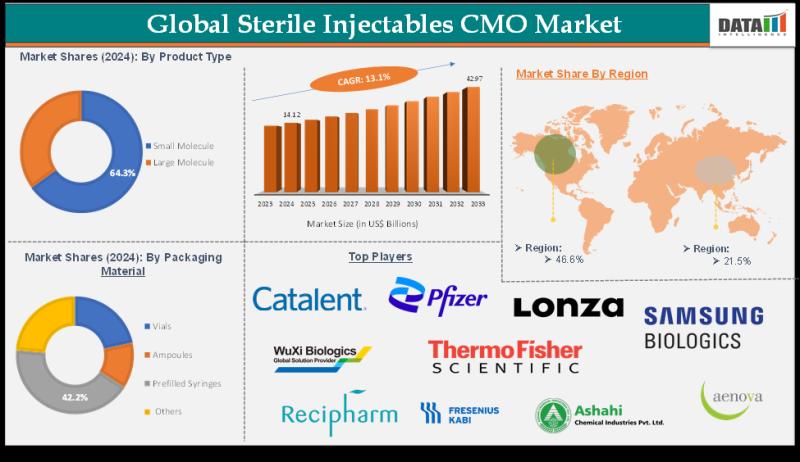

Market Size and Growth:

The Sterile Injectables CMO Market Size reached US$ 14.12 Billion in 2024 and is expected to reach US$ 42.97 Billion by 2033, growing at a CAGR of 13.1% during the forecast period of 2025-2033.

DataM Intelligence has published a new research report on "Sterile Injectables CMO Market Size 2026". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…