Press release

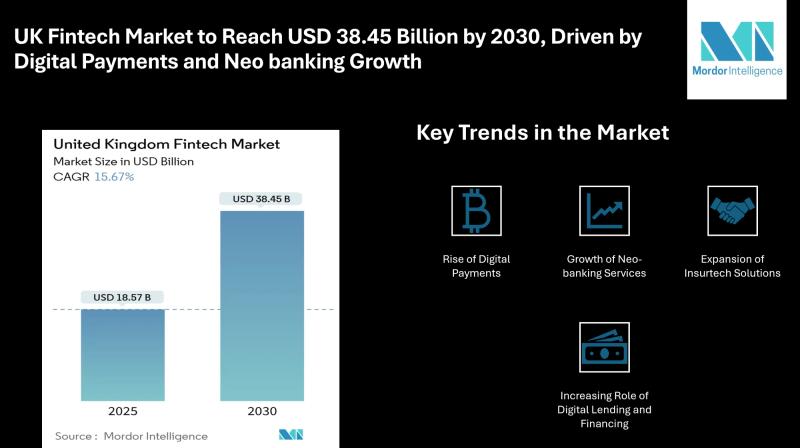

UK Fintech Market to Reach USD 38.45 Billion by 2030, Driven by Digital Payments and Neo banking Growth

Mordor Intelligence has published a new report on the "UK Fintech Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction: Expanding Opportunities in Financial Technology

The UK fintech market stands at USD 18.57 billion in 2025 and is forecasted to reach USD 38.45 billion by 2030, reflecting a 15.67% CAGR. This rapid expansion highlights how the country continues to serve as one of the most dynamic financial hubs globally. The combination of an advanced banking system, a digitally active population, and regulatory support has established a fertile environment for fintech growth.

The industry is evolving to meet shifting consumer expectations and business demands. From seamless digital payments to AI-enabled risk assessments, fintech solutions in the UK are changing how individuals and organizations manage their finances. Startups and established players alike are strengthening their position, leveraging mobile-first services and partnerships with traditional institutions. This strong foundation ensures the UK remains a frontrunner in shaping the global financial technology landscape.

Report Overview: https://www.mordorintelligence.com/industry-reports/united-kingdom-fintech-market?utm_source=openpr

Key Trends in the UK Fintech Market

Rise of Digital Payments

Digital payments remain at the core of fintech adoption. The widespread use of smartphones and mobile wallets has accelerated contactless transactions across retail and service industries. Consumers are drawn to convenience, speed, and security, while businesses value the efficiency and reduced cash-handling costs. The expansion of open banking has further improved interoperability between banks and fintechs, fostering an ecosystem where payments are not only faster but also more transparent.

Growth of Neobanking Services

Neobanks are gaining customer trust by offering flexible, user-friendly platforms compared with traditional banking institutions. Features such as real-time spending insights, instant account setup, and low-fee structures have positioned neobanks as attractive alternatives, particularly for younger and tech-savvy users. Their success is also linked to the agility of their business models, which allow them to respond quickly to customer demands while offering personalized solutions.

Expansion of Insurtech Solutions

Insurance companies in the UK are increasingly integrating fintech into their operations. Insurtech services streamline processes such as underwriting, claims management, and fraud detection. By using digital platforms, insurers are improving customer experiences and reducing administrative burdens. As consumer expectations shift toward faster and more transparent services, insurtech is likely to capture a larger market share.

Increasing Role of Digital Lending and Financing

The fintech industry in UK is reshaping access to credit through digital lending platforms. Small and medium-sized enterprises, often underserved by traditional banks, are finding alternative financing solutions with quicker approvals and flexible repayment terms. Peer-to-peer lending platforms and digital credit providers are also filling gaps for individuals, offering inclusive and convenient financial services.

Advancements in Investment Platforms

Digital investment platforms have lowered entry barriers for retail investors, enabling access to tools once reserved for wealthier clients. Automated advisory services and simplified trading apps are making it easier for individuals to build diversified portfolios. The trend reflects a democratization of investing, with fintech platforms providing intuitive interfaces, educational content, and cost-effective solutions.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/united-kingdom-fintech-market?utm_source=openpr

Market Segmentation: Service Offerings and User Base

The UK fintech market is diverse, with multiple service categories catering to different audiences.

By Service Proposition

Digital Payments

Digital Lending and Financing

Digital Investments

Insurtech

Neobanking

By End-User

Retail

Businesses

By User Interface

Mobile Applications

Web / Browser

POS / IoT Devices

This segmentation highlights how fintech services in the UK extend beyond traditional banking alternatives. Mobile applications dominate in customer engagement, while web platforms and connected devices enable broader adoption across retail and enterprise sectors. The diversity in services also ensures that both individual consumers and corporate clients have access to tailored solutions.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players Shaping the UK Fintech Market

The market is supported by a blend of agile startups and scale-ups that are redefining customer engagement:

Revolut Ltd - A key player known for its global reach in digital banking services, offering everything from currency exchange to stock trading. Revolut's rapid expansion reflects the market's appetite for integrated financial ecosystems.

Monzo Bank Ltd - One of the leading neobanks in the UK, Monzo's mobile-first approach has captured a large user base. Its community-driven strategy and focus on transparency continue to resonate strongly with customers.

Wise plc - Originally focused on cross-border transfers, Wise has broadened its portfolio to provide borderless accounts for businesses and individuals. Its emphasis on low-cost, efficient international transactions supports global trade.

Starling Bank Ltd - Starling's success lies in its focus on SME banking, personal accounts, and its banking-as-a-service offering. The bank has carved out a strong position by serving niche markets while scaling its technology for broader applications.

Checkout.com - A major name in payment processing, Checkout.com enables merchants to streamline transactions across geographies. Its platform supports e-commerce expansion, aligning with the rising demand for frictionless payment experiences.

Together, these companies highlight how the UK fintech market is driven by a blend of neobanking, payments, and cross-border services. Their growth stories underscore the country's position as a competitive hub for fintech development.

Explore more insights on UK fintech market competitive landscape: https://www.mordorintelligence.com/industry-reports/united-kingdom-fintech-market/companies?utm_source=openpr

Conclusion: Future Outlook for the UK Fintech Market

The UK fintech market is expected to sustain strong growth over the coming years, underpinned by rising digital adoption, regulatory openness, and a culture of entrepreneurship. Digital payments and neobanking are set to remain primary drivers, while lending, insurtech, and investment platforms will add further depth to the industry's portfolio.

As consumers seek greater personalization and businesses demand more efficient tools, the sector will continue to evolve. Competition among startups and established financial institutions is likely to intensify, leading to enhanced customer experiences and wider service availability. With a supportive regulatory environment and high levels of digital literacy, the UK is well placed to maintain its leadership in global fintech.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/united-kingdom-fintech-market?utm_source=openpr

Industry Related Reports

Global Fintech Market: The Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices), and by Region (North America, South America, Europe, Asia-Pacific, & Middle East and Africa).

Get more insights: https://www.mordorintelligence.com/industry-reports/global-fintech-market?utm_source=openpr

UAE Fintech Market: UAE Fintech Market is Segmented by Service Proposition (money Transfer and Payments, Savings and Investments, Digital Lending and Lending a Online Insurance & Insurance Marketplaces).

Get more insights: https://www.mordorintelligence.com/industry-reports/uae-fintech-market?utm_source=openpr

US Fintech Market: US Fintech Market is Segmented by Service Proposition (Digital Payments (Mobile POS Payments, Digital Remittance, and Digital Commerce), Digital Investments (Neo-Brokers and Robo-Advisors), Alternative Lending, Alternative Funding (Crowd Investing and Crowd Funding), Neo-banking, and Online insurance and insurance marketplaces.

Get more insights: https://www.mordorintelligence.com/industry-reports/us-fintech-market?utm_source=openpr

China Fintech Market: The China Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices).

Get more insights: https://www.mordorintelligence.com/industry-reports/china-fintech-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Raja Pushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK Fintech Market to Reach USD 38.45 Billion by 2030, Driven by Digital Payments and Neo banking Growth here

News-ID: 4178864 • Views: …

More Releases from Mordor Intelligence

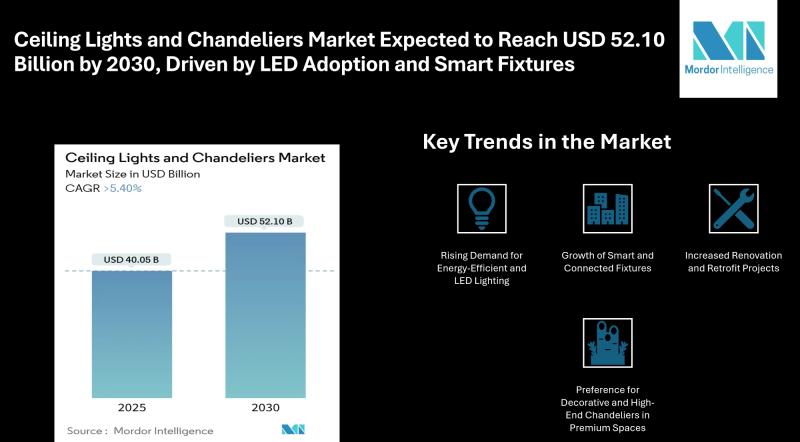

Ceiling Lights and Chandeliers Market Expected to Reach USD 52.10 Billion by 203 …

Ceiling Lights and Chandeliers Market Overview :

According to Mordor Intelligence, the Ceiling Lights & Chandeliers Market size is estimated at USD 40.05 billion in 2025, and is expected to reach USD 52.10 billion by 2030, at a CAGR of greater than 5.40%. This expansion reflects steady demand across residential and commercial sectors worldwide. Key factors influencing the market include rising consumer interest in energy-efficient lighting, increased adoption of LED…

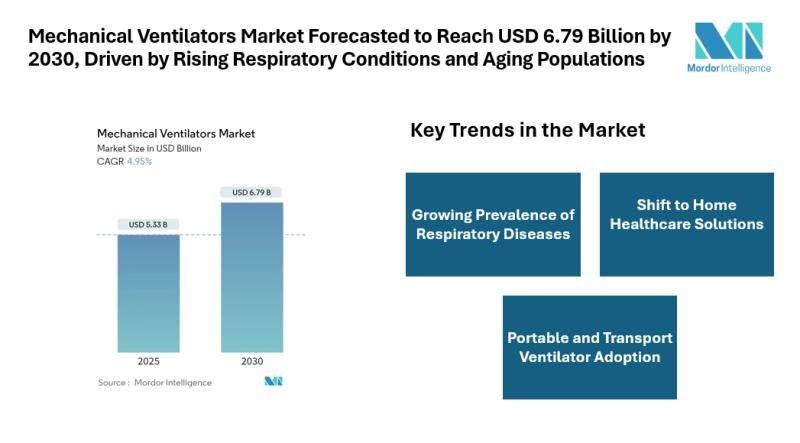

Mechanical Ventilators Market Set to Reach USD 55.55 Billion by 2030, Driven by …

Mordor Intelligence has published a new report on mechanical ventilator market offering a comprehensive analysis of trends, growth drivers, and future projection

Introduction

The mechanical ventilator market is valued at USD 5.33 billion in 2025 and is forecast to reach USD 6.79 billion by 2030, advancing at a 4.95% CAGR, according to research from Mordor Intelligence. The expansion in the mechanical ventilators market size is being supported by…

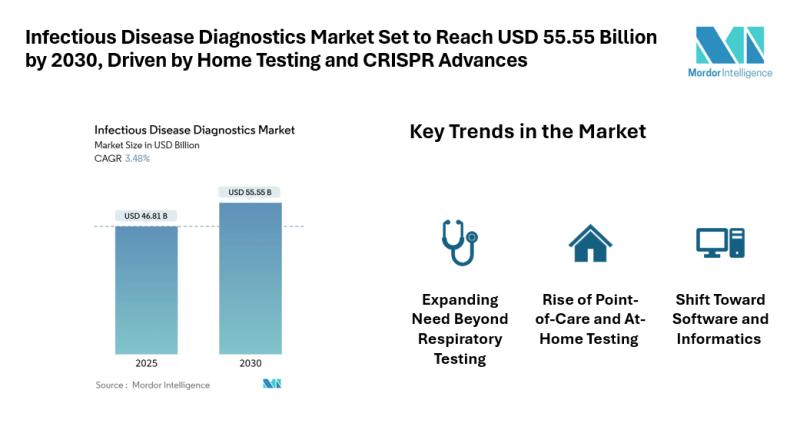

Infectious Disease Diagnostics Market Set to Reach USD 55.55 Billion by 2030, Dr …

Mordor Intelligence has published a new report on infectious disease diagnostics market offering a comprehensive analysis of trends, growth drivers, and future projection

Introduction

The infectious disease diagnostics market stands at USD 46.81 billion in 2025 and is on course to reach USD 55.55 billion by 2030, growing at a 3.48% CAGR. As COVID-19 testing volumes stabilize, laboratories and diagnostic firms are broadening their focus toward other critical areas …

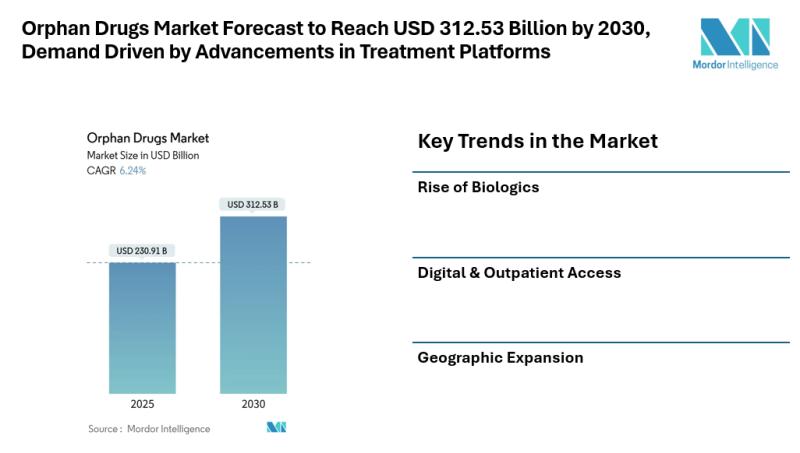

Orphan Drugs Market Forecast to Reach USD 312.53 Billion by 2030, Demand Driven …

Mordor Intelligence has published a new report on orphan drugs market offering a comprehensive analysis of trends, growth drivers, and future projection

Introduction:

The orphan drugs market is gaining significant attention globally as healthcare systems and pharmaceutical companies focus on addressing rare diseases with tailored treatments. According to recent insights from a detailed orphan drugs market analysis, The orphan drugs market stood at USD 230.91 billion in 2025 and is…

More Releases for Digital

Digital luxury brands Market Is Booming Worldwide | Major Giants Balenciaga Digi …

HTF MI recently introduced Global Digital luxury brands Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2033). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

Major companies in Digital luxury brands Market are:

Balenciaga Digital, Louis Vuitton Digital, Gucci Digital, Dolce & Gabbana DGFamily, Prada Virtual,…

Introducing Digital Sales Pro, Inc: Revolutionizing Digital Sales in the Digital …

Digital Sales Pro, Inc. is a company that helps content creators and publishers make money from content and reach a larger audience with their craft.

In today's world, it can be tough for content creators and publishers to make money and connect with their audience.

At, Digital Sales Pro, Inc. we understand these challenges and have created a suite of solutions that help our clients build a strong online presence, monetize…

Digital Twin in Healthcare Market Analysis By Type - Product Digital Twins, Proc …

Introduction

The healthcare industry has seen significant growth and development over the years, with technology playing a critical role in transforming patient care. One such innovative technology that has emerged in recent years is the Global Digital Twin in Healthcare Market. This technology allows healthcare professionals to create a virtual replica of a patient's physical self, enabling them to monitor and analyze patient data in real-time. The Global Digital Twin in…

Digital Twin in Healthcare Market Analysis By Type - Product Digital Twins, Proc …

In 2021, the market for Digital Twin in Healthcare worldwide was worth $6.75 billion US dollars. AMR Group projects that the market will reach US$ 96.5 billion by 2031, growing at a CAGR of 40 percent between 2022 and 2031.

Industry Overview

Digital twins are virtual copies of physical objects or things that data scientist & IT professionals can use to compute simulations prior to developing and deploying the original devices. Digital…

Digital Therapeutics Market, Digital Therapeutics Market Size, Digital Therapeut …

The global digital therapeutics market is expected to reach US$ 8,941.1 Mn by 2025 from US$ 1,993.2 Mn in 2017. The market is estimated to grow with a CAGR of 20.8% during the forecast period from 2018 to 2025.

North America is the largest geographic market and it is expected to be the largest revenue generator during the forecast period, whereas the market is expected to witness growth at a significant…

Digital Display Market Future Growth with Worldwide Players (Digital Virgo, Digi …

Digital Display Industry 2019 Global Market 2025 research report represents the historical overview of current Market situation, size, share, trends, growth, supply, outlook and manufacturers with detailed analysis. It also focuses on Digital Display volume and value at global level, regional level and company level. From a global perspective, this report represents overall Digital Display market size by analyzing historical data and future prospect.

Get Sample Copy of this Report -…